Are you a meticulously organized individual with a keen eye for detail? Do you find satisfaction in ensuring that financial operations run like a well-oiled machine? If so, a career as an Accounts Payable (AP) Coordinator might be the perfect fit, offering a stable and rewarding path within the heart of any business's finance department. But beyond job satisfaction, you're likely asking the crucial question: what is the typical accounts payable coordinator salary? The answer is more complex and promising than you might think, with a national average often falling between $48,000 and $65,000, and senior professionals in high-demand areas commanding significantly more.

Early in my career, I consulted for a rapidly growing tech company that was hemorrhaging money through disorganized vendor payments and a lack of process. The person who turned it all around wasn't a high-flying executive, but a newly hired, sharp-as-a-tack AP Coordinator. She single-handedly implemented a new system, identified duplicate payments, and renegotiated terms with key vendors, saving the company tens of thousands of dollars in her first six months. That experience solidified for me that the AP Coordinator is not just a clerk; they are a financial gatekeeper, a process optimizer, and a crucial defender of a company's bottom line.

This comprehensive guide will illuminate every facet of the Accounts Payable Coordinator career. We will dissect salary expectations, explore the factors that can increase your earning potential, map out a clear career trajectory, and provide you with a step-by-step plan to launch your journey.

### Table of Contents

- [What Does an Accounts Payable Coordinator Do?](#what-does-an-accounts-payable-coordinator-do)

- [Average Accounts Payable Coordinator Salary: A Deep Dive](#average-accounts-payable-coordinator-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is This Career Right for You?](#conclusion)

What Does an Accounts Payable Coordinator Do?

At its core, an Accounts Payable Coordinator is the central hub for managing a company's short-term financial obligations. They ensure that all vendor invoices and bills are legitimate, accurate, and paid on time. This is far from a simple data entry role; it requires a blend of investigative skills, strong communication, and impeccable organization to safeguard a company's cash flow and maintain healthy relationships with its suppliers.

The AP department is the lifeblood of vendor relations. A well-run AP process means suppliers are paid correctly and punctually, fostering goodwill and ensuring an uninterrupted supply of goods and services. Conversely, a poorly managed AP function can lead to late payment fees, damaged vendor relationships, credit holds, and even operational shutdowns. The AP Coordinator is the frontline professional preventing these disasters.

Core Responsibilities and Daily Tasks:

An AP Coordinator's role is a dynamic mix of routine processing and unique problem-solving. Their duties typically include:

- Invoice Processing: Receiving, reviewing, and verifying invoices from vendors. This involves matching invoices to purchase orders (POs) and receiving documents (a process known as the "three-way match") to confirm the validity of the charge.

- Data Entry and Coding: Accurately entering invoice data into the accounting system (like SAP, Oracle NetSuite, or QuickBooks) and coding expenses to the correct general ledger (GL) accounts. This is critical for accurate financial reporting and budget tracking.

- Vendor Management and Communication: Serving as the primary point of contact for vendor inquiries regarding payment status, discrepancies, or invoice details. This requires professional and clear communication skills.

- Payment Processing: Preparing and scheduling weekly or bi-weekly payment runs via check, ACH, wire transfer, or virtual card.

- Discrepancy Resolution: Investigating and resolving any issues, such as price or quantity differences between the invoice and the PO, missing approvals, or incorrect tax calculations.

- Month-End Close: Assisting the accounting team with month-end closing activities, such as accruing for unpaid invoices, reconciling the AP aging report to the general ledger, and providing documentation for auditors.

- Expense Report Auditing: Reviewing and processing employee expense reports to ensure compliance with company policy before reimbursement.

### A Day in the Life of an AP Coordinator

To make this more tangible, let's walk through a typical day for an AP Coordinator at a mid-sized manufacturing company:

- 8:30 AM: Arrive, grab a coffee, and log into the ERP system and email. The first task is to review the shared "invoices@" email inbox and download all new invoices that arrived overnight.

