For ambitious students and young professionals scanning the horizon of lucrative careers, the world of investment banking shines like a beacon. It promises intellectual challenge, high-stakes deal-making, and a level of compensation that can be life-altering right out of college. But beyond the glittering facade of Wall Street, what does the reality of an investment banking analyst salary truly look like? It’s a complex tapestry woven from base pay, staggering bonuses, firm prestige, and geographic location.

The allure is undeniable. A first-year analyst, often just 22 years old, can expect an all-in compensation package ranging from $175,000 to over $250,000. This figure far surpasses the starting salaries in nearly every other industry, making it one of the most sought-after, and fiercely competitive, entry-level jobs on the planet. But this reward is not given lightly; it is earned through relentless dedication and famously long hours.

I still remember a mentee of mine describing his first year as an analyst. He called it a "paid MBA on hyper-speed," a trial-by-fire where he learned more about valuation and corporate finance in three months than he did in four years of university. The cost was a year of 100-hour workweeks, but the reward was a skill set and a network that would launch his entire professional future. This guide is for those who, like him, are drawn to that challenge and want to understand every facet of the compensation, the career, and the commitment required.

This comprehensive article will serve as your ultimate roadmap. We will dissect the investment banking analyst salary, explore the factors that drive it higher, map out the career trajectory, and provide an actionable, step-by-step plan to help you break into this elite field.

### Table of Contents

- [What Does an Investment Banking Analyst Do?](#what-does-an-analyst-do)

- [Average Investment Banking Analyst Salary: A Deep Dive](#average-salary-deep-dive)

- [Key Factors That Influence Salary](#key-factors-influencing-salary)

- [Job Outlook and Career Growth](#job-outlook-and-growth)

- [How to Get Started in This Career](#how-to-get-started)

- [Conclusion](#conclusion)

---

What Does an Investment Banking Analyst Do?

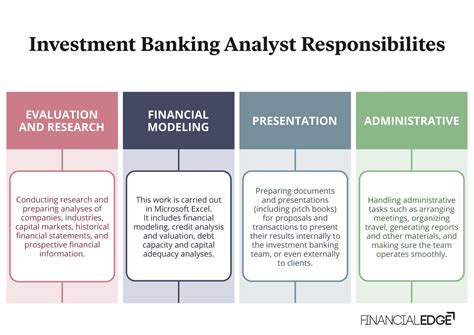

Before we break down the numbers, it's crucial to understand what an investment banking analyst actually *does* to command such a high salary. The role is far more than just a title; it is the engine room of a bank's corporate finance and advisory divisions. Analysts are the junior-most members of a deal team, tasked with the foundational analytical work that underpins every merger, acquisition, and capital raise.

At its core, the job revolves around three primary functions:

1. Financial Modeling and Valuation: This is the analyst's bread and butter. They build complex financial models in Microsoft Excel to forecast a company's future performance and determine its value. Common valuation methodologies include Discounted Cash Flow (DCF) analysis, Comparable Company Analysis ("Comps"), and Precedent Transaction Analysis. These models are the quantitative bedrock upon which strategic recommendations are made.

2. Creating Presentations and Marketing Materials: Analysts spend a significant portion of their time in Microsoft PowerPoint, creating "pitch books." These are detailed presentations used to pitch ideas to potential clients or to market a company to potential buyers. They also create Confidential Information Memorandums (CIMs), which are comprehensive documents describing a client's business for a sale process.

3. Process Management and Due diligence: For live deals, analysts are responsible for managing the flow of information, coordinating with various parties (clients, lawyers, accountants), and conducting due diligence. This involves meticulously reviewing a company's financial statements, contracts, and internal data to identify potential risks or opportunities.

While senior bankers (Managing Directors and Vice Presidents) are responsible for client relationships and strategic oversight, the analyst is the one executing the work, often under immense pressure and tight deadlines.

### A "Day in the Life" of an Investment Banking Analyst

To make this tangible, let's walk through a typical (and very busy) day for an analyst working on a live M&A deal.

