Table of Contents

- [What Does an Accounting Director Do?](#what-does-an-accounting-director-do)

- [Average Accounting Director Salary: A Deep Dive](#average-accounting-director-salary-a-deep-dive)

- [Key Factors That Influence an Accounting Director's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Accounting Directors](#job-outlook-and-career-growth)

- [How to Become an Accounting Director: A Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career as an Accounting Director Right for You?](#conclusion)

For many aspiring finance and accounting professionals, the title "Accounting Director" represents a significant career pinnacle. It’s a role that signifies a transition from being a skilled practitioner to a strategic leader, from managing ledgers to shaping a company's financial future. But beyond the prestige and responsibility, a compelling question drives many to pursue this path: what is the true earning potential? The accounting director salary is often a key motivator, a tangible reward for years of dedicated study, certification, and hands-on experience. The answer is encouraging: this senior-level position commands a substantial income, often well into the six figures, complemented by significant bonuses and benefits that reflect its critical importance to any organization's success.

As a career analyst, I once coached a highly skilled Controller who felt her career had plateaued. She saw her role as purely operational—closing the books, ensuring compliance, managing her team. After we analyzed the strategic impact of her work—how her accurate forecasting enabled a successful product launch and how her streamlined reporting gave the CEO critical insights for a merger negotiation—she began to see herself not just as an accountant, but as a strategic partner. This mindset shift was the catalyst that propelled her into her first Accounting Director role, where her salary and influence grew commensurately.

This guide is designed to be your definitive resource for understanding the accounting director salary landscape. We will move beyond simple averages and delve into the intricate factors that shape your earning potential. We will explore the responsibilities of the role, dissect compensation packages, analyze the powerful impact of location, experience, and specialization, and provide a clear, actionable roadmap for you to follow. Whether you are a student mapping out your future, an accountant aiming for the next level, or a professional considering a career change, this comprehensive analysis will provide the data-driven insights and expert guidance you need to navigate your journey to becoming a successful and highly compensated Accounting Director.

---

What Does an Accounting Director Do? A Look Beyond the Numbers

An Accounting Director is far more than a senior accountant. While they possess a deep, technical understanding of accounting principles (GAAP, IFRS), their primary function is strategic leadership and oversight. They are the head of the accounting department, responsible for ensuring the accuracy, integrity, and timeliness of all financial information and reporting. This role serves as a crucial bridge between the day-to-day accounting operations, typically managed by a Controller or Accounting Manager, and the high-level financial strategy set by the Chief Financial Officer (CFO).

The Director of Accounting ensures that the entire accounting function operates like a well-oiled machine, providing the data and analysis that underpins every major business decision. They are guardians of financial accuracy, stewards of compliance, and leaders of a team of dedicated professionals.

Core Responsibilities and Daily Tasks:

An Accounting Director's duties are a blend of technical oversight, team management, and strategic contribution. While specific tasks vary by company size and industry, the core responsibilities universally include:

- Financial Reporting Leadership: Overseeing the preparation and consolidation of all financial statements, including the income statement, balance sheet, and statement of cash flows. They ensure these reports are accurate, compliant with regulatory standards (like SEC filings for public companies), and delivered on time for board meetings, investor calls, and internal reviews.

- Internal Controls and Compliance: Designing, implementing, and maintaining a robust system of internal controls to prevent fraud, minimize risk, and ensure the integrity of financial data. This includes ensuring compliance with Sarbanes-Oxley (SOX) for public companies and other relevant regulations.

- Team Management and Development: Leading, mentoring, and developing the entire accounting team, which may include Accounting Managers, Senior Accountants, Staff Accountants, and Accounts Payable/Receivable specialists. This involves hiring, training, performance reviews, and creating a culture of accuracy and continuous improvement.

- Audit Management: Acting as the primary point of contact for external and internal auditors. They prepare the company for audits, manage the information flow, and address any findings or recommendations.

- Technical Accounting Expertise: Serving as the company's foremost expert on complex accounting issues. They research and implement new accounting standards, determine the proper accounting treatment for complex transactions (e.g., mergers and acquisitions, revenue recognition for new products, lease accounting), and write technical accounting memos.

