Unlocking Your Earning Potential: A Deep Dive into Accounts Payable Manager Salaries

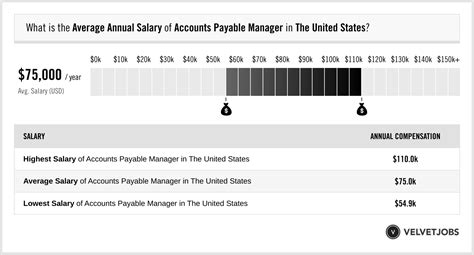

A career as an Accounts Payable (AP) Manager is a cornerstone of a company's financial health, offering a stable and rewarding path for detail-oriented professionals. But what does that stability and responsibility translate to in terms of compensation? If you're considering this career, you'll be pleased to know it offers significant earning potential, with a national average salary often ranging from $75,000 to over $110,000 annually, depending on a variety of critical factors.

This comprehensive guide will break down the accounts payable manager salary, exploring the data-backed figures and the key drivers that can maximize your income in this essential role.

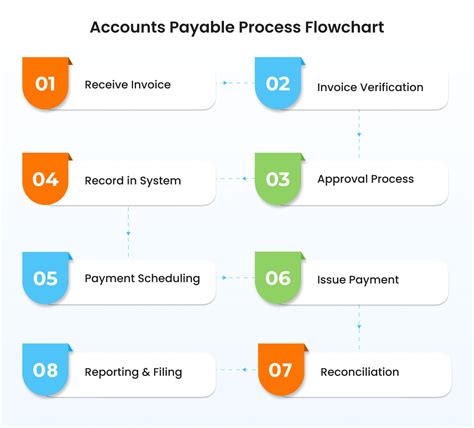

What Does an Accounts Payable Manager Do?

Before we dive into the numbers, let's clarify the role. An Accounts Payable Manager is a strategic leader within the finance department who oversees the entire process of paying a company's bills and invoices. They are not just processing payments; they are managing a critical function that impacts cash flow, vendor relationships, and financial reporting accuracy.

Key responsibilities typically include:

- Leading and mentoring a team of AP specialists or clerks.

- Developing and implementing policies and procedures to ensure timely and accurate payment processing.

- Managing vendor relations, including negotiating payment terms and resolving disputes.

- Overseeing month-end and year-end closing processes for the AP department.

- Ensuring compliance with company policies and government regulations (like Sarbanes-Oxley for public companies).

- Driving process automation and seeking efficiencies through new technologies.

Average Accounts Payable Manager Salary

Salary data for an Accounts Payable Manager can vary based on the source, its methodology, and the data points included (e.g., base salary vs. total compensation). To provide a clear picture, let's look at figures from several authoritative sources as of late 2023 and early 2024.

- Salary.com reports a median annual salary for an Accounts Payable Manager in the United States of $96,754, with a typical range falling between $85,679 and $109,796.

- Payscale provides an average salary of around $73,500 per year, but notes that this can climb significantly with experience and the addition of bonuses and profit-sharing.

- Glassdoor estimates a total pay average of $98,157 per year, which combines a base salary of around $84,000 with additional pay like cash bonuses and other incentives.

The U.S. Bureau of Labor Statistics (BLS) does not track AP Managers as a distinct category. However, they are included in the broader "Financial Managers" category. The median pay for Financial Managers was $139,890 per year in May 2023. While this figure includes higher-level roles like controllers and finance directors, it highlights the significant upward mobility and earning potential within the financial management field.

Based on this data, a realistic salary expectation for a mid-level Accounts Payable Manager is $80,000 to $100,000, with the potential to earn well into the six figures in senior roles or at larger companies.

Key Factors That Influence Salary

Your salary isn't a single, fixed number. It's a dynamic figure influenced by your unique background, skills, and work environment. Here are the most significant factors.

###

Level of Education

A solid educational foundation is standard for this management role.

- Bachelor's Degree: The vast majority of AP Manager positions require a bachelor's degree in Accounting, Finance, Business Administration, or a related field. This is considered the baseline qualification.

