Introduction

Are you a meticulous, numbers-oriented professional with a knack for leadership and a passion for ensuring a company's financial health? If you're looking for a career that is both challenging and critical to business success, the role of an Accounts Receivable (AR) Manager might be your perfect fit. This isn't just about chasing payments; it's a strategic position that directly impacts a company's cash flow, profitability, and client relationships. The compensation reflects this importance, with the average accounts receivable manager salary in the United States typically ranging from $75,000 to over $115,000 annually, depending on a host of factors we'll explore in detail.

I once worked with a rapidly growing tech startup that was a marvel of innovation but was constantly teetering on the edge of a cash flow crisis. They brought in a sharp, experienced AR Manager who, within six months, not only streamlined their entire collections process but also used the data to help the sales team identify more financially stable clients. She wasn't just a collector; she was a strategic partner who transformed the company's financial stability. This role is the lifeblood of an organization, turning promises of revenue into the tangible cash needed to operate and grow.

This comprehensive guide will serve as your definitive resource for understanding the accounts receivable manager salary, career trajectory, and what it takes to succeed. We will delve deep into compensation data, the factors that drive your earning potential, and the concrete steps you can take to launch and advance in this rewarding field.

### Table of Contents

- [What Does an Accounts Receivable Manager Do?](#what-does-an-accounts-receivable-manager-do)

- [Average Accounts Receivable Manager Salary: A Deep Dive](#average-accounts-receivable-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does an Accounts Receivable Manager Do?

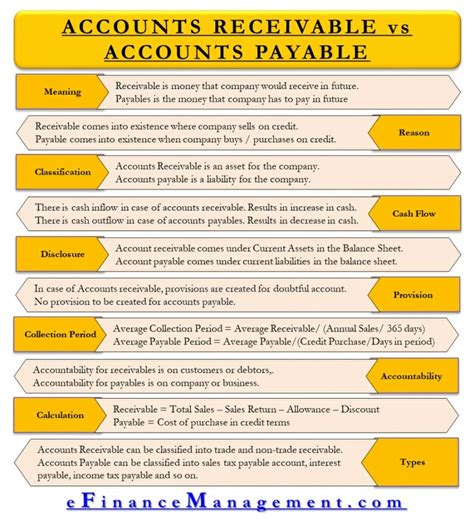

At its core, an Accounts Receivable Manager oversees the entire process of invoicing customers and collecting the money owed to the company. They are the guardians of a company's revenue stream, ensuring that sales translate into actual cash in the bank. This goes far beyond simply sending reminder emails. The AR Manager is a leader, a strategist, a process improvement expert, and a skilled negotiator.

Their primary objective is to minimize the amount of time it takes to collect payments, a key metric known as Days Sales Outstanding (DSO), while maintaining positive and professional relationships with customers. A low DSO means the company has a healthy cash flow, enabling it to pay its own bills, invest in growth, and meet payroll.

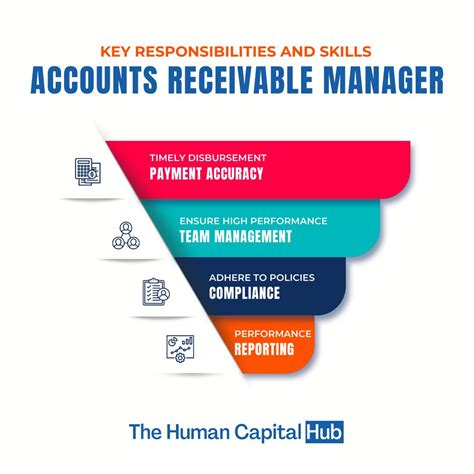

Core Responsibilities and Daily Tasks:

- Team Leadership and Management: Supervising, training, and motivating the accounts receivable team (clerks, specialists, and collectors). This includes setting goals, conducting performance reviews, and managing workloads.

- Process and Policy Development: Designing, implementing, and refining policies for billing, credit checking, and collections. This involves creating standardized procedures to ensure efficiency and compliance.

