Earning $20 per hour is a significant financial milestone for many professionals across the United States. It often represents a transition into roles that require specific skills, experience, or certifications, paving the way for a stable career and financial independence. But what does that hourly wage actually translate to over the course of a year?

Simply put, a $20 per hour wage equates to an annual salary of approximately $41,600. This figure can serve as a strong foundation, supporting a comfortable lifestyle in many parts of the country and acting as a launching point for a wide variety of promising careers.

In this guide, we'll break down the numbers, explore the types of jobs that pay in this range, and detail the key factors that can help you earn even more.

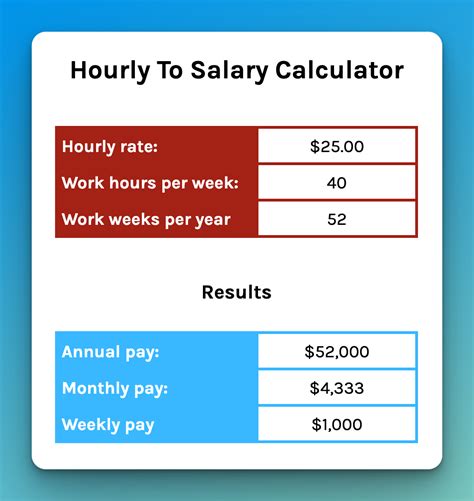

From Hourly Wage to Annual Salary: The Calculation

Understanding your annual income starts with a simple calculation. The standard formula assumes a full-time employee works 40 hours a week for 52 weeks a year.

The Math:

$20/hour × 40 hours/week = $800/week

$800/week × 52 weeks/year = $41,600/year

It's important to remember that this is your *gross income*—the amount you earn before taxes, health insurance premiums, retirement contributions, and other deductions are taken out. Your take-home pay, or *net income*, will be lower. This calculation also doesn't account for potential overtime pay, which could increase your annual earnings, or any unpaid time off, which could lower them.

Jobs That Typically Pay Around $20 Per Hour

A $20/hour wage is not tied to a single profession. It's a common pay rate for a diverse set of skilled jobs that are vital to our economy. These roles often require a high school diploma plus some specialized training, an associate's degree, or a few years of relevant experience.

Here are a few examples of professions where the median pay hovers around this mark, with data from the U.S. Bureau of Labor Statistics (BLS) and other reputable sources:

- Administrative and Executive Assistants: These professionals are the backbone of an office. The BLS reports a median pay of $21.90 per hour ($45,550 per year) as of May 2023.

- Medical Assistants: Working in clinics, hospitals, and private practices, Medical Assistants perform both administrative and clinical duties. The BLS lists their median pay at $18.99 per hour ($39,500 per year), with experienced assistants easily exceeding the $20/hour threshold.

- Bookkeeping, Accounting, and Auditing Clerks: These employees produce financial records for organizations. According to the BLS, their median pay was $22.34 per hour ($46,470 per year) in May 2023.

- Customer Service Representatives: While entry-level roles may start lower, experienced or specialized customer service professionals often earn in this range. Payscale reports the average hourly wage for a Customer Service Representative is $18.23, with the top 10% earning over $25/hour.

- Phlebotomists: Specialized clinical lab technicians who draw blood, Phlebotomists had a median pay of $19.51 per hour ($40,580 per year) according to the latest BLS data.

Key Factors That Influence Your Salary

Earning $20 per hour is a great goal, but it's rarely the ceiling. Several factors can significantly impact your earning potential, pushing your hourly wage well beyond this figure. Understanding these elements is key to advancing your career.

### Level of Education

While many jobs in the $20/hour range are accessible with a high school diploma and on-the-job training, further education is one of the most reliable ways to increase your income.

- Certifications: Industry-specific certifications (e.g., Certified Medical Assistant - CMA, Microsoft Office Specialist - MOS) validate your skills and can lead to a higher starting wage or a pay bump.

