Introduction

In a world of evolving workplace dynamics, complex regulations, and a growing demand for ethical corporate conduct, a new kind of hero has emerged in the professional landscape: the Labor Compliance Manager. This is a career for those who are driven not by profit alone, but by a profound commitment to fairness, justice, and the fundamental rights of employees. If you envision a professional life where you are the bulwark against exploitation, the architect of fair policies, and the trusted expert who ensures a company’s integrity, then a career in labor compliance may be your calling.

The role of a Labor Compliance Manager is both challenging and immensely rewarding. These professionals are the guardians of workplace law, ensuring that companies adhere to a labyrinth of regulations governing everything from wages and hours to workplace safety and equal opportunity. The financial compensation reflects this critical responsibility, with average salaries for experienced professionals often exceeding six figures. According to data from Salary.com, the median salary for a Compliance Manager in the United States is approximately $120,530 as of late 2023, with the typical range falling between $103,170 and $140,560.

I recall a time early in my career when a close friend, a salaried employee at a fast-growing tech startup, was routinely working 70-hour weeks without any additional compensation, under the guise of "company loyalty." It was the intervention of a newly hired, sharp-witted HR Compliance Specialist that completely transformed the company culture. By auditing practices and implementing clear policies on work hours and project management, she not only protected employees from burnout and illegal exploitation but also improved morale and productivity, proving that ethical practices are a cornerstone of sustainable success. This experience cemented my belief in the profound impact of this vital profession.

This guide will serve as your comprehensive roadmap to a career as a Labor Compliance Manager. We will delve into the day-to-day responsibilities, dissect salary expectations, explore the factors that can maximize your earning potential, and provide a step-by-step plan to help you launch and advance in this crucial and rewarding field.

### Table of Contents

- [What Does a Labor Compliance Manager Do?](#what-does-a-labor-compliance-manager-do)

- [Average Labor Compliance Manager Salary: A Deep Dive](#average-labor-compliance-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Labor Compliance Manager Do?

A Labor Compliance Manager is a strategic expert responsible for ensuring an organization's adherence to all labor and employment laws and regulations. They are proactive problem-solvers who bridge the gap between legal requirements and business operations. Their primary mission is to protect the company from legal risks and financial penalties while simultaneously fostering a fair, ethical, and lawful environment for all employees. This is a multi-faceted role that requires a blend of legal acumen, business savvy, analytical skills, and interpersonal finesse.

The scope of their work is vast, covering federal, state, and even local municipal laws. They are the go-to experts on cornerstone legislation like the Fair Labor Standards Act (FLSA), which governs minimum wage, overtime pay, and recordkeeping. They also manage compliance with the Family and Medical Leave Act (FMLA), the Americans with Disabilities Act (ADA), Title VII of the Civil Rights Act (which prohibits employment discrimination), and Occupational Safety and Health Administration (OSHA) regulations.

Core Responsibilities and Daily Tasks:

- Policy Development and Implementation: Drafting, reviewing, and updating employee handbooks, company policies, and procedures to ensure they are current with all legal standards. This includes policies on working hours, overtime for non-exempt employees, meal and rest breaks, leave of absence, and anti-harassment.

- Audits and Risk Assessments: Conducting regular internal audits of HR practices. A key audit involves wage and hour classifications, where they meticulously review job descriptions and duties to ensure employees are correctly classified as "exempt" (salaried, not eligible for overtime) or "non-exempt" (hourly, eligible for overtime). Misclassifying employees is a common form of wage theft and a primary area of focus for compliance managers.

- Training and Education: Developing and delivering training programs for managers and employees. A manager might be trained on how to properly track hours for non-exempt staff or how to handle an FMLA request. Employees might receive training on their rights and the company's anti-discrimination policies.

- Investigations: Acting as an impartial investigator for internal complaints related to harassment, discrimination, retaliation, or wage disputes. This requires a methodical approach to gathering evidence, interviewing parties, and recommending corrective action.

- Recordkeeping and Reporting: Overseeing the maintenance of accurate and complete employment records as required by law. This includes I-9 forms, payroll records, and documentation related to hiring, promotion, and termination decisions. They may also be responsible for preparing and submitting government-mandated reports, such as EEO-1 reports.

