Introduction

For millions of Americans, the figure "$16 per hour" isn't just a number—it's a daily reality, a starting line, and a critical benchmark in their professional lives. It represents the wage for many essential, entry-level, and foundational jobs that keep our economy running. But what does earning an annual salary of $16 per hour truly mean for your lifestyle, your finances, and your future? Is it a temporary stepping stone or a long-term plateau? This guide is designed to answer those questions and more, providing a comprehensive, data-driven look at the world of work at this pay grade. We will dissect the numbers, explore the jobs, and, most importantly, lay out a strategic roadmap for growth and advancement.

Earning this wage can be a challenging balancing act. It often sits in a precarious space between the federal minimum wage and what many experts consider a "living wage," especially in major metropolitan areas. It requires careful budgeting, strategic planning, and a clear-eyed view of the future. I remember my own first full-time job out of college, working in a support role that paid a similar inflation-adjusted wage. The experience taught me invaluable lessons about financial literacy and, more crucially, the urgent need to acquire new skills to build a bridge to my next career chapter. That experience is the foundation of this guide: to provide the clarity and strategy I wish I had back then.

This article is your definitive resource. We will go far beyond a simple calculation. We’ll delve into the specific roles that pay this wage, the crucial factors that can increase your pay, the long-term career outlook, and a step-by-step plan to help you get started or, more importantly, get ahead.

### Table of Contents

- [What Does a $16/Hour Job Actually Look Like?](#what-does-a-16hour-job-actually-look-like)

- [Deconstructing a $16 Per Hour Annual Salary: A Deep Dive](#deconstructing-a-16-per-hour-annual-salary-a-deep-dive)

- [Key Factors That Influence Your Salary (And How to Leverage Them)](#key-factors-that-influence-your-salary-and-how-to-leverage-them)

- [Job Outlook and Career Growth from a $16/Hour Starting Point](#job-outlook-and-career-growth-from-a-16hour-starting-point)

- [How to Get Started and Strategically Advance Your Career](#how-to-get-started-and-strategically-advance-your-career)

- [Conclusion: Your $16/Hour Job as a Launchpad, Not a Destination](#conclusion-your-16hour-job-as-a-launchpad-not-a-destination)

What Does a $16/Hour Job Actually Look Like?

An hourly wage of $16 per hour is not tied to a single profession but is a common pay scale for a wide array of entry-level and early-career positions across various industries. These roles are often the backbone of the service, administrative, and light industrial sectors. They typically require a high school diploma or equivalent and offer on-the-job training, making them accessible entry points into the workforce.

The core responsibility in these roles often involves direct service, support, or operational tasks. While the specific duties vary greatly, they share common threads of being process-oriented and essential to the daily function of a business. These are not abstract, strategic roles; they are the hands-on jobs that ensure customers are served, products are moved, and offices run smoothly.

Let's explore some of the most common jobs that fall within the $15-$17 per hour range, according to data from the [U.S. Bureau of Labor Statistics (BLS)](https://www.bls.gov/ooh/) and salary aggregators like [Payscale](https://www.payscale.com/).

Common Jobs Paying Around $16/Hour:

- Customer Service Representative: These professionals are the voice of a company. They answer calls, emails, and chats to resolve customer issues, process orders, and provide information about products and services. The national median pay is around $18.16/hour, but entry-level positions frequently start in the $15-$16/hour range.

- Administrative Assistant (Entry-Level): Responsible for clerical and organizational tasks like scheduling appointments, managing files, answering phones, and supporting other staff members. While experienced assistants earn more, entry-level roles often begin here.

- Certified Nursing Assistant (CNA): CNAs provide basic care for patients in hospitals and long-term care facilities, assisting with activities of daily living like eating, bathing, and dressing. The median pay, per the BLS, is $17.03 per hour, making $16 a very common starting wage.

- Retail Salesperson: Working on the front lines of commerce, these individuals assist customers, manage inventory, and operate cash registers. Wages vary significantly by company and location, but $16/hour is a typical rate for experienced associates at larger retail chains.

- Bank Teller: Tellers are the primary point of contact for most bank customers, handling routine transactions like deposits, withdrawals, and cashing checks. The BLS reports a median pay of $17.93 per hour, with many new tellers starting slightly lower.

- Warehouse Associate / Stocker: These workers are critical to the logistics and supply chain industry. They receive, unpack, organize, and track inventory in a warehouse or distribution center, often using equipment like pallet jacks or forklifts.

### A Day in the Life: A Customer Service Representative

To make this more tangible, let's imagine a day in the life of "Alex," an entry-level Customer Service Representative earning $16 per hour at a mid-sized e-commerce company.

