So, you’re drawn to the world of finance—the high stakes, the intellectual challenge, and, of course, the significant earning potential. You've heard the term "Associate Banker" and are curious: what does it truly mean for your career and your wallet? Is it the key to a seven-figure future or a demanding role with a more modest, albeit respectable, income? The answer, as with most things in finance, is complex and depends heavily on where you work, what you do, and who you know.

The path of a banker is one of ambition, rigor, and immense opportunity. A successful associate banker is not just a number cruncher; they are a trusted advisor, a sharp analyst, and a strategic partner to their clients. While the average base salary for an associate banker in the United States hovers around $85,000 to $120,000 per year, this figure is just the tip of the iceberg. In the high-octane world of investment banking, total compensation for an associate can easily soar past $300,000 or even $400,000 with bonuses.

I remember mentoring a young professional who had just landed an associate role at a mid-sized commercial bank. She was brilliant and driven but fixated on the investment banking salaries she read about online, feeling she was already "behind." I had to remind her that a career is a marathon, not a sprint, and that her role in helping local businesses secure capital was creating tangible value in her community—a reward that can't always be measured in a year-end bonus. This guide is built on that same principle: to give you the complete, unvarnished truth about an associate banker salary, covering all its facets so you can chart a path that aligns with your financial goals *and* your professional aspirations.

This comprehensive guide will serve as your blueprint, exploring everything from the day-to-day responsibilities and salary breakdowns to the critical factors that will shape your earning potential for years to come.

### Table of Contents

- [What Does an Associate Banker Do?](#what-does-an-associate-banker-do)

- [Average Associate Banker Salary: A Deep Dive](#average-associate-banker-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is This the Right Career for You?](#conclusion-is-this-the-right-career-for-you)

What Does an Associate Banker Do?

Before we can talk numbers, it's crucial to understand that the title "Associate Banker" is not a monolith. Its meaning, responsibilities, and, consequently, its salary, vary dramatically depending on the sector of banking you're in. Broadly, we can categorize the role into three main areas: Retail Banking, Commercial Banking, and Investment Banking.

1. Retail Banking Associate (or Personal Banker):

This is the role most people are familiar with. A retail associate works in a local bank branch, directly serving individual customers. They are the face of the bank, building relationships and helping clients with their day-to-day financial needs.

- Core Responsibilities:

- Opening and managing checking and savings accounts.

- Advising clients on personal loans, mortgages, and credit cards.

- Identifying customer needs and cross-selling other bank products like certificates of deposit (CDs), retirement accounts (IRAs), or basic investment products.

- Handling customer service issues and ensuring a positive client experience.

- Processing transactions and adhering to strict compliance and regulatory procedures.

2. Commercial Banking Associate:

A step up in complexity, commercial banking associates work with business clients, from small local businesses to large corporations. Their focus is on providing financial solutions that help these companies operate, grow, and manage their finances.

- Core Responsibilities:

- Analyzing a company's financial statements (income statement, balance sheet, cash flow statement) to assess creditworthiness.

- Structuring and underwriting business loans, lines of credit, and commercial real estate financing.

- Managing a portfolio of business clients, acting as their primary point of contact at the bank.

- Assisting senior relationship managers with due diligence and client presentations.

- Providing services like treasury and cash management to help companies optimize their cash flow.

3. Investment Banking Associate:

This is the most demanding, competitive, and lucrative of the associate banker roles. Investment banking associates work on high-stakes, complex transactions for large corporations, financial institutions, and governments. This is the world of Wall Street, long hours, and multi-million-dollar deals.

- Core Responsibilities:

- Financial Modeling: Building intricate financial models from scratch to value companies (Discounted Cash Flow, Comparable Company Analysis, Precedent Transactions) for mergers, acquisitions, and IPOs.

- Due Diligence: Conducting exhaustive research on companies and industries to identify risks and opportunities ahead of a transaction.

- Pitch Book and Presentation Creation: Creating detailed presentations (pitch books) for senior bankers to use when pitching ideas to clients.

- Transaction Execution: Managing the deal process from start to finish, coordinating with lawyers, accountants, and other parties.

- Managing Analysts: Overseeing the work of junior analysts, who typically handle the initial data gathering and model building.

### A Day in the Life of an Investment Banking Associate

To make this tangible, let's walk through a hypothetical day for an associate in a Mergers & Acquisitions (M&A) group.

- 8:30 AM: Arrive at the office. Scan emails that came in overnight from senior bankers and clients. Immediately start updating a financial model based on new client data that arrived late last night.

