Are you analytical, detail-oriented, and looking for a career path that offers stability, growth, and a respectable income? Do you see numbers not just as figures on a page, but as the language of business, telling a story of success, challenge, and opportunity? If so, a career as a staff accountant might be the perfect fit for you. This role is the bedrock of the financial world, a crucial position within any organization that values fiscal health and strategic planning. But beyond its importance, a key question for any aspiring professional is: what can you actually earn? The average staff accountant salary is a compelling starting point, but the full picture reveals a landscape of significant earning potential shaped by your skills, choices, and ambition.

While the national average provides a solid benchmark, often hovering between $65,000 and $75,000 annually, this figure is merely the beginning of the story. Your actual compensation can be influenced by a multitude of factors, pushing your earnings well into the six-figure range as you advance in your career. I once mentored a bright but uncertain graduate who was weighing a "passion" project against the perceived rigidity of an accounting career. They chose the latter, and years later, as a senior accountant, they reached out to thank me. The financial stability and skills they gained had not only built a fantastic career but also gave them the resources and freedom to pursue their passions without financial anxiety. This is the power of a foundational role like a staff accountant: it doesn't just offer a job; it builds a launchpad for your life.

This guide is designed to be your definitive resource, moving far beyond a simple salary number. We will dissect every component of a staff accountant's career, from daily responsibilities and job outlook to the specific strategies you can employ to maximize your income and accelerate your professional growth.

### Table of Contents

- [What Does a Staff Accountant Do?](#what-does-a-staff-accountant-do)

- [Average Staff Accountant Salary: A Deep Dive](#average-staff-accountant-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Staff Accountant Career Right for You?](#conclusion-is-a-staff-accountant-career-right-for-you)

---

What Does a Staff Accountant Do?

A staff accountant is the engine of a company's finance department. While titles like "CFO" or "Controller" often get the spotlight, it's the staff accountant who performs the essential, hands-on work that ensures the financial integrity of the entire organization. They are the guardians of the general ledger, the meticulous record-keepers who ensure that every dollar is tracked, categorized, and reported accurately.

Their role is a blend of routine tasks, complex problem-solving, and critical analysis. They are responsible for maintaining and reconciling balance sheet and income statement accounts, tasks that are crucial for producing accurate financial statements. This isn't just data entry; it requires a deep understanding of accounting principles like GAAP (Generally Accepted Accounting Principles) to ensure all transactions are recorded correctly.

Core Responsibilities and Daily Tasks:

A staff accountant's duties can vary depending on the size and type of the company, but a core set of responsibilities remains consistent:

- General Ledger (GL) Maintenance: The GL is the central repository of all financial transactions. Staff accountants are responsible for its accuracy, preparing and posting journal entries for everything from payroll to asset depreciation.

- Month-End Close Process: This is a critical, high-pressure period where accountants work to close the books for the month. It involves reconciling all accounts, investigating discrepancies, and preparing reports for management. A smooth month-end close is a sign of an efficient accounting department.

- Bank and Credit Card Reconciliations: This involves matching the company's internal records with bank statements to ensure all cash transactions are accounted for and to identify any fraudulent activity or errors.

- Accounts Payable (AP) and Accounts Receivable (AR): While larger companies may have dedicated AP/AR clerks, staff accountants often oversee or assist with these functions. This includes processing invoices, managing vendor payments, tracking customer payments, and following up on past-due accounts.

- Financial Reporting: They play a key role in preparing fundamental financial statements, including the Balance Sheet, Income Statement, and Statement of Cash Flows. These reports are vital for internal management and external stakeholders like investors and lenders.

- Audit and Tax Support: Staff accountants are instrumental during annual audits, providing auditors with necessary documentation, schedules, and explanations. They also assist the tax team by preparing data needed for federal, state, and local tax filings.

- Fixed Asset Management: Tracking the purchase, depreciation, and disposal of company assets like equipment, vehicles, and buildings.

