Considering a career as an Aflac Benefits Advisor? You're exploring a path that offers not only the chance to help individuals and businesses secure their financial well-being but also significant earning potential. While the role provides autonomy and direct impact, a common question arises: What can you realistically expect to earn?

This guide breaks down the Aflac Benefits Advisor's compensation, key influencing factors, and the overall career outlook. While the "salary" is often more of a commission-based earning structure, top performers can achieve a six-figure income, making it a highly attractive prospect for motivated professionals.

What Does an Aflac Benefits Advisor Do?

An Aflac Benefits Advisor, often referred to as a Benefits Consultant or Insurance Sales Agent, is a licensed professional who works with businesses and their employees to offer voluntary insurance policies. Unlike major medical insurance, Aflac specializes in supplemental insurance—policies that pay cash directly to policyholders to help with expenses that health insurance doesn't cover.

Key responsibilities include:

- Business-to-Business (B2B) Sales: Prospecting and meeting with business owners and HR managers to establish Aflac as a voluntary benefits option for their company.

- Consultative Advising: Educating employees on the value of supplemental policies like short-term disability, accident, cancer, and critical illness insurance.

- Enrollment and Account Management: Guiding employees through the enrollment process and providing ongoing service and support to client accounts.

- Building a "Book of Business": Developing a long-term portfolio of clients, which generates both new and renewal commissions.

It's crucial to understand that most Aflac Benefits Advisors are independent contractors (working on a 1099 basis), not salaried employees. This means your income is directly tied to your performance, primarily through commissions.

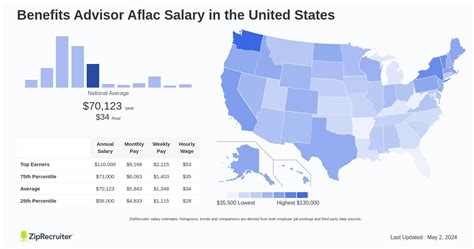

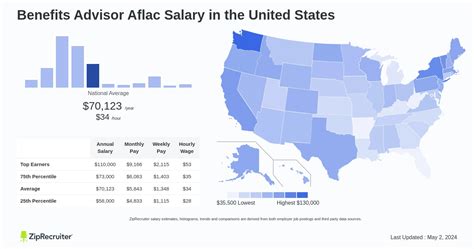

Average Aflac Benefits Advisor Salary

Because this is a commission-driven role, a "salary" is not fixed. Instead, we look at average total compensation, which includes commissions, bonuses, and renewals.

Data from reputable salary aggregators provides a strong baseline for what you can expect to earn. It's important to note that first-year earnings are typically lower as you build your client base, while experienced advisors with a strong renewal stream earn significantly more.

- Payscale reports that the average total compensation for an Aflac Insurance Agent is approximately $52,000 per year, with a typical range falling between $31,000 and $104,000.

- Glassdoor estimates that the total pay for a Benefits Advisor at Aflac is around $73,286 per year, with a likely range between $49,000 and $109,000. This figure includes estimated base pay, commissions, and bonuses.

- Salary.com lists the median salary for a general "Insurance Sales Agent" in the U.S. at $60,111, with the top 10% earning over $120,000.

The key takeaway: While a new advisor might start in the $30k-$45k range in their first year, a tenured and successful advisor can easily surpass $100,000 annually through a combination of new sales and renewing policies.

Key Factors That Influence Salary

Your total compensation as an Aflac Benefits Advisor isn't determined by a single number. It’s a dynamic figure influenced by several critical factors.

### Years of Experience

Experience is arguably the most significant factor in a commission-based sales role.

- First-Year Advisors: The initial 1-2 years are focused on learning, prospecting, and building a client portfolio. Earnings are often lower during this period but are supplemented by training programs and potential bonuses for hitting initial targets.

- Mid-Career Advisors (3-7 years): At this stage, advisors have a solid "book of business" that generates consistent renewal commissions. They are more efficient at prospecting and closing new accounts, leading to a substantial increase in income.

- Senior/Veteran Advisors (8+ years): Highly experienced advisors benefit from a large and stable renewal base, strong referral networks, and deep industry knowledge. Their earnings are often in the top percentile, frequently exceeding six figures.