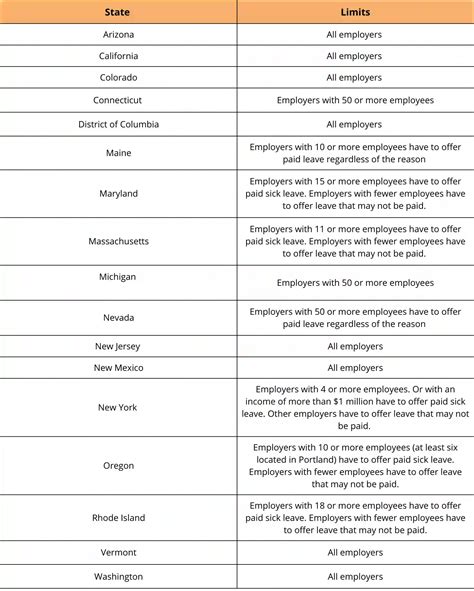

- Staying Current with Legislation: Continuously monitoring changes in labor law at all levels of government. When a new law is passed (e.g., a new state-mandated paid sick leave law), the compliance manager is responsible for analyzing its impact on the company and implementing the necessary changes.

### A Day in the Life of a Labor Compliance Manager

To make this tangible, let's follow "Alex," a Labor Compliance Manager at a mid-sized retail company.

- 8:30 AM: Alex starts the day by reviewing a legal alert digest. A new municipal ordinance regarding predictable scheduling for retail workers has just been passed in a city where the company has three stores. Alex flags this, drafts a preliminary impact analysis, and schedules a meeting with the Head of Operations to discuss a compliance strategy.

- 10:00 AM: Alex leads a training session via Zoom for 25 newly promoted store managers. The topic: "FLSA Essentials: Avoiding Off-the-Clock Work and Properly Managing Overtime." The goal is to prevent managers from inadvertently asking non-exempt employees to perform work during unpaid breaks or after their shifts, a common source of wage and hour lawsuits.

- 11:30 AM: An anonymous complaint has been filed through the company's ethics hotline, alleging a salaried department head is pressuring their team to misreport project hours to make their department seem more efficient. Alex opens a confidential investigation file, outlining the initial steps: securing relevant data and planning discreet interviews.

- 1:00 PM: After lunch, Alex dives into a major project: a company-wide audit of all "exempt" salaried positions. Using a detailed questionnaire and reviewing job descriptions, Alex is analyzing whether certain roles, like "Assistant Manager," truly meet the strict "duties test" required for an exemption from overtime pay. Any roles found to be misclassified will need to be reclassified, and back pay might be required.

- 3:30 PM: Alex meets with the VP of Human Resources to provide a status update on the FMLA policy revision. They are working to incorporate recent guidance from the Department of Labor to make the policy clearer for both employees and managers.

- 4:45 PM: Before logging off, Alex reviews the draft of the company's annual EEO-1 report, cross-referencing demographic data with payroll records to ensure accuracy before the submission deadline.

This "day in the life" illustrates the dynamic and impactful nature of the role. A Labor Compliance Manager is not just a rule-enforcer; they are a strategic partner who actively builds a more just and legally sound organization from the inside out.

Average Labor Compliance Manager Salary: A Deep Dive

Compensation for Labor Compliance Managers reflects the high level of responsibility, specialized knowledge, and significant impact they have on an organization's financial and legal health. A mistake in compliance can lead to multi-million dollar lawsuits, government fines, and reputational damage, making skilled professionals in this field highly valuable.

The salary landscape is broad, influenced by a multitude of factors we will explore in the next section. However, we can establish a strong baseline by examining data from reputable sources. It's important to note that titles can vary—"Compliance Manager," "HR Compliance Specialist," "Employment Counsel," or "Labor Relations Manager"—but the core function of ensuring labor law adherence remains central. For our purposes, we will analyze data for "Compliance Manager," which is a widely recognized title.

National Averages and Salary Ranges

According to several leading salary aggregators, the national average and typical salary range for a Compliance Manager in the United States are robust.

- Salary.com: As of November 2023, the median annual salary for a Compliance Manager is $120,530. The typical salary range is quite wide, generally falling between $103,170 and $140,560. This range does not include bonuses or other compensation, focusing solely on base salary. The top 10% of earners can reach over $163,000, while the bottom 10% may start around $84,000.

- Glassdoor: Glassdoor's data, which incorporates user-submitted salary information, reports a total pay estimate for a Compliance Manager in the US at $129,545 per year, with an estimated base salary of $107,313 per year. The "likely range" for total pay is between $98,000 and $171,000. The difference between base pay and total pay highlights the importance of variable compensation.