### A Day in the Life of a Staff Accountant

To make this more tangible, let's walk through a typical day for "Alex," a staff accountant at a mid-sized tech company, during a normal period (not month-end close).

- 9:00 AM - 10:00 AM: Alex starts the day by reviewing overnight bank transactions and categorizing them in the accounting software. They respond to emails from department managers who have questions about their recent budget reports.

- 10:00 AM - 12:00 PM: Focus time is dedicated to a key project: reconciling the company's main corporate credit card statements. This involves collecting receipts from dozens of employees, ensuring proper coding for each expense, and identifying any out-of-policy spending.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 2:30 PM: Alex works on preparing several journal entries. One is for the monthly software subscription accrual, and another is to record the depreciation of new computer equipment purchased last month.

- 2:30 PM - 3:00 PM: A quick meeting with a senior accountant to review the progress on the credit card reconciliation and discuss a complex entry that requires a second opinion.

- 3:00 PM - 4:30 PM: Alex shifts focus to accounts payable, reviewing a batch of vendor invoices for accuracy and approval, and scheduling them for payment in the next check run.

- 4:30 PM - 5:00 PM: They wrap up the day by updating their month-end close checklist, noting the tasks completed today and planning priorities for tomorrow.

This example illustrates the blend of routine (bank recs, emails) and project-based work that defines the role. It requires sharp technical skills, strong organizational abilities, and effective communication to succeed.

---

Average Staff Accountant Salary: A Deep Dive

Now for the central question: what is the earning potential for a staff accountant? The salary for this role is multifaceted, comprising a base salary alongside other forms of compensation. It's crucial to look at the complete picture to understand the true financial benefits.

First, it's important to distinguish between the broader category of "Accountants and Auditors" and the specific role of "Staff Accountant." The U.S. Bureau of Labor Statistics (BLS) provides data for the general category. As of May 2022 (the most recent detailed data available), the median annual wage for accountants and auditors was $78,000. The lowest 10 percent earned less than $48,560, while the top 10 percent earned more than $132,690. This wide range reflects the diverse roles, experience levels, and specializations within the accounting profession.

For the more specific "Staff Accountant" title, we turn to reputable salary aggregators that collect real-time, user-reported data.

- Salary.com reports that the average Staff Accountant I (entry-level) salary in the United States is $65,110 as of late 2023, with a typical range falling between $59,316 and $71,607.

- Payscale indicates a similar average base salary of around $62,245 per year, with a common range of $50,000 to $79,000.

- Glassdoor places the total pay average higher, at approximately $73,500 per year, which includes base pay and additional compensation like bonuses.

Synthesizing this data, a realistic expectation for an entry-level to mid-career staff accountant is a base salary in the $60,000 to $80,000 range. However, this is just the starting point.

### Salary Progression by Experience Level

Your value—and therefore your salary—grows significantly with experience. As you move from executing tasks to managing processes and people, your compensation reflects your increased responsibility.

Here is a typical salary progression, compiled from industry sources like the Robert Half Salary Guide and the aggregators mentioned above:

| Experience Level | Typical Title(s) | Typical Annual Base Salary Range (2024) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Staff Accountant I, Junior Accountant | $55,000 - $72,000 | Basic reconciliations, journal entries, data entry, assisting with month-end close, AP/AR processing. |

| Mid-Career (3-5 years) | Staff Accountant II, General Ledger Accountant | $68,000 - $88,000 | Handling complex reconciliations, taking ownership of month-end close areas, preparing financial statements, variance analysis. |

| Senior Staff (5+ years) | Senior Accountant, Senior GL Accountant | $85,000 - $110,000+ | Reviewing work of junior staff, managing the entire month-end close, handling complex technical accounting issues, leading projects (e.g., system implementations), mentoring. |

*Note: These are national averages. As we'll explore in the next section, these figures can be 15-30% higher in high-cost-of-living metropolitan areas.*

### Beyond the Base Salary: Understanding Total Compensation

Your salary is only one component of your total compensation package. When evaluating a job offer, it’s vital to consider these other financial benefits, which can add 10-25% or more to your overall earnings.