- 9:00 AM - 11:00 AM: Begin the morning's processing batch. This involves opening each PDF invoice, verifying the PO number, matching it to the receiving report in the system, and coding the expense to the correct department and GL account. One invoice from a key supplier has a price discrepancy; a quick email is sent to the procurement manager for clarification.

- 11:00 AM: A vendor calls to check on the status of a payment. The Coordinator quickly looks up the vendor in the system, confirms the invoice was approved, and informs them that the payment is scheduled for this Friday's ACH run.

- 11:30 AM - 12:30 PM: Focus on exception handling. The procurement manager has replied—the price discrepancy was due to an approved price increase. The invoice is now clear for processing. Another invoice is missing a required departmental approval; it's routed to the correct manager through the workflow system.

- 12:30 PM - 1:30 PM: Lunch break.

- 1:30 PM - 3:00 PM: Prepare the weekly payment run. A report is generated of all due invoices. The Coordinator reviews it for accuracy, ensuring no duplicate payments are included and all available early payment discounts are captured.

- 3:00 PM - 4:00 PM: The payment proposal is sent to the AP Manager or Controller for final review and approval. While waiting, the Coordinator works on auditing a batch of employee expense reports that have been submitted, flagging a few for missing receipts.

- 4:00 PM - 5:00 PM: The payment run is approved. The Coordinator executes the payments in the banking portal. The final hour is spent on digital filing, responding to final emails, and preparing a to-do list for tomorrow, which includes following up on aged, unresolved invoices.

This "day in the life" illustrates that the role is structured yet requires constant critical thinking and communication to navigate the inevitable exceptions and inquiries that arise.

Average Accounts Payable Coordinator Salary: A Deep Dive

Understanding the financial potential of a career is essential. The accounts payable coordinator salary is influenced by a multitude of factors, but we can establish a strong baseline by examining data from authoritative sources. This role is a cornerstone of the accounting support profession, and its compensation reflects its importance.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups AP Coordinators under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." While this is an excellent starting point for job outlook data, salary-specific platforms provide more granular insights for the "Accounts Payable Coordinator" title.

### National Average and Salary Ranges

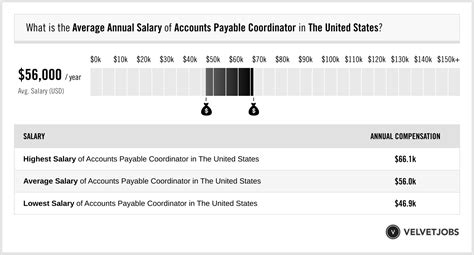

Across the United States, the salary for an Accounts Payable Coordinator is competitive for a role that typically requires an associate's or bachelor's degree.

- Salary.com: As of late 2023/early 2024, Salary.com reports that the median salary for an Accounts Payable Coordinator in the United States is approximately $53,853. The typical range falls between $48,158 and $60,571. This range represents the middle 50% of earners, with the bottom 10% earning below $43,000 and the top 10% earning above $65,000.

- Payscale: Payscale provides a similar perspective, reporting an average base salary of around $52,050 per year. Their data shows a broad range from $42,000 to $65,000, illustrating the impact of experience, location, and other factors.

- Glassdoor: Based on user-submitted data, Glassdoor estimates the total pay (including base salary and additional compensation) for an AP Coordinator in the US is around $58,951 per year, with a likely range between $49,000 and $71,000.

Synthesizing this data, a reasonable expectation for a mid-level Accounts Payable Coordinator in a market with an average cost of living is a base salary in the low-to-mid $50,000s. However, this is just the midpoint of a much larger story.