- Payscale: Payscale provides an average base salary of $85,511 per year for a Compliance Manager. Their reported range is from $58,000 to $124,000. This lower average may reflect a broader sample that includes compliance roles outside of the more specialized and higher-paying labor/HR field, as well as roles in smaller companies or non-profits.

Taking a composite view of these sources, a reasonable expectation for a mid-career Labor Compliance Manager's base salary is between $100,000 and $130,000, with significant potential for higher earnings based on experience, location, and company size.

### Salary Progression by Experience Level

Salary growth in compliance is directly tied to experience and proven expertise. As you progress from an entry-level specialist to a senior leader, your compensation will increase substantially.

| Experience Level | Typical Title(s) | Typical Base Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-3 years) | Compliance Analyst, HR Compliance Specialist, Compliance Coordinator | $65,000 - $85,000 | Assisting with audits, maintaining compliance records, researching regulations, preparing reports, helping to coordinate training logistics. |

| Mid-Career (4-8 years) | Compliance Manager, Senior Compliance Analyst, Labor Relations Specialist | $90,000 - $135,000 | Managing compliance programs, conducting investigations, developing and leading training, auditing wage & hour classifications, advising business leaders. |

| Senior-Level (8+ years) | Senior Compliance Manager, Director of Compliance, VP of Labor Relations | $140,000 - $200,000+ | Setting enterprise-wide compliance strategy, managing a team of compliance professionals, representing the company in audits, interfacing with executive leadership and legal counsel. |

*(Salary ranges are estimates compiled from sources like Salary.com, Glassdoor, and industry observations. Actual salaries will vary.)*

### Deconstructing the Compensation Package

Base salary is only one piece of the puzzle. A comprehensive compensation package for a Labor Compliance Manager, especially at the mid to senior level, often includes several other valuable components.

- Annual Bonuses: This is the most common form of variable pay. Bonuses are typically tied to a combination of individual performance and company performance. An annual bonus can range from 10% to 25% of the base salary, and sometimes more for director-level roles. Performance metrics might include the successful completion of a company-wide compliance audit, a reduction in employee complaints, or the seamless implementation of a new regulatory requirement.

- Profit Sharing: Some companies, particularly in the private sector, offer a profit-sharing plan where a portion of the company's profits is distributed among employees. This provides a direct incentive to contribute to the company's overall success.

- Stock Options or Restricted Stock Units (RSUs): In publicly traded companies or high-growth startups, equity is a significant component of compensation. Stock options give you the right to buy company stock at a predetermined price, while RSUs are grants of company shares that vest over time. This can add substantial value to your total compensation, especially if the company performs well.

- Retirement Benefits: A strong 401(k) or 403(b) plan with a generous employer match is a critical part of long-term financial planning. A typical match might be 50% of your contribution up to 6% of your salary, effectively giving you a 3% raise that is invested for your future.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a standard expectation. Many companies also offer wellness stipends (for gym memberships or fitness apps), generous paid time off (PTO), and robust parental leave policies.

- Professional Development Budget: Because compliance is an ever-changing field, many forward-thinking companies will provide a budget for continuing education, professional association memberships (like SHRM or SCCE), and certification exam fees. This is a crucial benefit that supports your career growth and keeps your skills sharp.

When evaluating a job offer, it is essential to look at the "total rewards" package. A slightly lower base salary at a company with an outstanding bonus structure, excellent benefits, and a significant 401(k) match may be far more lucrative in the long run than an offer with a higher base salary but little else.

Key Factors That Influence Salary

While the national averages provide a useful benchmark, a Labor Compliance Manager's actual salary is a dynamic figure shaped by a confluence of specific, identifiable factors. Understanding these levers is the key to maximizing your earning potential throughout your career. Aspiring and current professionals can strategically focus on these areas to build a resume and skill set that commands a premium salary.

###

Level of Education

Your educational background is the foundation upon which your compliance career is built, and it directly impacts your starting salary and long-term trajectory.

- Bachelor’s Degree: A bachelor's degree is the standard entry requirement. Relevant majors include Human Resources, Business Administration, Finance, or Pre-Law. A degree in one of these fields provides the fundamental knowledge of business operations and organizational structures necessary for the role. Candidates with a bachelor's degree will typically qualify for entry-level roles like Compliance Analyst or HR Coordinator.

