Table of Contents

- [Introduction](#introduction)

- [What Does a Small Business Tax Accountant Do?](#what-does-a-small-business-tax-accountant-do)

- [Average Tax Accountant Salary: A Deep Dive](#average-tax-accountant-salary-a-deep-dive)

- [Key Factors That Influence a Tax Accountant's Salary](#key-factors-that-influence-a-tax-accountants-salary)

- [Job Outlook and Career Growth for Tax Professionals](#job-outlook-and-career-growth-for-tax-professionals)

- [How to Become a Tax Accountant Specializing in Small Business Advisory](#how-to-become-a-tax-accountant-specializing-in-small-business-advisory)

- [Conclusion: Is a Career in Tax Accounting Right for You?](#conclusion-is-a-career-in-tax-accounting-right-for-you)

Introduction

If you’ve searched for an "S Corp reasonable salary calculator," you've stumbled upon one of the most critical and nuanced financial concepts for small business owners in the United States. This isn't just about plugging numbers into a formula; it's a strategic decision with significant tax implications, legal scrutiny, and financial consequences. But here's the crucial insight: an "S Corp reasonable salary calculator" isn't a standalone tool, nor is it a career. It's a complex *process*, a puzzle that requires deep expertise to solve correctly. The individuals who master this puzzle—the expert career analysts of the tax world—are highly sought-after, well-compensated professionals. This guide is for those who don't just want to *use* the calculator but aspire to become the expert who *builds* the defensible logic behind it: the Small Business Tax Accountant or Certified Public Accountant (CPA).

This career path is about much more than crunching numbers during tax season. It's about becoming a trusted advisor, a strategic partner who helps entrepreneurs navigate the labyrinthine tax code, maximize their profits, and build sustainable businesses. The professionals in this field command respect and impressive salaries, with the U.S. Bureau of Labor Statistics (BLS) reporting a median pay of $79,880 per year for accountants and auditors in 2023, and top earners easily clearing six figures.

I once worked with a new S Corp owner, a brilliant graphic designer, who wanted to pay herself a tiny salary to save on payroll taxes. Her logic seemed sound on the surface. However, a skilled CPA intervened, walking her through the IRS's multi-factor test and documenting a "reasonable" salary that was higher but legally sound. A year later, that same business owner faced an IRS inquiry. Because of her CPA's meticulous work and documentation, the inquiry was resolved quickly with no penalties. That single piece of advice didn't just save her from fines; it secured her peace of mind and validated the immense value of expert guidance.

This comprehensive guide will illuminate the path to becoming that expert. We will dissect the role, explore the significant earning potential, break down the factors that dictate your salary, analyze the promising job outlook, and provide a step-by-step roadmap to launch your career. You'll learn not just what a tax accountant does, but how to become an indispensable advisor in the world of small business finance.

What Does a Small Business Tax Accountant Do?

At its core, a Tax Accountant specializing in small businesses and S Corporations is a financial strategist and compliance guardian. While the title might conjure images of someone hunched over tax forms under a green visor, the modern reality is far more dynamic and advisory-focused. These professionals are the key interpreters between the complex language of the Internal Revenue Code (IRC) and the practical realities of running a business.

Their primary mandate is twofold:

1. Ensure Compliance: They ensure that a business, particularly an S Corp, adheres to all federal, state, and local tax laws. This includes filing accurate and timely tax returns (like the Form 1120-S for S Corps) and correctly handling payroll, sales tax, and other regulatory requirements.

2. Provide Strategic Tax Planning: This is where their value truly shines. They proactively identify opportunities to legally minimize a company's tax burden. This involves entity selection (is an S Corp truly the best choice?), retirement plan structuring (like a SEP IRA or Solo 401(k)), and, critically, advising on reasonable compensation.