- 10:00 AM: Join a conference call with the client's management team and the legal team to discuss due diligence findings for a potential acquisition. Take detailed notes and identify key follow-up items for the analyst on the team.

- 12:30 PM: Grab a quick lunch at your desk while reviewing the analyst’s work on a new pitch book for a meeting tomorrow. You notice a few formatting errors and an assumption in the valuation that needs to be double-checked.

- 2:00 PM: Your Managing Director (MD) stops by. The client for tomorrow's meeting wants to see an additional analysis on a potential divestiture. This means a new model needs to be built, and it's a top priority.

- 4:00 PM - 8:00 PM: Deep focus mode. You and your analyst work together to build the new divestiture model. You are in Excel, building out scenarios, checking formulas, and ensuring every number ties out.

- 8:30 PM: The team orders dinner to the office. You eat while on another call, this time with a different client in a later time zone.

- 10:00 PM: You send the first draft of the new analysis to your Vice President (VP) for review. They send back comments within an hour.

- 11:30 PM - 2:00 AM: You incorporate the VP’s feedback, refine the presentation slides, and send the final version to the team. You do a final check of your emails before heading home, knowing you need to be back in the office in six hours for the big client meeting.

This example highlights the intensity of the investment banking track. A commercial or retail associate's day is more structured and typically aligns with standard business hours, but the pressure to meet sales goals or manage complex client relationships is still very present.

Average Associate Banker Salary: A Deep Dive

Now for the central question: what can you expect to earn? As established, the salary for an "associate banker" is a story told in chapters, with each banking sector writing its own. We will break down compensation into base salary (your guaranteed income) and variable compensation (bonuses, profit sharing), which can often be larger than the base salary, especially in investment banking.

All data presented is based on the latest available information from 2023 and early 2024 from authoritative sources like Salary.com, Glassdoor, Payscale, and reports from specialized financial recruiting firms like Johnson Associates and Wall Street Oasis.

### Disambiguation: The "Associate" Title

It's critical to understand that the title "Associate" signifies different levels of seniority in different banking worlds.

- In Retail and Commercial Banking, an "Associate" is often a junior to mid-level role, requiring a bachelor's degree and 2-5 years of experience.

- In Investment Banking, "Associate" is a specific rung on the ladder. It is a *post-Analyst* role. Professionals are typically promoted after 2-3 years as an Analyst or hired directly into the role after completing an MBA from a top business school.

This distinction is the single most important factor in the vast salary differences.

### Salary Breakdown by Banking Sector

Let's dissect the numbers for each of the three main banking tracks.

#### 1. Retail Banking Associate Salary

Retail associates have the most predictable but lowest overall compensation. Their pay is heavily influenced by sales commissions and branch performance.

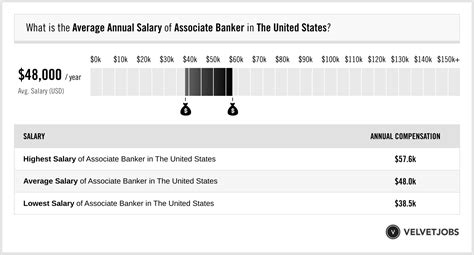

- Average Base Salary: According to Salary.com, the average base salary for a Personal Banker (a common title for this role) in the U.S. is $45,000 to $65,000 as of early 2024.

- Total Compensation Range: With commissions and small bonuses, total compensation typically falls between $50,000 and $80,000.

- Variable Pay: Bonuses are modest, often tied to meeting quarterly sales quotas for new accounts, loans, or investment referrals. They might range from $2,000 to $10,000 annually.

#### 2. Commercial Banking Associate Salary

Commercial banking offers a significant step up in compensation, reflecting the increased complexity and analytical rigor required.

- Average Base Salary: Data from Glassdoor and Payscale indicates an average base salary range of $75,000 to $110,000 for a Commercial Banking Associate or Credit Analyst.

- Total Compensation Range: Including bonuses, total compensation typically ranges from $90,000 to $150,000. Senior associates at large money-center banks can push this higher.

- Variable Pay: Bonuses are more structured than in retail banking and are tied to the performance of the associate's loan portfolio and the bank's overall profitability. A typical annual bonus is 15-30% of the base salary.

#### 3. Investment Banking Associate Salary

This is where compensation becomes truly stratospheric. Investment banking associates are highly compensated for their elite educational backgrounds, specialized skills, and grueling work hours. The numbers below are for associates at major banks (Bulge Brackets or Elite Boutiques) in major financial hubs.

