So, you’re considering a career as an accountant in the Lone Star State. You’ve heard about Texas’s booming economy, its influx of corporate headquarters, and its reputation as a land of opportunity. But you’re asking the smart, practical question that lies at the heart of any career decision: *What can I actually earn?* Answering the query "accountant Texas salary" isn't just about a single number; it's about understanding the vast landscape of a profession that serves as the financial backbone of every business, from a startup in Austin to an energy giant in Houston.

This guide is designed to be your definitive resource. We will move beyond simple averages to dissect the nuanced factors that determine your earning potential. We will explore how your education, your chosen specialization, the city you work in, and the very skills you cultivate will shape your financial trajectory. The demand for skilled accountants in Texas is robust and growing, with salaries ranging from a solid entry-level wage of around $60,000 to well over $200,000 for experienced, specialized leaders. In my years as a career analyst, I've seen countless professionals build incredibly rewarding lives in this field. I once advised a young entrepreneur whose small business was on the brink of collapse due to chaotic finances; it was a sharp, strategic accountant who not only cleaned up the books but provided the insights that allowed the company to pivot and triple its revenue in two years. That is the power of this profession—it’s not just about numbers, it's about strategy, stability, and success.

This article will provide you with the data, insights, and actionable steps to navigate your path. We will cover everything you need to know to build a successful and lucrative accounting career in Texas.

### Table of Contents

- [What Does an Accountant in Texas Do?](#what-does-an-accountant-do)

- [Average Accountant Texas Salary: A Deep Dive](#average-salary)

- [Key Factors That Influence an Accountant's Salary in Texas](#key-factors)

- [Job Outlook and Career Growth in Texas](#job-outlook)

- [How to Become an Accountant in Texas](#how-to-get-started)

- [Conclusion: Is an Accounting Career in Texas Right for You?](#conclusion)

What Does an Accountant in Texas Do?

At its core, accounting is the language of business. An accountant is a professional fluent in this language, responsible for recording, analyzing, interpreting, and communicating an organization's financial information. While the stereotype might be a solitary figure hunched over a calculator during tax season, the modern reality is far more dynamic and strategic. In Texas's diverse economy—spanning energy, technology, healthcare, and logistics—accountants are indispensable partners in decision-making.

Their responsibilities are broad but can be categorized into a few key areas:

- Financial Record-Keeping and Reporting: This is the foundation of accounting. Accountants ensure that all financial transactions are accurately recorded in the general ledger. They are responsible for preparing critical financial statements, including the Balance Sheet (a snapshot of assets and liabilities), the Income Statement (profitability over a period), and the Statement of Cash Flows (movement of cash).

- Compliance and Regulation: Accountants ensure that a company adheres to financial laws and standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). They also manage tax compliance, preparing and filing federal, state, and local tax returns, a crucial role for businesses navigating Texas's specific tax codes.

- Budgeting and Forecasting: Looking forward is just as important as looking back. Accountants play a vital role in creating budgets, monitoring spending, and developing financial forecasts. This helps leadership make informed decisions about resource allocation, expansion plans, and strategic investments.

- Analysis and Advisory: This is where accountants truly become strategic partners. They analyze financial data to identify trends, pinpoint inefficiencies, and highlight opportunities for cost savings or revenue growth. A skilled accountant advises management on the financial implications of business decisions, from launching a new product to acquiring another company.

- Auditing: Some accountants, known as auditors, specialize in examining financial records to ensure accuracy and compliance. Internal auditors work for a single company to improve internal controls, while external auditors work for public accounting firms to provide an independent opinion on a company's financial statements.

### A Day in the Life: Corporate Accountant in Dallas

To make this more tangible, let's imagine a day for "Alex," a mid-level corporate accountant at a mid-sized technology company in the Dallas-Fort Worth Metroplex.

- 8:30 AM: Alex arrives and starts the day by reviewing the previous day's financial transactions and bank reconciliations. Alex spots a discrepancy in a vendor payment and flags it for investigation.

- 9:30 AM: It’s the fifth business day of the month, which means "month-end close" is in full swing. Alex's primary focus is on preparing journal entries for accrued expenses and prepaid assets, a critical step to ensure the financial statements for the previous month are accurate.

