A career in corporate finance is not just a job; it's a launchpad into the strategic heart of a business. It offers a unique blend of analytical rigor, strategic planning, and a direct impact on a company's success. For those drawn to numbers and strategy, it also offers significant financial rewards. So, what can you realistically expect to earn?

While a six-figure salary is common, the path to top earnings is shaped by a variety of factors. This guide will break down the typical corporate finance salary, explore the key drivers that influence your pay, and provide a clear picture of what your future in this dynamic field could look like.

What Does a Corporate Finance Professional Do?

Before diving into the numbers, it's essential to understand the role. A corporate finance professional is the financial steward of a company. They are not just accountants crunching historical numbers; they are forward-looking analysts and strategists who guide the company’s financial future.

Key responsibilities often include:

- Financial Planning & Analysis (FP&A): Budgeting, forecasting future performance, and analyzing financial results to provide insights to leadership.

- Capital Budgeting: Evaluating potential investments and projects (like building a new factory or launching a product line) to determine their financial viability.

- Treasury Management: Managing the company's cash flow, debt, and investments to ensure financial stability.

- Financial Modeling: Building complex spreadsheets to predict the outcome of business decisions.

- Reporting: Preparing financial statements and performance reports for management, investors, and regulatory bodies.

In essence, they help the company make smart, data-driven decisions to maximize shareholder value.

Average Corporate Finance Salary

The compensation for a corporate finance professional is competitive and reflects the high level of skill required. While salaries vary widely, we can establish a strong baseline using data from authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for financial analysts was $99,890 in May 2023. This is a strong indicator, as many corporate finance roles fall under this category.

However, a single median figure doesn't tell the whole story. The salary range is broad:

- The lowest 10 percent of financial analysts earned less than $63,610. This typically represents entry-level positions in lower-cost-of-living areas.

- The highest 10 percent earned more than $178,020. This reflects senior-level professionals, such as Finance Managers or Directors, in high-paying industries or locations.

Data from aggregators like Salary.com often shows a slightly higher median, with their 2024 data for a "Corporate Finance Analyst II" (a mid-level role) hovering around $104,800.

It's also crucial to remember that corporate finance compensation is more than just base salary. Annual bonuses, performance-based incentives, and profit-sharing can add significantly to the total package, often ranging from 5% to 20% (or more) of the base salary, depending on the role and company performance.

Key Factors That Influence Salary

Your specific salary is not determined by a single number but by a combination of your qualifications, experience, and where you work. Here are the five most significant factors.

###

Level of Education

Your educational foundation is the price of entry and a key salary driver.

- Bachelor's Degree: A bachelor's degree in finance, accounting, economics, or a related field is the standard requirement for entry-level analyst roles.

- Master's Degree: An advanced degree, particularly a Master of Business Administration (MBA) from a reputable program or a specialized Master's in Finance (MSF), can significantly accelerate your career and earning potential. It often serves as a prerequisite for leadership roles like Finance Manager or Director.

- Professional Certifications: Earning a prestigious certification is one of the most effective ways to increase your value. The Chartered Financial Analyst (CFA) designation is considered the gold standard in the investment and finance world. Other valuable credentials include the Certified Public Accountant (CPA) and the Certified Management Accountant (CMA).

###

Years of Experience

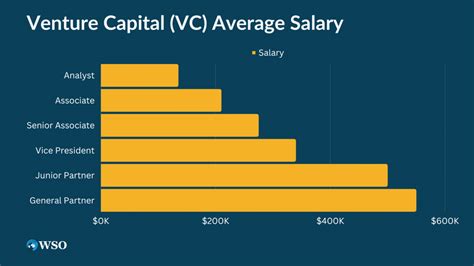

Corporate finance offers a clear and rewarding career ladder, with compensation growing at each step.

- Entry-Level (0-2 years): As a Financial Analyst, you'll focus on data gathering, spreadsheet maintenance, and supporting senior staff. Typical Salary Range: $65,000 - $85,000.

- Mid-Level (3-7 years): As a Senior Financial Analyst, you take on more complex modeling, forecasting, and present findings to management. You begin to own processes and projects. Typical Salary Range: $85,000 - $115,000.

- Senior/Managerial (8+ years): At the Finance Manager or Director level, you oversee a team, manage the entire budgeting process, and act as a strategic partner to business unit leaders. At this stage, salaries rise sharply. Typical Salary Range: $120,000 - $200,000+.

###

Geographic Location

Where you work matters. Salaries are adjusted for the local cost of living and the concentration of corporate headquarters. Major financial and business hubs offer the highest salaries.

- Top-Tier Cities: Metropolitan areas like New York City, San Francisco, Boston, and Chicago consistently offer the highest salaries to attract top talent. It's not uncommon for salaries in these cities to be 15-30% higher than the national average.

- Mid-Tier and Lower-Cost Cities: While the base salary may be lower in cities across the Midwest and Southeast, the reduced cost of living can mean your take-home pay goes further. The rise of remote work is also starting to blur these traditional geographic lines.

###

Company Type

The size and type of your employer play a massive role in your compensation structure.

- Fortune 500 / Large Public Corporations: These companies typically offer highly structured compensation packages with competitive base salaries, well-defined bonus programs, and excellent benefits.

- High-Growth Tech Companies & Startups: While the base salary can be competitive, a significant portion of the compensation may come in the form of stock options or equity. This offers a higher-risk, higher-reward scenario tied to the company's long-term success.

- Small to Medium-Sized Businesses (SMBs): Salaries may be slightly lower than at large corporations, but these roles can offer broader responsibilities and more direct exposure to senior leadership, providing invaluable experience.

###

Area of Specialization

"Corporate finance" is an umbrella term for several distinct functions, each with its own pay scale.

- Financial Planning & Analysis (FP&A): This is the most common path and aligns well with the average salary data presented.

- Treasury: Specialists managing a company's cash, debt, and financial risk are highly valued. Senior treasury roles can command salaries well above the average.

- Corporate Development (Mergers & Acquisitions): This is one of the most lucrative areas. Professionals who analyze and execute acquisitions, divestitures, and other major strategic transactions often receive very high bonuses tied to successful deals.

- Investor Relations (IR): This role blends finance, strategy, and communication. IR professionals who effectively manage a company's relationship with the investment community are well-compensated, especially at the senior level.

Job Outlook

The future for corporate finance professionals is bright. The BLS projects that employment for financial and investment analysts will grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

This growth is driven by several trends, including the increasing complexity of the global economy, the need for in-depth data analysis to guide business strategy, and a continued focus on corporate governance and financial compliance. A career in corporate finance is not only stable but also poised for sustained demand.

Conclusion

A career in corporate finance offers a powerful combination of intellectual challenge, strategic influence, and financial reward. While a median salary approaching six figures is a strong starting point, your ultimate earning potential is in your hands.

By investing in your education and professional certifications, strategically gaining experience, and understanding the impact of your location, company, and specialization, you can build a highly lucrative and fulfilling career. For those with a passion for numbers and a strategic mindset, corporate finance offers a clear and compelling path to success.