What Social Security Benefit Can You Expect with a $100k Salary? A Detailed Guide

Planning for retirement is one of the most significant financial undertakings of your professional life. For many Americans, a key component of that plan is Social Security. A common question we see is, "What will my Social security check be if I earn a $100,000 salary?" While there isn't a single, direct answer, understanding the system allows for a very accurate estimation.

This guide will break down how your benefit is calculated, provide a concrete estimate based on a consistent $100,000 salary, and explore the key factors that can change your final monthly payment.

How Is Your Social Security Check Calculated?

First, it’s crucial to understand that your Social Security benefit is not based on your final salary or even your best salary. Instead, it's a reflection of your lifetime earnings. The Social Security Administration (SSA) uses a complex formula to determine your benefit, but here is an engaging overview of the process:

1. Your 35 Highest-Earning Years: The SSA records all your annual earnings where you paid Social Security taxes. They then adjust, or "index," these earnings to account for changes in average wages over time. This ensures your earnings from decades ago are valued in today's dollars.

2. Calculating Your AIME: The SSA takes your 35 highest-earning (indexed) years, adds them up, and divides the total by 420 (the number of months in 35 years). The result is your Average Indexed Monthly Earnings (AIME). If you have worked for fewer than 35 years, the SSA will input a zero for each missing year, which can significantly lower your AIME.

3. Applying the Formula: Your AIME is then put through a formula using "bend points" to calculate your Primary Insurance Amount (PIA). The PIA is the benefit you would receive if you start collecting at your full retirement age (FRA). For 2024, the formula is:

- 90% of the first $1,174 of your AIME.

- Plus, 32% of your AIME between $1,174 and $7,078.

- Plus, 15% of your AIME over $7,078.

This progressive formula ensures that lower-income earners receive a higher percentage of their pre-retirement income than high-income earners.

Estimated Social Security Check for a $100k Salary

To provide a clear estimate, let's create a hypothetical scenario.

Assumption: You work a full 35-year career and consistently earn an inflation-adjusted salary of $100,000 per year.

1. Annual Salary: $100,000

2. Monthly Salary: $100,000 / 12 = $8,333

3. Your AIME: In this simplified scenario, your AIME is $8,333.

4. Applying the 2024 Bend Point Formula:

- 90% of $1,174 = $1,056.60

- 32% of the amount between $1,174 and $7,078 ($5,904) = $1,889.28

- 15% of the amount over $7,078 ($8,333 - $7,078 = $1,255) = $188.25

Estimated Total Benefit (PIA): $1,056.60 + $1,889.28 + $188.25 = $3,134.13

> Based on this calculation, a worker who consistently earned an inflation-adjusted $100,000 salary for 35 years would receive an estimated $3,134 per month if they claimed benefits at their full retirement age in 2024.

Key Factors That Influence Your Salary and Final Check

Your final monthly check can be higher or lower than this estimate. The most significant factors are your unique earnings history and, most importantly, when you decide to claim.

###

Your Lifetime Earnings History

The $3,134 estimate assumes a steady, high income for 35 years. In reality, most careers don't follow such a straight line. Periods of lower earnings at the start of your career, or years taken off for family or education, will lower your AIME. Conversely, if you earn significantly more than $100,000 in some years, it could raise your AIME. Remember, only your top 35 years count.

*Source: All calculation methodology and program rules are set by the Social Security Administration (SSA).*

###

The Age You Claim Benefits

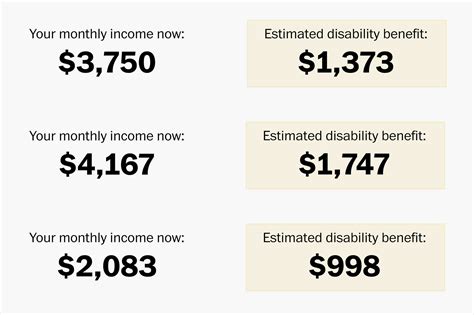

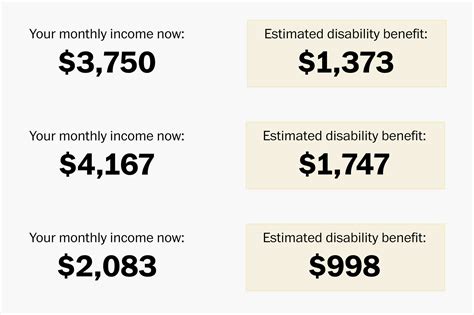

This is the single most powerful lever you can pull to change your monthly benefit.

- Full Retirement Age (FRA): Your FRA depends on your birth year. For those born in 1960 or later, it is 67. Claiming at your FRA gets you 100% of your calculated benefit (our $3,134 estimate).

- Claiming Early (Age 62): You can claim as early as age 62, but your benefits will be permanently reduced. If your FRA is 67, claiming at 62 results in about a 30% reduction. The estimated $3,134 check would become approximately $2,194 per month.

- Claiming Late (Age 70): For every year you delay claiming past your FRA, your benefit increases by 8%. If your FRA is 67, waiting until age 70 results in a 24% increase. The estimated $3,134 check would become approximately $3,886 per month.

*Source: Benefit reduction and increase percentages are provided by the Social Security Administration (SSA).*

###

Geographic Location

Unlike salary, Social Security benefits are a federal program and are not adjusted based on the cost of living in your state or city. A person with an identical earnings history in San Francisco, California, and Lincoln, Nebraska, will receive the same monthly benefit. Your salary may be higher in a high-cost-of-living area to compensate, but this only impacts your benefit by contributing to a potentially higher lifetime earnings record.

###

Annual Wage Base Limit

You only pay Social Security tax on earnings up to a certain annual limit, known as the "wage base limit." This limit changes almost every year. For 2024, this limit is $168,600. Any income earned above this amount is not subject to Social Security tax and is not included in your earnings record for benefit calculation. A $100,000 salary is well within this limit.

*Source: The annual wage base limit is announced by the Social Security Administration (SSA) each year.*

Planning Your Future: Beyond the Estimate

While our estimate provides a strong benchmark, it's no substitute for the real thing. The Social Security Administration offers the most accurate tools for retirement planning.

We highly encourage you to create a `my Social Security` account on the official SSA website. Once you register, you can view your entire earnings history and get a personalized, real-time estimate of your future benefits at different claiming ages (62, FRA, and 70). This official estimate is based on your actual work history and is the gold standard for retirement planning.

Conclusion

Understanding your future Social Security income is a cornerstone of effective retirement planning. For someone with a consistent, career-long salary of $100,000, an estimated monthly check of around $3,100 to $3,200 is a reasonable expectation if claimed at full retirement age.

However, the key takeaways are:

- It's About a Lifetime: Your benefit is a reflection of 35 years of work, not a single salary.

- You Have Control: The age you decide to claim is the most significant factor you can control, with the potential to swing your monthly check by over 75% from age 62 to age 70.

- Use Official Tools: Your personalized estimate from the SSA.gov website is the most reliable number for your financial plan.

By understanding these principles, you can move from asking "what if" to confidently planning for a secure and comfortable retirement.