- 11:00 AM: Alex joins a video call with the marketing department. They are planning a major new campaign and need Alex's input on the budget. Alex analyzes the proposal, asks clarifying questions about expected return on investment, and advises them on how to structure the expense tracking for clear reporting.

- 1:00 PM: After lunch, Alex dives into a variance analysis report. This involves comparing the actual results from the last quarter to the budgeted figures, investigating significant differences, and writing a commentary for the Chief Financial Officer (CFO) to explain why certain departments were over or under budget.

- 3:00 PM: Alex's manager, the Corporate Controller, asks for help in pulling data for an upcoming audit. Alex uses the company's Enterprise Resource Planning (ERP) system, like Oracle NetSuite or SAP, to extract specific data sets the external auditors have requested.

- 4:30 PM: The last part of the day is spent responding to emails, following up on the vendor payment issue from the morning, and planning priorities for the next day to ensure the month-end close process stays on schedule.

This example illustrates the blend of routine tasks, collaborative projects, and analytical work that defines the modern accounting role. It’s a profession that demands meticulous attention to detail, strong analytical skills, and the ability to communicate complex financial information to non-financial stakeholders.

Average Accountant Texas Salary: A Deep Dive

Now, let's get to the numbers. Understanding the salary landscape requires looking at data from multiple authoritative sources to create a complete and trustworthy picture. We'll examine national averages as a baseline before focusing on the specific data for Texas.

### National vs. Texas: The Big Picture

Nationally, the U.S. Bureau of Labor Statistics (BLS) is the gold standard for employment data. According to the May 2023 BLS Occupational Employment and Wage Statistics (OEWS) report, the median annual wage for Accountants and Auditors in the United States was $79,880. The lowest 10 percent earned less than $51,770, and the highest 10 percent earned more than $141,680.

So, how does Texas stack up?

The Lone Star State is a major hub for this profession. The BLS reports that Texas has one of the highest employment levels for accountants and auditors in the nation, second only to California. For Texas specifically, the BLS data from May 2023 shows:

- Mean Annual Wage: $90,810

- Median Annual Wage: $81,590

This data immediately tells us that, on average, accountant salaries in Texas are slightly higher than the national median and significantly higher than the national mean, indicating a strong presence of high-paying accounting roles within the state.

### Salary by Experience Level in Texas

Averages provide a starting point, but your salary will grow significantly as you gain experience. Salary aggregators like Salary.com, Glassdoor, and Payscale offer valuable insights into this progression. By synthesizing their data for Texas-based roles (as of early 2024), we can construct a typical career trajectory.

| Experience Level | Typical Role(s) | Estimated Annual Salary Range (Texas) | Key Responsibilities & Expectations |

| ----------------------- | ---------------------------------------------- | ------------------------------------- | ------------------------------------------------------------------------------------------------ |

| Entry-Level (0-2 Years) | Staff Accountant, Junior Accountant, Audit Associate | $58,000 - $75,000 | Focus on transactional tasks: bank reconciliations, journal entries, assisting with month-end close. |

| Mid-Career (3-7 Years) | Senior Accountant, Financial Analyst | $75,000 - $110,000 | Manages complex accounting areas, prepares full financial statements, mentors junior staff. |

| Senior/Experienced (8-15+ Years) | Accounting Manager, Controller, Senior Manager (Public) | $110,000 - $180,000+ | Oversees the entire accounting department, strategic financial planning, manages teams, reports to executives. |

| Executive Level (CPA/MBA) | CFO, VP of Finance, Partner (Public) | $200,000 - $500,000+ | Sets company-wide financial strategy, responsible for all financial operations, major M&A decisions. |

*Sources: Synthesized from 2023-2024 data from the U.S. Bureau of Labor Statistics, Salary.com, Glassdoor, and Payscale.*

As you can see, the growth potential is substantial. An accountant who starts in the low $60s can realistically double their salary within a decade through consistent performance, skill development, and strategic career moves.

