The role of an Assistant Controller is a critical stepping stone for any ambitious accounting professional aiming for the C-suite. As a key player in the finance department, this position offers significant responsibility, career growth, and, importantly, strong earning potential. For those eyeing this role, a common and crucial question arises: What salary can you expect as an Assistant Controller?

While the answer varies, the financial prospects are promising. Across the United States, an Assistant Controller can expect a salary typically ranging from $90,000 to over $160,000 annually, with many factors influencing where you'll land on that spectrum.

This in-depth guide will break down the average Assistant Controller salary, explore the key variables that dictate your pay, and provide a clear outlook on this rewarding career path.

What Does an Assistant Controller Do?

Before diving into the numbers, it's essential to understand the scope of the role. The Assistant Controller is the direct support for the Corporate Controller and is deeply involved in the day-to-day management of the accounting department. Think of them as the operational leader of the accounting function.

Key responsibilities often include:

- Overseeing Financial Reporting: Assisting in the preparation of accurate and timely financial statements (e.g., balance sheets, income statements).

- Managing the Month-End Close: Leading the process to close the books each month, ensuring all transactions are recorded correctly.

- Supervising Staff: Managing a team of accountants, including accounts payable, accounts receivable, and general ledger staff.

- Ensuring Compliance & Internal Controls: Maintaining and improving internal controls to prevent errors and fraud, and ensuring compliance with regulations like Sarbanes-Oxley (SOX).

- Supporting Audits: Acting as a key point of contact for external auditors during annual audits.

Average Assistant Controller Salary

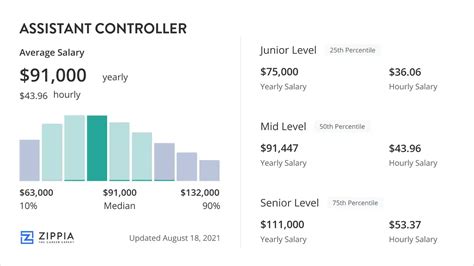

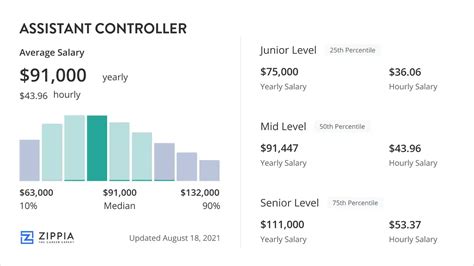

Based on data from leading compensation resources, the average base salary for an Assistant Controller in the United States typically falls between $105,000 and $130,000 annually.

However, a simple average doesn't tell the whole story. The complete salary range is much wider, reflecting differences in experience, location, and company size.

- A more comprehensive salary range, including entry-level and senior positions, spans from approximately $90,000 to $165,000+.

- Salary.com, a trusted source for compensation data, reports that the median Assistant Controller salary in the U.S. is approximately $129,500 as of late 2023, with a common range between $115,280 and $145,560.

- Glassdoor indicates an average base pay of around $111,000 per year, based on user-submitted data.

- Payscale shows a similar average base salary of about $92,000, with a reported range from $68,000 to $124,000, which may reflect smaller companies or professionals earlier in their career path.

These figures represent base salary and often do not include bonuses, profit-sharing, or stock options, which can add another 10-20% to total compensation, especially in larger, public companies.

Key Factors That Influence Salary

Your specific salary will be determined by a combination of powerful factors. Understanding these levers is the key to maximizing your earning potential.

### Level of Education

A bachelor's degree in accounting, finance, or a related field is the standard entry requirement. However, advanced credentials are what truly unlock higher salary brackets.

- Master's Degree: A Master of Business Administration (MBA) or a Master of Accountancy (MAcc) can provide a competitive edge. It signals advanced knowledge in financial strategy, leadership, and technical accounting, often justifying a higher starting salary.

- CPA Certification: The Certified Public Accountant (CPA) license is the gold standard in the accounting industry. For many mid-to-large-sized companies, it is a non-negotiable requirement for an Assistant Controller. Holding a CPA can result in a salary premium of 5% to 15% and opens the door to the most lucrative opportunities.

