Table of Contents

- [Introduction](#introduction)

- [Understanding the "Average Salary" Metric: What It Really Means](#what-it-means)

- [The Average Ireland Salary: A Deep Dive into the Numbers](#deep-dive)

- [Key Factors That Influence Your Salary in Ireland](#key-factors)

- [Ireland's Economic Outlook and Salary Trends](#outlook)

- [How to Maximize Your Earning Potential in Ireland](#how-to-start)

- [Conclusion: Is a Career in Ireland Right for You?](#conclusion)

---

Introduction

Are you considering a career move to the Emerald Isle? Perhaps you're a recent graduate weighing your options, or an international professional drawn by Ireland's thriving tech and pharmaceutical sectors. Whatever your situation, one question likely sits at the forefront of your mind: "What is the average salary in Ireland?" Understanding this figure is the crucial first step in evaluating your potential quality of life, negotiating a fair compensation package, and ultimately, building a successful and prosperous career in one of Europe's most dynamic economies.

The answer, however, is far more complex than a single number. While recent data from Ireland's Central Statistics Office (CSO) places the mean annual salary around €50,000 to €55,000, this figure is merely a signpost on a long and varied road. Your actual earnings will be a unique tapestry woven from your industry, experience, location, and skills. An entry-level administrator in a rural county will have a vastly different financial reality than a senior software engineer at a multinational corporation in Dublin's "Silicon Docks."

As a career analyst who has guided countless professionals through international relocations, I've seen firsthand how a lack of understanding about local salary norms can lead to missed opportunities or financial strain. I once coached a highly skilled data scientist from outside the EU who almost accepted a job offer in Dublin that was 20% below the market rate, simply because they converted their home currency and thought it looked "good enough." A deep dive into Irish-specific data empowered them to renegotiate, securing a package that truly reflected their value and set them up for success. This guide is designed to give you that same power.

This article is your definitive resource for navigating the intricacies of the Irish salary landscape. We will dissect the official statistics, explore the powerful factors that can increase your earning potential, and examine the economic trends shaping the future of work in Ireland. By the end, you won't just know the "average Ireland salary"; you'll have a strategic framework for maximizing your own.

---

Understanding the "Average Salary" Metric: What It Really Means

Before we dive into the hard numbers, it's essential to deconstruct what "average salary" truly signifies. When you see a headline figure, it's easy to anchor your expectations to it, but this number is a statistical abstraction, not a promise. Understanding its components is the first step toward becoming a savvy navigator of the Irish job market.

The "average" can be calculated in two main ways, and the difference is significant:

- Mean Salary: This is the most common "average" you'll see reported. It's calculated by adding up all the salaries in the country and dividing by the number of employees. The major drawback of the mean is that it's heavily skewed by a small number of extremely high earners (like C-suite executives and highly specialized professionals). This pulls the average up, meaning more than half of the population actually earns *less* than the mean salary.

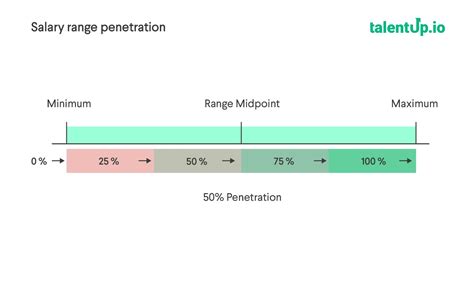

- Median Salary: This is the middle salary in the entire list of salaries—the point where 50% of people earn more, and 50% earn less. Most economists and career analysts, myself included, consider the median a much more accurate representation of the "typical" person's earnings because it isn't affected by those outlier high incomes.

Beyond mean vs. median, you must also consider:

- Gross vs. Net Pay: The figures you see in this guide, and in most job advertisements, are gross salary (before tax). Your take-home pay, or net salary, will be significantly lower after deductions for PAYE (Pay As You Earn income tax), PRSI (Pay-Related Social Insurance), and USC (Universal Social Charge). For example, a gross salary of €60,000 might result in a net monthly income of around €3,600-€3,800, depending on your individual circumstances.

