Of course. Here is a comprehensive, in-depth article on the salary of a Chief Compliance Officer, written in the requested tone and structure.

---

Decoding the Chief Compliance Officer Salary: A 2024 Guide

In an era of ever-increasing regulation and scrutiny, the role of the Chief Compliance Officer (CCO) has evolved from a back-office function to a critical C-suite position. These leaders are the ethical backbone of an organization, navigating complex legal landscapes to protect the company from risk. For those with the right skills and dedication, this vital role also comes with significant financial rewards, with top professionals earning well into the six figures.

This article will provide a comprehensive breakdown of a Chief Compliance Officer's salary, explore the key factors that dictate earning potential, and examine the career outlook for this essential profession.

What Does a Chief Compliance Officer Do?

A Chief Compliance Officer is a senior-level executive responsible for overseeing and managing an organization's compliance with laws, regulations, and internal policies. Their primary duty is to ensure the company operates in a legal and ethical manner.

Key responsibilities include:

- Developing and Implementing Policies: Creating and managing a company-wide compliance program.

- Monitoring and Auditing: Regularly reviewing business practices to identify and mitigate potential risks.

- Training and Education: Ensuring all employees understand their compliance obligations.

- Reporting: Communicating with senior leadership and the board of directors on compliance matters.

- Investigations: Leading internal investigations into any suspected violations of policy or law.

In essence, the CCO is the organization's guardian, protecting it from costly fines, legal penalties, and reputational damage.

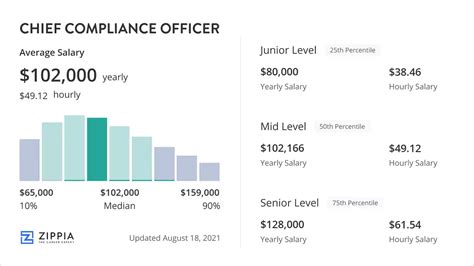

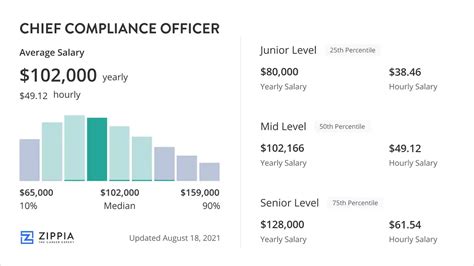

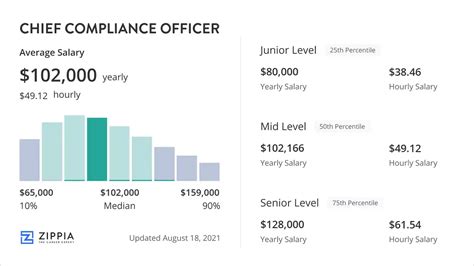

Average Chief Compliance Officer Salary

The compensation for a Chief Compliance Officer reflects the high level of responsibility and expertise required for the role. While salaries vary widely, the national averages point to a lucrative career path.

According to Salary.com, as of early 2024, the median annual salary for a Chief Compliance Officer in the United States is approximately $242,500. However, the typical salary range is quite broad, generally falling between $191,700 and $304,900.

Other reputable sources provide similar data, often emphasizing the importance of total compensation, which includes bonuses, profit-sharing, and equity:

- Payscale reports an average base salary of around $183,000, with total pay packages (including bonuses up to $50k+) pushing compensation significantly higher.

- Glassdoor lists a national average "total pay" for a Chief Compliance Officer at $226,000 per year, combining a base salary of around $168,000 with additional cash compensation of nearly $58,000.

It's clear that while the base salary is substantial, performance bonuses and other incentives play a major role in a CCO's overall earnings. The top 10% of earners in this field can command salaries well over $350,000 annually.

Key Factors That Influence Salary

The national average provides a useful benchmark, but an individual's actual salary is determined by a combination of critical factors. Understanding these variables is key for anyone aspiring to maximize their earning potential in this field.

###

Level of Education

A strong educational foundation is non-negotiable for a CCO. A bachelor's degree in business, finance, or a related field is the minimum requirement. However, advanced degrees significantly boost earning potential.

- Master's Degree: An MBA (Master of Business Administration) or a Master of Science in Law (MSL) can provide a competitive edge and lead to higher salary offers.