- Process Improvement and System Implementation: Continuously seeking to improve the efficiency and accuracy of accounting processes. This often involves leading the implementation or optimization of Enterprise Resource Planning (ERP) systems like Oracle NetSuite, SAP, or Microsoft Dynamics 365.

- Strategic Collaboration: Working closely with the CFO, FP&A (Financial Planning & Analysis) teams, and other department heads to provide financial insights that support strategic planning, budgeting, and forecasting.

### A Day in the Life of an Accounting Director

To make this role more tangible, let's walk through a typical day for an Accounting Director at a mid-sized technology company during a month-end close period.

- 8:30 AM - 9:30 AM: The day begins with a review of the preliminary month-end financials prepared by the Controller. The Director scans for anomalies in revenue trends, gross margin, and operating expenses, flagging several items for discussion. They respond to an urgent email from the CFO regarding a question about deferred revenue balances.

- 9:30 AM - 10:30 AM: Leads a "Month-End Close" status meeting with the accounting team. The Controller provides an update on the general ledger, the AR Manager discusses collections, and the Senior Accountant presents a challenge with a new accrual. The Director provides guidance, resolves the roadblock, and sets clear priorities for the day.

- 10:30 AM - 12:00 PM: Dives into a technical accounting issue. The company just signed a complex software-as-a-service (SaaS) contract with non-standard terms. The Director researches the ASC 606 revenue recognition standard, drafts a technical memo outlining the correct accounting treatment, and schedules a meeting with the sales operations team to ensure future contracts are structured properly.

- 12:00 PM - 1:00 PM: Working lunch while reviewing the deck for the upcoming Audit Committee meeting, ensuring the financial narratives are clear, concise, and anticipate potential questions from the board.

- 1:00 PM - 2:30 PM: Meets with the Director of FP&A and the CFO. They discuss the month's preliminary budget-vs-actual variance analysis. The Accounting Director provides context on why certain expenses were higher than planned, offering insights that the FP&A team will use to refine their forecast for the next quarter.

- 2:30 PM - 4:00 PM: Conducts one-on-one meetings with two direct reports: the Accounting Manager and a Senior Accountant. They discuss career development goals, ongoing projects, and provide constructive feedback on recent performance.

- 4:00 PM - 5:30 PM: Final review of the consolidated financial statements. After receiving updates from the team, the Director performs a final check for accuracy and completeness before signing off and submitting the package to the CFO. They end the day by outlining a plan to automate a manual reconciliation process they identified as a bottleneck during the close.

This "day in the life" highlights the dynamic nature of the role—a constant shift between detailed technical work, high-level strategic thinking, and people leadership.

---

Average Accounting Director Salary: A Deep Dive

The salary for an Accounting Director is a reflection of the role's immense responsibility, technical expertise, and leadership demands. It is a senior-level position that typically requires a decade or more of progressive experience, and the compensation package is structured accordingly. While the exact figure can vary significantly based on the factors we'll explore in the next section, we can establish a clear and reliable baseline using data from trusted industry sources.

Nationally, the total compensation for an Accounting Director is firmly in the six-figure range, often approaching or exceeding $200,000 when bonuses and other incentives are included.

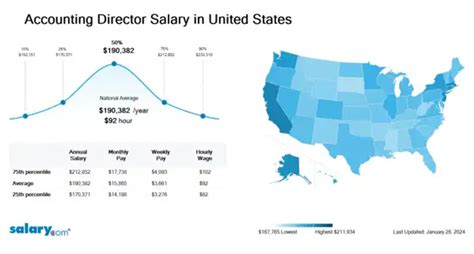

According to Salary.com, as of late 2023, the median base salary for an Accounting Director in the United States is $176,190. However, the typical salary range is quite broad, generally falling between $157,117 and $196,932. This range represents the 25th to 75th percentile, meaning the top quarter of Accounting Directors earn above this, and the bottom quarter earn below. The top 10% of earners in this role can command salaries exceeding $219,000 in base pay alone.

Payscale.com provides a similar perspective, reporting an average base salary of approximately $133,000, but their data shows a total pay range (including bonuses and profit sharing) that extends from $92,000 to $191,000. This highlights the critical importance of variable pay in the overall compensation picture.

Data from Glassdoor, which aggregates self-reported salary data, shows an average total pay (base plus additional compensation) of $181,351 per year in the United States as of early 2024. Their "likely range" for total pay spans from $144,000 to $231,000.