- Credit Management: Evaluating the creditworthiness of new and existing customers to determine appropriate payment terms and credit limits, thereby mitigating the risk of bad debt.

- Collections Strategy: Developing and overseeing strategies for collecting overdue payments. This can range from establishing a cadence of friendly reminders to escalating difficult accounts to collections agencies or legal action.

- Reporting and Analysis: Preparing and analyzing AR aging reports, DSO calculations, and other key performance indicators (KPIs) for senior management. These reports provide a clear picture of the company's financial health and highlight potential problem areas.

- Dispute Resolution: Investigating and resolving billing discrepancies, customer disputes, and payment issues in a timely and professional manner.

- System and Technology Oversight: Managing and optimizing the accounting software and systems (like ERPs—Enterprise Resource Planning systems) used for billing and collections.

### A Day in the Life of an AR Manager

To make this more tangible, let's walk through a typical day for an AR Manager at a mid-sized manufacturing company.

> 8:30 AM: Arrive at the office, grab coffee, and review the daily cash receipts report to see what payments came in overnight.

>

> 9:00 AM: Lead a brief morning huddle with the AR team. Review the AR aging report, identify top priorities for the day (e.g., accounts hitting 60 days past due), and assign specific accounts to team members.

>

> 10:00 AM: Analyze a credit application for a large new customer. This involves reviewing their financial statements, checking credit references, and using a credit reporting service like Dun & Bradstreet to make a recommendation on a credit limit to the CFO.

>

- 11:00 AM: Field an escalated call from a major client who is disputing an invoice. The AR Manager calmly listens, pulls up the relevant shipping documents and purchase orders, identifies a small discrepancy, and works with the customer and the sales department to issue a corrected invoice, preserving a valuable client relationship.

>

> 12:30 PM: Lunch.

>

> 1:30 PM: Work on the month-end closing process. This involves reconciling the accounts receivable sub-ledger to the general ledger and preparing a detailed report for the executive team that analyzes DSO trends, bad debt allowance, and collection effectiveness.

>

> 3:00 PM: Conduct a one-on-one coaching session with a junior AR specialist, providing feedback on their collection call techniques and helping them strategize on a particularly difficult account.

>

> 4:00 PM: Collaborate with the IT department to discuss potential upgrades to the billing module of their ERP system (e.g., SAP or Oracle NetSuite) to automate invoice delivery and payment reminders.

>

> 5:00 PM: Final check of emails and review the team's progress for the day. Prepare a short list of priorities for the following morning before heading home.

This "day in the life" illustrates that the AR Manager role is a dynamic mix of leadership, financial analysis, customer service, and strategic planning.

Average Accounts Receivable Manager Salary: A Deep Dive

Understanding the compensation for an Accounts Receivable Manager requires looking beyond a single number. Salary potential is a spectrum influenced by experience, location, company size, and more. Here, we'll break down the national averages, typical ranges, and the components that make up the total compensation package.

### National Averages and Salary Ranges

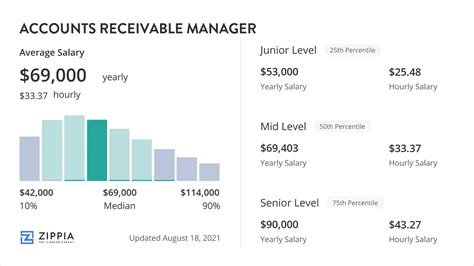

According to leading salary aggregators, the average accounts receivable manager salary in the United States paints a strong picture.

- Salary.com reports that the median annual salary for an Accounts Receivable Manager is $96,658 as of late 2023. The typical range falls between $85,022 and $110,632. This range often excludes bonuses and other forms of compensation.

- Payscale provides a slightly broader range, with an average base salary of around $73,200. Their data shows a total pay spectrum (including bonuses and profit sharing) from $53,000 for entry-level roles to over $98,000 for highly experienced managers.

- Glassdoor corroborates these figures, listing an average base salary of approximately $85,500 per year, with total pay (including additional compensation) often reaching closer to $95,000.

Taking these sources together, a reasonable expectation for a mid-career Accounts Receivable Manager in a city with an average cost of living is a base salary in the $80,000 to $100,000 range. However, this is just the starting point.

