For professionals aiming to build a career in finance that combines customer interaction with sales acumen, the Relationship Banker role at a major institution like Bank of America is a compelling choice. It serves as a vital entry point into the world of retail and consumer banking, offering significant growth potential. But what can you expect to earn?

This in-depth guide will break down the Bank of America Relationship Banker salary, exploring the average compensation, key influencing factors, and the long-term career outlook. A typical total compensation package for this role often falls between $55,000 and $80,000+ per year, but this figure is heavily influenced by performance, location, and experience.

What Does a Bank of America Relationship Banker Do?

Before diving into the numbers, it's essential to understand the role. A Relationship Banker is the face of the bank for many customers, moving beyond the transactional duties of a teller to build lasting client relationships. Their primary goal is to understand a customer's complete financial picture and proactively offer solutions.

Key responsibilities include:

- Building Client Relationships: Engaging with new and existing customers to understand their financial needs and life goals.

- Financial Guidance: Offering advice on products and services like checking and savings accounts, credit cards, auto loans, mortgages, and small business solutions.

- Sales and Referrals: Identifying opportunities to deepen the client relationship by meeting sales goals for various banking products and referring clients to specialists for investment or wealth management services.

- Problem Resolution: Handling complex customer service issues and ensuring a positive client experience.

- Compliance: Adhering to all banking regulations and internal policies.

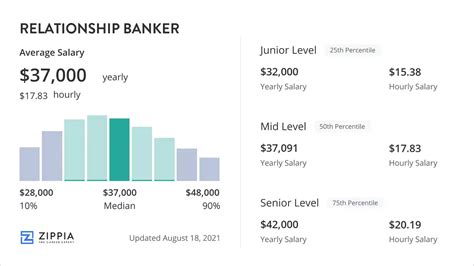

Average Bank of America Relationship Banker Salary

The compensation for a Relationship Banker at Bank of America is structured with two main components: a base salary and a variable incentive or bonus plan tied to performance.

According to recent data from authoritative salary aggregators, the average base salary for a Bank of America Relationship Banker typically falls between $48,000 and $55,000 per year.

- Glassdoor reports an average base pay of approximately $51,500, with additional cash compensation (bonuses, commission) averaging around $8,000 to $10,000 annually.

- Payscale notes a similar range, with the average base salary centered around $52,000.

However, the base salary is just the foundation. The incentive-based component is where high-performing individuals can significantly increase their earnings. When factoring in these bonuses, the total average compensation package generally ranges from $60,000 to $80,000.

The full salary spectrum can be broken down as follows:

- Entry-Level (0-2 years of experience): Total compensation typically ranges from $50,000 to $65,000.

- Experienced (3-5+ years of experience): Total compensation can increase to $70,000 - $85,000.

- Senior / Top Performers: Highly successful bankers in prime locations can exceed $90,000 in total annual earnings.

Key Factors That Influence Salary

Your specific salary as a Bank of America Relationship Banker is not a single, fixed number. It is influenced by a combination of personal qualifications, market forces, and performance.

Level of Education

While a bachelor's degree is often preferred, it is not always a strict requirement for a Relationship Banker role, especially if a candidate has strong sales and customer service experience. However, a degree in a relevant field like Finance, Business Administration, or Economics can lead to a higher starting salary and a faster track to promotion. Furthermore, obtaining financial licenses, such as the FINRA Series 6 and Series 63, can open doors to a "licensed banker" or Financial Solutions Advisor role, which comes with substantially higher earning potential.

Years of Experience

Experience is one of the most significant drivers of salary growth.

- Entry-Level: Newcomers to the role will start at the lower end of the base salary range as they learn the products, sales processes, and compliance requirements.

- Mid-Career (2-5 years): With a proven track record of meeting sales goals and managing a client portfolio, a Relationship Banker can command a higher base salary and earn more consistent, larger bonuses.

- Senior-Level (5+ years): A veteran banker with extensive experience and a deep book of business is a highly valuable asset. They often take on mentorship roles, handle more complex client needs (like small business banking), and earn at the top end of the pay scale.

Geographic Location

Where you work matters immensely. Bank of America, like all large corporations, adjusts its pay scales based on the cost of living and market competition in different metropolitan areas.

- High Cost of Living (HCOL) Areas: In cities like New York, San Francisco, Boston, and Los Angeles, salaries will be significantly higher to offset the steep cost of housing and other expenses. Base salaries here can easily start 15-25% above the national average.

- Medium to Low Cost of Living (LCOL) Areas: In smaller cities and rural locations, salaries will be closer to or slightly below the national average.

For example, a Relationship Banker in San Jose, California, might earn a base salary of $65,000, while the same role in Omaha, Nebraska, might offer a base of $50,000.

Company Type

While this article focuses on Bank of America, it's helpful to see where it stands in the industry. As one of the largest national banks, Bank of America generally offers competitive salaries and robust bonus structures to attract top talent.

- Large National Banks (e.g., JPMorgan Chase, Wells Fargo): Compensation is typically very similar to Bank of America, with a strong emphasis on performance-based incentives.

- Regional Banks and Credit Unions: These institutions may offer a slightly lower base salary and bonus potential but often counter with a better work-life balance and a strong community focus.

Area of Specialization

Within the broader Relationship Banker role, specialization can dramatically impact your income. A banker who develops expertise in a high-value area will earn more. For instance, a banker who specializes in Small Business Banking or who becomes licensed to offer investment products (often a promotion to a Financial Solutions Advisor) will have access to more complex, higher-commission products, directly increasing their earning potential.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) provides insightful data for related professions. The closest proxy for a Relationship Banker is often "Loan Officers." The BLS projects a 1% decline in employment for Loan Officers from 2022 to 2032.

However, this statistic requires context. The decline is largely driven by the automation of simple, transactional loan applications. The core function of a *Relationship Banker*—building trust, understanding complex needs, and providing holistic financial advice—is becoming *more* critical than ever. Banks need skilled professionals who can do what an algorithm cannot: forge genuine human connections.

For those who excel, the career path can lead to more senior and lucrative roles like Financial Advisor, a field the BLS projects will grow by 13%—much faster than the average for all occupations. This highlights the excellent upward mobility available to successful Relationship Bankers.

Conclusion

A career as a Relationship Banker at Bank of America offers a solid entry point into the financial services industry with a competitive compensation package. While the average base salary hovers around the low $50,000s, your true earning potential is in your hands, driven by your performance and ability to meet client needs.

For those considering this path, the key takeaways are:

- Expect total compensation between $55,000 and $80,000+, with top performers earning more.

- Your salary is heavily influenced by your experience, geographic location, and ability to hit sales targets.

- Focus on continuous learning: Pursue specializations like small business or get licensed to unlock higher-paying roles.

- The future of banking is relational. While simple tasks are being automated, the need for skilled advisors who can build trust is growing, ensuring a stable and rewarding career trajectory for those who excel.