Are you a seasoned accountant with an eye for detail and a knack for leadership? If you're considering a move into management, one of your primary questions is likely about compensation. The role of an Accounting Manager is not only a critical leadership position within an organization but also a financially rewarding one, with many professionals earning well into the six-figure range.

This guide will provide a comprehensive breakdown of what you can expect to earn as an accounting manager, the key factors that drive salary, and the bright future this career path holds.

What Does an Accounting Manager Do?

Before we dive into the numbers, let's clarify the role. An Accounting Manager is the backbone of a company's financial health and integrity. They lead the accounting team and are responsible for overseeing the accurate and timely execution of all accounting operations.

Key responsibilities typically include:

- Managing the month-end and year-end closing processes.

- Preparing and reviewing financial statements, such as the balance sheet, income statement, and statement of cash flows.

- Overseeing the general ledger, accounts payable, accounts receivable, and payroll.

- Ensuring compliance with Generally Accepted Accounting Principles (GAAP) and other financial regulations.

- Developing and implementing internal controls to protect company assets.

- Hiring, training, and mentoring accounting staff.

In essence, they ensure that the financial engine of the organization runs smoothly, accurately, and efficiently.

Average Accounting Manager Salary

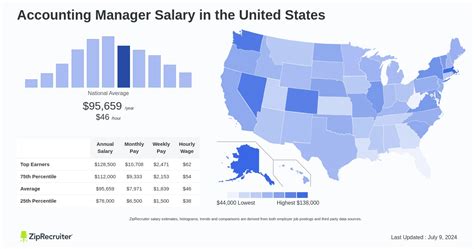

So, what can you expect to earn in this pivotal role? While figures vary based on several factors, we can establish a strong baseline from leading data sources.

Across the United States, the average base salary for an Accounting Manager typically falls between $115,000 and $140,000 per year.

However, the complete salary range is much broader. According to data aggregated by Salary.com, the typical range for an accounting manager is between $105,951 and $149,021, with the top 10% of earners exceeding $165,000. Similarly, Glassdoor reports an average total pay (including bonuses and profit sharing) of around $128,000 per year.

It's also useful to look at the U.S. Bureau of Labor Statistics (BLS) data for the closely related and often senior category of "Financial Managers." The BLS reports a median annual wage of $139,790 as of May 2022, with the highest 10 percent earning more than $208,000. This demonstrates the significant upward mobility and high earning potential in the field.

Key Factors That Influence Salary

Your specific salary will be determined by a blend of your personal qualifications, where you work, and the nature of your role. Understanding these factors is key to maximizing your earning potential.

### Level of Education

A bachelor's degree in accounting or a related field is the standard entry requirement. However, advanced credentials significantly boost earning power.

- Master's Degree: An MBA or a Master of Accountancy (MAcc) can provide specialized knowledge in areas like financial analysis or corporate finance, making you a more valuable candidate.

- Professional Certifications: The most impactful certification is the Certified Public Accountant (CPA). It is often a prerequisite for management positions and can command a salary premium of 10-15%. Other valuable certifications include the Certified Management Accountant (CMA) and the Certified Internal Auditor (CIA).

### Years of Experience

Experience is arguably the most significant driver of salary growth. Employers pay a premium for proven leaders who can navigate complex financial landscapes.

- Early-Career Manager (5-8 years of total experience): Professionals recently promoted to manager may fall in the $90,000 to $115,000 range as they build their leadership track record.

- Mid-Career Manager (8-15 years): With a solid history of managing teams and processes, these managers typically earn within the national average range of $115,000 to $145,000.

- Senior/Experienced Manager (15+ years): Managers with extensive experience, particularly in large or complex organizations, can command salaries of $150,000+, often moving into roles like Senior Accounting Manager or Assistant Controller.

### Geographic Location

Where you work matters. Salaries for accounting managers vary significantly based on the cost of living and the demand for financial talent in a specific metropolitan area.

- High-Paying States: States with major financial hubs like California, New York, Massachusetts, New Jersey, and Washington D.C. consistently offer the highest salaries, often 20-30% above the national average to compensate for a higher cost of living.

- Average and Lower-Paying States: States in the Midwest and Southeast may offer salaries closer to or slightly below the national average, though the lower cost of living can often offset this difference.

### Company Type and Size

The type and scale of your employer have a direct impact on your compensation package.

- Large Public Corporations: These companies typically offer the highest base salaries, along with substantial bonuses, stock options, and comprehensive benefits packages. Experience with SEC reporting and Sarbanes-Oxley (SOX) compliance is highly valued here.

- Private Companies & Start-ups: Salaries can be competitive, but compensation may also include equity or profit-sharing. The role might be broader, offering more diverse experience.

- Public Accounting Firms: While demanding, working as a manager at a large public accounting firm (like the "Big Four") is a prestigious and high-earning path that often serves as a springboard to top corporate finance roles.

- Non-Profit & Government: These sectors generally offer lower base salaries but often compensate with excellent benefits, job security, and a better work-life balance.

### Area of Specialization

Within accounting management, certain specializations are more in-demand and command higher pay. If you have expertise in a niche area, you can leverage it for a higher salary. High-value specializations include:

- Technical Accounting & Financial Reporting (SEC)

- Tax Management

- Internal Audit Management

- Forensic Accounting

- Financial Planning & Analysis (FP&A)

Job Outlook

The future for accounting managers is exceptionally bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

This robust growth is driven by several factors, including the increasing complexity of global commerce, a constantly evolving regulatory environment, and the growing need for in-depth data analysis to guide business strategy. This high demand ensures strong job security and continued salary growth for qualified professionals.

Conclusion: A Rewarding Path Forward

Becoming an accounting manager is a significant career milestone that offers both professional fulfillment and substantial financial rewards. While the national average salary provides a solid benchmark, your ultimate earning potential is in your hands.

To maximize your salary, focus on a strategy of continuous improvement: pursue advanced certifications like the CPA, gain experience in high-demand industries and specializations, and be open to opportunities in major metropolitan markets. By building a strong foundation of skills and credentials, you can position yourself for a long, successful, and highly lucrative career in accounting leadership.