- Bonuses: Annual performance-based bonuses are common in corporate accounting. According to Payscale, the average annual bonus for a staff accountant is around $4,000, but this can be significantly higher in profitable companies or high-performing industries like tech and finance. Some companies also offer signing bonuses to attract top talent.

- Profit Sharing: Some private companies, especially smaller firms, offer profit-sharing plans where a portion of the company's profits is distributed to employees. This can be a powerful incentive and a significant addition to your income.

- 401(k) or 403(b) Matching: This is essentially free money. A common company match is 50% of your contribution up to 6% of your salary. For an accountant earning $70,000, this could mean an extra $2,100 per year directly into their retirement account.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a standard expectation. The value of a good employer-sponsored health plan can be worth thousands of dollars per year compared to purchasing a plan on the open market.

- Paid Time Off (PTO): Generous PTO, including vacation, sick leave, and holidays, contributes to a better work-life balance and is a valuable part of the compensation package.

- Tuition Reimbursement & Professional Development: This is a particularly valuable benefit for accountants. Many companies will help pay for a Master's degree or, crucially, for the study materials and exam fees for the Certified Public Accountant (CPA) license. Earning a CPA can lead to an immediate and substantial salary increase.

When you combine a base salary of $75,000 with a $5,000 bonus, a $2,500 401(k) match, and a robust benefits package, the total compensation package is clearly much more lucrative than the base salary alone suggests.

---

Key Factors That Influence Salary

While national averages and experience levels provide a general framework, your specific salary is determined by a complex interplay of factors. Understanding these variables is the key to strategically navigating your career and maximizing your earning potential. This is where you can move from being a passive job-seeker to an active architect of your financial future.

###

Level of Education & Professional Certifications

Your educational background is the foundation of your accounting career, but it's your certifications that truly unlock the highest earning potential.

- Bachelor's Degree: A Bachelor's degree in Accounting is the standard and non-negotiable entry ticket to the profession. Degrees in Finance or General Business can also be a gateway, but an accounting major is preferred by most employers.

- Master's Degree (MAcc or MSA): A Master of Accountancy (MAcc) or Master of Science in Accounting (MSA) can provide a salary bump of 5-10% from the outset. More importantly, it is often the most direct path to fulfilling the 150-credit-hour requirement needed to sit for the CPA exam in most states. This makes it a strategic investment for those serious about their career trajectory.

- The CPA (Certified Public Accountant): This is the gold standard in the accounting world. The CPA license is a rigorous, four-part exam that demonstrates a deep level of expertise in auditing, regulation, financial accounting, and business concepts. The impact on salary is profound. The AICPA reports that CPAs earn, on average, 10-15% more than their non-certified counterparts. This premium often translates to a $10,000 to $20,000 annual salary increase and opens doors to leadership roles like Accounting Manager, Controller, and CFO. Many public accounting firms require their accountants to be on a CPA track for promotion.

- Other Certifications: While the CPA is paramount, other certifications can boost your salary and marketability in specific niches:

- CMA (Certified Management Accountant): Ideal for accountants in corporate finance who focus on internal decision-making, budgeting, and financial planning. It showcases expertise in cost management and strategic analysis.

- CIA (Certified Internal Auditor): The premier certification for professionals in internal audit, focusing on risk management, governance, and internal controls.

- CGFM (Certified Government Financial Manager): Essential for those pursuing a career in government accounting at the federal, state, or local level.

###

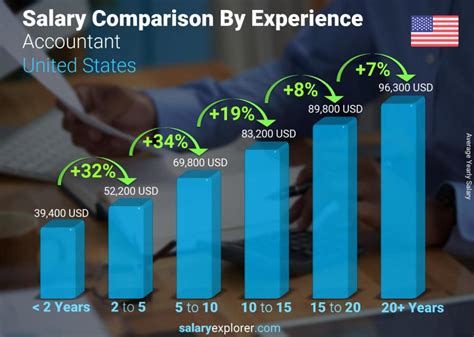

Years of Experience

As detailed in the previous section, experience is perhaps the most direct driver of salary growth in the early to mid-stages of your career. This isn't just about time served; it's about the accumulation of skills and responsibilities.