- Master's Degree: An MBA or a Master's in Accounting can provide a competitive edge and a salary bump, particularly for roles in large, complex organizations. It signals a deeper understanding of financial strategy and business management.

- Certifications: Professional certifications are a powerful way to validate your expertise and increase your earning potential. Highly respected certifications include the Accredited Payables Manager (APM) from the Institute of Finance & Management (IOFM) and the Certified Public Accountant (CPA).

###

Years of Experience

Experience is perhaps the single most important factor in determining salary. A clear career progression exists in accounts payable.

- Early-Career (0-4 years): Professionals may be in a senior specialist or AP supervisor role, building foundational management skills. Salaries at this stage, or in a first-time manager role at a smaller company, typically fall in the $70,000 to $85,000 range.

- Mid-Career (5-10 years): With a proven track record of managing a team, improving processes, and handling complex vendor accounts, these managers are in high demand. Their salaries often land squarely in the $85,000 to $105,000 range.

- Senior/Experienced (10+ years): Senior AP Managers, often found at large corporations, may oversee global payables, lead major system implementations, or manage very large teams. These seasoned professionals can command salaries of $110,000 or more.

###

Geographic Location

Where you work matters. Salaries are adjusted to reflect the local cost of living and the demand for financial talent in a specific market. Major metropolitan areas with high costs of living and a concentration of corporate headquarters typically offer the highest salaries.

For example, an AP Manager in San Francisco, CA, or New York, NY, can expect to earn 20-30% more than the national average. In contrast, salaries in smaller cities or regions with a lower cost of living in the Midwest or South will likely be closer to or slightly below the national average.

###

Company Type

The size, industry, and type of company you work for will have a direct impact on your paycheck.

- Company Size: Large, multinational corporations with billions in revenue have more complex AP functions and larger budgets, leading to higher salaries compared to small or medium-sized businesses (SMBs).

- Industry: Industries like technology, biotechnology, and finance are known for offering highly competitive compensation packages. In contrast, non-profit organizations or public sector entities may offer lower base salaries, though sometimes with better benefits.

- Public vs. Private: Publicly traded companies often pay more due to the stringent regulatory and compliance requirements (e.g., Sarbanes-Oxley) that add complexity and risk to the role.

###

Area of Specialization

As the AP function becomes more strategic, specialized skills can unlock higher pay. Expertise in the following areas is particularly valuable:

- ERP Systems: Deep knowledge of large-scale Enterprise Resource Planning (ERP) systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly sought after.

- Process Automation: Experience leading digital transformation projects—such as implementing e-invoicing, automated workflows, and payment automation platforms—is a high-value skill.

- Global Payables: Managing cross-border payments, dealing with multiple currencies, and understanding international tax regulations is a complex specialty that commands a premium salary.

Job Outlook

The future for financial professionals is bright. According to the U.S. Bureau of Labor Statistics (BLS), employment of Financial Managers is projected to grow 16 percent from 2022 to 2032, a rate considered much faster than the average for all occupations.

This strong growth is driven by the increasing complexity of the global economy and the continued need for sound financial stewardship and regulatory compliance within organizations. As companies continue to focus on optimizing cash flow and leveraging technology for efficiency, the strategic role of the Accounts Payable Manager will remain critical.

Conclusion

A career as an Accounts Payable Manager offers a clear path to a strong, six-figure salary and a stable position within an organization's financial core. While a national average provides a good baseline, your ultimate earning potential is in your hands.

To maximize your salary, focus on these key takeaways:

- Build a Strong Foundation: A bachelor's degree is essential, but professional certifications like the APM can set you apart.

- Gain Diverse Experience: Progress from a specialist to a leader, and don't be afraid to take on complex projects.

- Specialize in High-Value Skills: Become an expert in process automation, global payables, or a major ERP system.

- Be Strategic About Your Environment: Target industries and locations known for higher compensation.

By strategically developing your skills and experience, you can position yourself for a successful and lucrative career as a highly respected Accounts Payable Manager.