For professionals scanning the global landscape for career opportunities, Switzerland often appears as a shining beacon. It’s a country synonymous with an unparalleled quality of life, breathtaking scenery, political stability, and, most alluringly, some of the highest salaries in the world. But behind the enticing headlines of six-figure paychecks lies a complex and nuanced economic reality. What does the "average Swiss salary" truly mean for your take-home pay, your cost of living, and your overall career trajectory? Is the grass—and the currency—truly greener on the Swiss side?

This guide is designed to be your definitive resource, moving beyond simplistic figures to provide a comprehensive, data-driven analysis of the Swiss salary landscape. We will dissect the numbers, explore the cultural context of work, and provide a strategic roadmap for anyone aspiring to build a career in this unique and rewarding nation. I once coached a highly skilled data scientist who was offered a seemingly astronomical salary of CHF 130,000 to move to Zurich. While initially ecstatic, a deeper dive revealed that after factoring in mandatory social contributions, taxes, and one of the world's highest costs of living, his disposable income was more comparable to his previous role in a major US city—a crucial realization that underscores the importance of the detailed analysis we are about to undertake. This guide will equip you with that same level of critical insight.

Here, we will explore everything from the foundational national average salary to the intricate factors—like your industry, canton, and experience—that will ultimately shape your earnings. We will look at the job market's future and provide actionable steps to navigate the competitive process of securing a role in the heart of Europe.

### Table of Contents

- [Understanding the Swiss Work Culture & Economy](#understanding-the-swiss-work-culture--economy)

- [The Average Swiss Salary: A Deep Dive into the Numbers](#the-average-swiss-salary-a-deep-dive-into-the-numbers)

- [Key Factors That Influence Your Salary in Switzerland](#key-factors-that-influence-your-salary-in-switzerland)

- [The Swiss Job Market: Outlook and Opportunities](#the-swiss-job-market-outlook-and-opportunities)

- [How to Land a High-Paying Job in Switzerland](#how-to-land-a-high-paying-job-in-switzerland)

- [Conclusion: Is a Swiss Career Right for You?](#conclusion-is-a-swiss-career-right-for-you)

---

Understanding the Swiss Work Culture & Economy

Before diving into salary specifics, it's crucial to understand the environment where that salary is earned. The Swiss workplace is a unique blend of efficiency, precision, and a surprising emphasis on work-life balance. It’s governed by a strong economy built on high-value industries. Understanding this context is the first step to truly evaluating a Swiss job offer.

The Swiss economy is one of the most stable and advanced in the world. Its strength is not built on vast natural resources but on a highly skilled workforce, political stability, and a focus on innovation and quality. The key pillars of the economy include:

- Pharmaceuticals and Life Sciences: Home to giants like Novartis and Roche, the Basel region is a global hub for this sector.

- Banking and Financial Services: Zurich and Geneva are world-renowned financial centers, specializing in private banking, wealth management, and insurance.

- High-Tech Manufacturing and Engineering: Switzerland is a leader in precision instruments, machinery, and watchmaking. Companies like ABB and Swatch Group are major employers.

- Information Technology: A rapidly growing sector, particularly in areas like FinTech, cybersecurity, and AI, with major hubs in Zurich and the "Crypto Valley" of Zug.

The professional culture is deeply ingrained with values that reflect this economic structure. Punctuality is not just a suggestion; it is a sign of respect. Meetings are expected to start and end precisely on time. Communication is often direct and to the point, valuing clarity over elaborate pleasantries. The decision-making process can be slower than in some other cultures, as it often relies on building consensus among stakeholders, but once a decision is made, implementation is swift and efficient.

While the Swiss work hard, there is also a strong legal and cultural emphasis on work-life balance. The statutory maximum workweek is 45 hours for most white-collar workers, and overtime is either compensated or strictly regulated. It is common for offices to empty out promptly at the end of the workday, and taking a full hour for lunch, often away from one's desk, is standard practice.

### A "Week in the Life" of a Professional in Zurich

To make this more tangible, let's imagine a week for "Anna," a marketing manager at a tech firm in Zurich.

- Monday: The week starts with a 9:00 AM team meeting, which begins precisely on the dot. The agenda is clear, and discussion is focused on Q3 targets. After the meeting, Anna works on a campaign analysis, collaborating with colleagues in a quiet, focused office environment. She leaves at 5:30 PM to meet friends for an "Apéro" (after-work drinks and snacks).

