Have you ever wondered who decides what a job is worth? In a world of fluctuating economies, remote work, and a growing demand for pay transparency, the art and science of employee compensation have never been more critical. If you are a strategic thinker with a passion for fairness, a knack for data, and a desire to shape the very foundation of a healthy workplace, a career as a Compensation & Equity Strategist might be your calling. This is the professional who stands at the nexus of finance, human resources, and corporate strategy, tasked with designing pay systems that are competitive, equitable, and legally sound. They are the experts who are ultimately responsible for answering the difficult question that many employees fear: "Can a company lower your salary?" The average salary for experienced professionals in this field often ranges from $90,000 to over $150,000, reflecting the immense value they bring to an organization.

Early in my career, I witnessed a large-scale salary reduction at a company handled with all the grace of a sledgehammer. The communication was opaque, the logic was unclear, and the resulting collapse in morale was catastrophic. It was then I realized that managing compensation isn't just about numbers on a spreadsheet; it's about respect, strategy, and preserving the human capital that is a company's greatest asset. A skilled Compensation & Equity Strategist could have navigated that crisis, saved trust, and perhaps even strengthened the company in the process.

This comprehensive guide will explore every facet of this demanding but rewarding career path. We will delve into the day-to-day responsibilities, dissect salary potential with real-world data, analyze the job outlook, and provide a step-by-step roadmap for you to get started.

### Table of Contents

- [What Does a Compensation & Equity Strategist Do?](#what-does-a-compensation--equity-strategist-do)

- [Average Compensation & Equity Strategist Salary: A Deep Dive](#average-compensation--equity-strategist-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation & Equity Strategist Do?

A Compensation & Equity Strategist is a highly specialized professional, often situated within the Human Resources or Finance department, who designs, implements, and manages an organization's entire compensation framework. Their mission is twofold: to ensure the company can attract and retain top talent in a competitive market and to maintain internal equity and fairness, ensuring that employees are paid fairly relative to their peers, skills, and contributions.

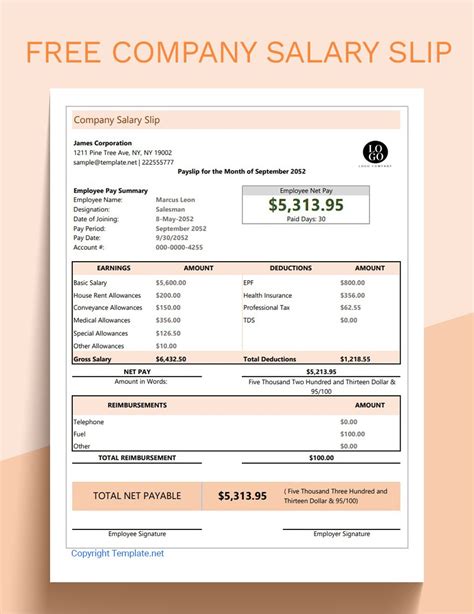

This role is far more than just "setting salaries." It is a blend of data science, financial modeling, legal compliance, and strategic communication. They are the architects of total rewards, which includes not only base salary but also bonuses, commissions, stock options, and other long-term incentives. They live in spreadsheets, market data reports, and legal documents, translating complex information into a coherent and defensible compensation strategy that aligns with the company's budget, goals, and values.

One of their most critical and sensitive responsibilities is managing salary adjustments across the organization. This includes standard merit increases and promotions but also extends to more challenging scenarios like pay freezes, market-based adjustments, or, in difficult economic times, salary reductions. In these situations, the strategist becomes a key advisor to senior leadership. They must analyze the financial necessity, explore alternatives, understand the legal landscape (e.g., contract law, state regulations), and, most importantly, develop a communication plan to explain the "why" and "how" to employees in a way that minimizes damage to trust and morale. So, when an employee asks, "Can my company lower my salary?" the strategist is the one who has already determined if it's legally permissible, strategically sound, and has created the playbook for how it would be executed.

### A Day in the Life of a Senior Compensation Strategist

To make this tangible, let's walk through a typical day:

- 9:00 AM - 9:30 AM: Market Data Review. The day begins with a review of new compensation survey data from third-party providers. Are our salary bands for software engineers still competitive in the Austin market? Has there been a recent surge in demand for data scientists that requires a market adjustment?