### The Art and Science of "Reasonable Compensation"

For a Tax Accountant, the "S Corp reasonable salary calculator" isn't a piece of software; it's a methodical analysis they perform for their clients. S Corporation owners who are also employees must pay themselves a "reasonable salary" for the services they provide before they can take tax-free distributions. The salary portion is subject to FICA taxes (Social Security and Medicare), while distributions are not. This creates a powerful incentive to minimize salary and maximize distributions.

The IRS is acutely aware of this and scrutinizes S Corps that pay suspiciously low salaries to their owner-employees. A Tax Accountant's job is to build a defensible case for the salary figure they recommend. This involves:

- Research and Benchmarking: Using industry data from salary aggregators, professional surveys, and government sources (like the BLS) to determine what a comparable role would command on the open market.

- Analyzing the Owner's Role: Documenting the owner's specific duties, skills, experience, and time commitment. Are they acting as CEO, lead salesperson, and chief technician all at once? Each role has a market value.

- Applying IRS Factors: The IRS doesn't provide a magic formula. Instead, they use a variety of factors derived from court rulings. A tax professional must consider:

- Training and experience

- Duties and responsibilities

- Time and effort devoted to the business

- Dividend history

- Payments to non-shareholder employees for similar services

- Timing and manner of paying bonuses to key people

- What comparable businesses pay for similar services

- Documentation and Reporting: Creating a formal compensation study or memo that outlines the methodology and justifies the chosen salary. This document is the first line of defense in an IRS audit.

### A Day in the Life of a Small Business Tax Accountant

To make this concrete, let's imagine a typical Tuesday for "Alex," a Senior Tax Accountant at a regional CPA firm.

- 9:00 AM - 10:30 AM: Alex starts the day reviewing emails and responding to an urgent query from a new client, a software development startup structured as an S Corp. The founder wants to know how to pay himself. Alex schedules a discovery call for the afternoon.

- 10:30 AM - 12:00 PM: Alex works on a reasonable compensation analysis for an established e-commerce client. She uses the firm's subscription to a salary data service (like Salary.com or ERI) to pull compensation reports for "Marketing Director" and "Operations Manager" roles in the client's geographic area. She blends this data based on the owner's 60/40 split of duties.

- 12:00 PM - 1:00 PM: Lunch and a quick read of a tax journal to stay current on recent tax court rulings.

- 1:00 PM - 2:30 PM: Alex holds the discovery call with the software startup founder. She asks detailed questions about his role, the company's financials, his technical skills, and his business development activities. She explains the concept of reasonable salary vs. distributions and sets expectations for the analysis she will perform.

- 2:30 PM - 4:30 PM: Alex shifts gears to tax compliance work, reviewing a Form 1120-S prepared by a junior accountant. She flags a potential issue with how equipment depreciation was calculated and leaves a detailed review note.

- 4:30 PM - 5:30 PM: Alex finalizes the compensation memo for the e-commerce client, attaching the salary reports and a clear summary of her recommendation. She emails it to the client, ready to discuss it on their weekly call.

This snapshot shows a role that is analytical, client-facing, and deeply strategic. It's about problem-solving and risk management, with the "calculator" being the intellectual framework they apply daily.

Average Tax Accountant Salary: A Deep Dive

The earning potential for a professional skilled in tax accounting and advisory services is substantial and grows significantly with experience and specialization. While a single national average provides a starting point, a true understanding requires looking at the entire career trajectory, from entry-level associate to seasoned partner, and considering the full compensation package.

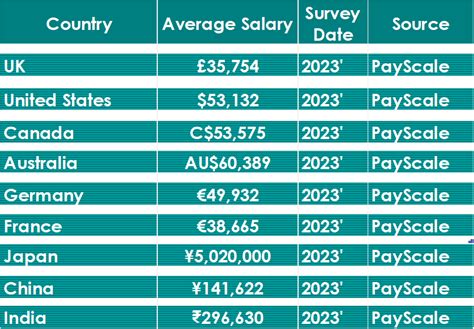

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Accountants and Auditors was $79,880 in May 2023. The lowest 10 percent earned less than $50,580, while the highest 10 percent of earners brought in more than $138,580. This broad category includes all types of accountants, but tax specialists, particularly those with a CPA license, often command salaries at the higher end of this spectrum.