- Master’s Degree: A master's degree can provide a competitive edge and a salary bump. A Master of Business Administration (MBA) is highly valued as it equips candidates with a strategic business perspective. A Master's in Human Resource Management (MHRM) or Industrial and Labor Relations (MILR) offers specialized knowledge directly applicable to the role. These advanced degrees often allow candidates to enter at a higher level or command a salary at the upper end of the entry-level range.

- Juris Doctor (JD) Degree: The "gold standard" for top-tier labor compliance roles, especially those titled "Employment Counsel" or "Director of Compliance," is a law degree. A JD provides unparalleled expertise in statutory interpretation, legal research, and risk analysis. Professionals with a JD are uniquely qualified to handle complex internal investigations, manage litigation risk, and interface directly with outside counsel and regulatory agencies. A JD can easily add $30,000 to $50,000+ to the median salary for a comparable role held by a non-lawyer, particularly in large, heavily regulated corporations.

- Professional Certifications: Certifications demonstrate a commitment to the profession and a validated level of expertise. They are a powerful way to increase your marketability and salary. Key certifications include:

- Certified Compliance & Ethics Professional (CCEP): Offered by the Society of Corporate Compliance and Ethics (SCCE), this is one of the most respected certifications in the broader compliance field.

- SHRM Certified Professional (SHRM-CP) or Senior Certified Professional (SHRM-SCP): Offered by the Society for Human Resource Management, these certifications are essential for any HR-focused compliance role, demonstrating broad knowledge of HR principles and practices.

- Professional in Human Resources (PHR) or Senior Professional in Human Resources (SPHR): Offered by the HR Certification Institute (HRCI), these are also highly respected HR certifications.

Acquiring one or more of these can justify a salary increase and open doors to more senior positions.

###

Years of Experience

Experience is perhaps the single most significant factor in salary determination. The ability to demonstrate a track record of successfully navigating complex compliance challenges is invaluable to employers.

- Entry-Level (0-3 years): At this stage, you are learning the ropes. Your salary will be in the $65,000 - $85,000 range. You will be building foundational skills—assisting with audits, learning the relevant laws, and supporting senior team members.

- Mid-Career (4-8 years): With a solid track record, you can expect a significant jump in pay, into the $90,000 - $135,000 range. You are now managing your own projects, leading investigations, and advising business unit leaders. You have moved from executing tasks to managing programs. At this stage, a professional with a JD or multiple certifications will trend toward the higher end of this range.

- Senior-Level (8-15+ years): As a senior manager or director, your focus shifts from tactical execution to strategic leadership. You are responsible for the entire compliance framework, managing a team, and advising the C-suite. Your salary will reflect this, typically ranging from $140,000 to $200,000+. Top professionals in this bracket, such as a Vice President of Labor & Employment at a Fortune 500 company, can earn significantly more, with total compensation packages including equity reaching $250,000 to $400,000 or higher.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of labor and cost of living. Furthermore, states and cities with more complex and employee-friendly legal landscapes often place a higher value on compliance professionals.

- High-Paying Metropolitan Areas: Major coastal cities and tech hubs consistently offer the highest salaries. These locations often have a higher cost of living and a more complex web of local and state regulations.

- San Francisco Bay Area, CA: Expect salaries 25-40% above the national average. California's unique laws (e.g., PAGA, stringent meal/rest break rules) make expert compliance managers essential.

- New York, NY: Salaries are typically 20-35% above average.

- Boston, MA: Salaries are often 15-25% above average.

- Washington, D.C.: A hub for regulatory work, with salaries 15-25% above average.

- Average-Paying Areas: Many major cities in the Midwest and Southeast will offer salaries close to the national average. Cities like Chicago, IL; Atlanta, GA; and Dallas, TX, have robust business communities and offer competitive compensation.

- Lower-Paying Areas: Rural areas and states with a lower cost of living and less complex regulatory environments will generally offer lower salaries, often 10-20% below the national average.

It's also crucial to consider the rise of remote work. Companies may adjust salaries based on an employee's location, even for remote roles. A company based in San Francisco might offer a lower salary to a remote employee living in a low-cost area compared to a local employee.

###

Company Type & Size

The type of organization you work for has a profound impact on your compensation and the nature of your work.

- Large Corporations (Fortune 500): These companies offer the highest salaries and most comprehensive benefits packages. They operate across multiple states (and often countries), facing an immense web of regulations. Compliance departments are large, well-funded, and highly specialized. The work is often focused on managing risk at a massive scale.