- Total Compensation: Salary is just one piece of the puzzle. A comprehensive compensation package in Ireland often includes a pension contribution, private health insurance, performance bonuses, stock options (especially in tech), and other benefits that carry significant monetary value.

### A "Day in the Life" of Different Irish Earners

To illustrate how varied the reality is behind the "average," let's imagine a day for three different professionals in Ireland, all contributing to the same national statistic:

- Aoife, the Entry-Level Marketing Assistant in Galway (€32,000/year): Aoife starts her day by cycling to a small but growing local business. Her tasks involve managing social media accounts, drafting newsletters, and coordinating with local printers. Her salary is below the national average, but her rent is more affordable than in Dublin. Her compensation is primarily base salary, with a statutory pension plan. She's focused on gaining experience to climb the ladder.

- David, the Senior Project Manager in Cork (€85,000/year): David works for a major pharmaceutical multinational. His day is packed with back-to-back video calls with teams in the US and Asia, managing timelines for a new drug trial. He's a mid-career professional with a decade of experience. His salary is well above average, and his package includes a significant performance bonus, a generous pension match, and full family health insurance.

- Liam, the Lead DevOps Engineer in Dublin (€120,000/year + stock): Liam works at a US tech giant's European headquarters in the Grand Canal Dock area. His day involves writing and deploying code, managing cloud infrastructure, and mentoring junior engineers. His base salary is more than double the national average, and a substantial portion of his total compensation comes from Restricted Stock Units (RSUs), making his financial outlook closely tied to his company's performance on the NASDAQ.

These three individuals—Aoife, David, and Liam—all contribute to the single "average Ireland salary" figure. Their stories highlight why you must look beyond the headline number and analyze the specific factors that apply to *your* unique career path.

---

The Average Ireland Salary: A Deep Dive into the Numbers

Now, let's get to the data. By examining figures from Ireland's most authoritative sources, we can build a detailed picture of the current salary landscape.

According to the Central Statistics Office (CSO), Ireland's official national statistics body, the most recent "Earnings and Labour Costs" release provides the foundational data.

- Mean Annual Earnings: The CSO reported that mean annual earnings for full-time employees in Q4 2023 stood at €54,345. This figure is often rounded to €55,000 in general discussions. Remember, this is the mean, skewed by high earners.

- Median Annual Earnings: The CSO's more detailed Structure of Earnings Survey provides a look at the median. The most recent comprehensive data placed the median annual earnings for full-time employees at approximately €45,000 - €47,000. This is a far more realistic benchmark for what a typical full-time worker in Ireland earns.

Leading recruitment agencies provide further context, often breaking down salaries by industry and role. For example, the Morgan McKinley 2024 Salary Guide and the CPL 2024 Salary Guide are invaluable resources that corroborate and expand upon CSO data, showing specific salary bands for hundreds of jobs.

### Salary Brackets by Experience Level

Salary growth in Ireland is strongly correlated with experience. While a degree gets your foot in the door, demonstrated expertise and a track record of success are what unlock higher earning potential. The following table provides a general framework for salary expectations based on career stage, synthesized from CSO data and recruitment industry reports.

| Experience Level | Typical Years of Experience | Typical Annual Salary Range (Gross) | Key Characteristics |

| ------------------- | --------------------------- | ----------------------------------- | ------------------------------------------------------------------------------------------------------------------------- |

| Entry-Level | 0-2 years | €30,000 - €42,000 | Graduate or early-career professional. Focus is on learning, executing tasks, and supporting senior team members. |

| Mid-Career | 3-8 years | €42,000 - €75,000 | Experienced professional with proven skills. Can work independently, manage small projects, and may begin to mentor others. |

| Senior/Lead | 8-15 years | €75,000 - €110,000+ | Subject matter expert. Leads complex projects, manages teams, and contributes to strategic planning. |

| Principal/Director | 15+ years | €110,000 - €200,000+ | Sets strategic direction for a department or function. High-level leadership, significant business impact. |

*Source: Synthesized data from CSO Earnings and Labour Costs, Morgan McKinley 2024 Salary Guide, and CPL 2024 Salary Guide.*

### Beyond the Base Salary: Understanding Total Compensation in Ireland

A competitive job offer in Ireland, particularly from a multinational company (MNC), extends far beyond the gross salary. Understanding these components is vital for accurately comparing offers and negotiating effectively.