More specialized salary aggregators provide a focused look at the "Tax Accountant" title:

- Salary.com: As of late 2023, the median salary for a Tax Accountant in the United States is reported as $70,069, with a typical range falling between $63,892 and $76,966. However, for a *Senior* Tax Accountant, the median jumps to $96,168, and for a Tax *Manager*, it rises to $128,155.

- Payscale: This platform reports a similar average salary for a Tax Accountant at around $65,000 per year. Importantly, Payscale highlights the significant impact of skills, noting that expertise in "Tax Consulting" and "Tax Advisory" can lead to higher-than-average pay.

- Glassdoor: Based on user-submitted data, Glassdoor estimates the total pay for a Tax Accountant in the U.S. to be around $80,000 per year, with a base salary of approximately $70,000 and additional pay (bonuses, profit sharing) of around $10,000.

These figures illustrate a clear and rewarding financial path. Your expertise in complex areas like S Corp reasonable compensation directly translates into higher earning potential because you are moving from a compliance-based role to a high-value advisory role.

### Salary Brackets by Experience Level

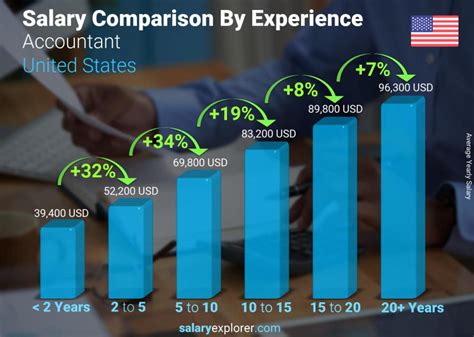

Salary growth in accounting is well-defined and closely tied to a combination of years of experience, performance, and professional certification (namely, the CPA). Here's a typical salary progression for a Tax Accountant in a public accounting firm, which serves as a common training ground for the profession.

| Career Stage | Typical Years of Experience | Typical Salary Range (Annual) | Key Responsibilities & Milestones |

| :--- | :--- | :--- | :--- |

| Entry-Level / Tax Associate | 0-2 years | $60,000 - $75,000 | Preparing individual and simple business tax returns (1040s, 1120-S). Learning tax software. Assisting with data entry and basic research. Working towards CPA license. |

| Mid-Career / Senior Tax Accountant | 2-5 years | $75,000 - $100,000+ | CPA license is often required. Manages more complex client engagements. Reviews work of associates. Begins to specialize (e.g., in S Corps). First point of client contact. Performs reasonable compensation analysis. |

| Senior / Tax Manager | 5-10 years | $100,000 - $150,000+ | Manages a portfolio of clients. Supervises a team of seniors and associates. Responsible for billing and client relationships. Provides high-level strategic tax planning and advisory. |

| Executive / Senior Manager or Partner | 10+ years | $150,000 - $300,000+ | Responsible for firm growth and bringing in new business. Expert in a specific tax niche. Represents clients before the IRS. Sets firm strategy. Earning potential is often tied to firm profitability. |

*Sources: Data compiled and synthesized from BLS, Robert Half Salary Guides, Payscale, and Glassdoor (2023-2024).*

### Beyond the Base Salary: Understanding Total Compensation

A Tax Accountant's earnings are rarely limited to their base salary. The total compensation package is a critical component of their financial picture, especially as they advance in their careers.

- Bonuses: Annual performance bonuses are standard in public accounting and many corporate roles. These can range from 5% of base salary at the junior levels to over 30% for managers and partners. Bonuses are often tied to individual performance, firm profitability, and billable hours.

- Profit Sharing: At the partner level in a CPA firm, compensation is directly tied to the firm's profits. This can lead to total compensation packages that are significantly higher than the salary ranges listed above. Some private companies also offer profit-sharing plans to their key financial employees.