- 8:45 AM: Alex arrives at the office (or logs into the remote work portal), grabs a coffee, and reviews any overnight team updates or policy changes.

- 9:00 AM: The phone lines and chat queues open. The first call is from a customer whose package is delayed. Alex uses tracking software to locate the package, apologizes for the delay, and provides a new estimated arrival date, documenting the interaction in the company's CRM (Customer Relationship Management) system.

- 11:00 AM: After handling a dozen more calls and chats about returns, product questions, and website issues, Alex takes a mandated 15-minute break.

- 12:30 PM: Lunch break. A chance to step away from the screen and recharge.

- 1:30 PM: The afternoon rush begins. Alex handles a complex issue with a frustrated customer whose product arrived damaged. This requires patience, empathy, and following a multi-step process to arrange for a return shipment and a replacement order, requiring supervisor approval for a shipping fee waiver.

- 3:30 PM: The call volume slows. Alex uses this time to respond to customer emails and complete documentation from earlier calls, ensuring every interaction is logged accurately.

- 5:00 PM: The day ends. Alex has interacted with over 50 customers, solving problems and representing the company brand with every click and conversation.

This example illustrates the structured, fast-paced, and problem-solving nature of many jobs in this pay bracket. Success requires reliability, patience, and the ability to follow established procedures consistently.

Deconstructing a $16 Per Hour Annual Salary: A Deep Dive

Understanding the true value of a $16 per hour wage requires looking beyond the hourly number and breaking it down into its annual, monthly, and post-tax reality. This context is essential for budgeting, financial planning, and evaluating job offers.

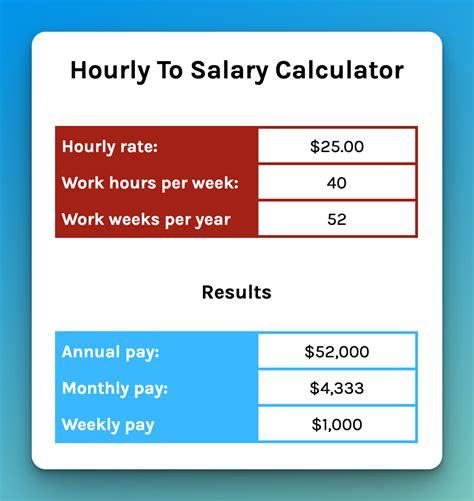

First, let's do the basic math. A full-time job is typically considered 40 hours per week. With 52 weeks in a year, the calculation is:

$16/hour × 40 hours/week × 52 weeks/year = $33,280 per year (Gross Annual Income)

This $33,280 figure is your starting point, but it's not the amount you take home.

### From Gross to Net: The Reality of Take-Home Pay

Your take-home pay (net income) is your gross income minus deductions. These typically include:

- Federal Income Tax

- State Income Tax (in most states)

- FICA taxes (Social Security and Medicare)

- Health Insurance Premiums

- Retirement Contributions (e.g., 401(k))

The exact amount deducted varies wildly based on your state, filing status (single, married, etc.), number of dependents, and the benefit choices you make. However, a general estimate for a single individual with no dependents might see 20-25% of their gross pay go toward these deductions.

- Gross Monthly Income: $33,280 / 12 = $2,773

- Estimated Net Monthly Income (after ~22% deductions): ~$2,163

This monthly take-home pay is the real number you have for rent, utilities, groceries, transportation, debt payments, and savings.

### National Context: How Does $33,280 Stack Up?

To understand what a $33,280 salary means, we need to compare it to national benchmarks.

- U.S. Median Wage: According to the [U.S. Bureau of Labor Statistics (BLS)](https://www.bls.gov/news.release/wkyeng.nr0.htm), the median weekly earnings for full-time wage and salary workers was $1,145 in the fourth quarter of 2023. This equates to an annual salary of $59,540. At $33,280, a $16/hour wage is significantly lower—about 56% of the national median.

- Federal Poverty Guidelines: The [Department of Health and Human Services](https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines) sets the 2024 poverty guideline for a one-person household at $15,060 and a two-person household at $20,440. While a $33,280 salary is well above the poverty line, it illustrates the limited financial cushion.

- The "Living Wage" Concept: Perhaps the most crucial comparison is with the "living wage," defined as the hourly rate an individual must earn to cover basic needs in their specific location. The [MIT Living Wage Calculator](https://livingwage.mit.edu/) is an authoritative source for this. For a single adult with no children in the U.S., the average living wage is $25.02 per hour. A $16/hour wage falls substantially short of this national average, highlighting the financial challenges many workers face. In high-cost-of-living areas like San Francisco County, CA, the living wage for a single adult is over $33/hour. In a lower-cost area like Brownsville, TX, it's closer to $16.50/hour, making a $16 wage much more viable.