Finally, the 2024 Robert Half Salary Guide, a highly respected source in the finance and accounting industry, places the salary range for a Director of Accounting at a large company ($250M+ revenue) between $180,250 and $293,000, and at a midsize company ($25M-$250M revenue) between $155,000 and $241,500. Robert Half's data often reflects the higher end of the market for top-tier candidates.

### Salary by Experience Level

Salary growth for an Accounting Director is directly tied to their accumulated experience and proven track record. The title "Director" itself implies a significant level of seniority, so "entry-level" in this context refers to someone newly promoted or hired into the role, who likely already has 8-10 years of prior experience.

Here is a typical salary progression based on experience, compiled from percentile data across Salary.com and Robert Half:

| Experience Level | Years of Experience in Role | Typical Base Salary Range (National Average) | Description |

| :--- | :--- | :--- | :--- |

| New to the Role | 0-2 years as Director (8-12 total) | $150,000 - $170,000 | Corresponds to the 25th-50th percentile. Typically at smaller to mid-sized companies. Focus is on mastering core director duties and team leadership. |

| Mid-Career | 3-7 years as Director (12-18 total) | $170,000 - $195,000 | Corresponds to the 50th-75th percentile. Has a proven track record of managing audits, implementing systems, and handling complex technical issues. |

| Senior/Experienced | 8+ years as Director (18+ total) | $195,000 - $250,000+ | Corresponds to the 75th-90th percentile and beyond. Often at large, public corporations. May hold a "Senior Director" title and manage multiple controllers or specialized teams. Heavily involved in M&A, strategic planning, and board-level presentations. |

*Source: Synthesized data from Salary.com, Glassdoor, and Robert Half (2023-2024 data).*

### Dissecting the Total Compensation Package

An Accounting Director's base salary is only one piece of the puzzle. Total compensation is a much more accurate measure of their earning potential.

- Annual Bonuses: This is the most common form of variable pay. Bonuses are typically tied to a combination of company performance (e.g., revenue or EBITDA targets) and individual performance (e.g., a clean audit, successful system implementation). According to industry reports, an Accounting Director's annual bonus can range from 15% to 30% of their base salary, and in high-performing years at public companies, it can be even higher. For a Director earning a $180,000 base salary, this translates to a bonus of $27,000 to $54,000.

- Profit Sharing: Some private companies offer profit-sharing plans, where a portion of the company's profits is distributed to employees. This directly aligns the Director's incentives with the financial health of the organization they are responsible for reporting on.

- Equity and Long-Term Incentives (LTIs): This is a significant component of compensation, especially at publicly traded companies and high-growth startups.

- Restricted Stock Units (RSUs): The company grants the Director a certain number of shares that vest over a period of time (typically 3-4 years). This is a powerful retention tool and can be extremely lucrative if the company's stock price appreciates.

- Stock Options: The Director is given the option to buy company stock at a predetermined price in the future. If the stock price rises above this "strike price," the options become valuable. This is more common in pre-IPO startups.

- Retirement and Benefits: Beyond standard health insurance, top-tier roles include robust benefits packages. This includes a 401(k) or 403(b) with a generous company match (e.g., a 100% match on the first 5-6% of contributions), which can add thousands of dollars in value annually.

- Other Perks: These can include a car allowance, professional development stipends (for CPE credits, conferences), executive health screenings, and more generous paid time off (PTO) policies.

When evaluating an offer for an Accounting Director position, it is crucial to look at the entire compensation package. A role with a slightly lower base salary but a substantial and achievable bonus target and a generous equity grant could be far more lucrative in the long run than a role with a higher base salary alone.

---

Key Factors That Influence an Accounting Director's Salary

The wide salary ranges presented above are not arbitrary. They are the result of a complex interplay of factors that can dramatically increase or decrease an individual's earning potential. A candidate who understands and strategically positions themselves across these dimensions can command a salary at the highest end of the spectrum. This section provides an exhaustive breakdown of the six most critical factors that influence an accounting director salary.

### 1. Level of Education and Professional Certifications

Your academic and professional credentials are the foundation of your career and a primary determinant of your starting point on the salary scale.

- Bachelor's Degree: A Bachelor's degree in Accounting or a closely related field like Finance or Business Administration is the absolute minimum requirement for this career path. It is the non-negotiable entry ticket.

