Thinking about a career in audit? It’s a smart move. A role as an audit associate is more than just a job; it’s a foundational stepping stone into the world of accounting and finance, offering stability, clear career progression, and significant earning potential. But what can you actually expect to make?

For ambitious professionals and students mapping out their future, understanding the salary landscape is crucial. An entry-level audit associate in the United States can expect a starting salary that often falls between $60,000 and $80,000 per year, with top-tier firms in major cities pushing that figure even higher. This article provides a data-driven breakdown of what an audit associate earns and the key factors that will shape your personal salary trajectory.

What Does an Audit Associate Do?

Before diving into the numbers, let's clarify the role. An audit associate is typically an entry-level professional at a public accounting firm or within a company's internal audit department. They are the frontline soldiers in the process of financial verification. Working as part of a team, their primary goal is to ensure a company's financial statements are accurate, complete, and compliant with laws and regulations.

Key responsibilities include:

- Examining Financial Records: Scrutinizing ledgers, bank statements, and other financial documents for accuracy.

- Testing Internal Controls: Evaluating a company's internal systems to see if they effectively prevent fraud and errors.

- Documenting Findings: Preparing detailed "workpapers" that document the audit procedures performed and the evidence gathered.

- Collaborating with Clients: Interacting with client personnel to request information and understand their business processes.

- Supporting the Audit Team: Assisting senior associates and managers in completing the overall audit engagement.

It's a role that demands a sharp analytical mind, meticulous attention to detail, and strong ethical principles.

Average Audit Associate Salary

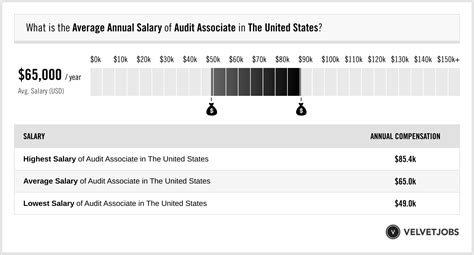

While salaries can vary widely, we can establish a strong baseline using data from trusted sources.

According to reputable salary aggregators, the average base salary for an Audit Associate in the United States typically falls between $65,000 and $75,000 annually.

- Salary.com reports the median salary for an Auditor I (an equivalent entry-level role) to be around $66,600 as of late 2023, with a typical range between $60,900 and $72,800.

- Glassdoor data, which is based on user-submitted reports, shows a national average base pay of approximately $70,000 per year for audit associates.

- Payscale notes a similar average, around $65,000, and highlights how additional skills and experience can quickly increase that figure.

It’s also helpful to look at the broader category. The U.S. Bureau of Labor Statistics (BLS) groups accountants and auditors together, reporting a median annual wage of $78,000 in May 2022. This higher figure reflects the entire profession, including those in more senior roles, underscoring the strong potential for salary growth as you gain experience.

Key Factors That Influence Salary

Your starting salary and long-term earnings are not set in stone. They are influenced by a combination of personal qualifications, career choices, and market forces. Here are the most significant factors.

###

Level of Education

Your educational background is the first gatekeeper to your earning potential.

- Bachelor’s Degree: A bachelor’s degree in accounting or a related field is the non-negotiable minimum requirement for an audit associate position.

- Master’s Degree: A Master of Accountancy (MAcc) or a similar graduate degree can provide a competitive edge and a salary bump. It is also the most common path for students to meet the 150 credit-hour requirement to sit for the CPA exam.

- CPA License: The Certified Public Accountant (CPA) license is the gold standard in the accounting industry. While you won’t have it as a brand-new associate, firms heavily incentivize and reward employees for passing the four parts of the CPA exam. Earning your CPA license can lead to immediate bonuses (often $3,000-$5,000) and is essential for promotion to senior and manager roles, where salaries increase substantially.