### The Critical Importance of Benefits and Total Compensation

When evaluating a job offer at this wage, the base pay is only part of the story. The benefits package, or total compensation, can dramatically alter the financial picture.

Compensation Components Beyond Salary:

| Component | Description & Impact |

| :--- | :--- |

| Health Insurance | Employer-sponsored health insurance is arguably the most valuable benefit. A good plan can save you thousands annually in premiums and out-of-pocket medical costs compared to buying a plan on the marketplace. |

| Paid Time Off (PTO) | This includes vacation days, sick leave, and paid holidays. A job with 15 days of PTO is effectively paying you the same amount for three fewer weeks of work compared to a job with no PTO, increasing your effective hourly rate. |

| Retirement Savings Plan | Access to a 401(k) or 403(b) is crucial for long-term financial health. The most important feature is an employer match. If a company matches your contributions up to, say, 4% of your salary, that is free money. For a $33,280 salary, a 4% match is an extra $1,331 per year directly into your retirement account. |

| Tuition Assistance/Reimbursement | For those looking to advance, this benefit is gold. Companies like Walmart, Amazon, and Starbucks have well-known programs that pay for some or all of an employee's college tuition or certifications. This is a direct investment in your future earning potential. |

| Bonuses & Profit Sharing | While less common in hourly roles, some companies offer performance-based bonuses or share a portion of their profits with employees, providing a potential boost to your annual income. |

| Overtime Pay | As an hourly employee, you are entitled to overtime pay (typically 1.5 times your regular rate) for any hours worked over 40 in a week. This can be a significant source of extra income, though it shouldn't be relied upon as a stable part of your budget. |

A $16/hour job with a robust benefits package (especially a strong health plan and tuition assistance) is vastly superior to a $17/hour job with no benefits at all. When comparing offers, always look at the full picture.

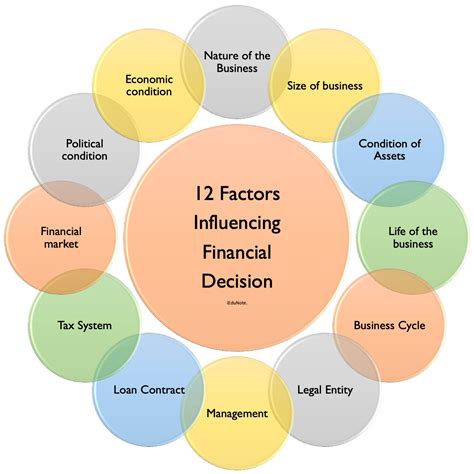

Key Factors That Influence Your Salary (And How to Leverage Them)

While $16 per hour is a common baseline, it is by no means a fixed ceiling. Your earning potential, even within the same job title, is influenced by a combination of factors. Understanding these levers is the first step toward strategically increasing your income. This section provides an in-depth analysis of what drives pay and how you can position yourself for higher earnings.

### 1. Level of Education and Certification

Education remains one of the most powerful determinants of lifetime earning potential. While many $16/hour jobs only require a high school diploma, adding formal education or specialized credentials is a proven path to a higher wage.

- The Data: The [Bureau of Labor Statistics](https://www.bls.gov/careeroutlook/2023/data-on-display/education-pays.htm) consistently shows a strong correlation between education and income. In 2022, the median weekly earnings for full-time workers were:

- High School Diploma: $853 ($44,356/year)

- Some College, No Degree: $957 ($49,764/year)

- Associate's Degree: $1,005 ($52,260/year)

- Bachelor's Degree: $1,432 ($74,464/year)

- Strategic Application: This doesn't mean you must get a four-year degree to escape a $16/hour wage. The most effective approach is often targeted and incremental.

- Certifications: These are shorter, more focused, and often less expensive than a full degree. A warehouse associate earning $16/hour might get a Forklift Operator Certification to qualify for roles paying $18-$22/hour. An entry-level administrative assistant could pursue the Microsoft Office Specialist (MOS) certification to demonstrate advanced proficiency and command a higher salary.

- Associate's Degrees: A two-year degree from a community college can be a powerful stepping stone. For example, a Certified Nursing Assistant (CNA) earning ~$17/hour can complete an Associate's Degree in Nursing (ADN) to become a Registered Nurse (RN), a profession with a median pay of $86,070 per year ($41.38/hour) according to the BLS.