### Salary by Experience Level

Experience is arguably the single most significant factor in determining your salary. As you gain expertise in managing larger teams, more complex portfolios, and implementing sophisticated AR strategies, your value—and compensation—grows substantially.

Here is a typical salary progression based on experience level, synthesized from industry data:

| Experience Level | Typical Title(s) | Average Base Salary Range | Key Responsibilities & Expectations |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-3 years) | Accounts Receivable Supervisor, Junior AR Manager | $60,000 - $75,000 | Supervising a small team of 2-4 clerks. Managing a smaller portfolio of accounts. Focus on daily operations and meeting collection targets. Learning company policies and systems. |

| Mid-Career (4-8 years) | Accounts Receivable Manager | $75,000 - $95,000 | Managing a full AR team. Developing and implementing collection policies. Performing credit analysis. Reporting on AR metrics to senior leadership. Resolving complex disputes. |

| Senior-Level (9-15 years) | Senior Accounts Receivable Manager, Credit Manager | $95,000 - $120,000+ | Overseeing the entire credit and collections function for a large division or entire company. Designing high-level strategy. Managing international accounts. Leading system implementations (e.g., ERP upgrades). |

| Executive-Level (15+ years) | Director of Credit & Collections, Director of Revenue Cycle | $120,000 - $160,000+ | Setting strategic direction for global revenue operations. Managing multiple managers. Presenting to the C-suite and Board of Directors. Deep involvement in financial planning and risk management. |

*(Salary ranges are estimates based on aggregated data and can vary significantly based on other factors discussed below.)*

### Beyond the Base Salary: Understanding Total Compensation

A savvy career analyst knows that base salary is only one piece of the puzzle. An AR Manager's total compensation package often includes significant variable pay components that can boost annual earnings considerably. When evaluating a job offer, it's crucial to look at the complete picture.

- Annual Bonuses: This is the most common form of variable pay. Bonuses for AR Managers are almost always tied to performance metrics. Common bonus triggers include:

- Achieving DSO Targets: Reducing the average number of days it takes to collect payments.

- Minimizing Bad Debt: Keeping the percentage of uncollectible debt below a certain threshold.

- Collection Percentage: Hitting a target for collecting a certain percentage of the monthly or quarterly receivables.

- Company Profitability: A bonus component tied to the overall performance of the company.

- An annual bonus can range from 5% to 20% of the base salary, depending on the company and performance.

- Profit Sharing: Some companies, particularly privately held or smaller firms, offer profit-sharing plans where a portion of the company's annual profits is distributed among employees. This can be a significant addition to income in a good year.

- Stock Options or Restricted Stock Units (RSUs): In publicly traded companies or high-growth startups, equity can be a major part of the compensation package. This gives you ownership in the company and aligns your long-term interests with its success. For a manager-level role, this can add tens of thousands of dollars in value over a vesting period.

- Retirement Benefits: Look for a strong 401(k) or 403(b) plan with a generous company match. A company that matches 50% of your contributions up to 6% of your salary is effectively giving you a 3% raise each year that you can invest for your future.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a standard expectation. Other valuable perks can include health savings accounts (HSAs), flexible spending accounts (FSAs), life insurance, disability insurance, and wellness stipends (e.g., for gym memberships).

- Paid Time Off (PTO): A generous PTO policy (vacation, sick days, and personal days) is a critical component of work-life balance and overall job satisfaction. Managerial roles typically start with at least 3-4 weeks of PTO per year.

When assessing an offer, an AR Manager earning a $90,000 base salary with a 15% performance bonus and a 4% 401(k) match has a total compensation package well over $107,000, demonstrating the importance of looking at the full picture.

Key Factors That Influence an Accounts Receivable Manager Salary

While experience is a primary driver, several other key factors create the wide salary variations we see across the country. Understanding these levers is essential for negotiating your salary and strategically planning your career path to maximize your earning potential.

###

Level of Education

Your educational background provides the foundational knowledge for a career in finance and accounting. While direct experience often trumps education later in a career, your degree can significantly impact your starting salary and long-term trajectory.