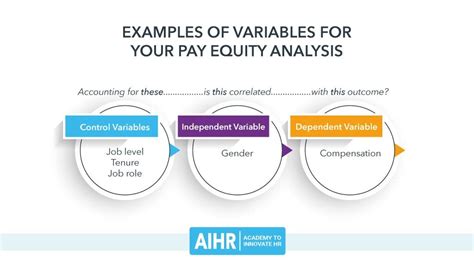

- 9:30 AM - 11:00 AM: Pay Equity Audit. The strategist runs a regression analysis on the company's payroll data, controlling for role, experience, and performance, to identify any statistically significant pay gaps based on gender or race. They flag several departments for a deeper review with HR Business Partners.

- 11:00 AM - 12:00 PM: Meeting with the CFO. The strategist presents their Q3 bonus accrual forecast. They discuss the financial impact of a potential acquisition and model a new commission structure for the sales team of the target company to ensure it aligns with the parent company's philosophy.

- 12:00 PM - 1:00 PM: Lunch & Learn. They host a virtual training session for managers on how to conduct effective compensation conversations during annual performance reviews, providing them with talking points and FAQs.

- 1:00 PM - 3:00 PM: Restructuring Strategy Session. This is the tough part of the job. The company is closing a division. The strategist meets with legal counsel and senior HR leadership to discuss the compensation implications. They model the cost of severance packages versus redeploying employees to other roles at adjusted salaries. They are tasked with answering the core question: *can we legally and ethically move a high-performing employee from the closing division into a different role at a lower salary, and if so, how do we structure that offer?*

- 3:00 PM - 4:30 PM: Executive Compensation Committee Prep. The strategist prepares a presentation for the Board of Directors' Compensation Committee. This involves benchmarking CEO and other executive salaries against peer companies and modeling the performance metrics for their long-term incentive plan.

- 4:30 PM - 5:00 PM: Answering Manager Queries. The day ends by responding to emails from managers asking for guidance on off-cycle salary increases for star performers or how to handle a new hire's salary negotiation.

This role is for those who can balance the cold, hard data with a deep understanding of human motivation and organizational psychology. You are the guardian of one of the most personal and impactful aspects of the employee experience: their pay.

Average Compensation & Equity Strategist Salary: A Deep Dive

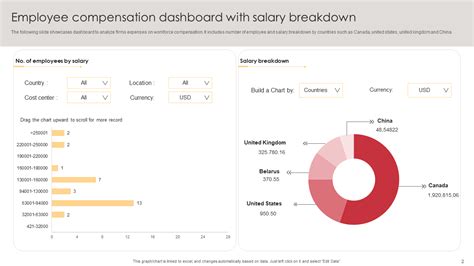

The role of a Compensation & Equity Strategist is a specialized function, and as such, it commands a competitive salary that reflects its strategic importance. While the BLS does not have a dedicated category for this exact title, we can create a highly accurate salary profile by analyzing data for closely related and overlapping professions, primarily Compensation Managers, Compensation, Benefits, and Job Analysis Specialists, and senior Human Resources Managers with a focus on compensation.

According to Salary.com, as of late 2023, the median annual salary for a Compensation Manager in the United States is approximately $129,575. The typical salary range falls between $115,193 and $145,510, but this can vary significantly based on the factors we'll explore in the next section.

Data from other reputable sources corroborates this, providing a comprehensive view of the earning potential:

- Payscale.com reports the average salary for a Compensation Manager at $93,989, with a range commonly spanning from $66,000 to $130,000. Their data often reflects a broader spectrum of company sizes and experience levels.

- Glassdoor.com estimates the total pay for a Compensation Manager in the U.S. to be around $139,152 per year, with a likely base salary of approximately $112,000 and additional pay (cash bonus, stock, etc.) of around $27,000.

- The U.S. Bureau of Labor Statistics (BLS), in its May 2022 data, places Compensation and Benefits Managers under the broader category of Human Resources Managers. The median annual wage for HR Managers was $130,000. The lowest 10 percent earned less than $77,970, and the highest 10 percent earned more than $235,010. For the more analytical role of Compensation, Benefits, and Job Analysis Specialists, the BLS reports a median annual wage of $72,400, which often represents the entry to mid-level of this career path.