- Average Base Salary: For a first-year associate (either newly hired from an MBA program or promoted from Analyst), the base salary is highly standardized across Wall Street. As of 2024, this is typically $175,000. This can increase to $200,000 for a second-year and $225,000 for a third-year associate.

- Variable Pay (The Bonus): The year-end bonus is the most significant part of the compensation. It is highly variable and depends on individual performance, group performance, and the bank's overall deal flow for the year.

- First-Year Associate Bonus: $90,000 to $150,000

- Second-Year Associate Bonus: $120,000 to $200,000

- Third-Year Associate Bonus: $150,000 to $250,000+

- All-In Total Compensation Range:

- Year 1: $265,000 to $325,000

- Year 2: $320,000 to $425,000

- Year 3: $375,000 to $500,000+

### Compensation Comparison Table: Experience Levels

| Career Stage | Banking Sector | Typical Base Salary Range | Typical Total Compensation Range | Notes |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Retail Banking | $45k - $55k | $50k - $65k | 0-2 years experience. |

| (0-3 years) | Commercial Banking | $70k - $90k | $80k - $110k | Often titled "Credit Analyst". |

| | Investment Banking | $175k (Year 1 Assoc.) | $265k - $325k | Requires MBA or promotion from Analyst. |

| Mid-Career | Retail Banking | $55k - $70k | $65k - $90k | Often a "Senior Personal Banker" or Branch Manager. |

| (4-8 years) | Commercial Banking | $90k - $120k | $110k - $160k | Titled "Associate" or "AVP". |

| | Investment Banking | $200k - $225k (Yr 2-3 Assoc.)| $320k - $500k | Progression to "Vice President" (VP) happens after ~3 years. |

| Senior-Level | Retail Banking | $70k+ | $90k - $120k+ | Branch Manager, Regional Manager. |

| (8+ years) | Commercial Banking | $120k - $160k+ | $160k - $250k+ | Senior Relationship Manager or VP. |

| | Investment Banking | $250k - $275k+ (VP Level) | $500k - $800k+ | Base salary + large bonus. |

*Sources: Glassdoor, Salary.com, Wall Street Oasis Compensation Reports (2023). Data is for major U.S. markets and can vary.*

### Beyond Salary and Bonus: Other Compensation Components

- Signing Bonus: Common in investment banking for new MBA hires, often ranging from $50,000 to $70,000 to help with relocation and tuition loan repayment.

- Stub Bonus: New hires starting mid-year often receive a prorated "stub" bonus at the end of their first calendar year.

- Profit Sharing & 401(k) Matching: Standard across all banking sectors, though the matching percentages can be more generous at larger institutions.

- Health and Wellness Benefits: Premium health insurance, gym memberships, and mental health resources are common perks, especially in high-stress investment banking roles.

- Carried Interest / Equity: While not typical for associates, this becomes a significant factor at the senior levels (VP, Director, MD) in investment banking and especially in the private equity firms that many bankers transition to.

Key Factors That Influence Salary

Your salary is not a static number determined solely by your job title. It’s a dynamic figure shaped by a powerful combination of your qualifications, location, and the specific nature of your work. Understanding these levers is the key to maximizing your earning potential throughout your career.

###

Level of Education

Your educational background is the foundation upon which your finance career is built. It acts as a primary signaling mechanism to employers, especially early in your career.

- Bachelor's Degree: For retail and commercial banking, a bachelor's degree in Finance, Economics, Accounting, or a related business field is the standard requirement. A high GPA (3.5+) from a well-regarded state or private university is essential for breaking into competitive commercial banking programs.

- Master of Business Administration (MBA): The MBA is the golden ticket for entering investment banking at the associate level. Specifically, an MBA from a top-tier ("M7" or Top 15) business school is almost a prerequisite for landing a role at a bulge bracket or elite boutique bank. Banks recruit heavily from these programs, and the starting salary for an MBA-level associate is significantly higher than for an undergraduate-level analyst. An MBA can increase starting salary potential in investment banking by 50-70% compared to an undergraduate starting point.

- Certifications: While not a substitute for a degree, professional certifications can significantly boost your credibility and salary.

- Chartered Financial Analyst (CFA): This is the gold standard for investment management, but it's also highly respected in investment banking and equity research. Earning the CFA charter can lead to a salary premium of 15% or more, according to the CFA Institute. It demonstrates a deep mastery of financial analysis, portfolio management, and professional ethics.