- Signing Bonuses: To attract top talent, especially experienced CPAs, firms often offer substantial signing bonuses, which can be $10,000 or more.

- Overtime Pay: While many senior roles are salaried exempt, some firms pay overtime (often at a straight-time rate) to staff and senior accountants during the busy season (typically January to April). This can add a significant amount to their annual earnings.

- Benefits and Perks: The value of the benefits package cannot be overstated. This includes:

- Health Insurance: Comprehensive medical, dental, and vision plans.

- Retirement Savings: 401(k) plans with employer matching contributions are standard.

- Paid Time Off (PTO): Generous vacation, sick, and personal day policies.

- CPA Exam Support: Many firms pay for CPA review courses (like Becker or Roger) and exam fees, an investment worth several thousand dollars.

- Continuing Professional Education (CPE): Firms pay for the ongoing training required to maintain a CPA license, ensuring their staff stays current on ever-changing tax laws.

When evaluating a career in tax accounting, it's essential to look beyond the initial salary and consider the entire financial ecosystem. The profession provides a clear, structured path for ambitious individuals to achieve significant financial success by delivering high-value, strategic advice on complex topics like S Corp reasonable compensation.

Key Factors That Influence a Tax Accountant's Salary

While the average salary figures provide a useful benchmark, an individual's actual earning potential is determined by a confluence of specific factors. In the world of tax accounting, where expertise is the primary product, these variables can create a vast difference in compensation. Mastering these elements is the key to accelerating your career and maximizing your income.

### Level of Education and Professional Certification

Your educational foundation is the launching pad for your career, and professional certifications are the rocket boosters.

- Bachelor's Degree: A bachelor's degree in Accounting is the standard and non-negotiable entry requirement for the profession. It provides the fundamental knowledge of accounting principles, tax law, and business ethics.

- Master's Degree: A Master of Science in Taxation (MST), Master of Accountancy (M.Acc.), or an MBA with a concentration in accounting can significantly increase starting salary and long-term earning potential. An MST, in particular, signals a deep commitment to the tax field and provides specialized knowledge that is highly valued by public accounting firms and corporate tax departments. An employee with a master's degree might command a starting salary that is $5,000 to $15,000 higher than a candidate with only a bachelor's degree.

- Certified Public Accountant (CPA) License: This is the single most important credential a tax accountant can earn. It is the gold standard of the profession, signifying a high level of competence, ethical standing, and commitment. According to a study by the AICPA, CPAs earn a lifetime premium of over $1 million compared to their non-certified counterparts. In most public accounting firms, promotion to a manager-level position is impossible without a CPA license. The salary jump upon receiving the license can be immediate, with many firms offering a "CPA bonus" of $5,000 or more, in addition to a salary increase.

- Other Certifications: While the CPA is paramount, other certifications can enhance a resume and salary, especially in niche areas. An Enrolled Agent (EA) is a tax expert licensed by the IRS, which is highly valuable for those focusing purely on tax representation. A Certified Financial Planner (CFP) can be a powerful combination with a CPA for those advising high-net-worth individuals and small business owners on holistic financial strategy.

### Years of Experience

As detailed in the salary table above, experience is a primary driver of compensation. However, the *quality* of that experience is just as important as the quantity. The salary growth trajectory is not linear; it accelerates at key inflection points.

- 0-2 Years (Associate): The focus is on learning the fundamentals. Your value is in your capacity to learn quickly and produce accurate work under supervision. Salary growth is steady but modest.

- 2-5 Years (Senior): This is a critical transition. You are now expected to work independently, manage smaller engagements, and begin reviewing the work of others. Achieving your CPA license during this period is the catalyst for a significant salary jump, often 10-15% or more. You move from being a pure "doer" to a "doer and reviewer."

