In an era of ever-increasing regulation and a global focus on ethical business practices, the role of a compliance manager has shifted from a back-office function to a critical strategic position. This high-stakes career is not only intellectually stimulating but also financially rewarding. For those considering this path, the salary potential is a significant draw, with experienced professionals often commanding six-figure incomes and enjoying strong job security.

This article provides a data-driven analysis of what you can expect to earn as a compliance manager, the key factors that will shape your income, and the bright future this career holds.

What Does a Compliance Manager Do?

A compliance manager is an organization's internal guardian of integrity and adherence to law. They are responsible for ensuring a company operates in a legal and ethical manner while meeting its business goals. Their role is to navigate the complex web of laws, regulations, and company policies that govern their industry.

Key responsibilities typically include:

- Developing and implementing compliance programs, policies, and procedures.

- Conducting risk assessments to identify potential areas of non-compliance.

- Training employees on regulatory requirements and internal policies.

- Monitoring business activities and conducting internal audits to ensure adherence.

- Investigating and resolving compliance violations or concerns.

- Serving as the point of contact for external regulators and auditors.

- Reporting on compliance status to senior management and the board of directors.

Average Compliance Manager Salary

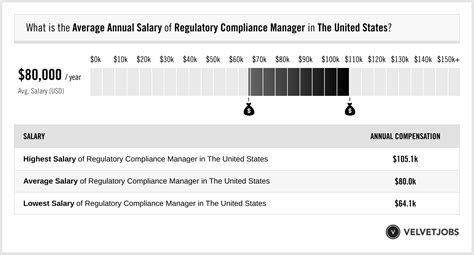

The compensation for a compliance manager is highly competitive, reflecting the critical nature of the role. While figures vary based on several factors, we can establish a strong baseline from leading data sources.

According to Salary.com, the median annual salary for a Compliance Manager in the United States is approximately $125,780 as of early 2024. The typical salary range falls between $109,290 and $145,030.

Data from other reputable sources supports this range:

- Glassdoor reports an average total pay (including base salary, bonuses, and other compensation) of around $139,000 per year.

- Payscale notes a similar average base salary of about $97,000, with a range that stretches from $68,000 for early-career professionals to over $135,000 for those with extensive experience.

It's important to distinguish this from the broader "Compliance Officer" category reported by the U.S. Bureau of Labor Statistics (BLS). The BLS reports a median annual wage of $75,980 for all compliance officers as of May 2023. This figure includes a wide spectrum of roles, including entry-level specialists and government employees, which is why it appears lower than the figures for a specific "manager" title in the corporate sector.

Key Factors That Influence Salary

Your specific salary as a compliance manager isn't set in stone. It is influenced by a combination of your qualifications, choices, and environment. Understanding these factors is key to maximizing your earning potential.

### Level of Education

A strong educational foundation is the bedrock of a compliance career.

- Bachelor's Degree: This is the standard entry requirement. Degrees in business, finance, accounting, or pre-law are most common and provide a solid foundation for understanding corporate environments and regulatory frameworks.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA), a Master of Laws (LLM), or a Juris Doctor (JD), can significantly increase earning potential. These degrees signal advanced analytical, leadership, and strategic thinking skills, often paving the way for senior leadership roles like Director of Compliance or Chief Compliance Officer (CCO).

- Professional Certifications: Certifications are a powerful way to demonstrate specialized expertise and can lead to a significant salary premium. Highly regarded credentials include the Certified Compliance & Ethics Professional (CCEP), the Certified Anti-Money Laundering Specialist (CAMS), and the Certified Information Privacy Professional (CIPP).

### Years of Experience

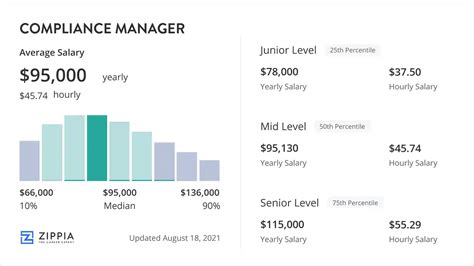

Experience is arguably the most significant driver of salary growth in the compliance field. A typical career and salary progression might look like this:

- Entry-Level (0-4 years): Professionals often start as Compliance Analysts or Specialists. In this phase, salaries typically range from $65,000 to $95,000 as they learn the fundamentals and support senior staff.

- Mid-Career (5-10 years): This is the sweet spot for the "Compliance Manager" title. With proven experience managing projects and a deep understanding of their industry, professionals can expect to earn within the core average range of $100,000 to $145,000.

- Senior/Executive Level (10+ years): With a decade or more of experience, managers can advance to roles like Senior Compliance Manager, Director of Compliance, or Chief Compliance Officer. At this level, salaries frequently exceed $150,000 and can push well over $200,000, especially in large, complex organizations.

### Geographic Location

Where you work matters. Salaries for compliance managers are significantly higher in major metropolitan areas with a high cost of living and a concentration of large corporations, particularly in the finance and tech sectors.

Top-paying cities often include:

- New York, NY

- San Francisco, CA

- Washington, D.C.

- Boston, MA

- Los Angeles, CA

Salaries in these hubs can be 15-30% or more above the national average. Conversely, salaries in smaller cities and rural areas will likely be closer to or slightly below the national median.

### Company Type

The size of your employer and the industry it operates in have a direct impact on your paycheck.

- Industry: Highly regulated and high-risk industries pay a premium for top compliance talent. Financial services (banking, fintech), healthcare (pharmaceuticals, insurance), energy, and technology (especially regarding data privacy) are the highest-paying sectors due to the immense financial and reputational risks associated with non-compliance.

- Company Size: Large, multinational corporations face more complex regulatory challenges and have larger budgets. Consequently, they offer higher salaries and more comprehensive benefits packages than small to medium-sized businesses or non-profit organizations.

### Area of Specialization

As the compliance field matures, specialization has become a key differentiator. Developing expertise in a high-demand niche can make you a more valuable and higher-paid professional.

In-demand specializations include:

- Anti-Money Laundering (AML): Critical in the financial services industry.

- Cybersecurity & Data Privacy: A booming field due to regulations like GDPR and CCPA.

- Healthcare Compliance: Expertise in HIPAA and FDA regulations is highly sought after.

- Financial & Securities Compliance: Involves navigating SEC, FINRA, and other regulatory bodies.

- Environmental, Social, and Governance (ESG): A rapidly growing area as companies focus on sustainability and corporate responsibility.

Job Outlook

The future for compliance managers is very promising. The U.S. Bureau of Labor Statistics (BLS) projects that employment for compliance officers will grow by 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady growth is fueled by several powerful trends:

- Increasingly Complex Regulations: New laws are constantly being introduced globally, requiring expert navigation.

- Focus on Data Privacy: The digital economy has put a spotlight on how companies handle personal data.

- Globalization: Companies operating across borders must comply with a multitude of international laws.

- Emphasis on Corporate Ethics: Mitigating reputational risk has become a top priority for boards and executives.

These factors ensure that demand for skilled compliance professionals will remain strong and stable for the foreseeable future.

Conclusion

A career as a compliance manager offers a clear path to a stable, impactful, and financially rewarding profession. While the national average salary provides a strong starting point, your ultimate earning potential is firmly within your control.

By focusing on continuous learning through advanced education and certifications, gaining deep experience in a high-growth industry, and developing a valuable specialization, you can position yourself for top-tier compensation. For anyone with a meticulous nature, a strong ethical compass, and a desire for a challenging career, the role of a compliance manager is an excellent and lucrative choice.