### Salary by Experience Level

Salary growth in this field is substantial as you accumulate expertise, take on more strategic responsibility, and move into leadership roles. Here is a breakdown of what you can expect at different stages of your career, compiled from the sources above.

| Experience Level | Job Title Examples | Typical Annual Salary Range (Base) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Compensation Analyst, Junior HR Analyst | $60,000 - $80,000 | Job description analysis, participation in salary surveys, data entry, running basic reports, responding to first-level queries. |

| Mid-Career (3-8 years) | Senior Compensation Analyst, Compensation Specialist, Compensation & Equity Strategist | $85,000 - $120,000 | Managing annual compensation cycles, conducting pay equity audits, designing salary structures for specific business units, benchmarking jobs against market data, developing incentive plans. |

| Senior/Managerial (8+ years) | Compensation Manager, Senior Compensation & Equity Strategist | $120,000 - $160,000+ | Overseeing the entire compensation function, managing a team of analysts, developing company-wide compensation philosophy, presenting to executive leadership, advising on executive compensation. |

| Director/Executive Level | Director of Total Rewards, VP of Compensation & Benefits | $170,000 - $250,000+ | Setting global compensation strategy, aligning total rewards with long-term business goals, managing executive compensation and equity programs, reporting to the C-suite and Board of Directors. |

### Beyond the Base Salary: Understanding Total Compensation

A crucial part of a Compensation Strategist's job is understanding and designing the *total rewards* package, and their own compensation reflects this complexity. Base salary is only one piece of the puzzle.

- Annual Bonuses: This is the most common form of variable pay. For mid-to-senior level professionals, annual bonuses are standard and are typically tied to a combination of company performance and individual goal achievement. These can range from 10% to 25% of the base salary, and even higher at the director level.

- Profit Sharing: Some companies, particularly in the private sector, offer a profit-sharing plan where a portion of the company's profits is distributed among employees. This directly ties the strategist's success in creating an effective workforce to the company's bottom line.

- Long-Term Incentives (LTI): Especially in publicly traded companies or high-growth startups, LTI is a significant component of compensation for senior strategists and managers. This can include:

- Stock Options: The right to buy company stock at a predetermined price in the future.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time.

- Performance Shares: Shares awarded only if specific, long-term company performance goals are met.

LTI plans can add tens or even hundreds of thousands of dollars to total compensation over the vesting period, especially at senior levels.

- Comprehensive Benefits: As experts in this area, you can expect top-tier benefits packages, including excellent health, dental, and vision insurance; generous 401(k) matching programs; and substantial paid time off.

In summary, while the path begins with a solid but not spectacular salary, the earning potential for a skilled and experienced Compensation & Equity Strategist is exceptionally high. Your ability to wield data, understand legal frameworks, and provide steady strategic guidance on sensitive pay issues—including salary reductions—makes you an invaluable asset worthy of significant investment.

Key Factors That Influence Salary

The wide salary bands discussed above are not arbitrary. A compensation professional's pay is a complex calculation influenced by a specific set of factors. Understanding these levers is key to maximizing your own earning potential in this field. As a strategist, you will use these same factors to determine pay for others, so mastering them for your own career is a fundamental skill.

###

Level of Education

Your educational background forms the foundational knowledge for a career in compensation. While a specific "Compensation" degree is rare, employers look for academic credentials that signal strong analytical, financial, and business acumen.

- Bachelor's Degree (Baseline Requirement): A bachelor's degree is the standard entry point. The most relevant and sought-after majors are Human Resources, Business Administration, Finance, and Economics. An HR or Business degree provides the organizational context, while a Finance or Economics degree builds the quantitative and modeling skills essential for the role. An entry-level analyst with a relevant degree from a reputable university can expect to start at the higher end of the entry-level salary band, potentially closer to $70,000-$75,000.

- Master's Degree (Accelerator): A master's degree can significantly accelerate your career trajectory and earning potential. An MBA (Master of Business Administration), particularly with a concentration in finance or human resources, is highly valued. A Master's in Human Resources (MHR) or a specialized Master's in Industrial and Labor Relations is also a powerful credential. Professionals with a master's degree can often command a 10-15% salary premium over those with only a bachelor's. They may also be able to enter the field at a more senior analyst level, bypassing some entry-level duties.

- Professional Certifications (The Great Differentiator): In the world of compensation, professional certifications are arguably as important as advanced degrees. They signify a deep, specialized knowledge of the craft. The gold standard is the Certified Compensation Professional (CCP®) designation offered by WorldatWork. Earning a CCP requires passing a series of exams on topics ranging from base pay administration to executive compensation. Holding a CCP can add 5% to 15% to your salary, according to Payscale data. Other valuable certifications include:

- Global Remuneration Professional (GRP®): For those working in multinational corporations.