- 5-10 Years (Manager): Here, your value shifts dramatically from technical execution to management and client relations. You are responsible for a team and a portfolio of clients. Your ability to retain clients, manage budgets, and develop staff directly impacts your compensation. Salaries at this level cross the six-figure threshold comfortably. For example, according to the Robert Half 2024 Salary Guide, a Tax Manager at a large public accounting firm can expect to earn between $141,500 and $201,750.

- 10+ Years (Senior Manager/Director/Partner): At this level, you are a business leader. Your compensation is driven by your ability to generate new business, your expertise in a highly specialized niche (like international tax or M&A), and your contribution to the firm's overall strategy and profitability. Base salaries are high, but the majority of income growth comes from performance bonuses and, for partners, a share of the firm's profits.

### Geographic Location

Where you work has a massive impact on your paycheck. This is driven by the local cost of living and the demand for skilled financial professionals in that market. High-cost-of-living metropolitan areas with major financial centers naturally offer the highest salaries.

- Top-Tier Cities: Major metropolitan areas like New York City, San Francisco, San Jose, Boston, and Washington D.C. offer the highest salaries for tax accountants. According to the BLS, the annual mean wage for accountants in the San Francisco-Oakland-Hayward metropolitan area was $112,980 in May 2023, well above the national average. In the New York-Newark-Jersey City metro, it was $107,370. While the salaries are higher, so is the cost of living.

- Mid-Tier Cities: Strong regional hubs like Chicago, Dallas, Atlanta, and Houston offer competitive salaries that often provide a better cost-of-living adjusted income than the top-tier cities. For instance, the annual mean wage in the Dallas-Fort Worth-Arlington metro area was $94,000.

- Lower-Paying Areas: Rural areas and smaller cities with less economic activity will generally have lower salaries. The salaries are commensurate with a significantly lower cost of living.

- The Rise of Remote Work: The post-pandemic shift towards remote work has introduced a new dynamic. Some national firms are now hiring talent from anywhere in the country. This can create opportunities for accountants in lower-cost-of-living areas to earn salaries closer to major market rates. However, many firms still adjust salary bands based on the employee's location, a practice known as "geographic pay differentiation."

### Company Type & Size

The type and size of your employer create different work environments, career paths, and compensation structures.

- Public Accounting - "Big Four": The four largest accounting firms in the world (Deloitte, PwC, Ernst & Young, and KPMG) are known for paying top-of-market salaries, especially for entry-level talent. They offer prestigious training, work with the largest clients (Fortune 500 companies), and provide clear paths for advancement. The trade-off is often a demanding work culture with long hours, particularly during busy season. A starting salary at a Big Four firm in a major market can be $70,000 - $85,000.

- Public Accounting - Regional & Local Firms: These firms offer a different experience. While their starting salaries might be slightly lower than the Big Four, they often provide a better work-life balance. They serve small and mid-sized businesses, which means you get direct exposure to clients like the S Corp owners who need reasonable compensation advice. This is often the best training ground for someone who wants to specialize in small business advisory.

- Corporate (Industry) Accounting: Moving from public accounting to a role as an in-house tax accountant for a corporation is a common career move. The work-life balance is typically better than in public accounting. Compensation is highly competitive, especially for experienced professionals. A Tax Manager at a large corporation can earn a salary comparable to or even higher than their public accounting counterpart, often with better bonuses and benefits.

- Government: Working for the government, such as for the Internal Revenue Service (IRS) or the Government Accountability Office (GAO), offers unparalleled job security and excellent benefits. While the base salaries may not reach the highest peaks of the private sector, the work-life balance and pension plans are significant draws. An IRS Revenue Agent, for example, is on the GS pay scale, with clear, transparent salary progression.

- Non-Profit: Non-profit organizations also need skilled accountants, but their salaries are generally lower than in the for-profit sectors due to budget constraints. Professionals in this area are often driven by a passion for the organization's mission.

### Area of Specialization

General tax knowledge is valuable, but deep specialization is what creates a lucrative, defensible career. As you gain experience, developing a niche makes you an indispensable expert.