- Tuesday & Wednesday: These are deep-work days. Anna develops a new market entry strategy, using data to back up her proposals. She has a scheduled one-hour lunch break both days, which she uses to go for a walk by Lake Zurich or eat with colleagues at a local restaurant.

- Thursday: Anna presents her strategy to her department head. The feedback is direct and constructive, focusing on potential risks and data validation. The culture encourages challenging ideas to arrive at the most robust solution.

- Friday: The morning is for wrapping up weekly tasks and planning for the next week. The office atmosphere is slightly more relaxed. By 4:00 PM, many colleagues have already left to start their weekend, perhaps heading to the Alps for a hike or to visit family in another part of the country. Anna finishes her work and leaves at 5:00 PM, respecting the clear boundary between professional and personal time.

This rhythm of focused, efficient work followed by a distinct separation for personal life is the hallmark of the Swiss professional experience.

---

The Average Swiss Salary: A Deep Dive into the Numbers

Now for the central question: What is the average salary in Switzerland? The headline figure is indeed impressive, but it's the beginning, not the end, of the story.

The single most authoritative source on Swiss earnings is the Swiss Federal Statistical Office (FSO). According to their latest comprehensive Swiss Earnings Structure Survey, the median gross monthly salary for a full-time job was CHF 6,788 as of 2022. This translates to an annual gross salary of CHF 81,456.

It's crucial to focus on the *median* rather than the *mean* (average). The median represents the midpoint of all salaries, meaning half the population earns more and half earns less. The mean can be skewed upwards by a small number of extremely high earners.

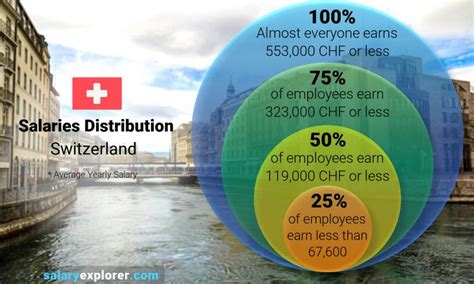

However, this national median lumps everyone together—from a retail worker in a small town to a banking director in Geneva. A more detailed look from the FSO reveals a wide distribution:

- The bottom 10% of earners made less than CHF 4,487 per month.

- The top 10% of earners made more than CHF 12,178 per month.

Salary aggregator websites, which rely on user-submitted data, often report higher figures, reflecting the fact that their user base is often skewed towards more highly educated professionals in international roles. For instance:

- Payscale lists the average salary in Switzerland as CHF 96,000 per year as of late 2023.

- Salary.com data suggests an average base salary closer to CHF 101,000.

While these sites provide useful, real-time reference points, the FSO data remains the gold standard for a comprehensive national picture.

### From Gross to Net: Understanding Swiss Deductions

That impressive gross salary figure is not what lands in your bank account. Switzerland has a mandatory, multi-pillar social security system, and contributions are deducted directly from your paycheck. Understanding these is essential for calculating your true take-home pay.

Here is a breakdown of the typical deductions from your gross salary:

| Deduction | Description | Approximate Rate (Employee's Share) |

| :--- | :--- | :--- |

| AHV/AVS (Old Age and Survivors' Insurance) | The first pillar of the state pension system. | 4.35% |

| IV/AI (Disability Insurance) | Provides income support in case of disability. | 0.7% |

| EO/APG (Income Compensation Insurance) | Covers income loss during military/civil service or maternity/paternity leave. | 0.25% |

| ALV/AC (Unemployment Insurance) | Provides benefits if you lose your job. | 1.1% (on income up to CHF 148,200) |

| BVG/LPP (Occupational Pension) | The second pillar, a mandatory employer-managed pension fund. Rates vary by age and pension plan, but this is a significant deduction. | ~5-9% (varies greatly) |

| NBU/AANP (Non-occupational Accident Insurance) | Covers accidents that happen outside of work. | ~1-3% (varies by insurer and risk profile) |

Total Social Security Deductions: You can expect roughly 12-18% of your gross salary to be deducted for these mandatory contributions *before* income tax.

Income Tax: Unlike in many countries, income tax is *not* always deducted at source (unless you are a foreign national on certain permits, where it is). Swiss residents are typically responsible for filing an annual tax return and paying federal, cantonal, and municipal taxes. This tax burden varies enormously depending on where you live (your canton and municipality), your marital status, and your religion (church tax is collected in many cantons). The overall tax burden is generally lower than in many other Western European countries like Germany or France, but it is still a significant cost.