- Juris Doctor (JD): A law degree is highly valued and often a prerequisite for CCO roles in heavily regulated industries like finance and healthcare. The ability to interpret complex legislation makes candidates with a JD particularly sought after, allowing them to command premium salaries.

- Certifications: Professional certifications like the Certified Compliance & Ethics Professional (CCEP) signal a high level of expertise and can positively impact compensation.

###

Years of Experience

Experience is arguably the most significant driver of a CCO's salary. This is not an entry-level position; it is a senior executive role that requires a deep history of navigating complex compliance issues.

- Early Career (e.g., Compliance Manager, 5-9 years): Professionals with several years of experience in compliance roles can expect to earn a solid salary, but it will be well below the CCO level.

- Mid-Career (e.g., Director of Compliance, 10-15 years): As professionals gain more experience leading teams and managing larger programs, their salaries climb substantially, often into the mid-to-high $100s.

- Senior/Executive Level (CCO, 15+ years): CCOs at large, complex organizations typically have over 15 years of experience. This extensive track record of proven leadership and strategic risk management is what commands salaries in the $250,000+ range.

###

Geographic Location

Where you work matters. Salaries for CCOs are significantly higher in major metropolitan areas with a high cost of living and a concentration of large corporations. Top-paying cities often include:

- New York, NY

- San Francisco, CA

- Washington, D.C.

- Boston, MA

- Chicago, IL

The demand in these financial and tech hubs drives salaries upward, often 15-30% higher than the national average. Conversely, salaries in smaller cities and rural areas will typically be lower.

###

Company Type

The size and nature of the employing organization have a profound impact on a CCO's salary.

- Industry: The highest salaries are consistently found in heavily regulated, high-risk industries. Financial services (banking, investment firms), healthcare (pharmaceuticals, insurance), and technology are top-paying sectors due to the complexity and severity of their compliance obligations (e.g., SEC rules, HIPAA, GDPR).

- Company Size: Large, multinational corporations (e.g., Fortune 500 companies) have more complex compliance needs, greater risk exposure, and larger budgets. Consequently, they pay their CCOs significantly more than small or mid-sized businesses.

- Public vs. Private: Publicly traded companies face stringent reporting requirements from bodies like the Securities and Exchange Commission (SEC). This added layer of responsibility and risk for the CCO often translates into a higher salary compared to a similar role at a private company.

###

Area of Specialization

Within the broad field of compliance, certain specializations are in higher demand and command higher pay. A CCO with expertise in a high-stakes area is an invaluable asset. Hot fields include:

- Anti-Money Laundering (AML): Critical for all financial institutions.

- Data Privacy & Cybersecurity: With regulations like GDPR and CCPA, experts who can navigate data protection are highly sought after.

- Healthcare Compliance: Deep knowledge of HIPAA and other healthcare regulations is essential and well-compensated.

- Environmental, Social, and Governance (ESG): A rapidly growing area of focus for investors and regulators, increasing the demand for leaders who can build and manage ESG compliance programs.

Job Outlook

The future for compliance professionals is bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compliance Officers, in general, is expected to grow 3% from 2022 to 2032.

While this growth rate appears average, it's crucial to look beyond the number. The BLS data covers all compliance roles, not just the executive level. The demand for *senior-level* and *chief* compliance officers is expected to be much stronger. As global regulations expand, cybersecurity threats intensify, and ESG becomes a boardroom priority, the need for experienced, strategic CCOs will only continue to grow. Organizations recognize that investing in a top-tier CCO is essential for sustainable, long-term success.

Conclusion

The path to becoming a Chief Compliance Officer is a demanding one, requiring extensive education, deep experience, and unwavering ethical integrity. However, the rewards are commensurate with the challenges. This is a career that offers both significant financial compensation and the opportunity to play a pivotal role in a company's success and stability.

For aspiring professionals, the key takeaways are clear:

- An average CCO salary is well into the six-figure range, with top earners exceeding $350,000.

- Maximize your potential with advanced education (like a JD or MBA) and specialized certifications.

- Target high-paying industries like finance and healthcare in major metropolitan areas.

- Build a long and proven track record, as experience is the single most important factor.

For those with the right blend of legal acumen, business sense, and ethical fortitude, the role of Chief Compliance Officer represents a highly promising and lucrative pinnacle of the compliance profession.