Thinking about a career as an Accounting Specialist? It’s a smart move. This role is a vital pillar of the business world, offering a stable and rewarding career path for detail-oriented individuals. But what can you expect to earn? While the answer varies, the national average salary for an Accounting Specialist in the United States typically falls between $48,000 and $72,000 per year, with significant potential for growth based on your experience, location, and expertise.

This article will break down everything you need to know about an accounting specialist salary, the factors that shape your earning potential, and the promising outlook for this essential profession.

What Does an Accounting Specialist Do?

Before we dive into the numbers, let's clarify the role. An Accounting Specialist is the financial engine of a department or company. They are hands-on professionals responsible for maintaining and processing an organization's day-to-day financial records. While a general accountant might focus on high-level strategy and reporting, a specialist handles the crucial transactional and reconciliation tasks that ensure financial data is accurate and compliant.

Key responsibilities often include:

- Processing accounts payable (invoices, payments) and accounts receivable (billing, collections).

- Performing bank and general ledger reconciliations.

- Assisting with month-end and year-end closing procedures.

- Preparing financial reports, such as balance sheets and income statements.

- Managing payroll processing.

- Ensuring compliance with financial policies and regulations.

Average Accounting Specialist Salary

The salary for an Accounting Specialist is competitive and reflects the critical nature of their work. Based on aggregated data from leading sources, you can expect the following:

- National Average Salary: Approximately $58,500 per year.

- Typical Salary Range: Most Accounting Specialists earn between $48,000 and $72,000 annually.

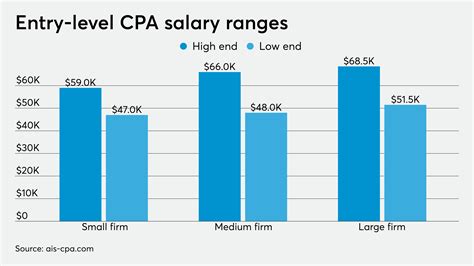

- Entry-Level Range: New professionals with limited experience can expect to start in the $42,000 to $50,000 range.

- Senior-Level Range: Experienced specialists, particularly those with supervisory duties or in-demand skills, can earn $75,000 or more.

*Sources: Salary data is a synthesized average from up-to-date reports by Salary.com, Payscale, and Glassdoor (as of late 2023/early 2024).*

Key Factors That Influence Salary

Your base salary isn't set in stone. Several key factors can significantly increase your earning potential. Understanding these levers is crucial for maximizing your income throughout your career.

###

Level of Education

Your educational background provides the foundation for your career. While you can enter the field with a high school diploma and relevant experience, formal education directly impacts your starting salary and long-term growth.

- Associate's Degree: An Associate's degree in Accounting is a common entry point and can lead to a competitive starting salary. It demonstrates a solid understanding of accounting principles and software.

- Bachelor's Degree: A Bachelor's degree in Accounting or Finance is the gold standard and unlocks the highest earning potential. It not only qualifies you for more complex specialist roles but also positions you for future advancement into senior accountant or management positions. Employers often prefer candidates with a four-year degree for roles requiring more analytical and critical-thinking skills.

###

Years of Experience

Experience is perhaps the single most significant factor in determining your salary. As you build a track record of accuracy, efficiency, and reliability, your value to an employer skyrockets.

- Entry-Level (0-2 years): In this stage, you're learning the ropes and focusing on core tasks like data entry and basic reconciliations. Expect a salary in the $42,000 - $50,000 range.

- Mid-Career (3-9 years): With several years of experience, you can handle more complex tasks, work independently, and may begin to specialize. Your salary will likely climb to the $55,000 - $68,000 range.

- Senior/Experienced (10+ years): At this level, you are a subject matter expert. You may be responsible for training junior staff, managing complex accounts, or leading month-end close processes. Your salary can easily exceed $70,000 - $75,000, especially with supervisory responsibilities.

###

Geographic Location

Where you work matters. Salaries are adjusted based on the cost of living and the demand for accounting professionals in a specific metropolitan area.