- Associate's Degree: An Associate's degree in Accounting or Business can be a stepping stone into an entry-level AR clerk or specialist role. It's less common for direct entry into a management position, but with substantial experience, it is possible.

- Bachelor's Degree: This is the standard and most common requirement for an Accounts Receivable Manager position. A Bachelor's degree in Accounting, Finance, or Business Administration is highly preferred by employers. Candidates with this credential can expect to start at a higher salary point and have access to a wider range of opportunities than those without. The difference in starting salary can be $10,000 to $15,000 annually compared to a candidate with only an Associate's degree and some experience.

- Master's Degree (MBA or Master's in Accounting): While not typically required, a Master's degree can be a powerful differentiator, especially for senior-level roles at large corporations. An MBA with a finance concentration can signal advanced strategic thinking, financial modeling, and leadership skills, potentially leading to a 10-15% salary premium and a faster track to Director-level positions.

- Professional Certifications: Certifications are a fantastic way to demonstrate specialized expertise and a commitment to your profession. They can directly translate into higher pay and greater responsibility. The most respected certifications for AR and credit professionals include:

- Certified Credit Executive (CCE): Offered by the National Association of Credit Management (NACM), this is the gold standard for senior-level credit and AR leaders. Achieving this designation requires significant experience and passing a rigorous exam. It can command a substantial salary increase and is often required for Director-level roles.

- Credit Business Associate (CBA) and Credit Business Fellow (CBF): Also from NACM, these are intermediate-level certifications that build a strong foundation in business and credit law, financial statement analysis, and credit management. They are excellent for AR Managers looking to advance.

- Certified Public Accountant (CPA): While more common for general accountants, a CPA license is highly respected in any financial management role. It signals a deep understanding of accounting principles, financial reporting, and internal controls, which can give you an edge and a salary boost.

###

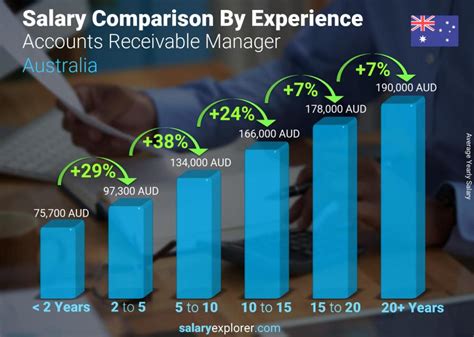

Years of Experience

As detailed in the previous section, experience is paramount. However, it's not just the *quantity* of years but the *quality* and *type* of experience that matters. Salary growth accelerates as you move from purely operational tasks to strategic responsibilities.

- Early Career (0-3 Years): Focus is on execution—processing invoices, making collection calls, and reconciling accounts. You're learning the ropes and proving your reliability.

- Mid-Career (4-8 Years): You transition to management. Your value is now in your ability to lead a team, improve processes, and analyze data. You might have successfully implemented a new collections strategy that reduced DSO by 15%—this is a quantifiable achievement that justifies a higher salary.

- Senior Career (9+ Years): Your value is strategic. You're not just managing collections; you're managing the company's financial risk. You're involved in high-level decisions, such as setting credit policies for international expansion, negotiating with major corporate clients, and selecting and implementing enterprise-wide financial systems. Each of these steps comes with a significant jump in compensation.

###

Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted for the local cost of living and the demand for skilled financial professionals in that market. A salary that feels like a fortune in a low-cost-of-living area might barely cover the bills in a major metropolitan hub.

Here’s a comparative look at estimated median salaries for an AR Manager in various U.S. cities, illustrating the wide disparity:

- High-Cost Metropolitan Areas:

- San Jose, CA: ~$125,000+

- San Francisco, CA: ~$122,000+

- New York, NY: ~$115,000+

- Boston, MA: ~$112,000+

- Washington, D.C.: ~$108,000+

- Average-Cost Metropolitan Areas:

- Chicago, IL: ~$98,000

- Dallas, TX: ~$95,000

- Atlanta, GA: ~$94,000

- Phoenix, AZ: ~$92,000

- Lower-Cost Metropolitan Areas:

- St. Louis, MO: ~$88,000

- Indianapolis, IN: ~$86,000

- San Antonio, TX: ~$85,000

*(Data synthesized from Salary.com and other aggregators, representing median figures. Actual salaries will vary.)*

It's crucial to consider the cost of living when comparing offers. A $95,000 salary in Dallas may provide a higher quality of life than a $115,000 salary in New York City.