### Salary by Experience Level

Your earning potential will grow significantly as you accumulate experience, master new systems, and take on more complex responsibilities. Here’s a breakdown of how the salary landscape changes throughout your career.

| Experience Level | Typical Years of Experience | Common Job Titles | Typical Salary Range (Base) | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | AP Clerk, Junior AP Coordinator, Accounting Assistant | $42,000 - $50,000 | Basic invoice processing, data entry, vendor file maintenance, learning company procedures and software. |

| Mid-Career | 3-7 Years | AP Coordinator, AP Specialist, Staff Accountant (AP Focus) | $50,000 - $62,000 | Full-cycle AP processing, three-way matching, discrepancy resolution, payment runs, month-end close support. |

| Senior/Lead | 8+ Years | Senior AP Coordinator, AP Lead, AP Analyst, AP Supervisor | $62,000 - $75,000+ | Overseeing complex vendors, mentoring junior staff, process improvement projects, system implementation support, advanced reporting. |

*Source: Analysis of data from Salary.com, Payscale, and Robert Half Salary Guides.*

As you can see, a dedicated professional can increase their base salary by 50% or more over the course of their career within the AP function before even moving into a full management role.

### Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the puzzle. A comprehensive compensation package for an AP Coordinator often includes several other valuable components that significantly increase your overall earnings and quality of life.

- Annual Bonuses: Many companies offer performance-based annual or quarterly bonuses. For an AP Coordinator, these might be tied to departmental goals (e.g., processing a certain volume of invoices with high accuracy) or company-wide profitability. According to Payscale, the average annual bonus for an AP Coordinator can range from $500 to $4,000.

- Profit Sharing: Some companies, particularly privately held or smaller firms, offer profit sharing plans. A percentage of the company's annual profits is distributed among employees, directly linking your compensation to the organization's success. This can add several thousand dollars to your annual income in a good year.

- Overtime Pay: As a non-exempt role under the Fair Labor Standards Act (FLSA) in most cases, AP Coordinators are eligible for overtime pay (1.5x their hourly rate) for any hours worked over 40 in a week. This can be a significant income booster during particularly busy periods like year-end or during an audit.

- Health and Wellness Benefits: This is a major component of total compensation. Look for comprehensive packages that include medical, dental, and vision insurance. Many companies now offer Health Savings Accounts (HSAs) with employer contributions, wellness stipends, and Employee Assistance Programs (EAPs).

- Retirement Savings: A 401(k) or 403(b) plan with a generous employer match is essentially free money. A common match is 50% of your contribution up to 6% of your salary. Maximizing this benefit is a critical long-term wealth-building strategy.

- Paid Time Off (PTO): A standard package includes vacation days, sick leave, and paid holidays. This can be worth thousands of dollars in paid time away from work each year.

- Professional Development & Tuition Reimbursement: Forward-thinking companies invest in their employees. This can include paying for relevant certifications (like the CAPP), continuing education courses, or even contributing to a degree program. This benefit not only saves you money but also directly helps you increase your future earning potential.

When evaluating a job offer, it's crucial to look beyond the base salary and calculate the total value of the entire compensation package. A job with a slightly lower base salary but an excellent bonus structure, a high 401(k) match, and low-cost health insurance could be far more lucrative in the long run.

Key Factors That Influence Salary

While we've established a national average, the actual accounts payable coordinator salary you can command is not a single number but a spectrum. Your unique combination of education, skills, and work environment will determine where you fall on that spectrum. Mastering these factors is the key to maximizing your income throughout your career.

###

1. Level of Education and Certifications

Your educational background forms the foundation of your career and has a direct impact on your starting salary and long-term growth.

- High School Diploma or GED: This is the minimum requirement for many entry-level AP Clerk positions. While it's possible to build a successful career from this starting point, your initial salary will be at the lower end of the scale, likely in the low $40,000s.

- Associate's Degree: An A.A. or A.S. in Accounting, Business Administration, or Finance is highly advantageous. It demonstrates a foundational understanding of accounting principles, such as debits and credits, the chart of accounts, and financial statements. Employers often prefer candidates with an associate's degree, and it can command a starting salary that is 5-10% higher than a candidate with only a high school diploma.

- Bachelor's Degree: A Bachelor of Science (B.S.) in Accounting or Finance is the gold standard and significantly broadens your career horizons. It not only positions you for a higher starting salary as an AP Coordinator (potentially in the low-to-mid $50,000s) but also provides the necessary credentials to advance into roles like Staff Accountant, AP Manager, or Controller.

