A career at Goldman Sachs represents a pinnacle of achievement in the financial world. For ambitious professionals, securing a position as an Associate at this prestigious firm is not only a mark of distinction but also a gateway to immense financial rewards. While the path is demanding, the compensation is a powerful motivator. A first-year Associate can expect a total compensation package that often ventures deep into six figures, with significant growth potential in the years that follow.

This article provides a data-driven breakdown of a Goldman Sachs Associate's salary, exploring the key factors that influence your earnings and the overall career landscape for this coveted role.

What Does a Goldman Sachs Associate Do?

Before diving into the numbers, it's crucial to understand the role. An "Associate" in investment banking is not an entry-level position. It is the next step up from an Analyst, a role typically filled by professionals who have either completed a top-tier MBA program or have been promoted after 2-3 years of exceptional performance as an Analyst.

Associates are the workhorses of deal teams, taking on significant responsibilities that include:

- Financial Modeling and Valuation: Building complex financial models (DCF, LBO, M&A) to value companies and analyze potential transactions.

- Creating Client Materials: Developing detailed presentations, pitch books, and confidential information memorandums for clients.

- Due Diligence: Conducting in-depth research on companies and industries to support mergers, acquisitions, and capital raises.

- Project Management: Overseeing the workflow of a deal, managing timelines, and mentoring junior analysts.

- Client Interaction: Increasingly participating in client meetings and calls, serving as a key point of contact.

Average Goldman Sachs Associate Salary

Compensation at Goldman Sachs, particularly for front-office roles like an Associate in the Investment Banking Division (IBD), is structured in two primary parts: a base salary and a year-end performance bonus.

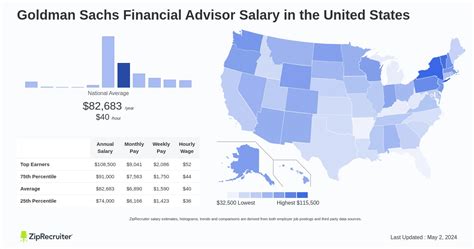

- Base Salary: For a first-year Associate at Goldman Sachs in a major financial hub like New York, the base salary is highly competitive and standardized. According to recent industry reports and data from salary aggregators like Glassdoor and Wall Street Oasis, the base salary for a first-year Associate typically falls in the range of $175,000 to $225,000 per year.

- Performance Bonus: The bonus is the highly variable component and is directly tied to both individual and firm performance. It can range significantly, from 50% to over 100% of the base salary.

Therefore, the total "all-in" compensation for a first-year Associate at Goldman Sachs can realistically range from $275,000 to $450,000+, depending on the year's deal flow and individual contribution. As an Associate progresses to their second and third years, the base salary sees incremental increases, but the bonus potential grows substantially.

*(Sources: Salary data synthesized from Glassdoor, Wall Street Oasis Compensation Reports, and Levels.fyi for 2023-2024)*

Key Factors That Influence Salary

While the entry-point for Associates is fairly structured, several factors can influence your long-term earnings trajectory at the firm.

###

Level of Education

The most common pathway to becoming an investment banking Associate is by earning a Master of Business Administration (MBA). However, the brand and ranking of the business school matter immensely. Goldman Sachs primarily recruits Associates from top-tier ("M7" or Top 15) MBA programs. While an MBA from a top school doesn't necessarily guarantee a higher starting salary than a peer from another top school (as base salaries are standardized), it is the critical key that unlocks the door to the interview and the job offer itself. An alternative path is a direct promotion from a high-performing Analyst, bypassing the MBA route entirely.

###

Years of Experience

Experience is a direct driver of compensation. The Associate role is typically a three-year program before one is considered for promotion to Vice President (VP).

- Associate Year 1: Establishes the baseline compensation ($175k-$225k base + bonus).

- Associate Year 2 & 3: Base salaries typically receive modest step-ups (e.g., $25,000 per year), but the bonus potential increases significantly as the Associate becomes more independent and valuable to the team.

