For detail-oriented individuals with a knack for numbers and organization, a career as an Accounts Payable (AP) Specialist is a stable and rewarding path. But beyond job satisfaction, what can you expect to earn? This role, critical to the financial health of any organization, offers a competitive salary that can grow significantly with the right skills and experience.

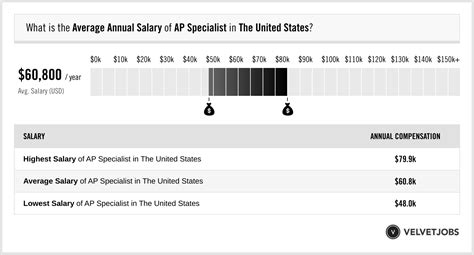

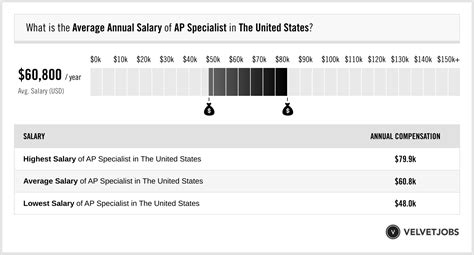

An AP Specialist can expect to earn a national average salary between $55,000 and $60,000 per year, with entry-level positions starting in the mid-$40,000s and senior specialists in high-demand areas commanding upwards of $75,000.

This article will break down the AP Specialist salary, explore the key factors that influence your pay, and look at the future of this essential profession.

What Does an AP Specialist Do?

Before we dive into the numbers, let's clarify the role. An Accounts Payable Specialist is the gatekeeper of a company's outbound cash flow. They ensure that all company bills and invoices are legitimate, accurate, and paid on time. Their core responsibilities are crucial for maintaining good vendor relationships, managing budgets, and preventing fraud.

Key duties often include:

- Receiving, processing, and verifying invoices.

- Reconciling purchase orders with invoices.

- Preparing and processing electronic transfers, wires, and checks.

- Managing vendor files and responding to vendor inquiries.

- Ensuring compliance with company policies and tax regulations (like W-9s).

- Assisting with month-end closing procedures.

Average AP Specialist Salary

Salary data shows a consistent and promising range for AP professionals. While the exact figure varies, multiple authoritative sources provide a clear picture of the earning landscape.

- Average Salary: According to Salary.com, as of late 2023, the median salary for an Accounts Payable Specialist in the United States is $58,010.

- Typical Range: The same data shows that the majority of AP Specialists earn between $51,755 and $65,516. This range often reflects differences in experience, location, and company size.

- Broader Context: The U.S. Bureau of Labor Statistics (BLS) groups AP Specialists under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." For this group, the median annual wage was $47,440 in May 2022. It's important to note that this BLS category includes a wide variety of clerical roles, and specialized AP positions within medium to large companies typically command higher salaries, as reflected in the data from salary aggregators.

Key Factors That Influence Salary

Your base salary is not a fixed number. It’s a dynamic figure influenced by several critical factors. Understanding these can empower you to negotiate a better salary and guide your career development.

### Level of Education and Certification

While a four-year degree is not always a strict requirement, your educational background plays a significant role.

- Baseline: Most positions require a high school diploma or GED, coupled with some relevant experience.

- Advantage: An Associate's or Bachelor's degree in Accounting, Finance, or a related business field can lead to higher starting salaries and faster advancement. It provides a foundational understanding of accounting principles that is highly valued.

- Certifications: This is where you can truly stand out. Professional certifications demonstrate a high level of commitment and expertise. The two most recognized certifications for AP professionals are:

- Accredited Payables Specialist (APS): An excellent credential for those starting their career.

- Certified Accounts Payable Professional (CAPP): A more advanced certification for experienced managers and leaders in the field.

Holding these certifications can significantly boost earning potential and qualify you for senior or leadership roles.