- Advanced Certified Compensation Professional (ACCP™): Demonstrates a higher level of mastery.

- SHRM-CP or SHRM-SCP: Broader HR certifications from the Society for Human Resource Management that are also highly respected.

###

Years of Experience

Experience is the single most significant factor in determining your salary as a compensation professional. This is a field where wisdom is gained through practice—navigating market cycles, implementing new systems, and managing sensitive employee situations.

- Entry-Level (0-2 years): $60,000 - $80,000. At this stage, you are an analyst, learning the ropes. Your work involves data gathering, survey submission, and supporting senior team members. Your value is in your accuracy, diligence, and ability to learn quickly.

- Mid-Career (3-8 years): $85,000 - $120,000. You have moved from a supporting role to a contributing and often leading role on major projects. You might own the annual merit cycle for a business unit or be the go-to expert for sales commission plan design. At this point, your salary jumps significantly as you are now a trusted advisor, not just an analyst. Senior analysts who demonstrate strategic potential can easily cross the $100,000 mark.

- Senior/Managerial (8+ years): $120,000 - $160,000+. As a manager or principal strategist, you are responsible for the work of others and for setting strategy. You interface directly with senior executives. Your experience in handling complex issues—like a pay equity crisis, a corporate merger, or the strategic decision to lower salaries during a downturn—is what commands a premium salary. Your judgment is now your most valuable asset. Professionals with 10-15 years of experience leading a compensation function in a large company can see base salaries approaching $200,000, before even considering bonuses and LTI.

###

Geographic Location

Where you work has a massive impact on your paycheck, as companies adjust pay scales to reflect the local cost of labor and cost of living. High-cost metropolitan areas, which are often home to corporate headquarters and competitive industries like tech and finance, offer the highest salaries.

- High-Paying Metropolitan Areas: Cities like San Jose (Silicon Valley), San Francisco, New York City, and Boston consistently offer the highest salaries for compensation professionals. A Compensation Manager in San Francisco can expect to earn 25-40% above the national average, according to Salary.com's location-based calculator. This could translate to a median salary well over $160,000.

- Mid-Tier Cities: Major economic hubs like Chicago, Dallas, Atlanta, and Washington D.C. also offer competitive salaries that are typically 5-15% above the national average.

- Lower-Paying Areas: Salaries will generally be lower in smaller cities and rural regions. However, the rise of remote work is beginning to complicate this. Many companies now have different pay strategies for remote workers, sometimes paying a national average, a location-based rate, or a hybrid of the two. A skilled Compensation Strategist is the one who designs these very policies.

###

Company Type & Size

The type and scale of the organization you work for are major determinants of your pay and the complexity of your work.

- Large Public Corporations (Fortune 500): These companies typically offer the highest salaries and most robust total rewards packages. The scale is immense (tens or hundreds of thousands of employees), the work is often global, and it involves complex issues like executive compensation, SEC reporting, and M&A integration. A Director of Total Rewards at a Fortune 500 company can easily earn a total compensation package (salary + bonus + equity) well into the $300,000 - $500,000+ range.

- High-Growth Tech/Startups: While base salaries might be slightly less than at a giant corporation, the potential for wealth creation through equity (stock options or RSUs) can be enormous. A founding Compensation Strategist at a pre-IPO startup is taking a risk, but if the company succeeds, the payoff can be life-changing. The work here is fast-paced, building compensation systems from scratch.

- Private Companies & Non-Profits: These organizations often have tighter budgets and may offer lower base salaries. However, they can offer better work-life balance or, in the case of non-profits, the fulfillment of a mission-driven purpose.

- Consulting Firms: Working for a compensation consulting firm (like Mercer, Willis Towers Watson, or Aon) is another high-paying path. Consultants advise multiple clients on their compensation strategies. While the hours can be demanding, the exposure to different industries is unparalleled, and compensation for senior consultants is on par with top corporate roles.

###

Area of Specialization

Within the broad field of compensation, specializing can make you a more valuable—and higher-paid—asset.