The Power of Professional Certifications:

Beyond formal degrees, professional certifications are arguably the most potent tool for an AP professional to increase their salary and demonstrate expertise. The premier certifying body in this field is the Institute of Finance & Management (IOFM).

- Certified Accounts Payable Specialist (CAPS): This is an excellent certification for those early in their careers. It validates your knowledge of fundamental AP processes, including invoice handling, T&E, and the procure-to-pay process. Earning your CAPS can lead to an immediate salary increase and make you a more competitive candidate.

- Certified Accounts Payable Professional (CAPP): This is the pinnacle certification for AP leaders. It is more comprehensive, covering topics like management, compliance, fraud detection, and technology implementation. According to IOFM's research, professionals holding the CAPP certification often earn significantly more than their non-certified peers—in some cases, upwards of $10,000 more per year. Achieving this certification signals that you are not just a processor but a strategic leader in the accounts payable function.

###

2. Years of Experience

Experience is a powerful driver of salary growth. As you progress, you move from simply executing tasks to optimizing processes and solving complex problems, making you a more valuable asset.

- 0-2 Years (Entry-Level): At this stage, you're learning the ropes. Your focus is on accuracy and efficiency in core tasks like data entry and basic invoice matching. Your salary will be in the $42,000 - $50,000 range. Your goal is to absorb as much as possible and build a reputation for reliability.

- 3-7 Years (Mid-Career): You are now a proficient, independent contributor. You can handle the full AP cycle, resolve most vendor issues without supervision, and assist with month-end close. You may be trusted with more complex accounts or assist in training new hires. Your salary moves into the $50,000 - $62,000 range. This is the ideal time to pursue a certification like the CAPS.

- 8+ Years (Senior/Lead): You are a subject matter expert. You are not just processing invoices; you are analyzing AP data for trends, identifying opportunities for process improvement, and potentially leading small projects or mentoring a team of junior clerks. You may be the go-to person for handling difficult vendor disputes or assisting with ERP system upgrades. At this level, salaries can push into the $65,000 - $75,000+ range, especially with a CAPP certification and strong technical skills.

###

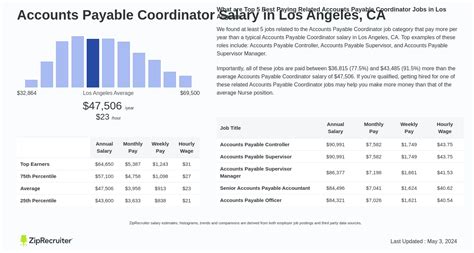

3. Geographic Location

Where you work is one of the single biggest factors determining your salary. High cost-of-living areas must offer higher wages to attract talent. Companies like Robert Half publish annual salary guides with adjustments for major metropolitan areas.

Here’s a comparative look at how salary ranges can vary:

High-Paying Metropolitan Areas:

- San Francisco / San Jose, CA: Salaries can be 30-40% above the national average. An experienced AP Coordinator here could easily command a salary in the $75,000 - $90,000 range.

- New York, NY: Expect salaries 25-35% above the national average. A typical salary would be in the $70,000 - $85,000 range.

- Boston, MA: With a strong tech and biotech presence, salaries are often 20-30% higher than average, placing them in the $65,000 - $80,000 bracket.

Average-Paying Metropolitan Areas:

- Chicago, IL: Salaries are often close to the national average, perhaps 5-10% higher. A typical range would be $55,000 - $68,000.

- Dallas, TX: A major business hub with a moderate cost of living, salaries are generally right at or slightly above the national average, typically $54,000 - $66,000.

- Atlanta, GA: Similar to Dallas, expect salaries to be very close to the national median, in the $53,000 - $65,000 range.

Lower-Paying Regions:

- In more rural areas or states with a significantly lower cost of living (e.g., Mississippi, Arkansas, West Virginia), salaries may be 10-20% below the national average. An AP Coordinator here might earn between $38,000 and $48,000.

