A career as an accounting associate serves as a powerful launchpad into the world of finance and business. It’s a role that combines stability with significant opportunities for growth, making it a popular choice for meticulous, detail-oriented professionals. But what can you realistically expect to earn?

An accounting associate salary in the United States typically falls between $45,000 and $70,000 per year, with a national average hovering around $55,000. However, this figure is just a starting point. Your actual compensation will be influenced by a powerful combination of your experience, location, education, and the type of company you work for.

This guide will break down every factor that impacts your earning potential and provide a clear roadmap for maximizing your salary as an accounting associate.

What Does an Accounting Associate Do?

Before we dive into the numbers, it's essential to understand the role. An accounting associate is a key player in a company's finance department, providing critical support to senior accountants and financial managers. They are the engine that keeps the daily financial operations running smoothly.

Key responsibilities often include:

- Processing accounts payable (AP) and accounts receivable (AR).

- Performing bank and credit card reconciliations.

- Assisting with the preparation of financial statements and month-end closing procedures.

- Maintaining the general ledger and recording journal entries.

- Managing expense reports and ensuring compliance with company policies.

- Utilizing accounting software like QuickBooks, SAP, or NetSuite for data entry and reporting.

In short, they are the trusted professionals who ensure a company's financial data is accurate, up-to-date, and organized.

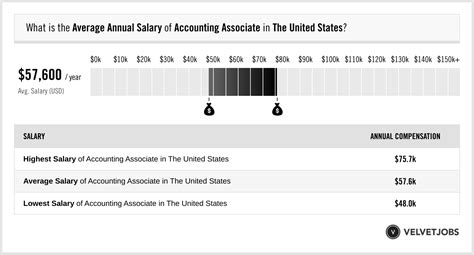

Average Accounting Associate Salary

Based on data from leading salary aggregators, the financial outlook for an accounting associate is solid.

- Salary.com reports that the median annual salary for an Accounting Associate I in the United States is approximately $52,650, with a typical range between $47,400 and $58,700.

- Payscale estimates the average base salary to be around $51,800 per year.

- Glassdoor places the total estimated pay (including potential bonuses and additional compensation) at an average of $59,500 per year.

For context, the U.S. Bureau of Labor Statistics (BLS) groups this role within the broader category of "Bookkeeping, Accounting, and Auditing Clerks," which had a median annual wage of $47,440 in May 2022. The slightly higher figures from salary aggregators often reflect roles in corporate environments that may require more advanced skills or an associate's degree, which perfectly describes the modern accounting associate position.

Key Factors That Influence Salary

Your salary isn't a fixed number; it's a dynamic figure shaped by several key variables. Understanding these factors is the first step toward negotiating a higher income.

### Level of Education

While you can secure an entry-level position with a high school diploma and relevant experience, formal education provides a significant salary advantage.

- Associate's Degree: An Associate of Science (A.S.) in Accounting or a related field is a common and highly effective entry point. It provides foundational knowledge and signals a commitment to the profession, often leading to higher starting offers than those without a degree.

- Bachelor's Degree: A Bachelor of Science (B.S.) in Accounting or Finance is the gold standard. It not only elevates your starting salary but also opens the door to more senior roles, promotions, and the eventual pursuit of lucrative certifications like the Certified Public Accountant (CPA) license. Graduates with a bachelor's degree are often placed on a faster track for advancement.

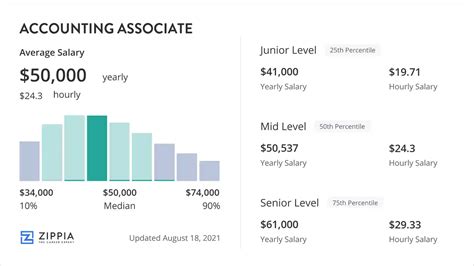

### Years of Experience

Experience is arguably the most significant driver of salary growth in this field. Employers pay a premium for professionals who can operate with increasing autonomy and handle more complex tasks.