- 0-2 Years (The Learning Phase): Your primary role is to learn and execute. You're mastering the fundamentals: debits and credits, reconciliations, and the month-end process. Your salary reflects that you are still being trained and your work is heavily reviewed.

- 3-5 Years (The Ownership Phase): You've moved beyond basic execution. You now *own* specific areas of the month-end close. You can troubleshoot discrepancies independently, perform more complex analyses (e.g., flux analysis), and begin to understand the "why" behind the numbers, not just the "what." This increased autonomy and reliability directly translate to higher pay. You might start training interns or new hires.

- 5+ Years (The Leadership & Expertise Phase): As a Senior Accountant, you are now a subject matter expert. You review the work of junior staff, lead complex projects like system upgrades, and act as a key point of contact for external auditors. Your salary reflects your ability to multiply your impact by leading others and solving the company's most challenging accounting problems. This stage is the launching point for management roles.

###

Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted to reflect the local cost of living and the demand for talent in that specific market. A $70,000 salary in Des Moines, Iowa, provides a very different lifestyle than the same salary in New York City.

According to the BLS, the metropolitan areas with the highest average salaries for accountants are concentrated in major business hubs:

- Top-Paying Metropolitan Areas:

- San Jose-Sunnyvale-Santa Clara, CA: $119,770 (annual mean wage)

- San Francisco-Oakland-Hayward, CA: $111,260

- New York-Newark-Jersey City, NY-NJ-PA: $105,770

- Washington-Arlington-Alexandria, DC-VA-MD-WV: $102,940

- Boston-Cambridge-Nashua, MA-NH: $98,240

Conversely, salaries are typically lower in rural areas and states with a lower cost of living. It's essential to use a cost-of-living calculator to compare offers from different cities to understand your true purchasing power. While a high salary in a major city is attractive, it may not stretch as far after accounting for housing, transportation, and taxes. The rise of remote work has also introduced new dynamics, with some companies paying location-based salaries while others have moved to a single pay scale regardless of location.

###

Company Type & Size

The type of organization you work for is a major determinant of your salary, work environment, and career path.

- Public Accounting (The Big Four & Regional Firms): Firms like Deloitte, PwC, EY, and KPMG (The Big Four) are known for offering some of the highest starting salaries to attract the best university graduates. The work is demanding, with long hours, especially during busy season. However, the training is world-class, and having a Big Four firm on your resume is a prestigious credential that opens countless doors. A few years in public accounting, especially if you earn your CPA, often leads to a significant salary jump when moving into a corporate role.

- Corporate/Industry Accounting (Private Sector): This is the most common path.

- Startups: May offer lower base salaries but compensate with equity (stock options). The environment is fast-paced and less structured, offering a chance to wear many hats.

- Mid-Sized Companies: Offer a balance of structure and opportunity. Salaries are competitive, and there's often a clearer path for advancement than at a small company.

- Large Corporations (Fortune 500): These companies typically offer the highest corporate salaries, excellent benefits, and highly specialized roles. You might focus solely on fixed assets, international accounting, or SEC reporting. The environment is more structured and corporate.

- Non-Profit Organizations: Salaries in the non-profit sector are generally lower than in the for-profit world. However, these roles often provide a strong sense of mission, a better work-life balance, and excellent benefits.

- Government (Federal, State, Local): Government accounting jobs (e.g., at the IRS, GAO, or a state comptroller's office) are known for their exceptional job security, predictable hours, and robust pension and healthcare benefits. Salaries are determined by structured pay scales (like the federal General Schedule or GS scale). While the starting salary may be lower than in public accounting, the long-term benefits can be substantial.

###

Area of Specialization

Within accounting, certain specializations are more lucrative or in-demand than others. As a staff accountant, you may be a generalist, but you can start to gravitate toward areas that command higher pay.