- Tech Startups (High-Growth): Startups, particularly those that are well-funded, can offer very competitive base salaries along with significant equity (stock options). The role here is often more dynamic; you might be the first compliance hire, building the entire function from the ground up. This offers incredible experience but can also be a high-pressure environment.

- Mid-Sized Companies: These companies offer a balance. Salaries are competitive, often slightly below large corporate levels, but the work can be more hands-on and have a broader scope than in a highly specialized corporate role.

- Non-Profit Organizations: Non-profits typically offer lower salaries than their for-profit counterparts. However, they can provide immense job satisfaction for those motivated by a specific mission. The compliance challenges are still significant, especially for larger non-profits with many employees.

- Government Agencies: Working for a government entity like the Department of Labor offers a different path. While base salaries may be lower than in the private sector, government roles often come with exceptional job security, predictable hours, and excellent pension and benefits packages.

###

Area of Specialization

Within the field of labor compliance, specializing can make you a more sought-after and highly paid expert.

- Wage and Hour (FLSA) Specialist: This is a core and highly valuable specialization. Experts who can flawlessly classify employees, audit pay practices, and defend against wage and hour lawsuits are always in demand.

- Leave of Absence (FMLA/ADA) Management: As leave laws become more complex, specialists who can manage the interactive process for disability accommodations and administer FMLA and state-specific leave programs are critical.

- Labor Relations: In unionized environments, a Labor Relations Specialist or Manager is key. This role involves negotiating collective bargaining agreements, handling grievances, and managing the relationship between management and the union. This is a highly specialized and often well-compensated niche.

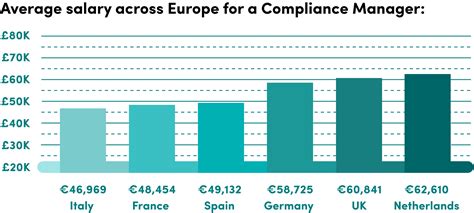

- International Labor Law: For multinational corporations, professionals with expertise in the labor laws of other countries (e.g., the EU, Asia) are essential for managing a global workforce and command premium salaries.

- Affirmative Action and EEO Compliance: Specialists who manage Affirmative Action Plans (AAPs) for government contractors and ensure compliance with Equal Employment Opportunity (EEO) regulations are vital in many large organizations.

###

In-Demand Skills

Beyond your formal qualifications, a specific set of skills will elevate your performance and your paycheck.

- Data Analysis: The ability to use HRIS and data analytics tools to audit large datasets for compliance issues (e.g., analyzing payroll data for pay equity gaps or overtime discrepancies) is a modern superpower for a compliance manager.

- Project Management: Implementing a new compliance program is a major project. Skills in planning, execution, and stakeholder management are crucial.

- Exceptional Communication and Training Skills: You must be able to translate complex legal jargon into clear, actionable guidance for everyone from front-line managers to C-suite executives. The ability to lead engaging and effective training is essential.

- Investigative Acumen: Conducting fair, thorough, and impartial investigations requires a unique skill set that includes interviewing, evidence gathering, and objective report writing.

- Business Acumen: The best compliance managers understand that they are business partners. They provide solutions that not only ensure compliance but also support the company's operational goals. They can articulate risk in business terms (e.g., "This practice creates a potential liability of X dollars").

- Negotiation and Conflict Resolution: Whether dealing with a disgruntled employee, negotiating with a regulatory agency, or mediating a dispute between a manager and an employee, these skills are used daily.

By strategically developing these skills, pursuing advanced education and certifications, and targeting high-paying industries and locations, you can actively steer your career towards its maximum earning potential.

Job Outlook and Career Growth

The future for Labor Compliance Managers is exceptionally bright. In an increasingly regulated and litigious world, the demand for professionals who can navigate the complexities of employment law is not just stable—it's growing. Organizations are recognizing that proactive compliance is not merely a cost of doing business, but a strategic imperative that protects the bottom line, enhances brand reputation, and fosters a positive work culture.

Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) provides strong data supporting this positive outlook. While the BLS doesn't have a dedicated category for "Labor Compliance Manager," it groups them under the broader category of "Compliance Officers."

According to the BLS's Occupational Outlook Handbook, employment for Compliance Officers is projected to grow 6 percent from 2022 to 2032, which is faster than the average for all occupations. This translates to about 24,100 new jobs over the decade. The BLS explicitly states that this growth will be driven by a "continued need for organizations to meet a growing number of regulations," including those in finance, healthcare, and, critically, employment.