Example Calculation:

Let's take a gross annual salary of CHF 100,000.

- Social Security Deductions (~15%): - CHF 15,000

- Salary after Social Security: CHF 85,000

- Income & Other Taxes (estimate for a single person in Zurich): ~15-20% of the remaining amount, roughly CHF 12,750 - CHF 17,000.

- Approximate Net Take-Home Pay: CHF 68,000 - CHF 72,250

This demonstrates why you cannot simply convert a Swiss salary to your home currency and celebrate. The net figure, considered alongside the high cost of living, provides the only true measure of your financial standing.

---

Key Factors That Influence Your Salary in Switzerland

The national average provides a baseline, but your personal earning potential is determined by a combination of powerful factors. In Switzerland, these variables can create salary differences of tens or even hundreds of thousands of francs for individuals working in the same country. This section will provide an exhaustive breakdown of what truly drives compensation.

###

Level of Education

Switzerland places an exceptionally high value on education and training, and this is directly reflected in salary structures. The country's dual-track education system, which combines traditional university paths with highly respected vocational and applied sciences training, creates a clear hierarchy in earning potential.

- Apprenticeship / Vocational Training (VET): The backbone of the Swiss workforce. Individuals with a completed Federal VET Diploma often start with solid, middle-class salaries. However, their long-term ceiling might be lower than those with university degrees unless they pursue further specialized training.

- *Median Monthly Salary (with completed apprenticeship):* ~CHF 6,000 - CHF 6,500

- Universities of Applied Sciences (Fachhochschule): These institutions offer practical, career-focused Bachelor's and Master's degrees. Graduates are highly sought after, particularly in fields like engineering, IT, and business administration.

- *Median Monthly Salary (with Applied Sciences degree):* ~CHF 8,000 - CHF 9,500

- Traditional University (Universität): A Bachelor's degree from a traditional university (like ETH Zurich or University of Geneva) is a prerequisite for many high-level professional roles. A Master's degree is often considered the standard entry-level qualification in many fields, such as finance and research.

- *Median Monthly Salary (with University Master's degree):* ~CHF 9,000 - CHF 11,000

- Doctorate (PhD): A PhD commands the highest salaries, particularly in R&D-intensive industries like pharmaceuticals, biotech, and high-tech engineering. It is often a prerequisite for senior research and leadership positions in these sectors.

- *Median Monthly Salary (with PhD):* ~CHF 11,000 - CHF 14,000+

*(Source: Swiss Federal Statistical Office, analysis of earnings by education level)*

###

Years of Experience

Experience is a universal driver of salary, but in the stable Swiss market, the trajectory is predictable and significant. Companies value proven expertise and loyalty, and compensation reflects this.

- Entry-Level (0-2 years): Graduates entering the workforce can expect a strong starting salary, but one that is firmly grounded in the reality of their training and initial lack of practical experience.

- *Typical Annual Salary Range:* CHF 75,000 - CHF 95,000

- Mid-Career (3-8 years): This is where significant salary growth occurs. Professionals have developed valuable skills, proven their competence, and can take on more responsibility, lead small teams, or manage complex projects.

- *Typical Annual Salary Range:* CHF 95,000 - CHF 130,000

- Senior / Experienced (8-15+ years): At this level, professionals are considered experts. They may hold titles like Senior Manager, Principal Engineer, or Director. Their compensation includes a higher base salary and often more significant performance-based bonuses.

- *Typical Annual Salary Range:* CHF 130,000 - CHF 180,000

- Executive / Leadership (15+ years): Top-level executives (C-suite, Head of Division) in large multinational corporations can see their total compensation, including bonuses and stock options, reach well into the multiple hundreds of thousands or even millions of francs.