- Pension (Superannuation): This is a cornerstone of Irish compensation. While there's a basic state pension, most professional roles offer a supplementary company pension. A common arrangement is a "defined contribution" plan where an employee contributes a percentage of their salary (e.g., 5%) and the employer "matches" it or contributes an even higher amount (e.g., 5-10%). This is essentially tax-free money for your retirement and a critical part of your long-term wealth building.

- Health Insurance (VHI, Laya, Irish Life Health): The Irish public healthcare system is robust, but many employers (over 50% of the population has private cover) offer private health insurance as a key benefit. This provides faster access to certain procedures and a wider choice of specialists. A full family plan can be worth over €4,000-€5,000 annually.

- Performance Bonus: Very common in sectors like tech, finance, and sales. This is typically expressed as a percentage of your base salary (e.g., 10-20%) and is tied to individual and company performance. When evaluating an offer, it's wise to ask about the historical payout rate of the bonus (i.e., "has the company paid out 100% of the target bonus for the last three years?").

- Stock Options/RSUs: A major wealth driver in the tech sector. Restricted Stock Units (RSUs) are grants of company shares that vest (i.e., become yours) over a set period, typically four years. This can add tens or even hundreds of thousands of euros to your total compensation over time, though it is subject to market fluctuations.

- Paid Time Off (PTO): The statutory minimum annual leave in Ireland is 20 days, plus public holidays (10 in 2024). However, most professional roles offer 22-27 days of annual leave as a competitive differentiator.

- Other Benefits: These can include a wellness stipend, education assistance, commuter benefits, life assurance (death-in-service benefit), and subsidized meals. While smaller in value, they contribute to your overall financial well-being and the attractiveness of an employer.

When assessing a job offer, you must calculate the Total Compensation Value (TCV) by adding the base salary, the cash value of the employer's pension contribution, the target bonus, and the fair market value of any health insurance or stock grants. This gives you the true measure of what you'll be earning.

---

Key Factors That Influence Your Salary in Ireland

The national average provides a baseline, but your personal salary will be determined by a specific set of factors. Mastering these levers is the key to maximizing your income. This section provides a comprehensive breakdown of the most influential variables in the Irish job market.

###

Level of Education

While experience often trumps education later in a career, your academic qualifications are a primary determinant of your starting salary and long-term trajectory.

- Leaving Certificate (High School Diploma): For roles that don't require a degree, the Leaving Cert is the baseline. Earnings are typically in the lower quartile, concentrated in retail, hospitality, and some administrative roles. Average salaries for these positions often range from the minimum wage (currently €12.70/hour) up to around €30,000 annually.

- Third-Level Diplomas & Certificates (NFQ Levels 6 & 7): Post-secondary qualifications from colleges of further education or technological universities open doors to more skilled roles, such as technicians, skilled trades, and higher-level administrative positions. Expect salaries in the €32,000 - €45,000 range.

- Bachelor's Degree (NFQ Level 8): This is the standard entry requirement for most professional careers in Ireland (e.g., in business, science, engineering, and arts). Graduates can expect starting salaries from €35,000 in fields like marketing to over €50,000 for high-demand areas like software engineering. The specific discipline of your degree is a major factor.

- Master's Degree / Postgraduate Diploma (NFQ Level 9): A Master's degree signals specialized knowledge and can provide a significant salary advantage, particularly in technical or research-intensive fields. It can add €5,000 - €15,000 to a starting salary compared to a Bachelor's degree holder. For example, a data scientist with an MSc may start at €55,000, while someone with a BSc might start at €45,000. It's also often a prerequisite for moving into senior management or specialized research roles later on.

