If you have a keen eye for detail, a passion for numbers, and a desire for a stable and rewarding career, the role of an accounting analyst might be your perfect fit. As the financial detectives of the business world, accounting analysts play a critical role in a company's health and strategy. But what does this responsibility translate to in terms of compensation?

In this comprehensive guide, we will break down the salary you can expect as an accounting analyst. This is a career with significant earning potential, where professionals in the United States can expect a typical salary range of $60,000 to over $100,000, with the national average often landing in the high $70,000s. We'll explore the key factors that drive this figure, from your experience and education to the city you work in.

What Does an Accounting Analyst Do?

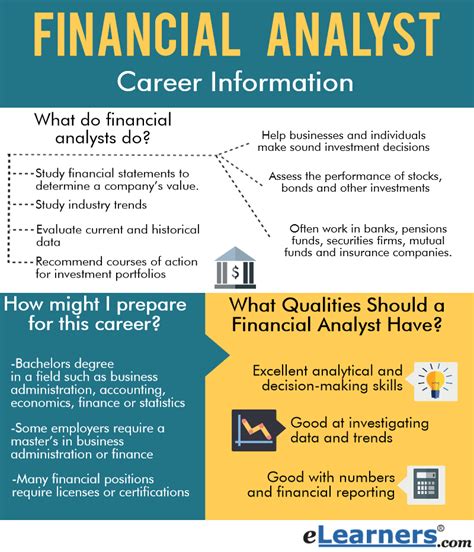

Before diving into the numbers, it's essential to understand the role. An accounting analyst is a professional who examines complex financial data, ensuring its accuracy and providing insights to guide business decisions. They are the bridge between raw accounting data and strategic planning.

Key responsibilities often include:

- Financial Reporting: Preparing and analyzing financial statements like the balance sheet, income statement, and cash flow statement.

- Budgeting and Forecasting: Assisting in the creation of company budgets and predicting future financial performance.

- Variance Analysis: Investigating discrepancies between budgeted and actual financial results.

- Ensuring Compliance: Making sure all financial practices adhere to regulations (like GAAP or IFRS) and internal policies.

- Process Improvement: Identifying inefficiencies in accounting processes and recommending solutions to improve accuracy and workflow.

Average Accounting Analyst Salary

While salaries can vary widely, data from authoritative sources provides a clear picture of the earning potential for an accounting analyst in the United States.

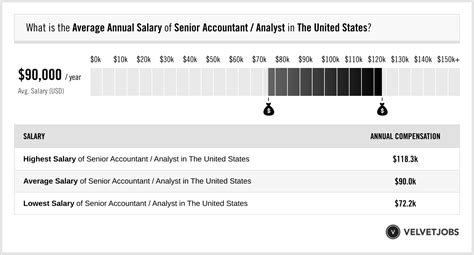

As of early 2024, the average base salary for an accounting analyst typically falls between $70,000 and $85,000 per year.

Let's look at the data from leading salary aggregators:

- Salary.com reports the median salary for an Accounting Analyst in the U.S. is approximately $78,500, with a common range falling between $69,000 and $89,000.

- Glassdoor estimates a higher total pay (including bonuses and other compensation) of around $83,000 per year.

- Payscale cites a slightly more conservative average base salary of about $65,000, but this figure rises significantly with added skills and experience.

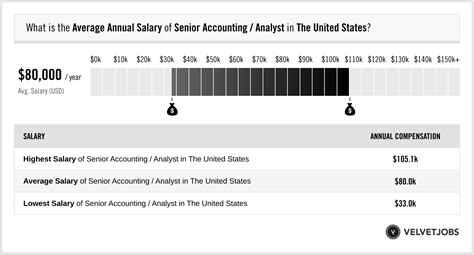

It’s clear that while the exact number varies by source, a qualified accounting analyst can expect a competitive salary. A typical full salary range spans from around $58,000 for an entry-level position to $110,000 or more for a senior, specialized analyst.

Key Factors That Influence Salary

Your salary isn't just one number; it's a dynamic figure influenced by several critical factors. Understanding these variables will empower you to maximize your earning potential throughout your career.

### Level of Education

Your educational background and professional certifications are the foundation of your career and a primary driver of your starting salary.

- Bachelor’s Degree: A bachelor's degree in Accounting, Finance, or a related field is the standard entry requirement for most accounting analyst positions.

- Master’s Degree: Pursuing a Master of Accountancy (MAcc) or an MBA with a concentration in finance or accounting can provide a significant salary advantage, often leading to a 10-20% higher starting salary and opening doors to leadership roles more quickly.