- Promotion to Vice President (VP): This is a major inflection point, with a substantial jump in both base salary and bonus potential, often pushing total compensation well over the $500,000 mark.

###

Geographic Location

Where you work plays a major role in your compensation. Salaries are highest in major global financial centers to account for the concentration of deal flow and higher cost of living.

- Top-Tier Hubs (New York, San Francisco, London): These locations command the highest salaries and bonuses, setting the industry benchmark.

- Other US Offices (Chicago, Houston): Compensation remains very strong but may be slightly lower than in New York.

- Growth Offices (Salt Lake City, Dallas): Goldman Sachs has large, strategic offices in these lower-cost-of-living cities. While salaries here are still extremely competitive for the local market, they are generally adjusted downward compared to New York.

###

Company Type

While this article focuses on Goldman Sachs, understanding its place in the market provides context. Goldman Sachs is a "Bulge Bracket" bank—one of the largest and most profitable multinational investment banks.

- Bulge Bracket Banks (e.g., Goldman Sachs, JPMorgan Chase, Morgan Stanley): Offer highly structured and competitive pay, excellent training, and a prestigious brand name.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These smaller firms specialize in advisory services. While their base salaries are often in line with bulge brackets, their all-in compensation can sometimes be higher, as a larger portion of revenue can be paid out as bonuses.

- Middle-Market Banks: These firms focus on smaller deals and typically offer lower, though still lucrative, compensation packages compared to bulge bracket and elite boutique firms.

###

Area of Specialization

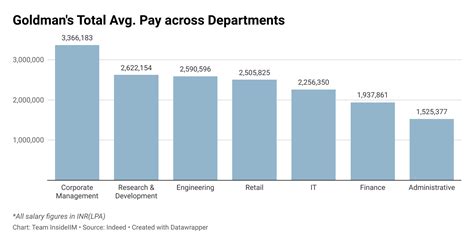

Not all Associates at Goldman Sachs are in the Investment Banking Division (IBD), and compensation varies significantly by department.

- Investment Banking Division (IBD): This is the classic M&A and capital markets role, which traditionally carries the highest potential for large bonuses.

- Global Markets (Sales & Trading): Compensation can be extremely high but is more volatile and directly tied to an individual's or desk's trading performance (P&L).

- Asset Management: This division manages investments for institutions and individuals. Associates here typically earn less than their IBD counterparts but often have a better work-life balance.

- Corporate & Support Roles (e.g., Technology, Risk, Compliance): While still highly paid compared to other industries, these roles have a much smaller performance bonus component and lower all-in compensation than front-office, revenue-generating roles.

Job Outlook

The specific role of a Goldman Sachs Associate is not tracked by the U.S. Bureau of Labor Statistics (BLS). However, we can look at the broader category of "Financial Analysts" as a proxy for the health of the industry.

According to the BLS, employment for Financial Analysts is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations. This growth is driven by a growing economy and the increasing complexity of financial products and regulations.

Despite this positive outlook for the industry, it is critical to remember that positions at elite firms like Goldman Sachs remain extraordinarily competitive. The number of applicants far exceeds the number of available positions each year. Success requires a combination of academic excellence, relentless drive, and superb networking skills.

Conclusion

A career as a Goldman Sachs Associate offers a direct path to a formidable and rewarding professional life. The financial compensation is exceptional, with total packages for first-year Associates frequently reaching $300,000 or more, driven by a strong base salary and a significant performance bonus.

For those aspiring to this role, the key takeaways are clear:

- Aim for an elite MBA program or be an exceptional performer in an Analyst role.

- Understand that compensation is heavily weighted by your performance, division, and location.

- Be prepared for a highly competitive and demanding environment that rewards excellence.

While the journey is challenging, the potential for rapid career progression, invaluable experience, and substantial financial reward makes being an Associate at Goldman Sachs one of the most sought-after positions in the world of finance.