- Doctorate (Ph.D., NFQ Level 10): A Ph.D. is essential for R&D roles in sectors like pharmaceuticals, biotech, and high-tech engineering. Starting salaries for Ph.D. holders in industry are substantial, often in the €65,000 - €85,000 range, reflecting their deep expertise and research capabilities.

###

Years of Experience

Experience is arguably the single most powerful driver of salary growth throughout a career. Employers pay a premium for proven ability and reduced risk.

- Entry-Level (0-2 years): At this stage, you are paid for your potential. Your salary is an investment by the company. As per the table in the previous section, this range is typically €30,000 - €42,000. The primary goal is to absorb as much knowledge as possible.

- Mid-Career Professional (3-8 years): You have moved from a cost center to a value generator. You can operate with greater autonomy and deliver consistent results. This is where the most significant salary jumps often occur, with earnings moving into the €45,000 - €75,000 bracket. Switching jobs after 3-5 years of solid experience is a common strategy to accelerate salary growth.

- Senior/Lead Professional (8-15 years): You are now a subject matter expert. You not only perform complex tasks but also mentor juniors, lead projects, and contribute to strategy. Salaries push into the €75,000 - €110,000+ range. Your value is in your ability to multiply the efforts of your team.

- Principal/Director Level (15+ years): At this echelon, you are responsible for business outcomes, not just tasks. Your influence spans entire departments or business units. Compensation reflects this strategic importance, often reaching €110,000 - €200,000+, frequently supplemented by significant bonuses and equity.

###

Geographic Location

Where you work in Ireland has a profound impact on your salary, primarily driven by the concentration of multinational companies and the associated cost of living.

| City/Region | Average Salary Index (Dublin = 100) | Cost of Living Index (Dublin = 100) | Key Industries |

| ----------- | ------------------------------------- | ----------------------------------- | ---------------------------------------------------- |

| Dublin | 100 | 100 | Tech, Finance, Pharmaceuticals, Professional Services |

| Cork | 90 - 95 | 85 - 90 | Pharmaceuticals, Tech (Hardware/SaaS), Food Science |

| Galway | 88 - 93 | 85 - 90 | Medical Devices (MedTech), Tech, Tourism |

| Limerick | 85 - 90 | 80 - 85 | Tech (FinTech), Engineering, Aviation Leasing |

| Waterford/SE | 80 - 85 | 75 - 80 | Pharmaceuticals, Engineering, Agriculture |

| Rural Areas | 75 - 80 | 70 - 75 | Agriculture, Tourism, Local Services |

*Source: Analysis based on data from CSO, Numbeo, and recruitment agency reports.*

- Dublin: As the economic and political capital, Dublin commands the highest salaries in the country by a significant margin. The heavy presence of global headquarters for companies like Google, Meta, Pfizer, and countless banks creates intense competition for talent, driving wages up. However, this is offset by the highest cost of living, particularly for accommodation. A salary that seems high on paper can be quickly eroded by rent.

- Cork: Ireland's second city has a thriving economy, particularly in the pharmaceutical and tech sectors, with major employers like Apple and Johnson & Johnson. Salaries are very competitive, typically only 5-10% lower than Dublin, but the cost of living is noticeably more manageable, offering a potentially better quality of life for many.

- Galway and Limerick: These cities have become powerful hubs in their own right. Galway is a global leader in the MedTech industry, while Limerick has carved out a niche in FinTech and engineering. Salaries are robust and attractive when weighed against a lower cost of living than the two main cities.

- Southeast & Rural Ireland: Outside the major urban centers, salaries are generally lower, reflecting a different economic structure based more on local businesses, agriculture, and tourism. The rise of remote work is beginning to change this dynamic, allowing some high earners to relocate to these areas while retaining a city-level salary, but this is not yet the norm for most roles.