### Years of Experience

Experience is arguably the most significant driver of salary growth in the AP field. Employers pay a premium for professionals who can handle complex issues with minimal supervision.

- Entry-Level (0-2 years): Professionals in this stage typically earn at the lower end of the salary range, often from $45,000 to $52,000. Their focus is on mastering core tasks like data entry and invoice processing.

- Mid-Career (3-5 years): With solid experience, specialists can expect to earn closer to the national average of $55,000 to $65,000. They take on more complex reconciliations, manage key vendor accounts, and may assist in training new team members.

- Senior/Lead (5+ years): Highly experienced specialists or AP leads can command salaries from $65,000 to $75,000+. These professionals often manage entire AP processes, implement new software (like ERP systems), and play a strategic role in cash flow management.

### Geographic Location

Where you work matters. Salaries for AP Specialists are adjusted based on the local cost of living and the demand for financial professionals in that market.

- High-Paying Metropolitan Areas: Major cities with high costs of living and a concentration of large corporate headquarters tend to offer the highest salaries. According to Glassdoor data, cities like San Francisco, CA; San Jose, CA; New York, NY; and Boston, MA, often pay 15-30% above the national average.

- Average-Paying Regions: Most other metropolitan and suburban areas across the country will offer salaries that hover close to the national median.

- Lower-Paying Regions: Rural areas and states with a lower cost of living will typically have salaries on the lower end of the spectrum.

### Company Type

The size and industry of your employer can have a major impact on your paycheck.

- Company Size: Large, multinational corporations often have more complex payables systems and larger transaction volumes, justifying higher salaries. According to the 2024 Robert Half Salary Guide, AP Specialists at large companies (over $500 million in revenue) can earn significantly more than their counterparts at small companies (under $50 million in revenue).

- Industry: Industries like technology, biotechnology, finance, and legal services often pay more due to higher revenue streams and more complex accounting requirements. In contrast, non-profit, retail, or hospitality industries may offer salaries that are closer to or slightly below the national average.

### Area of Specialization

As the AP function becomes more strategic, specialists with niche skills are in high demand. Developing expertise in a specific area can set you apart and increase your value.

- Systems Expertise: Proficiency in major Enterprise Resource Planning (ERP) systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is a highly sought-after skill.

- Process Improvement: Specialists who can analyze AP workflows and implement automation to improve efficiency are invaluable.

- International Payments: Experience with foreign currency transactions, international banking regulations, and global vendor management is a lucrative specialization, especially in global companies.

Job Outlook

The U.S. Bureau of Labor Statistics projects a 5% decline in employment for bookkeeping, accounting, and auditing clerks from 2022 to 2032. However, this statistic requires a nuanced interpretation.

The decline is primarily driven by the automation of routine, data-entry-level tasks. The role of the AP Specialist is not disappearing; it is evolving. Companies still need skilled professionals to manage these automated systems, handle exceptions, perform analytical reviews, ensure compliance, and manage vendor relationships.

The future of the AP profession belongs to those who adapt. By embracing technology, pursuing certifications, and developing analytical skills, you position yourself as a strategic asset rather than a data entry clerk. The BLS still projects about 158,500 openings for these roles each year, on average, over the decade, primarily to replace workers who retire or move to different occupations.

Conclusion

A career as an Accounts Payable Specialist offers a stable foundation with clear pathways for financial and professional growth. While a starting salary may be modest, your earning potential is directly in your control.

To maximize your salary, focus on these key takeaways:

- Build a Strong Foundation: Supplement your experience with an associate's or bachelor's degree if possible.

- Get Certified: Pursue an APS or CAPP certification to validate your skills and boost your income.

- Embrace Technology: Become an expert in your company's ERP and automation software.

- Target Growth Areas: Consider opportunities in high-paying geographic locations and industries.

For the meticulous and motivated professional, the Accounts Payable field is not just a job—it's a career with a bright and profitable future.