- Small Business / S Corp Advisory: This is the specialty at the heart of our discussion. Professionals who master the nuances of S Corp taxation, reasonable compensation, entity structure, and succession planning are in high demand by millions of small businesses. Their advisory services command premium fees.

- International Tax: In an increasingly global economy, experts who can navigate the complexities of cross-border transactions, transfer pricing, and foreign tax credits are among the highest-paid in the field. This is a common specialty in Big Four and large multinational corporations.

- State and Local Tax (SALT): With 50 different state tax regimes (and countless local ones), SALT is a perpetually complex and in-demand field. This is especially true after the *South Dakota v. Wayfair* Supreme Court decision, which changed the rules for online sales tax.

- Mergers & Acquisitions (M&A) Tax: These specialists advise on the tax implications of corporate deals, structuring transactions to be as tax-efficient as possible. This is a high-stakes, high-reward field.

- High-Net-Worth Individuals / Trusts & Estates: This area combines tax planning with wealth management, helping wealthy families minimize income and estate taxes. It requires strong interpersonal skills alongside technical tax knowledge.

### In-Demand Skills

Beyond your formal credentials, a specific set of technical and soft skills can dramatically increase your value and salary.

- Technical Tax Research: The ability to go beyond tax software and dive into the primary source material—the Internal Revenue Code, Treasury Regulations, and court case history (e.g., *Watson v. Commissioner* on reasonable compensation)—is a top-tier skill. Proficiency with research platforms like CCH, BNA, and RIA Checkpoint is essential.

- Data Analytics and Technology: The future of accounting is data. Skills in data analytics, using tools like Excel (at an advanced level, including Power Query and Power Pivot), Alteryx, or even Python, to analyze financial data and automate compliance tasks are becoming increasingly valuable.

- Client Advisory and Communication: Technical knowledge is useless if you can't explain it clearly to a non-accountant business owner. The ability to translate complex tax concepts into actionable business advice is perhaps the most important soft skill. This is what separates a tax preparer from a tax advisor.

- Project Management: As you advance, your ability to manage multiple client engagements, meet deadlines, and delegate effectively becomes critical to your success and the firm's profitability.

By strategically developing these six areas, a motivated professional can chart a course toward the highest echelons of the tax accounting profession.

Job Outlook and Career Growth for Tax Professionals

For anyone considering a career as a tax accountant, the long-term prospects are exceptionally bright and stable. In a world of constant economic and technological change, two things remain certain: death and taxes. This axiom underpins the enduring demand for skilled professionals who can navigate the complexities of taxation for individuals and businesses.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for accountants and auditors will grow by 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. This is projected to result in about 126,500 openings for accountants and auditors each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

While a 4% growth rate may seem modest, it represents a stable and consistent demand. The true story of career growth in this field lies not just in the number of jobs, but in the evolution of the role itself.

### Emerging Trends and the Future of Tax Accounting

The profession is currently undergoing a significant transformation driven by technology and globalization. Far from making accountants obsolete, these trends are elevating their role from compliance-focused number-crunchers to strategic advisors. Aspiring professionals who embrace these shifts will find themselves in the highest demand.

- The Shift from Compliance to Advisory: The most profound trend is the move away from manual data entry and tax preparation towards high-level advisory services. Artificial intelligence (AI) and sophisticated tax software can now automate many of the routine tasks that once consumed an accountant's time. This frees up professionals to focus on what technology cannot do: provide strategic advice, interpret gray areas of the law, and build client relationships. Expertise in areas like S Corp reasonable compensation analysis is a perfect example of this shift. A machine can pull salary data, but only a human expert can synthesize it with the client's unique circumstances, document the decision-making process, and defend it under scrutiny.

- The Growing Complexity of Tax Law: Globalization, the digital economy, and frequent legislative changes ensure that the tax code becomes more, not less, complex over time. Events like the