- Master's Degree: An advanced degree significantly enhances earning potential and marketability.

- Master of Accountancy (MAcc) or Master of Science in Accounting (MSA): These specialized degrees provide deep technical knowledge, which is highly valued for a role that serves as the ultimate arbiter on complex accounting rules. They can often lead to a higher starting salary and a faster path to leadership.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier business school, is a powerful asset. It signals a broader business acumen beyond pure accounting, focusing on strategy, operations, and leadership. An Accounting Director with an MBA is often seen as a stronger candidate for future CFO roles, and their compensation reflects this potential.

- The CPA: A "Game-Changer" Certification: The Certified Public Accountant (CPA) license is the gold standard in the accounting profession. For an Accounting Director role, it is often considered a mandatory credential, especially in public companies or regulated industries. Holding a CPA license signals a verified level of expertise, ethical commitment, and dedication to the profession.

- Salary Impact: According to the American Institute of Certified Public Accountants (AICPA), CPAs can earn 10-15% more than their non-certified peers over their careers. In the competition for a Director-level role, a CPA will almost always be chosen over a non-CPA candidate with similar experience. The salary premium is not just a one-time boost; it compounds over a lifetime, making it the single most important investment an aspiring director can make.

- Other Valued Certifications: While the CPA is paramount, other certifications can add value and command a salary premium, especially when aligned with a specific industry or role focus:

- Certified Management Accountant (CMA): Excellent for Directors in manufacturing or companies with complex cost accounting, as it focuses on management accounting and financial planning.

- Certified Internal Auditor (CIA): Highly valuable for Directors who are heavily involved in designing and overseeing internal control systems.

### 2. Years and Quality of Experience

Experience is arguably the most significant driver of salary growth. However, it's not just the number of years that matters, but the *quality* and *trajectory* of that experience.

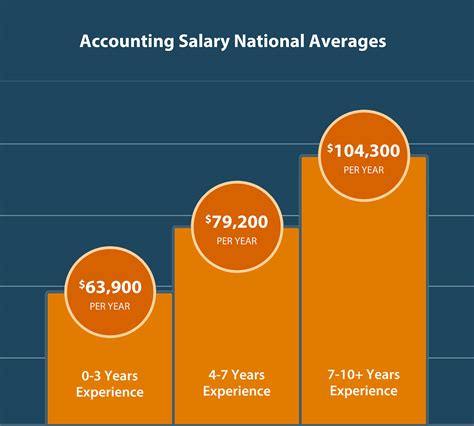

- The Typical Career Ladder: The path to Director is a long one, and compensation increases at each step:

1. Staff/Senior Accountant (2-5 years): Building the technical foundation.

2. Accounting Manager (5-8 years): First taste of management, overseeing a small team and a part of the month-end close.

3. Controller (8-12+ years): Managing the entire day-to-day accounting operation. This is often the final stepping stone to Director.

- Salary Growth Trajectory:

- <10 Years Experience (Pre-Director): Professionals with 5-9 years of experience are typically in Manager or Senior Manager roles, with salaries ranging from $90,000 to $130,000.

- 10-15 Years Experience (New to Mid-Level Director): This is the typical range for landing the first Director role. As shown previously, salaries jump significantly into the $150,000 - $195,000 range. At this stage, you've proven you can lead a team and manage the full accounting cycle.

- 15+ Years Experience (Senior/VP Level): With over 15 years of high-quality experience, including several years in a Director role, professionals command top-tier salaries ($200,000 - $300,000+). They have likely led major system implementations, navigated complex M&A accounting, managed SEC reporting for a public company, and are now seen as potential CFO candidates.

- "Big Four" Experience: Experience at one of the "Big Four" public accounting firms (Deloitte, PwC, Ernst & Young, KPMG) is highly prized. It provides unparalleled training, exposure to a wide range of industries and complex issues, and a rigorous work ethic. Professionals who spend 3-5 years in a Big Four audit practice before moving into industry often have a faster career progression and higher earning potential than those who started and stayed in corporate accounting.

### 3. Geographic Location

Where you work has a profound impact on your paycheck. Salaries are adjusted based on the local cost of living and the demand for top-tier talent in that specific market. High-cost-of-living metropolitan areas with a high concentration of large corporate headquarters will always offer the highest salaries.

