A career in commercial banking offers a unique blend of financial analysis, strategic relationship management, and direct impact on the growth of businesses in your community. For those with an aptitude for finance and strong interpersonal skills, it's a stable and rewarding path. But what does that mean for your bottom line? The earning potential is significant, with salaries often ranging from $70,000 for entry-level roles to well over $200,000 for senior professionals in major markets.

This guide will break down what a commercial banker earns, exploring the key factors that influence your salary and providing a clear outlook on the profession's future.

What Does a Commercial Banker Do?

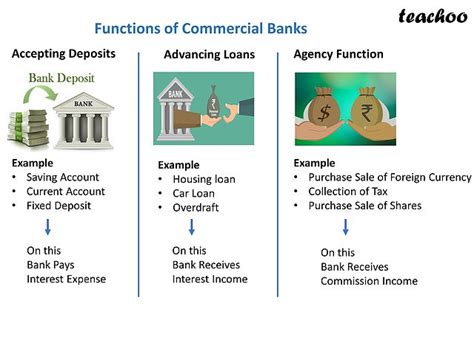

Before diving into the numbers, it's essential to understand the role. A commercial banker, often called a Relationship Manager or Commercial Loan Officer, is the primary point of contact between a bank and its business clients. Their core responsibility is to build and maintain a portfolio of commercial clients (from small businesses to large corporations) by providing financial solutions that help them thrive.

Day-to-day responsibilities include:

- Analyzing a company’s financial statements to assess creditworthiness.

- Structuring and underwriting loans, lines of credit, and other financial products.

- Advising clients on cash management, treasury services, and expansion financing.

- Managing risk for the bank while fostering client growth.

- Networking to bring in new business and expand their portfolio.

It's a dynamic role that requires both sharp analytical skills and the ability to build lasting trust with clients.

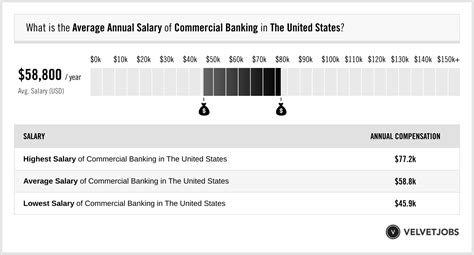

Average Commercial Banking Salary

The compensation structure in commercial banking is a key attraction. It typically consists of a competitive base salary plus significant variable pay in the form of annual bonuses or commissions tied to performance.

While figures vary, a clear picture emerges from leading data sources. The average total compensation for a Commercial Banker in the United States typically falls between $100,000 and $140,000 per year.

Let’s break this down further:

- Salary.com reports that the median salary for a Commercial Banker in the United States is approximately $115,602 as of May 2024, with a typical range falling between $99,737 and $131,525.

- Glassdoor data for a "Commercial Banker" indicates an average base salary of around $98,000 per year, with additional cash compensation (bonuses, commissions) averaging another $24,000, pushing the total pay significantly higher.

- The U.S. Bureau of Labor Statistics (BLS) groups Commercial Bankers under the broad category of "Loan Officers." For this group, the median annual wage was $76,340 in May 2023. It's crucial to note that this BLS figure includes all loan officers (mortgage, consumer, etc.). Roles specifically in commercial banking command higher salaries due to the increased complexity, larger deal sizes, and direct revenue generation.

The key takeaway is that while the base salary is strong, a significant portion of a commercial banker's income is performance-based, rewarding those who successfully grow their portfolios.

Key Factors That Influence Salary

Your specific salary in commercial banking isn't a single number; it's a dynamic figure influenced by several critical factors. Understanding these will help you navigate your career and maximize your earning potential.

### Level of Education

A bachelor's degree is the standard entry requirement for a commercial banking career, with preferred majors in Finance, Accounting, Business Administration, or Economics. While a bachelor's degree will get you in the door, advanced education can accelerate your career and earning trajectory. An MBA or a Master's in Finance can lead to higher starting positions and salaries, particularly at larger institutions. Professional certifications like the Chartered Financial Analyst (CFA) or completing a formal credit training program are also highly valued and can positively impact compensation.

### Years of Experience

Experience is arguably the most significant driver of salary growth in commercial banking. The career path is well-defined, with clear increases in responsibility and compensation at each stage.

- Entry-Level (0-2 years): Roles like Credit Analyst or Junior Relationship Manager typically have a salary range of $65,000 to $90,000. In these positions, you're learning the fundamentals of underwriting and supporting senior bankers.

- Mid-Career (3-8 years): As a Commercial Banker or Relationship Manager, you begin managing your own client portfolio. Total compensation, including bonuses, typically ranges from $90,000 to $150,000+. Your earnings are increasingly tied to the size and performance of your portfolio.

- Senior-Level (8+ years): Senior Relationship Managers, Team Leads, or Market Presidents manage the largest client relationships and lead teams of bankers. Total compensation can range from $150,000 to well over $250,000, with a substantial portion coming from performance bonuses.

### Geographic Location

Where you work matters. Banks in major financial hubs with a high cost of living and a high concentration of large businesses will pay significantly more. According to data from Salary.com, cities like New York, San Francisco, Boston, and Chicago offer salaries that can be 20-30% above the national average. Other strong markets include Charlotte, Dallas, and Atlanta. Conversely, salaries in smaller regional or rural markets will be closer to, or slightly below, the national average, though this is often offset by a lower cost of living.

### Company Type

The size and type of the banking institution you work for play a major role in your compensation package.

- Large Money-Center Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These institutions typically offer the highest base salaries, structured bonus programs, and comprehensive benefits. The work often involves larger, more complex clients.

- Super-Regional Banks (e.g., U.S. Bank, PNC, Truist): Compensation is highly competitive with money-center banks. These firms have a major presence across multiple states and offer a wide range of sophisticated commercial banking products.

- Community Banks and Credit Unions: While base salaries may be slightly lower, these institutions can offer a better work-life balance, a strong connection to the local community, and sometimes more direct or transparent bonus structures tied to local branch or regional performance.

### Area of Specialization

Not all commercial lending is the same. Developing expertise in a specific, high-demand niche can lead to higher pay.

- Middle Market Banking: This is the most common form of commercial banking, serving businesses with annual revenues typically between $10 million and $500 million.

- Corporate Banking (Large Cap): This specialization focuses on Fortune 500-level companies and involves highly complex, large-scale financing like syndicated loans. These roles are among the highest-paid in the banking industry.

- Specialized Industries: Bankers who focus on industries like healthcare, technology, commercial real estate (CRE), or agriculture can command premium salaries due to their specialized knowledge of industry-specific risks and opportunities.

Job Outlook

The career outlook for skilled commercial bankers remains positive. The U.S. Bureau of Labor Statistics projects a slight decline of 2% for the overall "Loan Officer" category from 2022 to 2032. However, this statistic requires context. The decline is largely driven by automation in more standardized lending areas like consumer and mortgage loans.

The need for relationship-based commercial banking is not diminishing. Businesses will always require trusted advisors to help them navigate complex financial decisions. The analytical judgment, strategic advice, and client management skills of a commercial banker cannot be easily automated, ensuring a continued demand for talented professionals in this field. As the economy grows, so will the need for business financing, which is the core of the commercial banker's role.

Conclusion

A career in commercial banking is a financially and professionally rewarding path for those who are driven, analytical, and personable. The salary potential is robust, with a clear and attainable trajectory for six-figure earnings and beyond.

Your income will be shaped by your experience, your willingness to pursue further education or specializations, and your choice of location and employer. For individuals looking for a stable career that puts them at the center of business and economic growth, commercial banking offers a compelling and lucrative opportunity.