A career as a corporate accountant is a cornerstone of the business world, offering stability, a clear path for advancement, and significant financial rewards. If you have a knack for numbers and a strategic mindset, this profession is a compelling choice. But what can you realistically expect to earn?

While the national average salary for a corporate accountant hovers around $78,000 per year, the full earning potential can range from approximately $55,000 for an entry-level position to well over $120,000 for experienced senior professionals. This guide will break down the salary you can expect and explore the key factors that will shape your career-long earnings.

What Does a Corporate Accountant Do?

Before diving into the numbers, it’s important to understand the role. A corporate accountant is the financial backbone of a company. Unlike public accountants who work for an accounting firm serving multiple clients, corporate accountants are employed directly by a single organization, whether it's a tech startup, a multinational corporation, or a non-profit.

Their core responsibilities include:

- Preparing Financial Statements: Crafting balance sheets, income statements, and cash flow statements.

- Month-End and Year-End Close: Reconciling accounts and ensuring financial records are accurate and finalized for reporting periods.

- Budgeting and Forecasting: Assisting management in planning for future financial performance.

- Ensuring Compliance: Making sure the company adheres to tax laws and financial regulations like GAAP (Generally Accepted Accounting Principles).

- Internal Analysis: Analyzing financial data to provide insights that drive business decisions.

They are the guardians of a company's financial health and integrity.

Average Corporate Accountant Salary

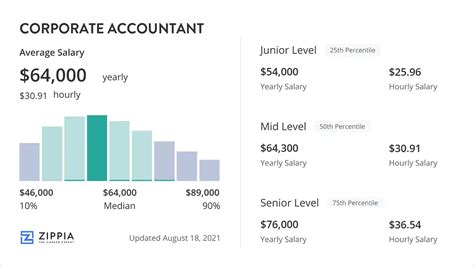

Salary data from various authoritative sources paints a consistent picture of a corporate accountant's earning potential.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all accountants and auditors was $78,000 in May 2022. This figure serves as an excellent benchmark for a mid-level professional.

Salary aggregators provide a more granular view of the salary spectrum:

- Entry-Level (Staff Accountant, 0-2 years): Typically earns between $55,000 and $70,000.

- Mid-Level (Corporate Accountant, 2-5 years): The salary range widens to $70,000 to $90,000.

- Senior-Level (Senior Accountant, 5+ years): Professionals with significant experience can expect to earn between $90,000 and $120,000+, with titles like Accounting Manager or Controller earning substantially more.

(Sources: U.S. Bureau of Labor Statistics, Salary.com, Glassdoor, 2023-2024 data)

These figures are a baseline. Your specific salary will be influenced by a combination of powerful factors.

Key Factors That Influence Salary

This is where you can take control of your earning potential. Understanding these five key drivers will help you make strategic decisions throughout your career.

### Level of Education & Certification

Your academic and professional qualifications are the foundation of your salary.

- Bachelor’s Degree: A bachelor's degree in accounting or a related field is the standard entry requirement for most corporate accounting positions.

- Master’s Degree: A Master of Accountancy (MAcc) or an MBA with a concentration in accounting can give you a competitive edge, often leading to a higher starting salary and quicker advancement to senior roles.

- The CPA License: Earning the Certified Public Accountant (CPA) license is the single most impactful step an accountant can take to increase their salary. It is the gold standard in the industry, signifying a high level of expertise and ethical standards. According to the Association of International Certified Professional Accountants (AICPA), CPAs can earn a salary premium of 5% to 15% over their non-certified peers.

### Years of Experience

Experience is a direct driver of compensation. As you move from foundational tasks to more complex and strategic responsibilities, your value—and your salary—increases accordingly.

- Entry-Level (0-2 years): You’ll focus on tasks like journal entries, account reconciliations, and assisting with the month-end close.

- Mid-Level (2-5 years): You take on full ownership of the closing process, prepare financial statements, and begin to engage in financial analysis and budgeting.

- Senior-Level (5+ years): You are expected to handle complex accounting issues, mentor junior staff, lead projects, and provide strategic insights to management. This level of responsibility commands a significant salary increase and opens doors to leadership positions like Accounting Manager or Controller.

### Geographic Location

Where you work matters. Salaries are often adjusted to the cost of living in a specific metropolitan area. Major urban centers with a high concentration of large corporations typically offer the highest salaries.

- Top-Paying States: States like California, New York, Massachusetts, and Virginia consistently report higher-than-average accountant salaries due to their strong economies and high cost of living.

- Metropolitan Hotspots: Cities such as San Jose, New York City, San Francisco, and Boston are known for offering top-tier compensation.

- The Remote Work Effect: While geography is still a major factor, the rise of remote work has created new opportunities. Some companies now offer competitive national rates regardless of location, while others adjust pay based on a tiered geographic system.

(Source: BLS Occupational Employment and Wage Statistics)

### Company Type & Size

The type of organization you work for has a direct impact on your paycheck.

- Public vs. Private: Publicly traded companies are subject to stringent SEC reporting requirements, making their accounting functions more complex. This complexity often translates into higher salaries for their accounting teams.

- Company Size: Large, multinational corporations generally have higher revenues and more intricate financial systems, allowing them to offer more competitive compensation and benefits packages compared to small- and medium-sized businesses (SMBs).

- Industry: Certain industries are more lucrative than others. Accountants in high-growth or high-margin sectors like technology, financial services, pharmaceuticals, and energy often command higher salaries than those in non-profit or retail sectors.

### Area of Specialization

Within corporate accounting, developing a specialized skillset can make you an invaluable asset. General accountants are always in demand, but specialists often earn more.

- Financial Reporting (SEC): Experts in SEC regulations and external reporting are highly sought after by public companies.

- Technical Accounting: Specialists who can interpret and implement complex new accounting standards (e.g., revenue recognition, lease accounting) are in high demand.

- Internal Audit: Professionals who focus on evaluating internal controls and risk management often have a direct path to leadership and are compensated well.

- Managerial/Cost Accounting: Crucial in manufacturing and production industries, these accountants help control costs and improve operational efficiency.

Job Outlook

The future for corporate accountants is bright and stable. The U.S. Bureau of Labor Statistics projects employment for accountants and auditors to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady growth is driven by the overall health of the economy, globalization, an increasingly complex tax and regulatory environment, and the constant need for organizations to maintain tight financial oversight. This ensures that skilled accountants will remain in consistent demand.

Conclusion

A career as a corporate accountant offers a financially rewarding and stable path for detail-oriented professionals. While the national median salary provides a solid benchmark, your individual earnings will be a direct reflection of your strategic career choices.

To maximize your salary potential, focus on these key takeaways:

1. Invest in Education and Certification: Prioritize earning your CPA license—it is the most significant salary booster.

2. Gain Diverse Experience: Move from foundational roles to positions with greater strategic responsibility.

3. Be Strategic About Location and Industry: Target high-growth industries in major metropolitan areas if possible.

4. Develop a Specialization: Cultivate expertise in a high-demand area like technical accounting or financial reporting.

By proactively managing these factors, you can build a successful and lucrative career as a vital financial leader in the business world.