###

Company Type & Size

The type and size of your employer create different work environments and compensation structures.

- Startups and Small Businesses:

- Salary: Often on the lower end of the spectrum.

- Environment: You'll likely wear many hats, possibly handling accounts payable and other accounting duties alongside AR. The environment is fast-paced and less structured.

- Perks: Potential for equity (stock options), which can be extremely valuable if the company succeeds. You'll have a major impact on the company's foundation.

- Mid-Sized Companies (50-500 employees):

- Salary: Tends to be around the national average.

- Environment: More structured than a startup, with a dedicated AR team. This is a common and stable environment for an AR Manager.

- Perks: Good balance of responsibility and resources, with established benefits packages and bonus structures.

- Large Corporations (Fortune 500, multinational companies):

- Salary: Typically at the top end of the salary range. These companies have the resources to pay for top talent.

- Environment: Highly structured and specialized. You might manage a large, geographically dispersed team and oversee a portfolio worth hundreds of millions or even billions of dollars. The processes are complex and often involve international currencies and regulations.

- Perks: Robust benefits, high bonus potential, clear paths for advancement into senior director and VP roles, and global opportunities.

- Non-Profit and Government:

- Salary: Generally lower than in the for-profit sector.

- Environment: Focus is on compliance, grant management, and stewardship of public or donor funds. The pace may be slower.

- Perks: Often includes strong benefits, pension plans (in government), and excellent work-life balance. The work can be deeply mission-driven.

###

Industry of Specialization

The industry you work in can influence your salary due to varying levels of complexity, risk, and profitability.

- Technology (SaaS, Hardware): Often pays at the higher end. Managing recurring revenue models (SaaS subscriptions) or complex hardware sales with milestone billing requires specialized skills.

- Healthcare: A large and complex sector. AR Managers (often called Revenue Cycle Managers) must navigate intricate billing codes, insurance company negotiations, and patient collections. This complexity commands a strong salary.

- Manufacturing and Distribution: These traditional industries rely heavily on efficient AR to manage cash flow tied to large physical inventory. Expertise in trade credit, liens, and international shipping can be highly valued.

- Construction: Involves unique challenges like progress billing, retainage, and mechanics' liens, requiring specialized knowledge and often leading to higher pay for experienced managers.

- Professional Services (Law Firms, Consulting): Managing billing for services rather than products presents its own challenges, such as tracking billable hours and managing client retainers.

###

In-Demand Skills

Beyond your formal qualifications, possessing a specific set of high-value skills can directly increase your salary and make you a more attractive candidate.

- Advanced ERP Proficiency: Expertise in major ERP systems like SAP S/4HANA, Oracle NetSuite, or Microsoft Dynamics 365 is highly sought after. Knowing how to not just use but optimize these systems for reporting, automation, and efficiency is a major salary driver.

- Data Analysis and Business Intelligence (BI): The ability to use tools like Microsoft Excel (at an expert level, including PivotTables, Power Query), Tableau, or Power BI to analyze AR data and provide strategic insights is no longer a "nice to have"—it's a core competency. Managers who can create dashboards that visualize trends in DSO, customer payment behavior, and collection effectiveness are invaluable.

- Automation and Process Improvement: Experience with implementing automation tools for invoicing, reminders, and cash application (e.g., using Robotic Process Automation - RPA) can significantly reduce manual work and improve accuracy. This skill demonstrates a forward-thinking, efficiency-focused mindset that companies will pay a premium for.