- Executive Compensation: This is one of the most lucrative specializations. It involves designing salary, bonus, and long-term incentive packages for C-suite executives. It requires deep knowledge of corporate governance, tax law, and SEC regulations. Experts in this niche are rare and highly sought after, commanding top-tier salaries.

- Sales Compensation: Designing incentive plans that motivate sales teams without driving the wrong behaviors is a complex art. Specialists who can create and administer effective sales commission, quota, and bonus plans are always in demand, particularly in industries like software (SaaS), pharmaceuticals, and financial services.

- Global Compensation: For multinational corporations, managing pay across different countries, currencies, and legal systems is a massive challenge. A GRP®-certified professional who can navigate these complexities is a critical asset.

- Equity Strategy: With the rise of startups and the tech industry, specialists who focus purely on designing and administering stock option and RSU programs are in high demand. This requires a blend of compensation, finance, and legal expertise.

###

In-Demand Skills

Finally, beyond your background, the specific skills you cultivate will directly impact your value.

- Advanced Data Analysis & Modeling: You must be a wizard with Microsoft Excel. Beyond that, proficiency in HRIS systems (like Workday or SAP SuccessFactors), and data visualization tools (like Tableau) is becoming standard. Experience with statistical software (R, Python) for tasks like pay equity regression analysis is a major plus that can boost your salary.

- Financial Acumen: You need to speak the language of the CFO. The ability to build a financial model showing the P&L impact of a new bonus plan or a change in salary structures is non-negotiable at senior levels.

- Legal & Regulatory Knowledge: Deep understanding of labor laws like the Fair Labor Standards Act (FLSA), Equal Pay Act, and emerging pay transparency laws is crucial. This knowledge is what allows you to confidently advise leadership on whether they *can* lower an employee's salary and what the risks are.

- Communication & Influence: You can have the best data in the world, but if you can't explain it clearly and persuasively to executives, managers, and employees, it's useless. Strong presentation and negotiation skills are paramount, especially when delivering difficult news.

By strategically developing these facets of your professional profile, you can actively steer your career towards higher levels of responsibility and compensation.

Job Outlook and Career Growth

The future for compensation professionals is bright and stable. As business environments grow more complex and the war for talent intensifies, the need for strategic compensation expertise has never been greater. Companies recognize that a well-designed compensation program is not just an expense; it's a critical investment in their success.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment for Compensation, Benefits, and Job Analysis Specialists is projected to grow 7 percent from 2022 to 2032, which is faster than the average for all occupations. This translates to about 6,700 new job openings each year, on average, over the decade. For the more senior role of Human Resources Managers (which includes Compensation Managers), the growth is projected at 5 percent, also faster than average, with about 16,300 openings projected each year.

This steady demand is driven by several powerful, long-term trends that are reshaping the professional landscape.

### Emerging Trends and Future Challenges

A forward-looking Compensation & Equity Strategist must not only manage the present but also anticipate the future. The following trends are defining the next decade of work in this field:

1. The Rise of Pay Transparency: This is arguably the biggest shift in the compensation world. States and cities across the U.S. (like Colorado, New York City, and California) are enacting laws that require employers to post salary ranges in job descriptions. This trend is empowering candidates and employees, but it puts immense pressure on companies to have a logical, defensible, and equitable pay structure. Strategists are on the front lines, tasked with cleaning up internal inequities *before* salaries become public knowledge. This legislative push directly increases the demand for skilled compensation professionals.

2. Diversity, Equity, and Inclusion (DEI): Pay equity has become a cornerstone of any credible DEI initiative. Companies are facing intense pressure from employees, investors, and the public to ensure they are paying people fairly, regardless of gender, race, or ethnicity. Compensation Strategists are now expected to be experts in conducting sophisticated statistical pay equity audits, identifying root causes of any identified gaps, and implementing remediation plans. This requires a new level of analytical rigor and sensitivity.

3. The Remote and Hybrid Work Revolution: The shift to remote work has shattered traditional, location-based pay models. This creates a massive strategic challenge: Do you pay a software engineer in Omaha the same as one in San Francisco? Companies are experimenting with different models:

- Location-Based Pay: Adjusting salary based on the employee's geographic location.

- National Rate: Paying a single rate for a role regardless of location.

- Hybrid Models: A blended approach.

Compensation Strategists are the architects of these new remote-work pay philosophies, a complex task that balances competitiveness, fairness, and budget constraints.