- Associate's Degree: A two-year degree in a field like accounting, IT support, or as a paralegal can open doors to jobs that start at or above $20/hour.

- Bachelor's Degree: A four-year degree typically qualifies you for professional roles with starting salaries that often exceed $50,000 per year ($24/hour), with much higher long-term earning potential.

### Years of Experience

Experience is a powerful negotiator. In nearly every field, demonstrated expertise is rewarded with higher pay.

- Entry-Level (0-2 years): You may start slightly below $20/hour as you learn the ropes.

- Mid-Career (3-8 years): With a proven track record, you can confidently command a wage in the $22-$28/hour range for the same or similar roles.

- Senior/Experienced (8+ years): Senior professionals or those who have moved into supervisory roles can often earn $30/hour or more. For example, according to Salary.com, the top 10% of Executive Assistants in the U.S. earn over $89,000 annually (or ~$43/hour).

### Geographic Location

Where you live is one of the biggest determinants of your salary. A $20/hour wage offers a very different standard of living in a rural town versus a major metropolitan area. Companies adjust their pay scales based on the local cost of living and competition for talent.

- High Cost of Living (HCOL) Areas: In cities like New York, San Francisco, or Boston, a role that pays $20/hour in a smaller city might pay $25-$30/hour to compensate for higher housing, food, and transportation costs.

- Low Cost of Living (LCOL) Areas: Conversely, in states like Mississippi, Arkansas, or Alabama, $20/hour ($41,600/year) can provide a very comfortable lifestyle, as the average cost of living is significantly lower than the national average.

### Company Type

The size, industry, and financial health of your employer play a crucial role in compensation.

- Large Corporations: Major companies often have structured pay bands and more comprehensive benefits packages (health insurance, 401(k) matching), which add to your total compensation. They may offer higher hourly wages to attract top talent.

- Small Businesses & Non-Profits: These organizations may offer wages at or slightly below the market average due to tighter budgets. However, they can provide other benefits, like a better work-life balance or a stronger sense of community.

- Startups: A tech or biotech startup might offer a competitive wage plus stock options, which could become highly valuable if the company succeeds.

### Area of Specialization

Developing a niche skillset can make you a more valuable and higher-paid employee. A generalist may earn a solid wage, but a specialist often earns a premium. For example:

- A general Administrative Assistant might earn $21/hour.

- An Executive Assistant supporting C-level executives requires greater discretion and skill and often earns $30+/hour.

- A Legal Assistant or Paralegal, with specialized knowledge of the legal system, has a median pay of $28.53 per hour, according to the BLS.

Job Outlook

The future is bright for many of the professions that command a $20/hour wage. The U.S. Bureau of Labor Statistics projects strong growth in several of these key sectors through 2032.

- Healthcare Support Occupations: The BLS projects this field to grow much faster than the average for all occupations, with hundreds of thousands of new jobs being created. The demand for Medical Assistants, for example, is projected to grow by 14%, a rate much faster than average.

- Administrative Roles: While some clerical roles may see slower growth due to automation, the need for skilled Administrative and Executive Assistants remains constant across every industry.

- Skilled Trades and Technicians: Roles like IT Support Specialists and other technical positions continue to be in high demand as technology becomes more integrated into our lives.

Conclusion: Your Path Forward

Earning $20 per hour, or an annual salary of $41,600, is a fantastic achievement that places you in a position of financial stability. It is the backbone of the American workforce, representing a diverse array of skilled and essential jobs.

Your key takeaways should be:

1. Know Your Worth: $41,600/year is the baseline for a full-time, $20/hour job.

2. Many Paths Lead Here: From healthcare to administration to finance, numerous career paths offer this level of pay.

3. Growth is Within Your Control: You are not locked into this wage. By investing in your education, gaining experience, specializing your skills, and making strategic career moves, you can significantly increase your earning potential.

Use this information not just as a benchmark, but as a roadmap. Analyze where you are, identify your goals, and take proactive steps to build the career and the income you deserve.