### Beyond the Base Salary: Understanding Total Compensation

Your base salary is only one piece of the puzzle. Total compensation is a more accurate measure of your earnings and is particularly important in a professional field like accounting. Here’s a breakdown of the other components you can expect:

- Bonuses: Annual performance-based bonuses are common, especially in corporate accounting and public accounting firms. These can range from 5% of your base salary at junior levels to over 30% for senior managers and executives. Bonuses are often tied to individual performance, department goals, and overall company profitability.

- Profit Sharing: Common in public accounting firms (especially at the partner level) and some private companies, profit sharing distributes a portion of the company's profits among employees.

- Stock Options/Equity: More common in publicly traded companies or tech startups, stock options give you the right to purchase company stock at a predetermined price. This can be a significant wealth-building tool if the company performs well.

- Retirement Plans: A 401(k) with a company match is a standard benefit. A typical match might be 50% of your contribution up to 6% of your salary, which is essentially a guaranteed return on your investment.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance are standard. Many Texas companies, competing for top talent, also offer wellness stipends, gym memberships, and generous mental health resources.

- Paid Time Off (PTO): Expect a standard of 2-3 weeks of vacation to start, often increasing with seniority. This is in addition to sick leave and paid holidays.

- Professional Development: This is a key, high-value benefit. Many employers will pay for CPA review courses, exam fees, and the annual dues and continuing professional education (CPE) credits required to maintain your license. This represents an investment of thousands of dollars in your career.

When evaluating a job offer, it's crucial to look at the entire compensation package. A role with a slightly lower base salary but an excellent bonus structure, a generous 401(k) match, and full support for your CPA certification may be far more valuable in the long run.

Key Factors That Influence an Accountant's Salary in Texas

Your salary is not a fixed number; it's a dynamic figure influenced by a combination of your qualifications, choices, and market forces. For accountants in Texas, these are the most critical factors that will determine your earning potential. Understanding and strategically navigating them is the key to maximizing your income.

###

Level of Education and Professional Certifications

Your educational foundation and professional credentials are the most powerful levers you have to increase your salary, especially early in your career.

- Bachelor's Degree: A bachelor's degree in accounting is the standard, non-negotiable entry ticket to the profession. It provides the fundamental knowledge of accounting principles, taxation, audit, and business law required for any staff-level role.

- Master's Degree (MAcc or MST): A Master of Accountancy (MAcc) or a Master of Science in Taxation (MST) can provide a significant salary bump. More importantly, it is the most common pathway to meet the 150-semester-hour requirement to become a Certified Public Accountant (CPA) in Texas. While a bachelor's degree is typically 120 hours, the extra 30 hours are mandatory for licensure. A master's degree not only fulfills this requirement but also provides specialized knowledge that makes you a more attractive candidate, often leading to higher starting offers.

- The CPA License (Certified Public Accountant): This is the undisputed gold standard in the accounting profession. Earning your CPA license is the single most impactful action you can take to boost your career and salary. According to the Association of International Certified Professional Accountants (AICPA), CPAs can earn 5-15% more than their non-certified peers, a premium that often translates to a lifetime earnings difference of over $1 million. In Texas, a CPA license is often a prerequisite for any management-level position (Accounting Manager, Controller, CFO). It signals a high level of expertise, ethical commitment, and professional dedication.

Other Valuable Certifications:

While the CPA is paramount, other certifications can enhance your salary in specific niches:

- CMA (Certified Management Accountant): Ideal for those in corporate/managerial accounting. It focuses on financial planning, analysis, control, and decision support. It's highly respected in manufacturing and corporate finance roles.

- CIA (Certified Internal Auditor): The premier certification for internal audit professionals. It demonstrates expertise in risk, control, and governance, leading to higher-paying roles in internal audit departments of large corporations.

- CFE (Certified Fraud Examiner): For accountants specializing in forensic accounting. CFEs are trained to detect and deter fraud and are highly sought after in litigation support, investigation, and risk management.

- EA (Enrolled Agent): A federal designation focused exclusively on taxation. EAs have unlimited practice rights before the IRS and are highly valued in tax-specific roles.

Takeaway: A bachelor's degree gets you in the door. The path to the CPA license (often via a Master's degree) is what unlocks significant six-figure earning potential and leadership opportunities.