###

Years of Experience

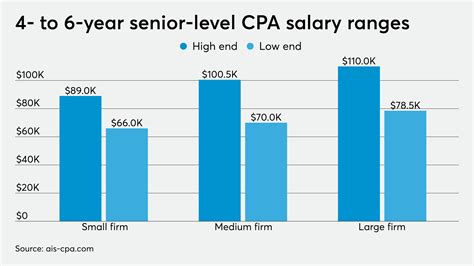

Public accounting offers one of the most structured and predictable career paths. Your title and salary will grow directly with your experience.

- Audit Associate (0-2 Years): This is the entry-level. You'll focus on learning the fundamentals and executing assigned audit tests. Salary range: $60,000 - $80,000.

- Senior Audit Associate (2-5 Years): After a couple of years, you are promoted to a senior role. You’ll take on more responsibility, lead smaller engagements, and supervise junior associates. Your salary will see a significant jump into the $85,000 - $110,000 range.

- Audit Manager (5+ Years): Managers are responsible for planning engagements, managing client relationships, and reviewing the team's work. At this level, salaries typically exceed $120,000 and can continue to climb well into the mid-$100s.

###

Geographic Location

Where you work matters—a lot. Salaries are adjusted for the local cost of living and market demand. Major metropolitan areas with a high concentration of corporate headquarters and financial institutions offer the highest salaries.

- High-Cost-of-Living (HCOL) Areas: Cities like New York, San Francisco, San Jose, and Boston will offer top-tier starting salaries, often exceeding $75,000 - $85,000 to compensate for higher living expenses.

- Mid-to-Low-Cost-of-Living Areas: In cities across the Midwest and Southeast, starting salaries will be closer to the national average, generally in the $60,000 - $70,000 range, but your purchasing power may be greater.

###

Company Type

The type and size of your employer is one of the biggest determinants of your starting pay.

- The Big Four (Deloitte, PwC, EY, KPMG): These global giants are known for offering the highest starting salaries, most prestigious client portfolios, and excellent training. They are highly competitive and generally demand long hours, but the experience is a powerful resume-builder.

- Mid-Tier National Firms (e.g., Grant Thornton, BDO, RSM): These firms offer very competitive salaries, often just shy of the Big Four, but are sometimes perceived as having a better work-life balance.

- Regional and Local Firms: Smaller firms may offer slightly lower starting salaries but can provide a more close-knit culture, a better work-life balance, and direct exposure to partners and a diverse range of local clients.

- Internal Audit (Industry): Working in the internal audit department of a large corporation (e.g., a Fortune 500 company) can also be lucrative. Salaries are often competitive with public accounting, and the hours are typically more predictable.

###

Area of Specialization

As you advance in your career, you may choose to specialize. Certain high-demand niches can lead to higher pay.

- IT Audit: With the increasing reliance on technology, IT auditors who can assess cybersecurity risks and system controls are in extremely high demand and can command premium salaries.

- Financial Services: Auditing complex entities like banks, insurance companies, and investment funds requires specialized knowledge and often comes with higher compensation.

- Forensic Accounting: This specialization focuses on investigating fraud and financial discrepancies and is a highly valued and well-compensated skill set.

Job Outlook

The future for auditors is bright. According to the U.S. Bureau of Labor Statistics, employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, about as fast as the average for all occupations.

This steady demand is driven by several factors, including economic growth, increasingly complex global regulations, and a constant need for organizations to ensure financial accuracy and prevent fraud. In short, auditing is a stable and essential profession that isn't going away.

Conclusion

A career as an audit associate is a fantastic entry point into the business world. While the national average salary provides a solid benchmark, your individual earning potential is in your hands.

Key Takeaways:

- Strong Starting Point: Expect a competitive starting salary, typically between $65,000 and $75,000.

- Growth is Guaranteed: Your salary is designed to grow significantly with experience, especially as you advance to senior and manager levels.

- Invest in Yourself: Pursuing the CPA license is the single most effective way to accelerate your earnings and career progression.

- Be Strategic: Your choice of company (Big Four vs. regional) and location (NYC vs. a smaller city) will have a major impact on your paycheck.

For those with a keen eye for detail, a strong ethical compass, and a desire for a challenging and structured career, becoming an audit associate is not just a job—it's a launchpad to a successful and rewarding future in the world of finance.