Another relevant BLS category is "Human Resources Managers," whose responsibilities often include overseeing compliance functions. This field is also projected to grow by 5 percent over the same period, adding approximately 9,600 new jobs. The BLS notes the importance of HR managers in ensuring compliance with ever-changing and complex employment laws as a key driver of this demand.

The takeaway is clear: the market for skilled compliance professionals is expanding, ensuring strong job security and opportunities for those entering and advancing in the field.

Emerging Trends and Future Challenges

The world of work is in constant flux, and the best compliance managers are those who can anticipate and adapt to emerging trends. Staying ahead of these changes is key to remaining relevant and valuable.

- The Rise of Remote and Hybrid Work: The massive shift to remote work has created a compliance minefield. Compliance managers must now contend with issues like:

- State Law Nexus: Which state's laws apply to a remote employee? (e.g., wage laws, leave laws, break requirements).

- Expense Reimbursement: Many states require reimbursement for necessary business expenses like internet and cell phone use for remote workers.

- Timekeeping for Non-Exempt Remote Workers: Ensuring accurate tracking of all hours worked when employees are not physically present is a major challenge.

- Pay Equity and Transparency: A growing number of states and cities are enacting pay transparency laws that require employers to disclose salary ranges in job postings. There is also a major push for pay equity audits to identify and remedy pay disparities based on gender, race, or other protected characteristics. Compliance managers are at the forefront of implementing these changes and conducting these sensitive analyses.

- Data Privacy: With laws like the California Privacy Rights Act (CPRA), the protection of employee data has become a critical compliance issue. HR departments handle vast amounts of sensitive personal information, and compliance managers must develop policies and procedures to ensure this data is collected, used, and stored lawfully.

- The "Gig Economy" and Worker Classification: The ongoing legal battles over the classification of workers as independent contractors versus employees (e.g., in ridesharing and delivery services) have massive compliance implications. Labor Compliance Managers are essential in helping companies correctly classify their workforce to avoid devastating legal penalties.

- AI in HR: The use of Artificial Intelligence in hiring and performance management is a new frontier for compliance. Professionals must ensure that AI tools are not creating discriminatory outcomes or violating employee rights, a complex and evolving challenge.

How to Stay Relevant and Advance Your Career

Advancement in compliance is not automatic; it requires a proactive commitment to continuous learning and strategic career management.

1. Become a Lifelong Learner: The law is not static. Subscribe to legal alerts from major law firms (e.g., Littler Mendelson, Ogletree Deakins), regularly read SHRM and SCCE publications, and attend webinars and seminars on emerging legal topics.

2. Specialize and Deepen Your Expertise: While a generalist background is great to start, developing a deep specialty in a high-demand area like wage and hour, leave management, or data privacy will make you a sought-after expert.

3. Build Your Network: Actively participate in professional organizations like SHRM and SCCE. Attend local chapter meetings and national conferences. The connections you make can lead to job opportunities, mentorship, and invaluable professional advice.

4. Embrace Technology: Become proficient in using Human Resources Information Systems (HRIS) like Workday or ADP. Develop skills in data analysis tools, including Excel at an advanced level and potentially even data visualization software like Tableau, to conduct more sophisticated audits and present your findings effectively.

5. Develop Your "Soft Skills": Your ability to influence, communicate, and build trust is just as important as your technical legal knowledge. Seek out opportunities to lead training sessions, present to leadership, and mediate disputes. These experiences build the leadership qualities needed for director-level roles.

6. Seek Out Complex Projects: Volunteer to lead the implementation of a new compliance program or to conduct a challenging internal investigation. These high-visibility projects are your chance to demonstrate your value and build a reputation as a problem-solver.

By embracing these strategies, you can move beyond simply managing compliance to becoming a strategic leader who shapes the ethical fabric of your organization, ensuring a long and successful career in this vital field.

How to Get Started in This Career

Embarking on a career as a Labor Compliance Manager is a journey that requires a deliberate combination of education, practical experience, and continuous professional development. There is no single, rigid path, but the following step-by-step guide outlines a proven framework for building a successful career dedicated to upholding workplace rights.

Step 1: Build a Strong Educational Foundation

Your first step is to acquire the necessary academic credentials. A bachelor's degree is the essential starting point.

- Choose a Relevant Major: Focus on degree programs that provide a solid understanding of business and legal principles. Top choices include:

- Human Resource Management: This is perhaps the most direct route,