###

Years of Experience: The Upward Climb

Experience is a direct driver of salary growth. As you progress from executing tasks to managing processes and eventually to leading strategy, your value—and your compensation—increases accordingly.

- Entry-Level (0-2 years): Your focus is on learning the fundamentals. You are a cost to be trained but provide value through execution. Salary is based more on educational credentials than proven performance.

- Staff/Senior Accountant (2-7 years): This is the critical growth phase. You have mastered the basics and can now work independently on complex tasks like the month-end close, financial statement preparation, and in-depth analysis. You may begin to specialize and mentor junior staff. This is where you see the most significant percentage-based salary jumps as you prove your competence. A move from a $65,000 Staff Accountant role to a $95,000 Senior Accountant position within 4-5 years is a very common and achievable trajectory in Texas.

- Manager/Controller (8-15 years): You are now a leader. You manage teams, own the entire accounting function for a division or a whole company, and interact directly with executive leadership. Your role shifts from "doing" to "managing and directing." A CPA is almost always required at this level. Salaries comfortably move into the $120,000 - $180,000+ range, heavily supplemented by bonuses.

- Director/VP/CFO (15+ years): At this executive level, you are a strategic leader for the entire organization. Your decisions impact the company's direction, profitability, and shareholder value. Compensation is heavily weighted towards performance bonuses and equity, with base salaries often exceeding $200,000 and total compensation reaching much higher.

###

Geographic Location: The Texas Triangle and Beyond

Not all of Texas pays the same. The state's major metropolitan areas, often referred to as the "Texas Triangle" (Dallas-Fort Worth, Houston, and Austin/San Antonio), are economic powerhouses with a higher concentration of corporate headquarters, leading to more competition for talent and higher salaries.

Here is a comparison of mean annual wages for Accountants and Auditors across major Texas metropolitan areas, based on the May 2023 BLS OEWS data:

| Metropolitan Statistical Area (MSA) | Annual Mean Wage | Notes on the Local Economy |

| ----------------------------------- | ---------------- | --------------------------------------------------------------------------------------- |

| Houston-The Woodlands-Sugar Land | $97,130 | Global energy hub (Oil & Gas), massive healthcare sector (Texas Medical Center), logistics. |

| Dallas-Fort Worth-Arlington | $91,650 | Diverse economy with HQs in finance, transportation (American Airlines), telecom (AT&T). |

| Austin-Round Rock | $90,540 | Booming tech hub ("Silicon Hills"), startups, major tech company presence (Dell, Apple). |

| San Antonio-New Braunfels | $81,560 | Strong military presence, growing healthcare and bioscience, tourism, and cybersecurity. |

| Midland, TX | $103,980 | An outlier. The epicenter of the Permian Basin oil boom, leading to extremely high wages. |

| Texas Nonmetropolitan Areas | $75,200 | Significantly lower cost of living but fewer large corporate opportunities. |

Analysis:

- Houston and Midland lead the pack, driven by the high-paying, capital-intensive energy sector. Accountants with experience in oil and gas accounting (e.g., revenue accounting, joint interest billing) can command premium salaries here.

- Dallas-Fort Worth (DFW) offers a vast number of opportunities across a highly diversified economy. While the average is slightly lower than Houston's, the sheer volume of jobs is immense.

- Austin's average reflects its tech-centric economy. While salaries are high, the cost of living in Austin is also the highest among the major metros, which is an important consideration.

- San Antonio offers more moderate salaries, aligning with its lower cost of living compared to the other three major hubs.

- Midland is a special case where the boom-and-bust cycle of the oil industry creates intense demand and exceptionally high pay, but with less stability than the major metro areas.

###

Company Type & Size

The type and size of your employer have a profound impact on your salary, work-life balance, and career path.

- Public Accounting (The Big Four): The "Big Four" firms (Deloitte, PwC, EY, KPMG) and other large national firms are known for paying the highest starting salaries to attract top university graduates. The trade-off is famously long hours, especially during busy season. However, the training and experience are unparalleled, and having a Big Four firm on your resume is a powerful credential that opens doors for the rest of your career.

- Public Accounting (Regional/Local Firms): These firms offer a better work-life balance than the Big Four. Salaries may be slightly lower initially, but they can still be very competitive, and the path to partnership can be much faster. They often serve small-to-medium-sized businesses (SMBs).