- Negotiation and Advanced Communication: You must be a firm, fair, and professional negotiator, whether you're dealing with a difficult client, an internal salesperson who promised non-standard terms, or a collections agency. The ability to de-escalate conflict and find mutually agreeable solutions is a key leadership skill.

- Understanding of International Finance: For multinational corporations, experience with foreign currency transactions, international credit laws, letters of credit, and hedging strategies is a rare and highly compensated skill.

- Leadership and Team Development: Proven success in hiring, training, and retaining a high-performing AR team is what separates a manager from a supervisor. This includes setting clear KPIs, providing constructive feedback, and fostering a positive, results-oriented culture.

Job Outlook and Career Growth

Investing your time and effort into a career path requires a clear understanding of its long-term viability. For Accounts Receivable Managers, the future is stable and evolving, offering significant opportunities for those who adapt and grow.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) does not have a separate category for "Accounts Receivable Manager." This role is classified under the broader category of "Financial Managers" (SOC Code 11-3031). The outlook for this group is exceptionally strong.

According to the BLS's Occupational Outlook Handbook, employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations. This translates to an estimated 126,600 new jobs over the decade.

The BLS attributes this robust growth to the increasing complexity of the global economy, the need for rigorous financial oversight to ensure regulatory compliance, and the critical importance of cash flow management for businesses of all sizes. While some transactional accounting tasks are being automated, the need for skilled managers who can interpret data, set strategy, and lead teams remains high. An Accounts Receivable Manager is a specialized type of financial manager, and they are essential to this ecosystem.

### Emerging Trends and Future Challenges

The role of the AR Manager is not static. It is evolving from a transactional, operational function to a more strategic, technology-driven one. To stay relevant and command a top-tier accounts receivable manager salary, you must be aware of these trends.

- The Rise of Automation and AI: Artificial intelligence (AI) and Robotic Process Automation (RPA) are transforming the AR landscape. Mundane tasks like sending out templated invoices, generating reminder emails, and applying cash payments are becoming increasingly automated.

- Challenge: Professionals who only perform these manual tasks may see their roles diminished.

- Opportunity: The AR Manager of the future will focus less on *doing* and more on *managing the system*. They will be responsible for selecting, implementing, and optimizing these automation tools. Their focus will shift to higher-value activities: analyzing the data generated by these systems, handling complex exceptions and disputes, and building strategic client relationships.

- Data-Driven Decision Making: Companies no longer want an AR aging report; they want to know the *story* behind the numbers. Why is DSO increasing for a particular customer segment? Can we predict which clients are likely to pay late based on historical data?

- Challenge: A lack of data analysis skills will be a significant career impediment.

- Opportunity: Managers who are proficient with business intelligence (BI) tools and can provide predictive analytics will become indispensable strategic partners to the CFO and the sales team.

- Emphasis on Customer Experience: The collections process is a critical customer touchpoint. A negative, overly aggressive collections experience can destroy a client relationship.

- Challenge: Balancing the need to collect cash with the need to retain customers.

- Opportunity: Modern AR Managers are focusing on "Customer-Centric Collections." This involves using data to understand customer preferences (e.g., communication channels, payment portals) and creating a more collaborative, less confrontational collections process. This skill in preserving customer lifetime value is highly prized.

### How to Advance and Stay Relevant

Your career doesn't end when you become an AR Manager. There is a clear and lucrative path for advancement.

1. Embrace Technology: Proactively learn about the latest AR automation software, BI tools, and ERP capabilities. Volunteer to be on a system implementation team. Take online courses in data analytics or RPA.

2. Become a Strategic Partner: Don't just report the numbers. Analyze them. Go to the Head of Sales with data showing that customers from a certain industry consistently pay 30 days late and suggest adjusting payment terms. This shows strategic value.

3. Hone Your Soft Skills: Continue to develop your leadership, negotiation, and communication skills. The best managers are great leaders who can motivate their teams and build strong cross-functional relationships.

4. Pursue Advanced Certifications: As you gain experience, aim for the NACM's CCE designation. This is a clear signal to employers that you are a top-tier professional ready for executive leadership.

5. Expand Your Scope: Look for opportunities to take on more responsibility. This could mean managing