- 9:00 AM: Arrive at the office. The first hour is spent catching up on overnight emails from senior bankers and the client, reading market news on the Bloomberg Terminal, and reviewing the team's to-do list for the day.

- 10:00 AM: Join an internal team meeting with the Associate and Vice President to discuss progress on the financial model for "Project Titan," a potential acquisition. The VP requests several new scenarios to be run, testing different revenue growth assumptions and cost synergies.

- 11:00 AM - 2:00 PM: "Grinding in the model." The analyst is deep in Excel, updating the DCF with the new assumptions, ensuring all formulas are correct, and creating summary output tables. This requires intense focus and attention to detail.

- 2:00 PM - 4:00 PM: Switch gears to PowerPoint. The analyst updates the pitch book with the new valuation outputs, refining slides and ensuring the formatting is "pixel-perfect" according to the bank's stringent style guide.

- 4:00 PM: A "fire drill" begins. A potential buyer for another deal, "Project Eagle," has submitted a long list of due diligence questions. The analyst must quickly coordinate with the client to find the answers and organize the data in a virtual data room.

- 6:30 PM: The team orders dinner to the office, a nightly ritual. The analyst eats at their desk while continuing to work.

- 7:30 PM - 10:00 PM: The VP reviews the updated "Project Titan" presentation and sends back a list of comments and revisions (known as "turns"). The analyst meticulously works through each comment, making changes to both the model and the presentation.

- 10:00 PM - 1:00 AM: After submitting the revised materials, the analyst might continue working on the due diligence request list for "Project Eagle" or begin preparing materials for a meeting the next day. The workday often ends when the senior bankers have signed off for the night.

This schedule illustrates why compensation is so high: it's not a 9-to-5 job. It's a high-intensity apprenticeship that demands immense sacrifice, resilience, and a near-superhuman work ethic.

---

Average Investment Banking Analyst Salary: A Deep Dive

The headline number for an investment banking analyst salary is often a source of awe and speculation. It’s essential to break it down into its core components—base salary and bonus—as the combination of the two, known as "all-in compensation," is the true measure of an analyst's earnings.

It's important to note that the data provided by salary aggregators can sometimes lag behind the rapid, real-time changes in Wall Street compensation. For the most up-to-date figures, we will synthesize data from these aggregators with recent industry reports from sources like Wall Street Oasis and eFinancialCareers, which specialize in tracking compensation trends at top banks.

### National Average and Typical Salary Range

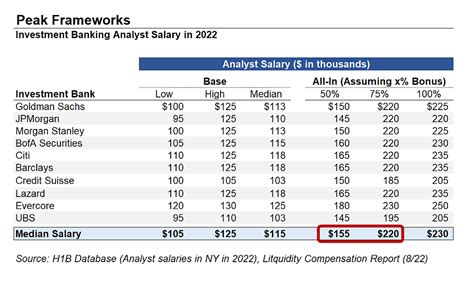

According to Salary.com, as of late 2023, the average base salary for an Investment Banking Analyst in the United States is around $89,691. However, this figure can be misleading as it often blends data from smaller, regional firms with the top-tier banks that define the industry's pay scale. For analysts at major "bulge bracket" or "elite boutique" banks, the reality is significantly higher.

A more accurate picture for a first-year analyst at a reputable firm is:

- Base Salary: $100,000 to $110,000

- Year-End Bonus: $80,000 to $110,000+

- Total All-In Compensation: $180,000 to $220,000+

This compensation scales rapidly with experience. A third-year analyst can see their all-in compensation approach or even exceed $300,000.