- *Typical Annual Salary Range:* CHF 180,000 - CHF 400,000+

###

Geographic Location (Canton)

This is arguably one of the most critical factors in Switzerland. Where you live and work dictates not only your salary but also your cost of living and tax burden. The differences between cantons can be immense. High-salary cantons are typically home to major cities and dominant industries.

| Canton (Major City) | Dominant Industries | Median Annual Gross Salary (Approx.) | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Zurich (Zurich) | Banking, Finance, Insurance, Tech, Consulting | CHF 93,000 | The economic powerhouse of Switzerland. Highest salaries but also one of the highest costs of living globally. |

| Geneva (Geneva) | Private Banking, Commodity Trading, International Orgs (UN, WHO) | CHF 90,000 | International hub with a very high cost of living, comparable to Zurich. Strong demand for multilingual professionals. |

| Basel-Stadt (Basel) | Pharmaceuticals, Life Sciences, Chemicals | CHF 88,000 | Global headquarters for pharma giants. High salaries driven by a high-value, R&D-focused industry. |

| Zug (Zug) | Finance, Commodities, Cryptocurrency/Blockchain | CHF 92,000 | Famously low corporate and personal tax rates attract many companies. High salaries and a very high quality of life. |

| Vaud (Lausanne) | Tech, R&D, Higher Education, Sports Orgs (IOC) | CHF 84,000 | Strong innovation ecosystem around EPFL university. Slightly lower cost of living than Geneva. |

| Bern (Bern) | Government, Administration, MedTech, Telecoms | CHF 81,000 | The nation's capital. Salaries are closer to the national median. More moderate cost of living. |

| Ticino (Lugano) | Finance, Tourism, Fashion | CHF 65,000 | Italian-speaking region. Salaries are significantly lower than in German or French-speaking parts, but so is the cost of living. |

*(Salary Source: FSO data cross-referenced with regional aggregators. Note: These are median figures for the canton, not just for the top professions.)*

A job offer of CHF 100,000 in Ticino is financially superior to the same offer in Zurich due to the vast difference in rent, taxes, and daily expenses.

###

Company Type & Size

The type of organization you work for plays a major role in your compensation package.

- Large Multinational Corporations (MNCs): Companies like Nestlé, Roche, Novartis, UBS, and Google are at the top of the pay scale. They offer highly structured salary bands, comprehensive benefits, generous pension contributions, and significant annual bonuses. Their brand prestige and resources allow them to attract top global talent.

- Small and Medium-Sized Enterprises (SMEs / "Mittelstand"): These companies are the engine of the Swiss economy. While their base salaries may be 10-20% lower than those at MNCs, they can offer other advantages like greater responsibility, faster career progression, a more intimate work culture, and sometimes more flexibility.

- Startups: Compensation in startups is a mixed bag. Early-stage startups may offer below-market salaries but compensate with significant equity (stock options). Well-funded, late-stage startups, particularly in FinTech or BioTech, will offer competitive salaries to attract talent away from large corporations.

- Government and Public Sector: Jobs with the federal or cantonal government, universities, or public transport offer immense stability, excellent benefits, and a great work-life balance. Salaries are transparent and based on fixed pay scales ("Gehaltsklassen"), which are generally competitive but rarely reach the highest levels seen in private finance or pharma.

###

Area of Specialization / Industry

This is where your specific skills meet market demand. Certain industries simply pay more due to the value they generate and the scarcity of the talent they require.

- Banking & Financial Services: Remains one of the highest-paying sectors. Roles in wealth management, investment banking, asset management, and quantitative analysis command top salaries, especially in Zurich and Geneva.

- *Financial Analyst (Mid-Career):* CHF 120,000 - CHF 150,000+

- *Private Banker / Relationship Manager:* Base salary of CHF 150,000+, with bonuses often exceeding the base.

- Pharmaceuticals & Life Sciences: A powerhouse of the Swiss economy. Scientists, researchers, clinical trial managers, regulatory affairs specialists, and commercial roles (e.g., brand managers) are all highly compensated, particularly in the Basel area.

- *R&D Scientist (with PhD):* CHF 110,000 - CHF 140,000

- *Regulatory Affairs Manager:* CHF 130,000 - CHF 170,000

- Information Technology: Demand for tech talent is exploding. While salaries might not reach the absolute peaks of Silicon Valley *after* cost of living adjustments, they are extremely strong and growing.

- *Senior Software Engineer (Zurich):* CHF 125,000 - CHF 160,000

- *Cybersecurity Specialist:* CHF 130,000 - CHF 175,000

- *Data Scientist:* CHF 115,000 - CHF 150,000

- Engineering & Manufacturing: Precision is the keyword. Chemical engineers, process engineers in manufacturing, and specialists in robotics and automation are well-rewarded.

- *Mechanical Engineer (Mid-Career):* CHF 100,000 - CHF 125,000

- Insurance: A stable, high-paying sub-sector of financial services. Actuaries, underwriters, and risk managers are in constant demand.