4. Data-Driven Decision Making: The "gut feeling" approach to compensation is dead. The future belongs to strategists who can leverage big data and analytics. This means using predictive modeling to forecast compensation costs, using AI tools to scrape market data in real-time, and presenting findings through compelling data visualizations. The skill set is evolving to be more like a data scientist's.

5. Focus on "Total Rewards": In a competitive talent market, salary is not enough. The focus is shifting to a holistic "total rewards" view that includes benefits, wellness programs, career development opportunities, and workplace flexibility. The Compensation & Equity Strategist is evolving into a "Total Rewards Strategist," responsible for designing an integrated package that appeals to a diverse workforce.

### How to Stay Relevant and Advance

To thrive in this evolving landscape and advance to senior leadership, you must be a lifelong learner. Here is actionable advice for career growth:

- Become a Data Guru: Don't just be good at Excel; strive for mastery. Learn advanced functions, pivot tables, and macros. Beyond that, invest time in learning data visualization tools like Tableau or Power BI. Taking an introductory course in a statistical language like R or Python will set you far apart from your peers.

- Follow the Law: Pay-related legislation is changing rapidly. Subscribe to legal blogs, HR news sites (like SHRM or HR Dive), and attend webinars on legal updates. Your ability to interpret and apply new laws is a core part of your value.

- Earn Your Certifications: As mentioned before, a CCP® is the table stakes for a serious career. Pursue advanced certifications like the ACCP™ or GRP® to signal your expertise and commitment to the profession.

- Develop Business Acumen: You must understand how your company makes money. Read your company's annual report. Sit in on sales meetings. Understand the key business metrics that drive success. When you can connect your compensation recommendations directly to business outcomes, you become a strategic partner, not just an HR functionary.

- Hone Your Communication Skills: Practice presenting complex data to non-experts. Join Toastmasters or take public speaking courses. Learn the art of negotiation and influence. Your career progression will depend as much on your ability to communicate your ideas as on the quality of the ideas themselves.

The career path is clear: from analyst to strategist, from manager to director, and for the most ambitious, to a Vice President of Total Rewards or even a Chief Human Resources Officer (CHRO). The demand is strong, and the challenges are fascinating.

How to Get Started in This Career

Breaking into the specialized field of compensation strategy requires a deliberate and focused approach. Unlike general HR or marketing roles, there are fewer direct entry points, so a clear plan is essential. Here is a step-by-step guide for aspiring professionals.

### Step 1: Build the Right Educational Foundation

Your journey begins with a strong academic background that signals your analytical and business capabilities.

- Choose a Relevant Undergraduate Major: Focus your studies in areas that will equip you with quantitative and organizational skills. The best choices are:

- Human Resources: Provides the essential context of employment law, talent management, and organizational behavior.

- Business Administration/Management: Offers a well-rounded view of how a company operates.

- Finance or Accounting: Builds the strong financial modeling and analytical skills that are critical for this role.

- Economics or Statistics: Develops the deep quantitative and research skills needed for market analysis and pay equity audits.

- Take Relevant Coursework: Regardless of your major, pack your schedule with courses in statistics, business law, microeconomics, corporate finance, and data analytics.

- Consider an Advanced Degree (Optional but Recommended): While not required to start, a Master's degree (MBA, MHR, etc.) can be a powerful accelerator later in your career. Many professionals choose to work for a few years before pursuing a graduate degree, often with tuition assistance from their employer.

### Step 2: Gain Initial Experience in a Related Role

Direct-entry "Compensation Analyst" roles for new graduates can be competitive. A common and effective strategy is to start in a broader HR or finance role to build foundational skills and experience, then pivot into compensation.

- Entry-Level HR Roles: Look for titles like HR Coordinator, HR Assistant, or HR Generalist. In these roles, you will be exposed to the entire employee lifecycle. Volunteer for any tasks related to payroll, benefits administration, or writing job descriptions. This demonstrates your interest and builds relevant experience.

- Recruiting Roles: As a recruiter or talent acquisition coordinator, you will gain firsthand experience with salary negotiations and market competitiveness. You'll learn what it takes to attract talent and where your company's pay stands relative to competitors.

- Entry-Level Finance/Data Analyst Roles: A role as a Financial Analyst or Business Analyst will hone your spreadsheet and data analysis skills to a razor's edge. After a year or two, you can market these highly transferable skills for a move into a compensation analyst position.

###