- High-Cost Areas: Major cities like San Francisco, CA, New York, NY, and Boston, MA, offer significantly higher salaries to compensate for the high cost of living. In these markets, an experienced specialist can command a salary well above the national average, often in the $75,000 to $90,000 range.

- Average-Cost Areas: In most other metropolitan areas across the country, salaries will align more closely with the national average.

- Remote Work: The rise of remote work has created a new dynamic. Companies may pay based on their headquarters' location or adjust salaries based on the employee's location. This can be a great opportunity for professionals in lower-cost areas to earn a higher-than-local-average salary.

###

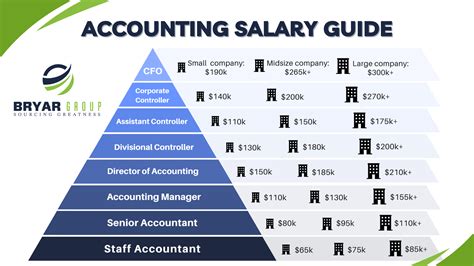

Company Type

The size and type of your employer play a major role in compensation.

- Large Corporations: Large, publicly-traded companies typically offer the highest salaries, best benefits, and structured career paths. Their complex accounting needs require highly skilled specialists.

- Small to Medium-Sized Businesses (SMBs): While base salaries at SMBs may be slightly lower than at large corporations, they can offer more diverse responsibilities, a better work-life balance, and opportunities to have a broader impact on the business.

- Non-Profit Organizations: Non-profits often operate with tighter budgets, so salaries may be on the lower end of the spectrum. However, the work can be incredibly fulfilling for those passionate about a specific cause.

- Public Accounting Firms: While these firms are known for hiring accountants and auditors, they also employ specialists for internal finance roles. Compensation is generally competitive.

###

Area of Specialization

The term "Accounting Specialist" is broad, and specializing in a high-demand area can boost your salary. Some lucrative specializations include:

- Payroll Specialist: Professionals who are experts in payroll processing, tax withholding, and compliance are always in demand.

- Tax Specialist: Assisting with tax preparation and compliance for a corporation requires specialized knowledge that commands a higher salary.

- Financial Reporting Specialist: These specialists help prepare external-facing financial documents like the 10-K and 10-Q, requiring a deep understanding of GAAP (Generally Accepted Accounting Principles).

- Systems Specialist: As accounting becomes more software-driven, specialists who are experts in specific ERP (Enterprise Resource Planning) systems like SAP, Oracle NetSuite, or advanced QuickBooks features are highly valued.

Job Outlook

The career outlook for accounting professionals is stable and promising. According to the U.S. Bureau of Labor Statistics (BLS), the category of "Bookkeeping, Accounting, and Auditing Clerks" is a massive field, with over 1.7 million jobs as of 2022.

The BLS projects a slight decline in the total number of jobs over the next decade, but this statistic requires context. The decline is primarily due to the automation of routine data entry tasks. This doesn't signal a disappearing profession but rather an evolution. The demand is shifting away from manual clerks and toward skilled specialists who can:

- Manage and troubleshoot sophisticated accounting software.

- Analyze financial data to provide business insights.

- Ensure complex regulatory compliance.

For those willing to adapt and embrace technology, the demand for true Accounting Specialists will remain strong.

Conclusion

A career as an Accounting Specialist is an excellent choice for those seeking stability, competitive pay, and a clear path for professional growth. While the national average salary provides a solid benchmark, your ultimate earning potential is in your hands.

To maximize your income, focus on these key takeaways:

1. Invest in Education: A Bachelor's degree opens the most doors and provides the highest long-term earning potential.

2. Build Experience: Diligently build your skills and track record, as experience is the most powerful driver of salary growth.

3. Be Strategic: Consider how location, company type, and specialization can influence your pay.

4. Embrace Technology & Lifelong Learning: The future of accounting is tech-driven. Become an expert in industry-standard software and never stop learning to stay ahead of the curve.

By strategically navigating these factors, you can build a financially rewarding and professionally fulfilling career as an indispensable Accounting Specialist.