### Years of Experience

Experience is arguably the most significant driver of salary growth. Companies pay for proven expertise. The path to Assistant Controller is not an entry-level one; it typically requires 5-10 years of progressive accounting experience.

- Early Career (5-7 years of experience): A professional moving from a Senior Accountant role into their first Assistant Controller position might earn in the $90,000 to $115,000 range.

- Mid-Career (8-12 years of experience): With a proven track record of managing month-end closes and supervising small teams, an Assistant Controller can expect to earn between $115,000 and $140,000.

- Senior Level (12+ years of experience): Highly experienced professionals with expertise in complex accounting systems, SEC reporting, and team leadership can command salaries of $140,000+.

### Geographic Location

Where you work matters—a lot. Salaries are adjusted based on the local cost of living and the demand for financial talent in that market.

- High-Paying Metro Areas: Major financial and tech hubs like San Francisco, San Jose, New York City, Boston, and Washington D.C. consistently offer the highest salaries, often 20-35% above the national average.

- Average-Paying Areas: Most other major metropolitan areas across the country will fall closer to the national average.

- Lower-Paying Areas: Rural communities and states with a lower cost of living will typically offer salaries on the lower end of the national spectrum.

For example, an Assistant Controller in New York City may earn $155,000 for the same job that pays $110,000 in a smaller Midwestern city.

### Company Type

The size, industry, and structure of a company heavily influence its compensation philosophy.

- Company Size: Large, multinational corporations (e.g., Fortune 500) with billions in revenue have more complex accounting needs and larger budgets, leading to higher salaries. Small and medium-sized businesses (SMBs) typically offer lower base salaries, though they may provide other benefits like better work-life balance or equity.

- Industry: High-growth, high-margin industries like technology, biotechnology, and financial services tend to pay more to attract top talent. Manufacturing, non-profit, and government sectors may offer more modest compensation packages.

- Public vs. Private: Publicly traded companies face stringent SEC reporting requirements and Sarbanes-Oxley (SOX) compliance rules. The expertise required to navigate this complexity means that Assistant Controllers at public companies generally earn more than their counterparts at private companies of a similar size.

### Area of Specialization

Within the accounting field, certain high-demand skills can further boost your salary. If you have demonstrable experience in any of the following, you become a more valuable candidate:

- Technical Accounting: Expertise in complex topics like revenue recognition (ASC 606), lease accounting (ASC 842), or mergers and acquisitions (M&A).

- Systems Implementation: Experience leading or playing a key role in the implementation of a new Enterprise Resource Planning (ERP) system like NetSuite, SAP, or Oracle.

- SEC Reporting: Direct experience preparing and filing forms 10-K and 10-Q for a public company.

Job Outlook

The career outlook for skilled accounting professionals is stable and positive. According to the U.S. Bureau of Labor Statistics (BLS), employment for Accountants and Auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

The BLS notes that globalization, a growing economy, and a complex tax and regulatory environment will continue to drive demand for accountants. As companies grow, the need for capable financial leaders like Assistant Controllers to manage this complexity will remain constant, ensuring strong job security for qualified individuals.

Conclusion

Becoming an Assistant Controller is a significant achievement that places you on a direct path toward senior financial leadership. The role offers not only professional fulfillment but also a substantial and growing salary.

Key Takeaways for Maximizing Your Salary:

1. Aim for the CPA: It is the single most impactful credential for unlocking top-tier roles and salaries.

2. Build Progressive Experience: Focus on gaining management experience, mastering the month-end close, and understanding internal controls.

3. Be Strategic About Industry and Location: Targeting high-growth industries in major metropolitan areas can significantly accelerate your earning potential.

4. Develop Specialized Skills: Expertise in technical accounting or systems implementation will make you a highly sought-after candidate.

For dedicated accounting professionals, the Assistant Controller position represents a financially rewarding and professionally challenging career with a bright and stable future.