The Rise of Remote Work: The pandemic has changed the geographic landscape. While some companies now pay a national rate regardless of location, many are adopting location-based pay tiers for remote workers. A remote worker for a San Francisco-based company living in a low-cost area may be offered a salary higher than their local market rate, but lower than what they would be paid if they lived in the Bay Area.

###

4. Company Type, Size, and Industry

The type of organization you work for has a profound impact on your compensation and work environment.

- Company Size:

- Startups/Small Businesses (<50 employees): Often offer lower base salaries but may compensate with a more dynamic culture, broader responsibilities (you might handle AP, AR, and payroll), and potentially stock options.

- Mid-Sized Companies (50-1000 employees): Often hit the sweet spot with competitive salaries, good benefits, and structured career paths without the bureaucracy of a massive corporation.

- Large Corporations (1000+ employees): Typically offer the highest base salaries, most robust benefits packages, and opportunities for specialization. The work may be more siloed, but the resources and pay are often top-tier. A senior AP Coordinator at a Fortune 500 company can earn significantly more than one at a small business.

- Industry: The industry you're in matters. Industries with complex supply chains, high-value transactions, or stringent regulations tend to pay more for skilled AP professionals.

- High-Paying Industries: Technology, Pharmaceuticals/Biotech, Financial Services, Manufacturing, Energy. An AP Coordinator in one of these sectors might earn 10-20% more than the general average due to the complexity of their work (e.g., managing international vendors, complex software licenses, or R&D-related invoices).

- Average-Paying Industries: Retail, Hospitality, Construction, Transportation.

- Lower-Paying Industries: Non-Profit, Education, Government. These sectors often have tighter budgets and may offer lower base salaries. However, they frequently compensate with excellent benefits, strong job security, and a better work-life balance (e.g., generous pension plans in government roles).

###

5. In-Demand Skills

This is where you have the most direct control over your value. Developing specific, high-demand skills can make you stand out and justify a higher salary.

Technical Skills (The "Hard Skills"):

- Enterprise Resource Planning (ERP) System Proficiency: Expertise in a major ERP system is a huge salary booster. The most sought-after are:

- SAP: The gold standard for large, global corporations.

- Oracle NetSuite: Extremely popular with mid-market and tech companies.

- Microsoft Dynamics 365: A major player across various industries.

- Knowing one of these systems inside and out is far more valuable than only having experience with entry-level software like QuickBooks.

- AP Automation Software: Companies are rapidly adopting platforms like Bill.com, Tipalti, and Coupa to streamline workflows. Experience implementing or being a "power user" of these tools is a highly marketable skill that signals you are forward-thinking and efficient.

- Advanced Microsoft Excel: This is non-negotiable. You must be proficient beyond basic data entry. Key skills include:

- VLOOKUP / XLOOKUP: For matching and reconciling large data sets.

- Pivot Tables: For summarizing and analyzing AP data, such as vendor spend or aging reports.

- Formulas (SUMIF, COUNTIF): For creating ad-hoc reports and checks.

Analytical and Soft Skills (The "Power Skills"):

- Problem-Solving and Investigation: The ability to independently investigate and resolve complex invoice discrepancies is what separates a clerk from a coordinator.

- Communication and Vendor Negotiation: Building professional relationships with vendors is key. Skillful communication can resolve issues amicably. Basic negotiation skills can help in discussing payment terms or resolving disputes over charges.

- Attention to Detail and Accuracy: In a role where a misplaced decimal can cost the company thousands, meticulous accuracy is paramount. Highlight your low error rate on your resume.

- Process Improvement Mindset: Don't just follow the process—question it. Actively look for bottlenecks and suggest more efficient ways of working. An employee who saves the company time and money is an employee worth paying more.

By strategically developing these skills, you transform yourself from a task-doer into a value-creator, which is directly reflected in your accounts payable coordinator salary.

Job Outlook and Career Growth

While salary is a critical component, the long-term viability and growth potential of a career path are equally important. For Accounts Payable Coordinators