An accounts payable (AP) clerk is the financial gatekeeper for any successful business, ensuring that bills are accurate, legitimate, and paid on time. If you're detail-oriented, organized, and looking for a stable and rewarding entry point into the world of finance and accounting, this career path holds significant potential. But what can you expect to earn?

An accounts payable clerk's salary typically ranges from $45,000 to over $65,000 per year, with the national average hovering around $52,000. However, this figure is influenced by a number of critical factors, from your level of experience to the city you work in. In this in-depth guide, we will break down the salary expectations and explore how you can maximize your earning potential in this essential role.

What Does an Accounts Payable Clerk Do?

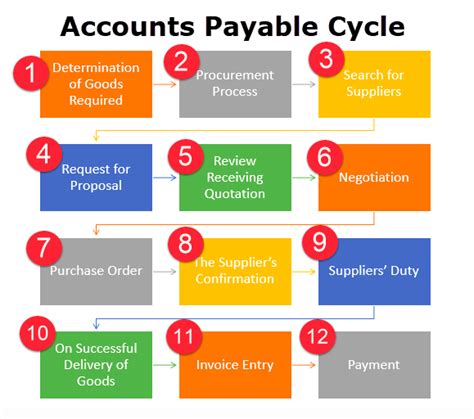

Before diving into the numbers, it's important to understand the role. An accounts payable clerk is a crucial member of the accounting team responsible for managing a company's short-term debts and obligations. They are the final checkpoint for all outgoing payments, aside from payroll.

Key responsibilities include:

- Receiving, processing, and verifying invoices from vendors.

- Matching purchase orders, invoices, and receiving reports (the "three-way match").

- Scheduling and preparing payments (checks, ACH transfers, wire transfers).

- Reconciling vendor statements and resolving any discrepancies.

- Maintaining accurate and organized financial records.

- Communicating with vendors and internal departments to address payment inquiries.

It’s a role that demands precision, integrity, and strong organizational skills, making it a cornerstone of a company's financial health.

Average Accounts Payable Clerk Salary

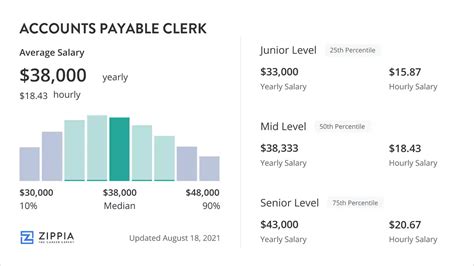

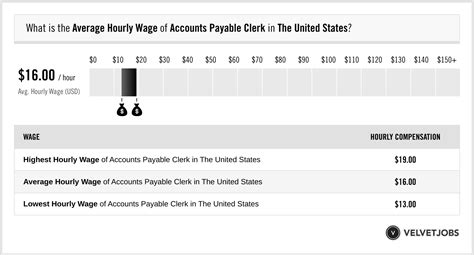

While salaries vary, we can establish a reliable baseline by looking at data from several authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for "Bookkeeping, Accounting, and Auditing Clerks," the category that includes AP clerks, was $47,490 in May 2023. The lowest 10 percent earned less than $31,520, while the top 10 percent earned more than $71,150.

Reputable salary aggregators, which often capture data from more specific job postings, provide a slightly different perspective:

- Salary.com reports that the median salary for an Accounts Payable Clerk I in the United States is around $51,600, with a typical range falling between $46,500 and $57,700.

- Payscale estimates the average base salary for an AP clerk at approximately $49,500 per year.

- Glassdoor places the average total pay (including base salary and additional compensation like bonuses) at around $54,000 per year.

Taking these sources together, a realistic salary range for a new or experienced accounts payable clerk is $45,000 to $65,000, with the median salary falling squarely in the low $50,00s.

Key Factors That Influence Salary

Your specific salary will depend on a combination of factors. Understanding these variables is the key to negotiating a better offer and advancing your career.

###

Level of Education

While a four-year degree is not always required, your educational background plays a significant role.

- High School Diploma: This is often the minimum requirement for entry-level positions, typically yielding salaries at the lower end of the spectrum.