###

Company Type & Size

The type of organization you work for is a critical salary determinant.

- Multinational Corporations (MNCs): US and other foreign-owned MNCs are the paymasters of the Irish economy. To attract top talent for their European headquarters, they typically pay a "Dublin premium" and offer the most comprehensive benefits packages (pensions, health, stock). These are the companies that set the high-water mark for salaries in tech, pharma, and finance.

- Large Irish Companies: Well-established Irish public limited companies (PLCs) like CRH, Ryanair, or Bank of Ireland offer competitive salaries and strong benefits, though they may not always match the absolute top-tier packages (especially on stock options) offered by US tech giants.

- Small and Medium-sized Enterprises (SMEs): This is the backbone of the domestic Irish economy. Salaries at SMEs are generally lower than at MNCs, and benefits packages can be less comprehensive. However, they can offer other advantages, such as a greater breadth of responsibility, a more direct impact on the business, and potentially a better work-life balance.

- Startups: Compensation in startups is a unique mix. Base salaries are often lower than the market average to conserve cash. However, this is usually offset by the offer of significant equity (stock options). This is a high-risk, high-reward proposition: if the startup succeeds, the equity could be worth far more than the foregone salary.

- Public Sector: Jobs in the civil service, healthcare (HSE), and education offer strong job security, excellent pension benefits, and defined salary scales. While starting salaries may be competitive, the ceiling for top earners is generally lower than in the private sector, and salary progression is rigid and based on incremental scales rather than performance-based negotiation.

###

Industry and Sector (Area of Specialization)

Your chosen field is a foundational element of your earning potential. The CSO breaks down average weekly earnings by economic sector, which clearly shows the hierarchy.

- Information & Communication Technology (ICT): This is consistently the highest-paying sector in Ireland. Driven by the "Silicon Docks" ecosystem, roles in software development, cybersecurity, data analytics, and cloud computing command premium salaries. As per Morgan McKinley's 2024 guide, a Senior Software Engineer can expect €80,000 - €110,000, and a Cybersecurity Analyst can earn €70,000 - €95,000.

- Financial & Insurance Services: Dublin's International Financial Services Centre (IFSC) is a major European hub for banking, funds, and insurance. Roles in risk management, compliance (especially AML/KYC), quantitative analysis, and asset management are highly lucrative. A Compliance Manager could earn €90,000 - €120,000, while a fund accountant's salary would range from €40,000 (entry) to €80,000+ (senior).

- Pharmaceuticals & Medical Devices (Pharma/MedTech): Ireland is a global powerhouse in this sector. Highly skilled, specialized roles in R&D, quality assurance (QA/QC), regulatory affairs, and process engineering are in constant demand and are compensated accordingly. A Senior Quality Engineer in MedTech might earn €75,000 - €90,000, while a Regulatory Affairs Manager in pharma could command €100,000+.

- Professional Services, Scientific & Technical: This broad category includes lawyers, accountants, architects, and management consultants. Salaries are strong, especially for those with professional qualifications (e.g., Chartered Accountant). A newly qualified accountant at a "Big Four" firm might start around €55,000 - €60,000, with rapid progression.

- Construction: Following a period of recovery, the construction sector is booming. Experienced project managers, quantity surveyors, and engineers are in high demand, with Senior Project Managers earning €80,000 - €100,000+.

- Accommodation & Food Services / Arts & Recreation: These sectors consistently appear at the lower end of the earnings scale. While management roles can offer good salaries, the majority of positions are lower-waged, often at or near the national minimum wage.

###

In-Demand Skills

Finally, possessing specific, high-value skills can allow you to command a salary above the average for your role and experience level.

- Tech Skills: Expertise in Cloud (AWS, Azure, GCP), Cybersecurity (threat intelligence, penetration testing), Data Science (Python, R, machine learning models), and specific programming languages (Go, Rust, Kotlin) are in exceptionally high demand.