- *Actuary:* CHF 140,000 - CHF 190,000

- Retail & Hospitality: These sectors are on the lower end of the Swiss salary spectrum. While still high by international standards, they are significantly below the national median.

- *Retail Store Manager:* CHF 70,000 - CHF 85,000

###

In-Demand Skills

Beyond your formal title, specific skills can add a significant premium to your salary.

- Language Skills: Switzerland has four national languages. While English is the corporate language in many MNCs, proficiency in German (especially Swiss German) is a massive advantage in the largest part of the country. French is essential in the Romandy region (Geneva, Vaud), and Italian in Ticino. Being bilingual (German/English) or trilingual can unlock more opportunities and command a higher salary.

- Tech-Specific Skills: Expertise in cloud platforms (AWS, Azure, GCP), specific programming languages (Python, Java, C++), cybersecurity frameworks, and AI/Machine Learning development are highly prized.

- Financial Certifications: Holding a CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), or CAIA (Chartered Alternative Investment Analyst) charter can significantly boost earnings in the finance sector.

- Project & Process Management: Certifications like PMP (Project Management Professional), PRINCE2, and Lean Six Sigma are recognized and valued across industries for demonstrating an ability to deliver results efficiently.

- Regulatory Knowledge: Deep expertise in specific regulatory environments, such as FINMA regulations for banking or Swissmedic regulations for pharmaceuticals, is a scarce and highly valuable skill.

---

The Swiss Job Market: Outlook and Opportunities

A high salary today is only valuable if the career path is sustainable. Fortunately, the Swiss job market is characterized by long-term stability, low unemployment, and a continuous demand for highly skilled labor.

According to the State Secretariat for Economic Affairs (SECO), Switzerland consistently maintains one of the lowest unemployment rates in Europe, often hovering around 2-2.5%. This signals a healthy and robust labor market. However, this stability does not mean the market is static. Several key trends are shaping the future of work in Switzerland.

Projected Growth Sectors:

The demand for talent is not uniform across all industries. The FSO and other economic forecasting bodies point to continued, robust growth in several key areas over the next decade:

1. Health and Social Work: Driven by an aging population and the world-class life sciences industry, the demand for doctors, nurses, therapists, and skilled workers in pharmaceutical R&D and production will continue to grow faster than the average.

2. Information and Communication Technology (ICT): The digitization of the Swiss economy is in full swing. The need for software developers, cybersecurity experts, cloud architects, and data scientists will remain acute. The growth of FinTech in Zurich and Zug is a particularly strong driver.

3. Professional, Scientific, and Technical Activities: This broad category includes consultants, lawyers, accountants, and engineers. As the economy becomes more complex, the need for specialized expert advice will continue to rise.

Emerging Trends and Future Challenges:

- The Skills Gap: While unemployment is low, there is a pronounced shortage of qualified personnel in specific fields, particularly in IT, engineering, and healthcare. This "skills gap" presents a significant opportunity for qualified foreign professionals but also puts pressure on the Swiss education system.

- Impact of a Strong Franc (CHF): The Swiss Franc is a "safe-haven" currency, meaning it strengthens during times of global uncertainty. While this reflects economic stability, it makes Swiss exports more expensive and can pose a challenge for manufacturing and tourism industries. High-value, less price-sensitive industries like pharma and finance are better insulated.

- Immigration and an Aging Workforce: Like many developed nations, Switzerland has an aging population. The country relies on skilled immigration to fill key roles and sustain its pension system. However, immigration is a sensitive political topic, and periodic votes on limiting the influx of foreign workers create a degree of uncertainty for non-Swiss professionals. Currently, a system of quotas is in place for non-EU/EFTA nationals.

How to Stay Relevant and Advance:

In a market that prizes expertise, continuous learning is not optional; it's a prerequisite for career advancement.

1. Embrace Lifelong Learning: The Swiss government and employers heavily invest in "Weiterbildung" (further education). Take advantage of company-sponsored training, pursue advanced certifications, or enroll in executive education courses at top Swiss universities.

2. Develop "T-Shaped" Skills: Cultivate deep expertise in your core domain (the vertical bar of the "T") but also build a broad understanding of adjacent fields, including business acumen, project management, and digital literacy (the horizontal bar).

3. Master the Local Language: Even if you work in an English-speaking office, learning the local language (German, French, or Italian) is the single most effective way to integrate culturally, expand your professional network, and open up a far wider range of long-term career opportunities, especially at the leadership level.

4. Network Strategically: The Swiss