### Compensation by Experience Level

The investment banking analyst program is typically a two or three-year structured program. Compensation increases meaningfully each year, rewarding performance and growing expertise.

| Experience Level | Typical Base Salary (2023-2024) | Typical Year-End Bonus Range | Estimated All-In Compensation |

| :--- | :--- | :--- | :--- |

| First-Year Analyst | $100,000 - $110,000 | $70,000 - $100,000 | $170,000 - $210,000 |

| Second-Year Analyst | $110,000 - $125,000 | $80,000 - $120,000 | $190,000 - $245,000 |

| Third-Year Analyst | $125,000 - $150,000 | $100,000 - $150,000+ | $225,000 - $300,000+ |

*Sources: Data synthesized from Wall Street Oasis 2023 Compensation Report, eFinancialCareers, and anecdotal data from recent hiring cycles. Base salaries have seen a significant increase since 2021.*

### Deconstructing the Compensation Package

The all-in compensation number is composed of several key elements:

1. Base Salary: This is the fixed, bi-weekly or monthly paycheck an analyst receives. In recent years, banks have significantly increased base salaries (from a previous standard of ~$85k) to attract top talent and provide more predictable income, especially in the face of public scrutiny over work-life balance. As of 2023, a $110,000 base salary is the new standard for first-year analysts at most top-tier U.S. banks.

2. Signing Bonus (Sign-On Bonus): This is a one-time, lump-sum payment given to analysts when they sign their full-time offer, typically a year before they start. It's intended to cover relocation expenses and serve as an incentive to accept the offer. For recent graduates, this bonus typically ranges from $10,000 to $25,000.

3. Stub Bonus: Analysts who start in the summer typically receive a smaller, pro-rated bonus at the end of their first calendar year (after about 5-6 months of work). This is known as the "stub" bonus and can range from $20,000 to $40,000.

4. Year-End Bonus (Performance Bonus): This is the largest variable component of an analyst's pay and the one that generates the most headlines. Paid out in the summer following a full year of work, this bonus is highly dependent on three factors: the bank's overall performance, the specific group's performance, and the analyst's individual performance ranking ("bucket"). An analyst ranked in the top bucket can receive a bonus that is 20-30% higher than an analyst in the bottom bucket, even within the same firm. This bonus is often equivalent to 80-120% of the base salary.

5. Other Benefits and Perks: While not direct cash, these perks add significant value and are part of the total compensation picture.

- 401(k) Match: Company contributions to a retirement account.

- Premium Health Insurance: Top-tier medical, dental, and vision plans.

- Meal Stipends: A generous allowance (e.g., $30-$40 per night) for dinners when working late.

- Car Service / Ride-Share Credits: Paid transportation home after a certain hour (e.g., 9 or 10 PM).

- Gym Memberships & Wellness Benefits: Subsidies for fitness and mental health resources.

Understanding this complete structure is key. The conversation isn't just about a base salary; it's about a comprehensive and highly lucrative package designed to attract and retain the absolute best talent.

---

Key Factors That Influence Salary

While the figures above provide a strong baseline, not all investment banking analyst salaries are created equal. An analyst's total compensation can vary significantly based on a confluence of factors. Understanding these drivers is critical for anyone aiming to maximize their earning potential in this field. This is the most crucial section for aspiring bankers to master.

###

1. Company Type & Size: The Wall Street Hierarchy

The single most significant factor determining an analyst's pay is the type of bank they work for. The world of investment banking has a well-defined pecking order, and compensation directly reflects this hierarchy.

- Bulge Bracket (BB) Banks: These are the largest, most well-known global banks, including Goldman Sachs, J.P. Morgan, Morgan Stanley, Bank of America, and Citigroup.

- Salary Impact: They set the market standard for compensation. Their base salaries and bonus pools are consistently at the top end of the range. They offer unparalleled deal flow, brand prestige, and structured training, making them the most common target for aspiring analysts. Competition is extraordinarily high.

- Elite Boutique (EB) Banks: These firms specialize primarily in advisory services (like M&A) and often eschew the other services (like lending) that BB banks offer. Key players include Evercore, Lazard, Centerview Partners, Moelis & Company, and PJT Partners.

- Salary Impact: To compete with the BBs for top talent, Elite Boutiques often pay *at or above* the bulge bracket scale, particularly on the bonus component. An analyst at a top EB can frequently be the highest-paid on the street. They offer more focused, technical experience, which is highly prized for "buy-side" exit opportunities.

