For professionals with a sharp analytical mind and a talent for assessing risk, a career as a senior underwriter offers a rewarding and financially stable path. This critical role within the insurance and finance industries is not only intellectually stimulating but also comes with a significant earning potential, with many experienced professionals commanding salaries well into the six figures.

If you're considering a move into a senior underwriting role or looking to advance your current underwriting career, understanding the salary landscape is essential. This guide breaks down the average senior underwriter salary and explores the key factors that can dramatically influence your compensation.

What Does a Senior Underwriter Do?

Before diving into the numbers, it's important to understand the role. A senior underwriter is an experienced professional who serves as a primary gatekeeper for financial risk. They evaluate, analyze, and ultimately approve or deny complex or high-value insurance policies or loan applications.

Unlike junior underwriters who handle more straightforward cases, senior underwriters tackle the most challenging files, mentor junior staff, help develop underwriting guidelines, and hold significant authority in making high-stakes financial decisions for their company. They are the seasoned experts who ensure the company assumes risks wisely, maintaining profitability and stability.

Average Senior Underwriter Salary

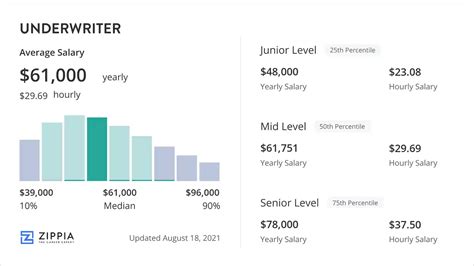

The compensation for a senior underwriter is highly competitive, reflecting the expertise and responsibility the role demands.

While salaries vary, data from leading compensation resources provides a clear picture. According to Salary.com, the average senior underwriter salary in the United States is $101,235 as of May 2024, with a typical range falling between $88,969 and $117,049.

Other authoritative sources provide a similar outlook:

- Payscale reports an average base salary of approximately $93,039 per year, with total pay (including bonuses and profit sharing) often reaching over $120,000.

- Glassdoor lists a national average of $105,429 in total pay, combining a base salary of around $89,000 with additional compensation like cash bonuses.

It's important to note the salary range is wide. Top earners in high-demand specializations and major metropolitan areas can command salaries exceeding $150,000 annually, especially when factoring in bonuses and other incentives.

Key Factors That Influence Salary

Your final salary as a senior underwriter isn't determined by a single number. It's a combination of several critical factors. Understanding these levers is key to maximizing your earning potential.

###

Years of Experience

Experience is arguably the most significant driver of an underwriter's salary. The career path has a clear and rewarding progression.

- Underwriter (1-4 years): Professionals at this stage are building their skills and typically earn between $60,000 and $80,000.

- Senior Underwriter (5-9 years): With proven expertise in handling complex cases, salaries jump significantly into the $90,000 to $115,000 range.

- Lead/Managing Underwriter (10+ years): Those with a decade or more of experience who take on leadership or team management responsibilities often earn upwards of $120,000, with top-tier managers and specialists exceeding $150,000.

###

Level of Education & Professional Certifications

While a bachelor's degree in finance, business, economics, or mathematics is the standard entry point, advanced credentials can provide a substantial salary boost. Holding sought-after professional certifications demonstrates a commitment to the field and a high level of expertise.

Key certifications that increase earning potential include:

- Chartered Property Casualty Underwriter (CPCU): The gold standard in the property and casualty insurance industry. Achieving this designation can lead to a significant salary increase and more senior opportunities.

- Chartered Life Underwriter (CLU): A highly respected designation for underwriters specializing in life and health insurance.

- Associate in Commercial Underwriting (AU): A valuable credential for those focused on the complexities of commercial insurance lines.

###

Geographic Location

Where you work matters. Salaries are adjusted to reflect the cost of living and the demand for talent in a specific region. Senior underwriters in major financial hubs like New York City, San Francisco, Boston, and Chicago can expect to earn significantly more than those in smaller cities or rural areas.

For example, a senior underwriter in New York, NY, might earn 20-30% more than the national average, while a professional in a lower-cost-of-living area like Des Moines, IA (a major insurance hub), might have a salary closer to the national average but with greater purchasing power.

###

Company Type

The size and type of your employer play a crucial role in compensation.

- Large National/Global Carriers: Companies like Chubb, AIG, Travelers, and Zurich typically have the resources to offer higher base salaries, robust bonus structures, and comprehensive benefits packages.

- Reinsurance Companies: These firms insure the insurance companies themselves. The risks are massive and complex, and senior reinsurance underwriters are highly specialized and compensated accordingly, often at the very top of the pay scale.

- Regional or Mutual Insurers: Smaller firms may offer salaries that are slightly below the top of the market, but they can provide excellent work-life balance and a strong company culture.

- Managing General Agents (MGAs) & Wholesalers: These specialized firms often seek underwriters with niche expertise and may offer highly competitive, performance-based compensation.

###

Area of Specialization

Not all underwriting is the same. Your area of expertise can have a major impact on your salary. Generally, the more complex and high-value the risk, the higher the pay.

- Commercial Lines (e.g., Cyber, Professional Liability, Directors & Officers): Underwriting complex commercial risks is a high-stakes field. Senior underwriters with expertise in specialty areas like cybersecurity or management liability are in high demand and can command premium salaries.

- Property & Casualty (P&C): This is a broad field, but senior underwriters on the commercial side tend to earn more than those on the personal lines (auto, home) side due to the complexity of business risk.

- Life & Health Insurance: This is a stable and lucrative specialization, with senior underwriters assessing individual and group life and health risks.

- Mortgage Underwriting: While demand can be cyclical with the housing market, experienced senior mortgage underwriters, especially those with authority to approve large or complex "jumbo" loans, are well-compensated.

Job Outlook

The career outlook for underwriters is evolving. The U.S. Bureau of Labor Statistics (BLS) projects a 2% decline in employment for insurance underwriters from 2022 to 2032. However, this statistic requires a closer look.

The projected decline is largely driven by the automation of data processing and underwriting for simple, standardized policies (like personal auto insurance). This is actually good news for *senior* underwriters. The demand for skilled experts who can analyze complex, unique, and high-value risks is expected to remain strong. Automated systems cannot replicate the critical thinking, judgment, and nuanced decision-making of a seasoned professional. Therefore, the future for experienced underwriters with specialized knowledge remains secure and promising.

Conclusion

A career as a senior underwriter is a testament to the value of deep expertise. The path offers not only financial rewards but also the satisfaction of making critical business decisions every day.

Key Takeaways:

- Strong Earning Potential: The average senior underwriter salary comfortably sits near or above the six-figure mark, with top earners exceeding $150,000.

- Experience is Paramount: Your salary will grow significantly as you gain experience and take on more complex responsibilities.

- Invest in Yourself: Pursuing advanced certifications like the CPCU is one of the most effective ways to boost your career and salary.

- Specialize Wisely: Focusing on high-demand, complex areas like commercial lines or reinsurance can open the door to the highest levels of compensation.

For analytical professionals seeking a stable and lucrative career, the role of a senior underwriter is an outstanding goal to work towards. By strategically building your experience, skills, and credentials, you can position yourself for a successful and prosperous future in this essential profession.