- Certifications: Professional certifications are arguably the most powerful salary boosters in accounting.

- Certified Public Accountant (CPA): This is the gold standard. Earning your CPA license can increase your salary by up to 25% and is often a prerequisite for senior and management-level positions.

- Certified Management Accountant (CMA): This certification is highly valued for roles in corporate finance and strategic management, signaling expertise in financial planning and decision-making.

- Certified Internal Auditor (CIA): For analysts specializing in internal controls and audit, the CIA is a globally recognized credential that enhances earning potential.

### Years of Experience

Experience is a direct measure of your proven ability to deliver value. As you gain expertise, your compensation will grow accordingly.

- Entry-Level (0-2 years): Analysts just starting out can expect a salary in the range of $58,000 to $70,000. The focus at this stage is on learning core processes, assisting with reports, and mastering foundational tasks.

- Mid-Career (3-5 years): With a few years of experience, analysts take on more complex responsibilities, including leading small projects and conducting in-depth variance analysis. Salaries typically rise to the $70,000 to $90,000 range.

- Senior-Level (6+ years): Senior accounting analysts often manage major reporting functions, mentor junior staff, and play a strategic role in financial planning. Their salaries commonly exceed $90,000 and can reach well into the six figures, especially for those with a CPA or other advanced certifications.

### Geographic Location

Where you work matters. Salaries are adjusted based on the local cost of living and the demand for skilled professionals in that market. Major metropolitan areas with large financial centers tend to offer the highest salaries.

Top-Paying Metropolitan Areas:

- San Francisco, CA

- New York, NY

- San Jose, CA

- Boston, MA

- Washington, D.C.

In these cities, salaries can be 20-35% higher than the national average to compensate for a higher cost of living. Conversely, salaries in smaller cities and rural areas will likely be closer to or slightly below the national average.

### Company Type

The type and size of the company you work for will have a direct impact on your paycheck and overall compensation package.

- Public Accounting Firms (e.g., The Big Four): Firms like Deloitte, PwC, EY, and KPMG often offer very competitive starting salaries to attract top talent. While the work can be demanding, the experience is invaluable and serves as a powerful career accelerator.

- Large Corporations (Fortune 500): Working in the accounting department of a large public or private company typically comes with a strong salary, excellent benefits, and opportunities for internal advancement.

- Startups and Small Businesses: Salaries at startups may be lower, but they are often supplemented with stock options or other forms of equity, offering high potential rewards if the company succeeds.

- Government and Non-Profit: While government and non-profit roles may offer lower base salaries than their for-profit counterparts, they often provide exceptional job security, generous benefits packages, and a better work-life balance.

### Area of Specialization

As you advance in your career, you may choose to specialize. Certain high-demand specializations can command premium salaries.

- Financial Planning & Analysis (FP&A): FP&A analysts focus on budgeting, forecasting, and strategic planning, making them integral to a company's future success. This is often one of the higher-paying paths.

- Forensic Accounting: These specialists investigate financial fraud and discrepancies. Due to the highly specialized and critical nature of this work, forensic accountants are very well compensated.

- IT Audit/Systems Analysis: Analysts who can bridge the gap between accounting and technology are in high demand. They ensure financial systems are secure, efficient, and compliant.

Job Outlook

The future for accounting professionals is bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for Accountants and Auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady growth is expected to result in about 126,500 openings for accountants and auditors each year, on average, over the decade. This demand is driven by economic growth, changing financial regulations, and an increased need for professionals who can analyze and interpret complex financial data to support business strategy.

Conclusion

A career as an accounting analyst offers a potent combination of stability, intellectual challenge, and strong financial reward. With a national average salary in the $70,000 to $85,000 range and a clear path to six-figure earnings, it is an excellent choice for detail-oriented individuals.

To maximize your earning potential, focus on these key takeaways:

1. Build a Strong Foundation: A bachelor's degree is your entry ticket, but a master's degree and, most importantly, a CPA certification will unlock the highest salary tiers.

2. Gain Diverse Experience: Embrace opportunities to learn and take on more complex tasks. Your value—and your salary—will grow with every year of experience.

3. Be Strategic About Location and Industry: Consider high-demand markets and industries that align with your career goals and offer competitive compensation packages.

For individuals with a sharp mind for numbers and a desire to influence business strategy, the role of an accounting analyst is not just a job, but a launchpad for a prosperous and influential career.