- Middle Market (MM) Banks: These firms focus on deals for mid-sized companies (typically with enterprise values between $50 million and $1 billion). Examples include Baird, Houlihan Lokey, William Blair, and Jefferies (which often bridges the MM and BB space).

- Salary Impact: Compensation is still exceptional but generally a step below BB and EB firms. A typical MM analyst might earn 10-20% less in all-in compensation than their BB counterparts. However, these roles often provide more hands-on experience earlier and a slightly better work-life balance (though still very demanding).

- Regional Boutiques: These are smaller, localized firms that serve a specific geographic area or a niche industry.

- Salary Impact: Compensation is the most variable and generally the lowest among the four tiers. While still very high compared to other industries, it will not match the levels seen in New York or at larger firms.

Takeaway: Aiming for a Bulge Bracket or Elite Boutique firm is the most direct path to maximizing your starting salary.

###

2. Geographic Location: Where You Work Matters

Investment banking is a geographically concentrated industry, and compensation is closely tied to the cost of labor and living in financial hubs.

- Tier 1 Financial Hubs (Highest Pay):

- New York City: The undisputed global capital of finance. NYC sets the benchmark for all U.S. investment banking salaries. The vast majority of BB, EB, and MM headquarters are here, creating the highest concentration of high-paying jobs.

- San Francisco / Bay Area: A close second, driven by the booming technology M&A market. Analysts in tech-focused groups in SF often receive compensation on par with, or even slightly exceeding, their New York peers to account for the high cost of living.

- London & Hong Kong: These are the primary international hubs. Compensation structures can differ slightly (e.g., bonuses as a percentage of base might vary), but they are broadly competitive with New York to attract global talent.

- Tier 2 Financial Hubs (Strong Pay):

- Chicago: A major financial center with a significant presence from many MM and BB banks. Compensation is very strong, though it may trail NYC by a small margin, which is often offset by a lower cost of living.

- Los Angeles: A growing hub for media, entertainment, and technology banking.

- Houston: The center of energy investment banking (oil & gas). Compensation is high but can be more volatile due to its dependence on commodity cycles.

- Charlotte: A major banking hub, particularly for Bank of America and Wells Fargo, with a growing investment banking presence.

Glassdoor's salary data often reflects these regional differences. Searching for "Investment Banking Analyst" in New York will yield a higher average than a search for the same role in a smaller city. The difference can be as much as 15-25% in all-in compensation between a top-tier and a regional market.

###

3. Level of Education: The Price of Admission

While your degree doesn't create tiers of pay within the same role at the same firm, your educational background is the critical gatekeeper that determines whether you can get the interview in the first place.

- Undergraduate Institution (Target vs. Non-Target): This is paramount. Banks heavily recruit from a list of "target schools" (like Ivy League universities, NYU Stern, UChicago, Michigan Ross, MIT) and "semi-target schools" (top public universities and other prestigious private schools). Students from these schools have a significant advantage due to structured recruiting pipelines and extensive alumni networks. Graduating from a "non-target" school makes breaking in significantly harder, but not impossible.

- Major/Field of Study: Finance, Economics, and Accounting are the most traditional paths. However, banks are increasingly hiring students with degrees in STEM (Science, Technology, Engineering, and Math) fields, valuing their quantitative and problem-solving skills. The major itself doesn't directly impact the salary offer; getting the offer is the key.

- GPA: A high GPA is a non-negotiable screening criterion. Most successful applicants have a GPA of 3.7 or higher. Below a 3.5, it becomes extremely difficult to pass initial resume screens at top firms.

- MBA (for the Associate role): An MBA is not for the analyst role. The analyst role is a pre-MBA position. After 2-3 years as an analyst, one might pursue an MBA and then return to banking at the "Associate" level, which is the next step up the ladder. An Associate's starting all-in compensation is significantly higher, often in the $300,000 - $400,000 range.