Here is a comparative table of average Accounting Director salaries in various U.S. metropolitan areas, demonstrating the significant geographic variance.

| Metropolitan Area | Average Base Salary | Percentage Difference from National Median | Reason for a High or Low Salary |

| :--- | :--- | :--- | :--- |

| San Francisco, CA | ~$221,000 | +25% | Extremely high cost of living, massive tech industry hub with high demand for experienced finance leaders. |

| New York, NY | ~$210,000 | +19% | Global financial center, high concentration of Fortune 500 HQs, high cost of living. |

| Boston, MA | ~$197,000 | +12% | Strong biotech, finance, and technology sectors, high cost of living. |

| Washington, D.C. | ~$194,000 | +10% | Hub for government contractors, non-profits, and associations requiring specialized accounting leadership. |

| Chicago, IL | ~$183,000 | +4% | Major business hub with a diverse range of industries and a more moderate cost of living than coastal cities. |

*National Median Base Salary Benchmark: ~$176,000*

| Dallas, TX | ~$173,000 | -2% | Growing business center with lower cost of living, making salaries competitive but slightly below the highest-paying metros. |

| Orlando, FL | ~$161,000 | -8% | Lower cost of living and a market dominated by hospitality and tourism. |

*Source: Salary.com (data retrieved late 2023). Figures are approximate and subject to change.*

It is crucial for candidates to research the specific salary benchmarks for their target city, not just the national average. A $180,000 salary in Dallas offers significantly more purchasing power than the same salary in San Francisco.

### 4. Company Type, Size, and Industry

The type of organization you work for is a massive salary differentiator.

- Company Size (by Revenue): Larger companies have more complex accounting operations, larger teams to manage, and more stringent regulatory requirements (especially if public). As a result, they pay significantly more.

- Small Company (<$25M revenue): Salary range: $135,000 - $190,000. The Director may also function as the Controller.

- Midsize Company ($25M - $500M revenue): Salary range: $155,000 - $240,000. This is the "sweet spot" for many Directors, offering substantial responsibility and pay.

- Large Company (>$500M revenue): Salary range: $180,000 - $300,000+. These are often complex, multinational corporations with significant equity compensation.

- Public vs. Private Company:

- Public Companies: Pay a significant premium. The Accounting Director is responsible for SEC reporting (10-Ks, 10-Qs) and rigorous SOX compliance, which are high-stakes, specialized skills. The increased liability and complexity are compensated with higher base salaries and substantial equity grants (RSUs).

- Private Companies: Salaries can be highly variable. A private-equity-backed, high-growth company may offer compensation packages that rival public companies, with a heavy emphasis on potential future payouts. A smaller, family-owned private business will likely pay less.

- Industry: The industry also plays a key role. Industries with complex regulations or high margins tend to pay more.

- High-Paying Industries: Technology (especially SaaS due to complex revenue recognition), Financial Services & Banking, Biotechnology & Pharmaceuticals, and Energy.

- Mid-Range Industries: Manufacturing, Retail, and Business Services.

- Lower-Paying Industries: Non-Profit, Education, and Government. These roles often offer better work-life balance and excellent benefits (like pensions) to compensate for the lower base salary.

### 5. Area of Specialization

Within the accounting field, certain specializations are in higher demand and command a premium. An Accounting Director who possesses deep expertise in a critical area becomes an invaluable asset.

- SEC Reporting and Technical Accounting: This is the most lucrative specialization. Directors who are experts in SEC rules, can write complex technical accounting memos, and can flawlessly manage the public reporting process are at the top of the pay scale.

- Mergers & Acquisitions (M&A): Experience with the financial due diligence and purchase accounting integration required in M&A transactions is a highly sought-after skill that adds significant value.

- System Implementation (ERP): A Director who has successfully led a major ERP implementation (e.g., migrating from QuickBooks to Oracle NetSuite) has a proven project management and technical skill set that companies will pay a premium for.

- Revenue Recognition (ASC 606): In industries like technology, media, and telecommunications, having deep expertise in the nuances of revenue recognition is critical and highly compensated.

### 6. In-Demand Skills (Hard and Soft)

Beyond formal qualifications, a specific set of modern skills can significantly boost an Accounting Director's salary.

- **Hard Skills