If you're meticulous, organized, and have a keen eye for detail, a career as an Accounts Payable (AP) Specialist could be a financially stable and rewarding path. This role is a critical component of any company's finance department, ensuring that vendors are paid accurately and on time, which is essential for maintaining business relationships and financial integrity. But what does this critical role pay?

In this in-depth guide, we'll break down the salary you can expect as an Accounts Payable Specialist, from your first day on the job to a senior-level position. On average, you can expect a salary ranging from $45,000 to over $68,000 annually, with numerous factors influencing your specific earning potential.

What Does an Accounts Payable Specialist Do?

Before diving into the numbers, it's important to understand the role. An Accounts Payable Specialist is the gatekeeper of a company's outflowing cash. They are responsible for managing the entire process of paying a company's bills and invoices. This isn't just simple data entry; it's a detail-oriented job that requires accuracy, timeliness, and strong communication skills.

Key responsibilities typically include:

- Receiving, processing, and verifying invoices.

- Tracking and reconciling purchase orders with invoices.

- Preparing and scheduling payments to vendors.

- Reconciling accounts payable transactions.

- Communicating with vendors to resolve discrepancies.

- Assisting with month-end closing procedures.

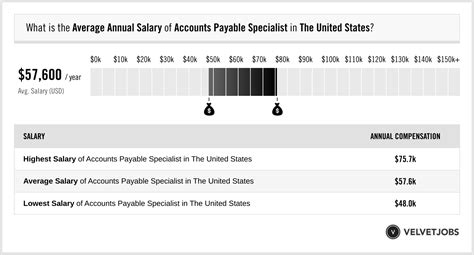

Average Accounts Payable Specialist Salary

Across the United States, the average salary for an Accounts Payable Specialist typically falls between $52,000 and $56,000 per year. However, this figure is just a midpoint. Your actual compensation will vary based on your experience, location, education, and the company you work for.

Data from leading salary aggregators provides a clear picture of the earning spectrum:

- Salary.com reports that the median salary for an AP Specialist is around $55,145 as of early 2024, with a typical range falling between $49,425 and $61,659.

- Payscale notes an average base salary of approximately $52,300, with a total pay range (including potential bonuses) from $42,000 to $65,000.

- Glassdoor lists a national average of $54,250 per year.

The U.S. Bureau of Labor Statistics (BLS) groups AP Specialists under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." As of May 2023, the BLS reports a median annual wage of $47,440 for this group. This lower figure reflects a wider range of roles, while the aggregator data is more specific to the "AP Specialist" title.

A typical salary progression looks like this:

- Entry-Level (0-2 years of experience): $45,000 - $50,000

- Mid-Career (3-5 years of experience): $51,000 - $58,000

- Senior/Lead (5+ years of experience): $59,000 - $68,000+

Key Factors That Influence Salary

Your base salary is not set in stone. Several key factors can significantly increase your earning potential. Understanding them is crucial for negotiating your salary and planning your career growth.

### Level of Education

While a bachelor's degree is not always a strict requirement, it can significantly impact your starting salary and long-term career trajectory.

- High School Diploma or GED: This is often the minimum requirement for entry-level positions, especially at smaller companies.

- Associate's Degree: An associate's degree in accounting or a related field can give you a competitive edge and a higher starting salary.

- Bachelor's Degree: A bachelor's in Accounting, Finance, or Business Administration is highly attractive to employers. It opens the door to higher-level roles, such as AP Manager or Staff Accountant, and often commands a salary at the higher end of the scale.

- Certifications: Professional certifications are one of the best ways to boost your salary. The Certified Accounts Payable Professional (CAPP) designation is the industry gold standard and demonstrates a high level of expertise, often leading to a salary increase of 5-10%.

### Years of Experience

Experience is arguably the most significant factor in determining an AP Specialist's salary. Employers pay a premium for professionals who can handle complex invoices, manage high volumes of transactions, and work independently.

- Entry-Level (0-2 years): In this stage, you're learning the fundamentals of invoice processing and company procedures. Your focus is on accuracy and efficiency.

- Mid-Career (3-5 years): You are now a proficient team member, capable of handling more complex vendor accounts, assisting with month-end close, and potentially training new hires.

- Experienced (5-10 years): With substantial experience, you are an expert in AP processes. You may be responsible for reconciling major accounts, improving AP workflows, and leading small projects.

- Senior/Lead (10+ years): At this level, you often take on supervisory responsibilities, manage the entire AP cycle, implement new software (like ERP systems), and play a strategic role in cash flow management. Salaries for these roles can easily exceed $70,000.

### Geographic Location

Where you work matters. Salaries for AP Specialists vary significantly by state and even by metropolitan area due to differences in cost of living and local market demand. Major metropolitan areas with a high concentration of large corporations typically offer the highest salaries.

For example, an AP Specialist in San Francisco, CA; New York, NY; or Boston, MA can expect to earn 15-25% more than the national average. Conversely, salaries in smaller cities and rural areas in the Midwest and South may be below the national average but are often balanced by a lower cost of living.

### Company Type and Size

The type of company you work for can have a major impact on your paycheck.

- Company Size: Large, multinational corporations often have more complex AP systems, higher transaction volumes, and more stringent compliance requirements. As a result, they tend to pay more than small to medium-sized businesses (SMBs).

- Industry: Industries like technology, finance, and professional services often pay higher salaries for financial roles compared to non-profit, retail, or hospitality sectors.

### Area of Specialization

As you advance in your career, developing specialized skills can make you a more valuable—and higher-paid—asset.

- ERP System Expertise: Proficiency in enterprise resource planning (ERP) software like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly sought after.

- Process Automation: Specialists who can help identify and implement AP automation solutions (e.g., automated invoice processing, electronic payments) are in high demand.

- International AP: Experience handling foreign currency transactions, VAT, and international vendor payments is a valuable niche skill.

- Vendor Management: Expertise in building and maintaining strong vendor relationships, negotiating payment terms, and managing a large vendor database can lead to senior roles.

Job Outlook

According to the U.S. Bureau of Labor Statistics (BLS), employment for "Bookkeeping, Accounting, and Auditing Clerks" is projected to decline by 2% from 2022 to 2032.

However, this statistic requires context. The decline is largely due to the automation of routine, transactional tasks. This means the nature of the AP Specialist role is evolving, not disappearing. Companies will continue to need skilled professionals who can oversee these automated systems, analyze financial data, solve complex discrepancies, and manage critical vendor relationships. The AP specialist of the future is less of a data entry clerk and more of a financial analyst and systems manager.

Conclusion

A career as an Accounts Payable Specialist offers a stable and accessible entry point into the world of finance and accounting. While starting salaries are modest, there is a clear and achievable path to significant salary growth. Your earning potential is directly in your hands and can be maximized by pursuing higher education, gaining valuable experience, earning professional certifications, and developing specialized skills in high-demand areas.

For individuals with strong attention to detail, a knack for numbers, and a commitment to continuous learning, a career as an Accounts Payable Specialist offers a rewarding pathway with clear opportunities for financial and professional advancement.