Earning a $70,000 annual salary is a significant financial milestone for many professionals in the United States. It often signifies a transition into a stable, mid-level career with opportunities for further growth. But what does that number actually mean for your daily life and budget? How does a $70k salary break down hourly, and what factors can help you reach—and exceed—this income level?

This article serves as your guide to understanding the full picture of a $70,000 salary, from the hourly math to the strategic career decisions that can get you there.

What Does a $70,000 Salary Look Like? The Hourly Breakdown

First, let's answer the core question. To calculate the hourly rate from an annual salary, the standard formula assumes a 40-hour work week for 52 weeks a year, totaling 2,080 work hours.

$70,000 ÷ 2,080 hours = $33.65 per hour

Here’s how that $70,000 gross salary breaks down over different pay periods:

- Hourly: $33.65

- Daily (8-hour day): $269.20

- Weekly: $1,346.15

- Bi-weekly: $2,692.31

- Monthly: $5,833.33

### Is $70,000 a Good Salary?

Context is crucial. A $70,000 salary is significantly higher than the median individual income for full-time workers in the United States. According to the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers was $1,145 in the fourth quarter of 2023, which annualizes to approximately $59,540.

This places a $70k salary comfortably within the middle class in many parts of the country. However, its real-world value is heavily dependent on factors like your location, family size, and financial obligations.

Jobs That Commonly Earn Around $70,000 Annually

A $70k salary isn't tied to a single profession; rather, it’s a common income level for professionals with a few years of experience across various industries. It can be an entry-level salary for highly skilled fields or a mid-career salary for others.

Examples of roles where the median salary hovers around or includes the $70k mark include:

- Financial Analyst: Analyzing financial data to help companies make business decisions.

- Marketing Manager: Developing and executing marketing campaigns to promote a brand.

- Registered Nurse (RN): Providing and coordinating patient care in hospitals and other healthcare facilities.

- Construction Manager: Planning, coordinating, budgeting, and supervising construction projects.

- HR Generalist/Specialist: Handling daily functions of a company's human resources department.

- Accountant: Preparing and examining financial records for accuracy and compliance.

Key Factors That Influence Your Salary

Reaching a $70,000 salary is not a matter of luck; it's the result of a combination of strategic factors. Understanding these elements is key to charting your path to this income level and beyond.

###

Level of Education

Your educational background remains a foundational pillar of your earning potential. While a bachelor's degree is often the minimum requirement for professional roles in this salary bracket, advanced degrees can significantly accelerate your income growth.

For instance, a Financial Analyst with a bachelor's degree might start around $60,000, but one with a Master of Business Administration (MBA) or a specialized master's in finance can command a starting salary well over $80,000. According to data from Salary.com, professionals with a master's degree can earn 20% or more than their counterparts with only a bachelor's degree in the same field.

###

Years of Experience

Experience is arguably the most powerful driver of salary growth. As you accumulate years in a specific role or industry, your value to an employer increases.

- Entry-Level (0-2 years): In many professional fields, a starting salary might be between $50,000 and $65,000.

- Mid-Career (3-8 years): This is the sweet spot where many professionals cross the $70k threshold. You have a proven track record, require less supervision, and can begin mentoring junior staff.

- Senior-Level (8+ years): With extensive experience, salaries often move into the $90,000 to $120,000+ range, depending on the role and industry.

Payscale's salary data consistently shows a strong positive correlation between years of experience and median pay across nearly all professions.