- Corporate/Industry Accounting (Large Corporations): Moving from public accounting to a role at a Fortune 500 company (of which Texas has many) is a very common career path. These roles offer high salaries, excellent benefits, and a better work-life balance. A Senior Accountant at a major energy company in Houston or a large retailer in Dallas will be a well-compensated position.

- Corporate/Industry Accounting (Startups & SMBs): Salaries at smaller companies can be more variable. Early-stage startups may offer lower base salaries but compensate with potentially lucrative stock options. The roles are often broader, giving you exposure to all aspects of finance and operations.

- Government: Accountants working for federal, state, or local government agencies (e.g., the IRS, a state comptroller's office, or a city finance department) typically earn less than their private-sector counterparts. However, they are compensated with exceptional job security, excellent benefits, pensions, and a predictable 40-hour work week.

- Non-Profit: Similar to government, non-profits generally offer lower salaries but provide the intrinsic reward of working for a mission-driven organization.

###

Area of Specialization

Within accounting, certain specializations are more lucrative than others due to higher demand, required expertise, or the value they bring to an organization.

- Tax Accounting (especially M&A or International): Highly complex areas of tax, such as advising on the tax implications of mergers and acquisitions (M&A) or navigating international tax treaties, are extremely high-paying fields.

- Forensic Accounting: Investigating financial fraud is a high-stakes, high-skill niche. Certified Fraud Examiners (CFEs) working on litigation support or corporate investigations command premium fees and salaries.

- IT Audit / Risk Assurance: In an age of cyber threats and complex IT systems, accountants who can audit IT controls and understand systems like SAP or Oracle are in massive demand. This blend of accounting and technology skills is highly compensated.

- Advisory/Consulting: Many public accounting firms have advisory arms that consult on everything from M&A deals to process improvement. These roles are project-based, highly strategic, and among the highest-paying in the profession.

- Technical Accounting: Specialists who are experts in interpreting and implementing complex new accounting standards (like revenue recognition or lease accounting) are invaluable to large public companies and are paid accordingly.

###

In-Demand Skills

Finally, beyond your formal credentials, the specific skills you possess can set you apart and justify a higher salary.

High-Value Technical Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a master of PivotTables, VLOOKUP/XLOOKUP, index-match, and complex formulas.

- Enterprise Resource Planning (ERP) Systems: Experience with major ERP systems like SAP, Oracle NetSuite, Microsoft Dynamics 365, or industry-specific software is a huge plus.

- Data Analytics and Visualization: The ability to use tools like Tableau, Power BI, or Alteryx to analyze large data sets and create insightful dashboards is a game-changing skill. This moves you from a reporter of data to an interpreter of data.

- SQL (Structured Query Language): The ability to pull your own data directly from databases without relying on the IT department makes you more efficient and valuable.

Essential Soft Skills:

- Communication and Presentation: You must be able to explain complex financial concepts clearly to non-financial colleagues and executives.

- Strategic and Critical Thinking: The best accountants don't just report the numbers; they ask "why?" and provide insights that guide business strategy.

- Problem-Solving: When the books don't balance or a variance appears, you need the analytical rigor to investigate and solve the problem.

- Leadership and Mentorship: As you become more senior, your ability to manage and develop a team becomes a key driver of your success and compensation.

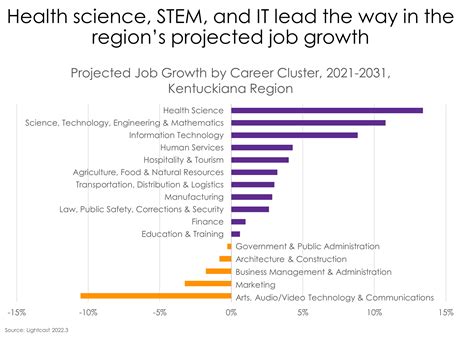

Job Outlook and Career Growth in Texas

A high salary is attractive, but career stability and growth opportunities are what ensure long-term success. For accountants in Texas, the future looks exceptionally bright.

### A Stable and Growing Profession

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Accountants and Auditors will grow **4 percent from 2022 to