- Employer-Funded Education: The smartest strategy is to leverage tuition assistance programs. Working at a company that pays for your education allows you to earn while you learn, avoiding student debt and immediately applying your new knowledge to advance your career, potentially within the same company.

### 2. Years of Experience

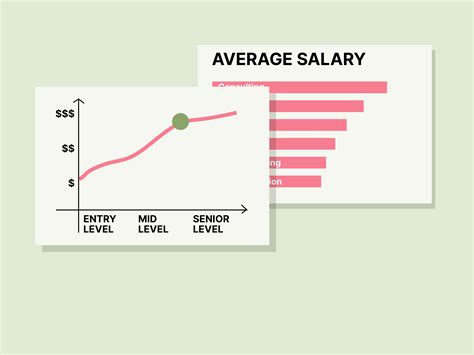

Experience is the currency of the workplace. In nearly every field, demonstrated competence and a track record of reliability lead to higher pay. The trajectory from entry-level to experienced professional is a primary driver of wage growth.

- Entry-Level (0-2 years): This is where the $15-$17/hour range is most common. Employers are taking a chance on your potential. Your focus should be on learning the role, demonstrating reliability, and being a good team player.

- Mid-Career (3-8 years): By this stage, you have proven your competence. You're no longer just following a script; you're solving more complex problems, possibly training new hires, and operating with more autonomy. According to [Salary.com](https://www.salary.com/), a Customer Service Representative I (entry-level) has a median salary of around $38,000, while a Customer Service Representative II (intermediate) has a median of $43,000, and a CSR III (senior) reaches $48,000. This shows a clear path of income growth directly tied to experience.

- Senior/Lead (8+ years): Senior-level individual contributors or those who move into supervisory roles see the largest pay increases. A Senior Administrative Assistant or an Office Manager can earn significantly more than an entry-level assistant. The warehouse associate who becomes a Warehouse Supervisor or Logistics Coordinator can move from an hourly wage to a salaried position in the $50,000-$70,000 range or higher.

- How to Leverage Experience: Actively seek opportunities to accelerate your learning. Volunteer for new projects, ask to be cross-trained in different functions, and find a mentor. When you hit the 2-3 year mark in a role, it's a natural time to either negotiate a significant raise based on your proven value or start looking for a new role at a different company, as external hires often receive a larger pay bump than internal promotions.

### 3. Geographic Location

Where you live is one of the single biggest factors determining how far your $16/hour salary will go—and how high that salary can climb. Wages are closely tied to the local cost of living and labor market demand.

- High Cost of Living (HCOL) Areas: In cities like New York, San Francisco, Boston, and Los Angeles, $16/hour is often below the legal minimum wage and is not considered a livable wage. For example, the minimum wage in New York City is $16/hour as of 2024. In these markets, the same "entry-level" job might pay $20-$25/hour out of necessity, but the cost of housing, food, and transportation is proportionally higher. A $33,280 salary in San Francisco is extremely difficult to live on.

- Low Cost of Living (LCOL) Areas: In many parts of the Midwest and South, the cost of living is significantly lower. In a city like Omaha, Nebraska, or Birmingham, Alabama, a $33,280 salary stretches much further. The [MIT Living Wage Calculator](https://livingwage.mit.edu/) shows the living wage for a single adult in Douglas County, NE (Omaha) is $19.46/hour, making a $16 wage more challenging but closer to manageable than in a HCOL city.

- Remote Work Impact: The rise of remote work has introduced a new dynamic. Some companies pay a national standard rate regardless of location, which can be a huge advantage for those in LCOL areas. Others are implementing location-based pay, adjusting salaries downward if an employee moves to a cheaper city. If you are in a customer service or data entry role, seeking a remote position with a company based in a HCOL area that pays a flat national rate can be a powerful financial strategy.

Sample City Comparison for a Customer Service Representative (Entry-Level):

| City | Estimated Hourly Wage Range (Payscale) | Local Minimum Wage (as of early 2024) |

| :--- | :--- | :--- |

| San Jose, CA | $20 - $25 | $17.55 |

| Denver, CO | $18 - $22 | $18.29 |

| Chicago, IL | $17 - $21 | $15.80 |

| Dallas, TX | $15 - $19 | $7.25 (Federal) |

| Cleveland, OH | $15 - $18 | $10.45 |

### 4. Company Type & Size

The type of organization you work for can have a major impact on your pay and benefits.

- Startups: Might offer lower base pay but could include equity (stock options) as part of the compensation. Benefits can be less robust, and job stability may be lower.