###

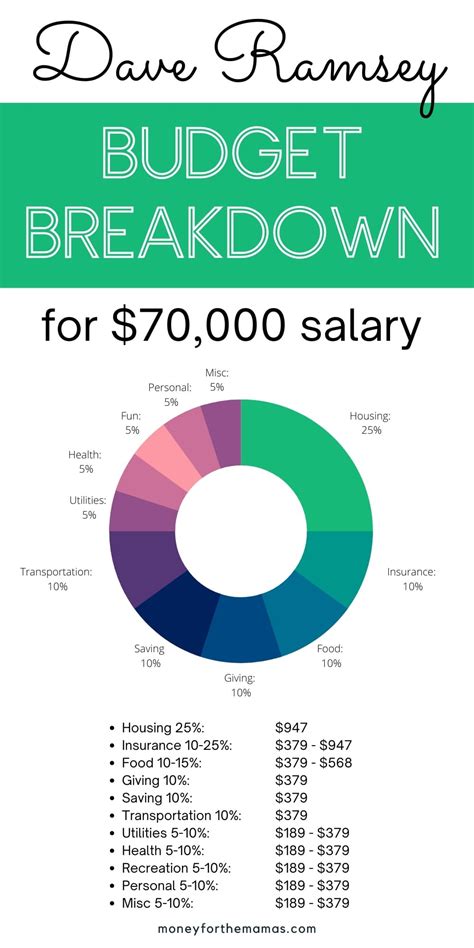

Geographic Location

Where you live and work has a massive impact on your salary. A $70,000 salary in a low-cost-of-living city like Omaha, Nebraska, provides significantly more purchasing power than the same salary in a high-cost-of-living metropolitan area like San Francisco or New York City.

Employers use Cost of Living Adjustments (COLA) to set competitive salaries for different regions. For example:

- An Accountant in Des Moines, Iowa, with a median salary of $68,000 might need to earn over $95,000 in Boston, Massachusetts, to maintain a similar standard of living, according to Glassdoor's salary comparison tools.

- A Registered Nurse in a rural state may earn around $65,000, while the same RN in California could earn over $100,000, as documented by BLS state-level data.

###

Company Type and Industry

The type of company you work for and its industry also play a vital role.

- Industry: Industries like technology, pharmaceuticals, and finance typically offer higher pay scales than non-profit or public education sectors. A Project Manager in a tech company will almost always earn more than a Project Manager at a non-profit organization with a similar level of responsibility.

- Company Size: Large, multinational corporations often have more structured and higher-paying salary bands compared to small businesses or startups. However, a startup might compensate with equity or stock options, which can have a high potential payoff.

###

Area of Specialization

Within any given profession, specialization can be a lucrative strategy. Developing in-demand, niche skills makes you a more valuable and harder-to-replace asset.

Consider a Software Developer. A generalist front-end developer might earn around $70,000 early in their career. However, a developer who specializes in a high-demand niche like Artificial Intelligence (AI), Cybersecurity, or cloud computing with AWS/Azure certifications can command a salary starting closer to $100,000.

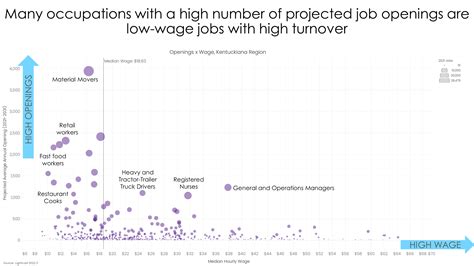

Job Outlook for Professions in This Salary Range

The future looks bright for many of the professions that command a $70k salary. The demand for skilled, educated, and experienced workers continues to grow, especially in sectors like healthcare, technology, and finance.

According to the U.S. Bureau of Labor Statistics' Occupational Outlook Handbook (2022-2032 projections):

- Registered Nurses: Employment is projected to grow 6% (faster than average), with a 2022 median pay of $81,220 per year.

- Financial Analysts: Employment is projected to grow 8% (much faster than average), with a 2022 median pay of $95,570 per year.

- Market Research Analysts: Employment is projected to grow 13% (much faster than average), with a 2022 median pay of $74,680 per year.

These figures demonstrate that careers in this salary bracket are not only financially rewarding but also stable and poised for continued growth.

Conclusion: Charting Your Course to $70k and Beyond

A $70,000 annual salary, or $33.65 per hour, represents a significant professional achievement and provides a solid financial foundation for many individuals and families. It is a benchmark that is well within reach for dedicated professionals who approach their careers with intention.

Your journey to this income level—and far beyond it—is not left to chance. It is shaped by your deliberate choices in:

- Education: Investing in degrees and certifications that align with high-demand fields.

- Experience: Patiently building a strong track record of success and responsibility.

- Specialization: Developing niche skills that set you apart from the competition.

- Strategic Location: Understanding how geography impacts both salary and cost of living.

By focusing on these key areas, you can effectively navigate your career path, maximize your earning potential, and achieve your financial goals.