### Level of Education

While a specific degree is not a strict requirement to become an Aflac Benefits Advisor, a postsecondary education can provide a competitive edge.

- Required: A high school diploma or equivalent is the minimum. More importantly, you must obtain a state-specific license to sell life and health insurance.

- Beneficial: A bachelor's degree in Business, Finance, Marketing, or Communications can equip you with valuable skills in financial analysis, strategic planning, and effective communication, which are all critical for success in this role. However, drive and sales acumen often outweigh formal education.

### Geographic Location

Where you work matters. Earnings can vary based on the density of businesses, local economic health, and cost of living. According to the U.S. Bureau of Labor Statistics (BLS) data for Insurance Sales Agents, states with major metropolitan areas and robust business climates often offer higher earning potential.

Top-paying states for insurance agents often include:

- Massachusetts

- New York

- Rhode Island

- District of Columbia

Working in a thriving urban or suburban area with a high concentration of small-to-medium-sized businesses—Aflac's core market—provides a larger pool of potential clients.

### Company Type

As an Aflac Benefits Advisor, you operate as an independent contractor representing a single, powerful brand. This differs from other roles in the insurance industry:

- Captive Agent (like Aflac): You represent one company's products. The advantage is strong brand recognition, established product lines, and extensive training and marketing support from Aflac. Your success is tied to your ability to sell these specific products.

- Independent Broker: Represents multiple insurance carriers. This offers more product flexibility but lacks the dedicated brand support and structured training of a company like Aflac.

The Aflac model is built for entrepreneurial individuals who want the backing of a Fortune 500 company.

### Area of Specialization

Focusing your efforts can lead to greater expertise and higher earnings. You might specialize in:

- Industry Verticals: Becoming the go-to advisor for specific industries like construction, healthcare, hospitality, or manufacturing allows you to understand their unique needs and challenges.

- Company Size: Some advisors excel at working with small businesses (under 50 employees), while others develop the skills to manage enrollments for large corporate accounts with hundreds or thousands of employees. Larger accounts naturally lead to higher commission volumes.

Job Outlook

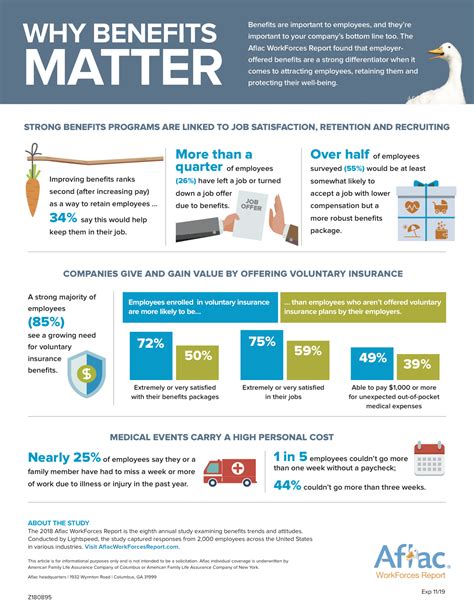

The career outlook for insurance professionals is positive and stable. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Insurance Sales Agents will grow 6% from 2022 to 2032, which is faster than the average for all occupations.

The BLS attributes this growth to the continued need for insurance products. As healthcare becomes more complex and out-of-pocket costs rise, the demand for supplemental insurance that Aflac provides is expected to remain strong. Businesses will continue to need knowledgeable advisors to help them offer competitive benefits packages to attract and retain talent.

Conclusion

Becoming an Aflac Benefits Advisor is less about securing a predictable salary and more about building your own business with the support of an industry leader. It is a career defined by opportunity, autonomy, and a direct link between effort and reward.

Key Takeaways:

- Income is Performance-Based: Your earnings are primarily from commissions, not a fixed salary.

- High Earning Potential: While initial earnings may be modest, successful veteran advisors can earn well over $100,000 annually.

- Success Factors: Your success hinges on your sales skills, networking ability, and the long-term relationships you build with clients.

- Strong Job Outlook: The demand for knowledgeable insurance advisors is projected to grow, ensuring long-term career stability.

If you are a self-motivated individual with an entrepreneurial spirit and a passion for helping others, a career as an Aflac Benefits Advisor offers a path to a financially and personally rewarding future.