- Certified Financial Planner (CFP): Crucial for roles in wealth management and advanced personal banking.

- Securities Industry Essentials (SIE), Series 7, and Series 63/66: These are not optional—they are licensing exams required by FINRA for anyone who sells securities products. Your employer will sponsor you to take them, and passing is a condition of employment.

###

Years of Experience

Banking, particularly on the investment and commercial tracks, has a very structured and transparent career progression. Your salary grows in predictable, significant jumps as you climb the ladder.

- 0-3 Years (Analyst to Associate): In investment banking, the journey begins as an Analyst. After 2-3 years, you are either promoted to Associate ("A2A") or you leave for an MBA or another industry. A newly promoted associate sees a massive pay bump. For example, a third-year analyst earning ~$250k total comp could jump to ~$300k+ as a first-year associate. In commercial banking, this period is about moving from a pure "analyst" (underwriting) role to a client-facing "associate" role, with salary growth from ~$80k to over $110k.

- 3-6 Years (Associate to Vice President - VP): This is the associate tenure. You are expected to master the technical skills and begin developing client management abilities. The leap from a third-year Associate to a first-year Vice President in investment banking is another huge financial milestone, often pushing total compensation well over $500,000. The VP role carries more responsibility for managing deals and client relationships.

- 7+ Years (VP and Beyond): As you progress to Director and Managing Director (MD), your compensation structure shifts dramatically. Base salaries may plateau around $300,000 - $500,000, but the bonus component becomes immense and is tied directly to the revenue you generate for the bank. An MD at a successful investment bank can earn $1 million to $5 million+ in a good year.

###

Geographic Location

Where you work is one of the biggest determinants of your salary. Financial centers have a much higher cost of living, and salaries are adjusted accordingly.

- Top Tier Financial Hubs (New York City, San Francisco): These cities command the highest salaries across all banking sectors. An investment banking associate in NYC sets the benchmark salary that other regions follow. A commercial banker in San Francisco, focused on the tech industry, will earn significantly more than a counterpart in a smaller Midwestern city.

- Major U.S. Financial Centers (Chicago, Los Angeles, Boston, Houston): These cities have robust banking scenes and offer salaries that are highly competitive, though slightly below NYC levels. Houston is a major hub for energy banking, and salaries there can rival other top centers for specialized roles.

- Regional Markets (Charlotte, Dallas, Atlanta): These cities are growing as financial centers, particularly for large commercial banks like Bank of America and Wells Fargo. Salaries are strong relative to the lower cost of living but will be 15-25% lower than in New York.

#### Salary Comparison by Major U.S. City (Investment Banking Associate - Year 1)

| City | Estimated Base Salary | Estimated All-In Compensation | Notes |

| :--- | :--- | :--- | :--- |

| New York, NY | $175,000 | $275,000 - $325,000 | The benchmark for global finance. |

| San Francisco, CA| $175,000 | $270,000 - $320,000 | Tech banking hub; very high cost of living. |

| Chicago, IL | $175,000 | $250,000 - $300,000 | Major hub for derivatives, M&A, and commercial banking. |

| Houston, TX | $175,000 | $260,000 - $310,000 | Global energy banking capital; pay is very competitive. |

| Los Angeles, CA | $175,000 | $250,000 - $300,000 | Strong in media, entertainment, and real estate finance. |

| Charlotte, NC | $165,000 | $220,000 - $270,000 | Major banking center with lower cost of living. |

*Source: Internal analysis based on data from Glassdoor, Wall Street Oasis, and industry recruiters.*

###

Company Type & Size

The type of bank you work for has a colossal impact on your pay stub.

- Bulge Bracket Investment Banks (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley): These are the largest, most prestigious global banks. They pay the highest, standardized salaries and bonuses (the numbers cited in the investment banking section are for these firms). The work is intense, the deals are massive, and the competition is fierce.

- Elite Boutique Investment Banks (e.g., Evercore, Lazard, Centerview Partners): These smaller, specialized firms focus purely on advisory services (like M&A) and often pay *more* than bulge bracket banks, especially at senior levels. Because they don't have lending or trading arms, their per-banker profitability can be higher, leading to larger bonus pools.

- Middle Market Banks (e.g., Baird, William Blair, Jefferies): These firms focus on deals for mid-sized companies. Compensation is still very strong but may be slightly lower than at the top bulge brackets. They often offer a better work-life balance.