###

4. Area of Specialization (Groups): Not All Deals are the Same

Within a bank, analysts are placed into either an "Industry Group" or a "Product Group." While base salaries are standardized across the analyst class, the group's performance and prestige can influence bonus size and, more importantly, future exit opportunities.

- Product Groups:

- Mergers & Acquisitions (M&A): Often considered the most prestigious group. Analysts here gain deep technical expertise in modeling complex transactions.

- Leveraged Finance (LevFin): Focuses on funding LBOs and other transactions with high-yield debt. Very quantitative and highly sought after by private equity recruiters.

- Restructuring (RX): Works with distressed or bankrupt companies. This is a highly specialized and technical field that is counter-cyclical (busier during economic downturns).

- Industry Groups:

- Technology, Media & Telecom (TMT): The "hottest" group for over a decade, especially in NYC and San Francisco, due to high deal volume and glamorous clients.

- Healthcare: A massive and consistently active sector with complex, recession-resistant deals.

- Financial Institutions Group (FIG): Deals with other banks, insurance companies, and asset managers. Known for its highly complex and unique valuation methodologies.

- Industrials, Consumer & Retail, Natural Resources: These are more traditional, cyclical groups but are the backbone of the economy and provide excellent, fundamental training.

An analyst in a top-performing group (e.g., TMT during a tech boom) that closed several large deals may receive a higher bonus than an analyst in a slower group that year.

###

5. In-Demand Skills: The Tools that Boost Your Value

While your background gets you the job, your skills determine your performance ranking, which directly impacts your bonus. Mastering these skills is essential.

- Technical Skills (Hard Skills):

- Advanced Financial Modeling: The ability to build a three-statement, LBO, DCF, or M&A model from scratch, quickly and accurately.

- Valuation Expertise: Deep understanding of comparable company analysis, precedent transactions, and DCF analysis.

- Excel Mastery: Knowing keyboard shortcuts, pivot tables, and data analysis tools to be incredibly efficient.

- PowerPoint Proficiency: The ability to create clean, professional, and persuasive presentations that adhere to the firm's branding.

- Soft Skills (Equally Important):

- Attention to Detail: Banking materials are client-facing and must be flawless. A single error in a number can have major consequences. This is arguably the most valued trait in a junior analyst.

- Resilience and Work Ethic: The ability to handle 100-hour weeks, intense pressure, and criticism without burning out.

- Communication Skills: Clearly and concisely articulating complex financial concepts to your team.

- "Coachability": The ability to take feedback and criticism from senior bankers and implement it quickly and positively.

Analysts who demonstrate a mastery of these skills are ranked higher, receive larger bonuses, and are given more responsibility, setting them up for a more successful career.

---

Job Outlook and Career Growth

An investment banking analyst role is rarely a final destination; it is one of the most powerful career launchpads in the business world. The compensation is high, but the career optionality it provides is arguably even more valuable.

### Job Outlook According to the Data

The U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banking Analyst" as a distinct profession. However, it can be viewed as a highly specialized subset of broader categories like "Financial Analysts" and "Securities, Commodities, and Financial Services Sales Agents."

- For Financial Analysts, the BLS projects job growth of 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. The BLS notes that "analysts with expertise in a specific industry may have better job prospects." This is highly relevant to the investment banking group structure.

- For Securities, Commodities, and Financial Services Sales Agents, the BLS projects a robust growth rate of 8 percent over the same period, faster than the average. This reflects the continued need for professionals who facilitate capital raising and investment.

While these broad statistics are positive, it's crucial to understand the reality of the analyst role: it is a highly cyclical and competitive field. Hiring surges during strong economic periods with high M&A activity and can pull back significantly during recessions. The number of front-office analyst positions at top banks is extremely limited, with tens of thousands of applicants vying for just a few hundred spots each year.

### The Analyst Program: A Two-Year Springboard

The typical investment banking analyst program is designed to be a two-to-three-year stint. At the end of this period, analysts face a few common and highly attractive career paths:

1. **Promote to Associate