- Entry-Level (0-2 years): Professionals in this bracket are learning the ropes. Salaries typically range from $45,000 to $55,000. The focus is on mastering core tasks like data entry, AP/AR processing, and basic reconciliations.

- Mid-Level (2-5 years): With a few years of experience, associates can handle more complex responsibilities, like assisting with month-end closes and preparing financial reports. Salaries often climb to the $55,000 to $65,000 range.

- Senior-Level (5+ years): A senior accounting associate or a specialist may oversee junior staff, manage complex accounts, or specialize in a specific area. Their expertise can command salaries of $65,000 to $75,000 or more, especially in high-demand areas.

### Geographic Location

Where you work matters immensely. Salaries are adjusted based on the local cost of living and the demand for accounting professionals in that market.

- High Cost of Living (HCOL) Areas: Major metropolitan hubs like San Francisco, New York City, San Jose, and Boston offer significantly higher salaries to compensate for steep living expenses. An associate in these cities might earn 20-35% above the national average.

- Average and Low Cost of Living (LCOL) Areas: In contrast, salaries in smaller cities and rural areas will likely be closer to or slightly below the national average. However, the lower cost of living means your take-home pay can go much further.

When evaluating a job offer, always consider the salary in the context of local housing, transportation, and tax costs.

### Company Type

The size, industry, and structure of a company play a pivotal role in its compensation strategy.

- Large Public Corporations: These companies often have the largest budgets and most structured pay scales, typically offering higher-than-average salaries and comprehensive benefits packages.

- Public Accounting Firms (e.g., Big Four, regional firms): While famous for demanding schedules, these firms offer competitive starting salaries and unparalleled experience that can supercharge your long-term career earnings.

- Small to Medium-Sized Businesses (SMBs): Salaries may be slightly lower than at large corporations, but the trade-off is often a broader range of responsibilities and a more direct impact on the company's financial health.

- Non-Profit and Government: These sectors are known for job stability and excellent benefits. While base salaries might be more modest, the total compensation package can be very attractive.

### Area of Specialization

While many accounting associate roles are generalist in nature, developing expertise in a niche area can significantly boost your value and income. Specializations to consider as you grow in your career include:

- Payroll: Managing payroll requires knowledge of complex tax laws and regulations.

- Tax Accounting: Assisting with tax preparation and compliance is a highly valued skill, especially in corporate settings.

- Forensic Accounting: This niche involves investigating financial discrepancies and fraud, commanding high salaries for experienced professionals.

- Cost Accounting: Specializing in analyzing manufacturing and production costs can be very lucrative in certain industries.

Job Outlook

The career outlook for this profession is a story of evolution, not extinction. According to the U.S. Bureau of Labor Statistics, employment for bookkeeping, accounting, and auditing clerks is projected to decline by 5 percent between 2022 and 2032.

However, it is crucial to understand the context behind this number. The decline is largely due to the automation of routine, transactional tasks by accounting software. The demand is shifting *away* from simple data entry and *towards* associates who can analyze financial data, troubleshoot software issues, and perform more complex analytical and client-facing tasks.

Therefore, the outlook is very strong for professionals who embrace technology, develop strong analytical skills, and position themselves as strategic partners to the business.

Conclusion

The role of an accounting associate is a financially sound and professionally rewarding career path. While the national average salary provides a useful benchmark, your true earning potential is in your hands.

Key Takeaways:

- Solid Starting Point: Expect a starting salary in the range of $45,000 to $55,000, with a national average in the mid-$50,000s.

- Growth is Guaranteed with Experience: Your salary will see significant increases as you move from an entry-level to a mid-level and senior professional.

- Education and Location are Power-Ups: A bachelor's degree and a position in a major metropolitan area are two of the fastest ways to increase your base salary.

- The Future is Analytical: The accounting associate role is evolving. Focus on developing analytical, software, and problem-solving skills to become an indispensable asset and secure your long-term career growth.

For anyone looking for a stable entry point into the world of finance, the accounting associate role offers a clear path to a comfortable living and a prosperous future.