- Technical Accounting & SEC Reporting: Specialists who can interpret and implement complex accounting standards (e.g., revenue recognition, lease accounting) and prepare filings for the Securities and Exchange Commission are highly valued and well-compensated.

- Forensic Accounting: This exciting field involves investigating financial fraud and discrepancies. It requires a unique investigative skillset and can be very lucrative.

- IT Audit/Systems Accounting: Accountants who bridge the gap between finance and technology are in high demand. They understand how financial data flows through ERP systems, help implement new software, and ensure data integrity and security.

- Tax Accounting: Specializing in corporate tax compliance and strategy can lead to a high-paying career, particularly for those who can help companies minimize their tax liabilities legally.

###

In-Demand Skills

Beyond your degree and certifications, a specific set of technical and soft skills can directly impact your salary negotiations and promotional opportunities.

High-Value Technical Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a master of VLOOKUPs, HLOOKUPs, INDEX/MATCH, PivotTables, and complex formula creation. Knowledge of Power Query and basic VBA/macros is a significant plus.

- Enterprise Resource Planning (ERP) System Proficiency: Experience with large-scale ERP systems is a huge resume booster. The most common are SAP, Oracle NetSuite, and Microsoft Dynamics 365. Demonstrating you can navigate these complex systems efficiently is a major selling point.

- Data Analytics & Visualization: The future of accounting is data. Skills in tools like Tableau or Microsoft Power BI to create dashboards and visualize financial data for non-accountants are becoming increasingly valuable.

- SQL (Structured Query Language): The ability to pull and query data directly from databases is a powerful skill that separates you from the pack, allowing you to perform more sophisticated analysis.

Essential Soft Skills:

- Communication: You must be able to clearly explain complex financial concepts to non-financial stakeholders (e.g., department heads, sales managers).

- Problem-Solving: Accounting is not just about recording what happened; it's about figuring out *why* it happened when numbers don't add up.

- Attention to Detail: A single misplaced decimal can have significant consequences. Meticulous accuracy is the hallmark of a great accountant.

- Business Acumen: The best accountants understand the business operations behind the numbers. They can connect a dip in revenue to a specific market trend or a spike in expenses to a new operational initiative.

By strategically developing these factors, you can actively steer your career towards higher compensation and greater professional fulfillment.

---

Job Outlook and Career Growth

Choosing a career isn't just about the starting salary; it's about long-term stability and the potential for advancement. In this regard, accounting continues to be a resilient and promising profession.

According to the U.S. Bureau of Labor Statistics (BLS), employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. While 4% might not sound explosive, it translates into a significant number of job openings. The BLS projects about 67,400 openings for accountants and auditors each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This steady demand is underpinned by several core factors:

- Economic Growth: As the economy grows, more businesses are created, requiring accountants to manage their finances.

- Regulatory Complexity: A constantly changing landscape of tax laws and financial regulations (like the Sarbanes-Oxley Act) necessitates the expertise of skilled accountants to ensure compliance.

- Globalization: Businesses operating internationally require accountants who understand complex international finance and tax laws.

### The Typical Career Trajectory

The staff accountant role is rarely a final destination; it is a foundational stepping stone to a wide range of senior leadership positions. The career path is well-defined and offers clear opportunities for advancement, especially for those who obtain their CPA license.

A common progression in corporate accounting looks like this:

Staff Accountant (1-3 years) → Senior Accountant (3-6 years) → Accounting Manager (5-10 years) → Controller (8+ years) → Chief Financial Officer (CFO)

- Senior Accountant: As discussed, this role involves more complex tasks and reviewing the work of junior staff.

- Accounting Manager: You transition from doing the work to managing the team that does the work. You are responsible for the entire accounting close process, managing a team of accountants, and presenting financial results to upper management. Salaries for Accounting Managers typically range from $100,000 to $150,000+.

- Controller: The Controller is the head of the accounting department, responsible for all accounting operations, including financial reporting, internal controls, and tax compliance. This is a senior leadership role with a salary often in the **$150,00