- Small & Medium-Sized Businesses (SMBs): Pay and benefits can vary widely. A local "mom-and-pop" shop might pay less than a larger corporation, but it could offer a better work-life balance or a more tight-knit culture.

- Large Corporations: Companies like Amazon, Target, Bank of America, or UnitedHealth Group often have highly structured pay scales. They frequently offer higher starting wages (many have set their own corporate minimums above $16/hour) and much more comprehensive benefits packages (health, retirement, tuition assistance) to attract and retain talent at scale.

- Non-Profits: Tend to pay less than for-profit companies due to budget constraints, but they can offer strong intrinsic rewards for mission-driven individuals.

- Government (Federal, State, Local): Government jobs are known for their stability and excellent benefits, particularly pensions and healthcare. While the starting hourly wage for an entry-level clerical role might be comparable to the private sector, the "total compensation" value is often much higher over the long term.

### 5. Area of Specialization / Industry

Even within the broad category of "$16/hour jobs," the industry you choose has a profound effect on your future growth potential.

- Retail/Hospitality: While accessible, these industries often have flatter career trajectories and lower wage ceilings unless you move into management.

- Administrative/Clerical: This path offers more opportunities for specialization. An administrative assistant can specialize in a legal, medical, or executive setting, each commanding higher pay.

- Healthcare Support: This is an industry with immense growth potential. A CNA ($17/hr) can become a Licensed Practical Nurse (LPN, ~$28/hr) or a Medical Assistant (~$19/hr) with relatively short training programs. The demand for healthcare workers is consistently high.

- Skilled Trades / Light Industrial: A general warehouse worker can upskill to become a certified forklift operator, a CNC machine operator, or a welder's assistant, all of which lead to significantly higher pay and a clear career ladder in the manufacturing and logistics sectors.

### 6. In-Demand Skills

Beyond your job title, the specific skills you possess can make you a more valuable candidate and justify a higher wage.

- Hard Skills:

- Bilingualism: In customer-facing roles, fluency in a second language (especially Spanish) can command a pay differential or open up specialized, higher-paying positions.

- Technical Proficiency: Advanced knowledge of specific software is highly valued. This could be mastery of Excel (pivot tables, VLOOKUPs), experience with a CRM like Salesforce, or proficiency with accounting software like QuickBooks.

- Fast & Accurate Typing/Data Entry: For administrative and data entry roles, a high words-per-minute (WPM) count with low error rates is a quantifiable skill that can set you apart.

- Specialized Equipment Operation: As mentioned, certifications for operating forklifts, medical equipment, or specific machinery directly translate to higher pay.

- Soft Skills:

- Communication: The ability to communicate clearly, concisely, and empathetically, both verbally and in writing, is paramount in any service or support role.

- Problem-Solving: Moving beyond reading a script to actively diagnosing and resolving unique customer issues demonstrates higher-level thinking.

- De-escalation: The ability to calmly handle upset or angry customers is a highly sought-after skill in any service industry and is often a prerequisite for team lead positions.

- Reliability and Time Management: Simply showing up on time, every time, and managing your workload effectively is a baseline skill that builds trust and makes you a candidate for more responsibility.

By understanding and strategically working on these six factors, you can transform a $16/hour job from a static wage into a dynamic platform for career and financial growth.

Job Outlook and Career Growth from a $16/Hour Starting Point

While a $16/hour wage is an entry point, the long-term career prospects depend entirely on the specific job and industry you choose. The U.S. Bureau of Labor Statistics' [Occupational Outlook Handbook (OOH)](https://www.bls.gov/ooh/) is the gold standard for projecting job growth. By analyzing the outlook for common $16/hour jobs, we can identify which paths offer a promising future and which may face challenges.

### Analyzing the 10-Year Outlook for Key Professions

Let's examine the projected growth from 2022 to 2032 for several of the roles we've discussed:

- Customer Service Representatives:

- Job Outlook: A 4% decline. This is a critical trend to understand. The BLS projects a loss of about 116,400 jobs in this field over the decade.

- Why? The primary drivers are automation, including chatbots and AI-powered interactive voice response (IVR) systems, which can handle routine inquiries more efficiently.

- Career Strategy: The future of customer service is in handling complex, nuanced, and high-empathy interactions that AI cannot. To thrive, a CSR must focus on developing exceptional problem-solving, de-escalation, and technical support skills to move into senior or specialized roles (e.g., Tier 2/3 support, product specialist). The job isn't disappearing, but the skill requirements are rising.

- Certified Nursing Assistants (CNAs):