For individuals with strong interpersonal skills and a keen interest in finance, a career as a Relationship Banker at a major institution like Bank of America offers a compelling path. It's a role that blends customer service, sales, and financial guidance, providing a stable foundation for a long-term career in the banking industry. But what is the earning potential?

A career as a Relationship Banker at Bank of America can be financially rewarding, with a total compensation package that often exceeds the base salary thanks to performance-based incentives. While a typical base salary might range from $48,000 to $70,000, high-performing bankers in prime locations can see their total earnings climb to $90,000 or more.

This article will break down the salary expectations for a Bank of America Relationship Banker, explore the key factors that influence your pay, and examine the job outlook for this dynamic profession.

What Does a Relationship Banker at Bank of America Do?

Before diving into the numbers, it's essential to understand the role. A Relationship Banker is the primary point of contact for clients within a Bank of America financial center. They are more than just a teller or customer service representative; they are proactive financial partners.

Key responsibilities include:

- Deepening Client Relationships: Understanding a client's complete financial picture—from checking accounts to long-term goals like buying a home or saving for retirement.

- Identifying Needs and Offering Solutions: Proactively recommending Bank of America products and services, such as credit cards, mortgages, auto loans, and investment referrals.

- Onboarding New Clients: Opening accounts and seamlessly integrating new customers into the Bank of America ecosystem.

- Achieving Sales and Referral Goals: Meeting specific targets for new accounts, loans, and referrals to specialized partners like Merrill Lynch financial advisors.

- Problem Resolution: Handling complex customer issues and ensuring a high level of client satisfaction.

Essentially, their goal is to grow their clients' business with the bank, acting as a trusted and knowledgeable advisor.

Average Bank of America Relationship Banker Salary

The compensation for a Relationship Banker is typically structured with a solid base salary plus a significant variable component based on performance.

According to an analysis of data from leading salary aggregators like Glassdoor, Payscale, and Salary.com, the average base salary for a Relationship Banker at Bank of America falls within the range of $55,000 to $65,000 per year.

However, the base salary is only part of the story. The total compensation, which includes bonuses, commissions, and other incentives, is a more accurate measure of earning potential.

- Typical Salary Range (Base): $48,000 to $70,000

- Average Total Compensation (Base + Incentives): $70,000 to $90,000+

Entry-level positions will start at the lower end of this spectrum, while experienced, high-performing bankers in major metropolitan areas will command salaries at the top end.

Key Factors That Influence Salary

Several key factors determine where you will fall on the salary spectrum. Understanding these variables is crucial for maximizing your earning potential throughout your career.

###

Years of Experience

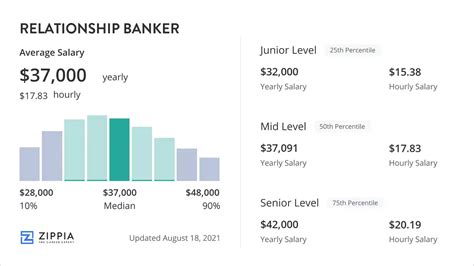

Experience is one of the most significant drivers of salary growth in this role. As you build a track record of meeting goals and developing a strong client portfolio, your value to the bank increases.

- Entry-Level (0-2 Years): Bankers new to the role can expect a base salary in the $48,000 to $58,000 range. The focus during this period is on learning the bank's products, mastering compliance procedures, and building foundational sales skills.

- Mid-Career (3-5 Years): With a proven ability to meet and exceed sales targets, mid-career Relationship Bankers can expect their base salary to rise to the $59,000 to $68,000 range. Their variable compensation often sees a significant increase during this time.

- Senior/Experienced (5+ Years): Senior Relationship Bankers who manage high-value client portfolios or take on mentorship roles can earn a base salary of $70,000 or more. Their total compensation, driven by consistent high performance, can easily exceed $90,000.

###

Geographic Location

Bank of America, like all major national employers, adjusts its pay scales based on the cost of living and market competition in different regions. A position in a major financial hub will pay substantially more than the same role in a lower-cost rural area.

- High-Cost-of-Living Areas: In cities like New York, San Francisco, Los Angeles, and Boston, salaries can be 15-25% higher than the national average to account for the higher cost of living.

- Medium-to-Low-Cost-of-Living Areas: In smaller cities and suburban locations, salaries will align more closely with the national average.

When considering a role, it's important to research the specific salary bands for your metropolitan area.

###

Level of Education

For a Relationship Banker role, a bachelor's degree is typically preferred, especially in fields like finance, business, economics, or communications. While an advanced degree like an MBA isn't necessary for this specific role, it can be a significant advantage for long-term career progression into management or more specialized wealth management positions. For securing an entry-level position, a four-year degree demonstrates commitment and a foundational knowledge base that employers value.

###

Area of Specialization

Within the Relationship Banker role, opportunities for specialization can directly impact your earnings. Bankers who acquire additional licenses or focus on specific client segments often have higher earning potential.

- Licensing: Relationship Bankers who obtain financial licenses, such as the SIE (Securities Industry Essentials), Series 6, and Series 63, are able to discuss and sell certain investment products. This capability opens up additional revenue streams and significantly increases bonus potential.

- Client Focus: Some bankers may specialize in serving small business clients or mass-affluent customers (those with a higher net worth). These segments often involve more complex financial needs and larger transactions, leading to higher compensation.

###

Company Type

While this article focuses on Bank of America, it's helpful to understand its position in the market. As one of the largest "bulge bracket" banks in the world, Bank of America offers a highly structured and competitive compensation package designed to attract and retain top talent. The emphasis on performance-based incentives is typical of large, sales-driven financial institutions. This often contrasts with smaller community banks or credit unions, which may offer a slightly lower salary ceiling but potentially a different work-life balance.

Job Outlook

The career outlook for skilled banking professionals is strong. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Services Sales Agents—a category that includes Relationship Bankers—is expected to grow 10% from 2022 to 2032, which is much faster than the average for all occupations.

The BLS attributes this growth to several factors, including the increasing complexity of financial products and the growing need for individuals to seek professional advice for retirement planning and investment management. This indicates a sustained demand for skilled Relationship Bankers who can build trust and provide valuable guidance.

Conclusion

A career as a Relationship Banker at Bank of America offers a clear path to a comfortable and rewarding financial future. For those considering this profession, here are the key takeaways:

- Think Total Compensation: Your earning potential is a combination of a competitive base salary and significant performance-based bonuses.

- Experience is Key: Your salary will grow substantially as you gain experience and demonstrate a consistent ability to meet your goals.

- Location Matters: Expect higher pay in major metropolitan financial centers.

- Specialize and Get Licensed: Obtaining financial licenses to sell investment products is a direct path to higher earnings.

- The Future is Bright: The demand for skilled financial professionals is strong, promising long-term job security and growth.

For the ambitious and personable individual, the Relationship Banker role at Bank of America is more than just a job—it's the first step in a promising and lucrative career in the world of finance.