- Language Skills: For customer-facing, sales, and support roles in MNCs that serve the entire EMEA region from Ireland, fluency in a second European language (especially German, Dutch, or Nordic languages) in addition to English can add a €3,000 - €7,000 premium to a salary.

- Regulatory & Compliance Expertise: In the post-Brexit world, deep knowledge of EU regulations (like GDPR for data, or MiFID II in finance) is invaluable. Professionals who can help companies navigate this complex landscape are highly sought after.

- Project & Program Management: Certifications like PMP (Project Management Professional) or PRINCE2, combined with a proven track record of delivering complex projects on time and on budget, are universally valuable and command higher salaries.

- Sales & Business Development: For revenue-generating roles, the ability to demonstrate a history of exceeding sales targets is the most direct way to increase earnings, as compensation is heavily tied to commission and bonuses.

---

Ireland's Economic Outlook and Salary Trends

Understanding the current salary landscape is one thing; positioning yourself for future growth is another. A professional's earning potential is intrinsically linked to the health and direction of the national economy. Fortunately, Ireland's economic outlook remains one of the most positive in Europe, though not without its challenges.

### Job Growth and Sectoral Outlook

Ireland's economic model is heavily reliant on Foreign Direct Investment (FDI), spearheaded by agencies like IDA Ireland. The continued success in attracting and retaining multinational corporations is the primary engine of job growth, particularly in high-skilled sectors.

According to the National Skills Bulletin 2023, published by the Skills and Labour Market Research Unit (SLMRU) in SOLAS, several areas are poised for significant growth over the next decade:

- High-Tech Manufacturing (Pharma & MedTech): Ireland is expected to further solidify its position as a global life sciences hub. The demand for biochemists, process engineers, quality assurance specialists, and regulatory experts will remain exceptionally high. The shift towards biologics and advanced therapies will create new, highly specialized roles.

- Information & Communication Technology (ICT): While some global tech giants have seen recent layoffs, the underlying demand for digital skills is unabated. Growth is particularly strong in cybersecurity, artificial intelligence (AI) and machine learning (ML), cloud computing, and software-as-a-service (SaaS). The need to digitalize all sectors of the economy ensures that ICT skills will be a passport to high-paying jobs for the foreseeable future.

- Financial Services: Dublin's role as an English-speaking EU financial center has been bolstered post-Brexit. Growth in sustainable finance (ESG), FinTech, and aviation leasing is expected to continue creating high-value jobs for accountants, risk managers, and financial analysts.

- Renewable Energy & Green Economy: As Ireland strives to meet its ambitious climate targets, there will be a massive expansion in jobs related to wind energy (onshore and offshore), solar power, grid modernization, and retrofitting buildings. This will create a surge in demand for electrical engineers, environmental scientists, and skilled construction trades.

The overall job growth forecast is positive. While the U.S. Bureau of Labor Statistics (BLS) provides a 10-year outlook for the US, Irish projections from bodies like the Economic and Social Research Institute (ESRI) point to continued, albeit potentially moderating, employment growth, outpacing the EU average.

### Future Challenges and Emerging Trends

While the outlook is strong, savvy professionals should be aware of the trends and challenges that will shape the salary landscape:

1. Inflation and Cost of Living: Ireland has experienced a significant surge in inflation, mirroring global trends. This has put pressure on wages, with many unions and employees demanding salary increases that keep pace with the rising cost of living. The most significant challenge is the housing crisis, particularly in Dublin, where soaring rents can negate the benefit of a high salary. Companies are increasingly aware that they must factor this into their compensation strategies to attract and retain talent.

2. The War for Talent & Skills Gaps: Despite economic headwinds, the competition for skilled professionals remains fierce. The National Skills Bulletin consistently highlights shortages of specific skills, particularly in STEM, finance, and multilingual roles. This skills gap gives significant leverage to qualified candidates, allowing them to command higher salaries and better benefits.

3. The Rise of Remote and Hybrid Work: The pandemic accelerated a fundamental