- Associate's Degree: An associate's degree in accounting, finance, or business administration can give you a competitive edge and a higher starting salary. It demonstrates a foundational understanding of accounting principles.

- Bachelor's Degree: A bachelor's degree in accounting or a related field significantly increases your earning potential and opens the door to more senior roles, including AP Supervisor or Staff Accountant.

- Certifications: Professional certifications are one of the best ways to boost your salary. The Institute of Finance & Management (IOFM) offers highly respected credentials like the Certified Accounts Payable Associate (CAPA) for those starting out and the Certified Accounts Payable Professional (CAPP) for experienced leaders. Earning these can directly lead to higher pay and better job opportunities.

###

Years of Experience

Experience is arguably the most powerful factor in determining an AP clerk's salary. Employers pay a premium for professionals who can handle complex tasks with minimal supervision.

- Entry-Level (0-2 years): In this stage, you will likely earn a salary in the $42,000 to $48,000 range. Your focus will be on learning the company's systems, mastering invoice processing, and performing basic data entry.

- Mid-Career (2-5 years): With a few years of experience, you can expect to earn between $48,000 and $58,000. You will be trusted with more complex vendor accounts, reconciliations, and may assist with month-end closing procedures.

- Senior/Experienced (5+ years): A senior AP clerk or AP specialist can command a salary of $58,000 to $70,000+. These professionals often handle the most complex vendor issues, mentor junior clerks, help implement new AP automation software, and contribute to process improvements.

###

Geographic Location

Where you work matters. Salaries are adjusted to reflect the local cost of living and the demand for skilled professionals in that area. Major metropolitan areas on the coasts typically offer higher salaries than smaller cities in the Midwest or South.

For example, an AP clerk in San Francisco, New York City, or Boston can expect to earn 15-30% more than the national average. Conversely, salaries in cities with a lower cost of living may be slightly below the national median, even though your purchasing power might be similar.

###

Company Type

The size and industry of your employer can have a major impact on your paycheck.

- Company Size: Large, multinational corporations often have larger budgets, more complex payables processes, and stricter compliance requirements. As a result, they tend to pay more and offer better benefits packages than small businesses or non-profits.

- Industry: Certain industries pay more for accounting talent. AP clerks working in high-growth sectors like technology, finance, biotechnology, and professional services typically earn more than those in retail or hospitality.

###

Area of Specialization

As you grow in your career, developing specialized skills will make you a more valuable asset. An AP clerk who is simply a data entry specialist will earn less than one who has mastered high-demand skills. Specializations that can increase your salary include:

- ERP System Proficiency: Expertise in large-scale Enterprise Resource Planning (ERP) systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly sought after.

- AP Automation Software: Knowledge of platforms like Bill.com, Tipalti, or AvidXchange demonstrates that you are ready for the modern, tech-driven accounting department.

- International Payments: Experience handling foreign currency transactions, VAT, and international vendor compliance is a valuable niche skill.

- Process Improvement & Analysis: Clerks who can analyze spending patterns, identify inefficiencies, and suggest improvements are moving beyond the traditional role and into a more analytical function, which commands higher pay.

Job Outlook

The career outlook for accounts payable clerks is undergoing a transformation. The BLS projects a 2% decline in employment for bookkeeping, accounting, and auditing clerks from 2022 to 2032.

However, this statistic doesn't tell the whole story. While automation and software are handling more of the routine data entry, the need for skilled clerks is not disappearing—it's evolving. Businesses still need professionals to manage the automated systems, resolve complex exceptions, analyze data, and maintain crucial vendor relationships.

Furthermore, the BLS still projects about 158,800 openings for these roles each year, primarily due to professionals retiring or transitioning to other occupations. For individuals who embrace technology and focus on developing analytical and problem-solving skills, the future remains bright.

Conclusion

A career as an accounts payable clerk offers a stable and accessible entry point into the financial backbone of a business. While a starting salary may be modest, your earning potential is directly within your control. By pursuing higher education, gaining valuable experience, earning professional certifications, and specializing in high-demand technologies, you can build a rewarding and financially successful career. The role is evolving, and those who evolve with it will be best positioned for advancement and higher pay in the years to come.