- Large Money-Center Banks (Commercial/Retail side - e.g., Bank of America, Chase, Wells Fargo): These institutions offer a wide range of services. An associate in their commercial banking division will earn a solid, six-figure income as detailed earlier, but it will be a fraction of what an associate in their *investment banking division* earns.

- Regional & Community Banks: These smaller banks serve local communities and businesses. Compensation is more modest and aligns with the retail and lower-end commercial banking salary bands. Work-life balance is typically the best in this category.

###

Area of Specialization (Investment Banking)

Even within a single investment bank, not all associate roles are created equal. The group you work in matters.

- Mergers & Acquisitions (M&A): Traditionally seen as one of the most prestigious and demanding groups. Compensation is consistently at the top end of the scale.

- Leveraged Finance (LevFin): This group structures debt for private equity buyouts and other highly leveraged transactions. It's highly technical and also pays at the top of the scale, often with excellent exit opportunities to private equity.

- Private Equity / Restructuring: While Restructuring is cyclical (busy during downturns), both it and direct private equity groups within banks are considered elite, with compensation to match.

- Industry Groups (e.g., Technology, Healthcare, Energy): Pay is generally strong across all coverage groups, but "hot" sectors can lead to bigger deal flow and slightly higher bonuses. An associate in a top TMT (Technology, Media, & Telecom) group in San Francisco will be extremely well-compensated.

- Capital Markets (ECM/DCM): Equity Capital Markets (ECM) and Debt Capital Markets (DCM) associates help companies raise money by issuing stock or bonds. The work is slightly less model-intensive than M&A, and compensation can be 10-15% lower, though still incredibly lucrative.

###

In-Demand Skills

Certain skills directly translate to higher value and a bigger paycheck. Developing these is non-negotiable for anyone serious about a top-tier banking career.

- Hard Skills:

- Advanced Financial Modeling: The ability to build a three-statement, LBO, DCF, or M&A model from scratch in Excel quickly and accurately is the single most important technical skill for an investment banking associate.

- Valuation Expertise: Deep understanding of the methodologies (comps, precedents, DCF) and the art of applying them.

- Data Analysis & Programming: While Excel is still king, proficiency in Python or R for data analysis is becoming a key differentiator, especially in quantitative roles.

- Presentation & Pitch Book Skills: Mastery of PowerPoint to create compelling, data-driven narratives for clients.

- Soft Skills:

- Communication & Presentation: The ability to clearly articulate complex financial concepts to clients and senior bankers.

- Attention to Detail: In a world where a misplaced zero can kill a deal, meticulousness is paramount.

- Resilience and Work Ethic: The ability to handle extreme pressure, long hours, and tight deadlines without sacrificing quality.

- Relationship Management: For commercial and senior investment bankers, the ability to build and maintain trust with clients is what ultimately drives revenue.

Job Outlook and Career Growth

Investing years of your life and potentially hundreds of thousands of dollars in an MBA requires a clear understanding of the long-term prospects. Fortunately, for skilled and driven banking professionals, the outlook remains strong, albeit with evolving demands.

The U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Associate Banker." However, the most relevant proxy is "Financial Analysts," a category that encompasses many of the core functions of commercial and investment banking associates.

According to the latest BLS Occupational Outlook Handbook, employment for Financial Analysts is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS projects about 29,600 openings for financial analysts each year, on average, over the decade.

### Key Drivers of Growth

- Globalization and Corporate Activity: As companies continue to expand globally, they require sophisticated financial advice for cross-border M&A, international fundraising, and managing currency risk. This directly fuels the need for investment bankers.

- Increasingly Complex Financial Products: The development of new derivatives, structured products, and investment vehicles requires highly knowledgeable professionals to create, sell, and manage them.

- Growing Pool of Investable Assets: A growing global economy and the concentration of wealth mean there is more capital that needs to be managed, invested, and put to work through loans and investments, supporting roles in wealth management and commercial banking.

- A Wave of Retiring Boomers: As experienced bankers from the baby boomer generation retire, there will be a need to fill senior-level positions, creating advancement opportunities for the current generation of associates and VPs.

### Emerging Trends and Future Challenges

The banking industry is not static. To thrive, you must adapt to powerful trends that are reshaping the landscape.

1. The Rise of Technology (Fintech & AI): Automation is a major force. Routine tasks like data gathering and basic analysis are increasingly being automated by AI and sophisticated software. This means future associates will need to be *more* analytical, strategic, and client-focused. The value will be in interpreting the data, not just collecting it. Proficiency with data science tools (Python, Tableau) will become a significant advantage.

2. **ESG (Environmental, Social, and Governance)