For individuals with an entrepreneurial spirit, a keen sense of risk assessment, and an interest in the justice system, a career as a bail bondsman can be both uniquely challenging and financially rewarding. But what does that financial potential actually look like? While the path to a six-figure income is a real possibility, a bail bondsman's salary is one of the most variable in any profession.

This article provides a data-driven analysis of a bail bondsman's salary, exploring the average earnings and the key factors that can dramatically influence your income in this dynamic field.

What Does a Bail Bondsman Do?

Before diving into the numbers, it's essential to understand the role. A bail bondsman, also known as a bail bond agent, provides a financial guarantee to a court that a defendant will appear for all their scheduled court dates.

Here's a simplified overview of their core responsibilities:

- Risk Assessment: The bondsman evaluates the defendant's flight risk by analyzing their criminal history, community ties, and financial stability.

- Financial Transaction: If the risk is acceptable, the defendant or their family pays the bondsman a non-refundable premium, typically 10% of the total bail amount.

- Posting the Bond: The bondsman then posts a "surety bond" with the court for the full bail amount, securing the defendant's release.

- Fugitive Recovery: If a defendant fails to appear in court (known as "skipping bail"), the bondsman is responsible for paying the full bail amount. To avoid this, they are legally empowered to locate and return the defendant to custody, often by hiring a fugitive recovery agent (bounty hunter).

This commission-based model is the foundation of a bail bondsman's earnings. Their salary is not a fixed hourly wage but a direct result of the number and value of the bonds they write.

Average Bail Bondsman Salary

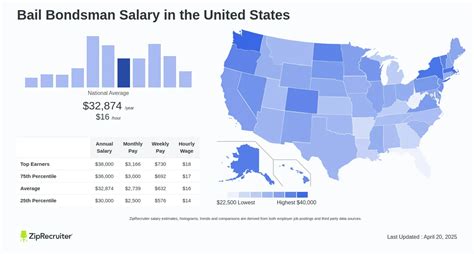

Unlike many traditional careers, the U.S. Bureau of Labor Statistics (BLS) does not have a dedicated category for "Bail Bondsman." They are often grouped with "Insurance Sales Agents" or "Financial Specialists, All Other," which makes a definitive government figure elusive.

However, data from major salary aggregators provides a clear and reliable picture.

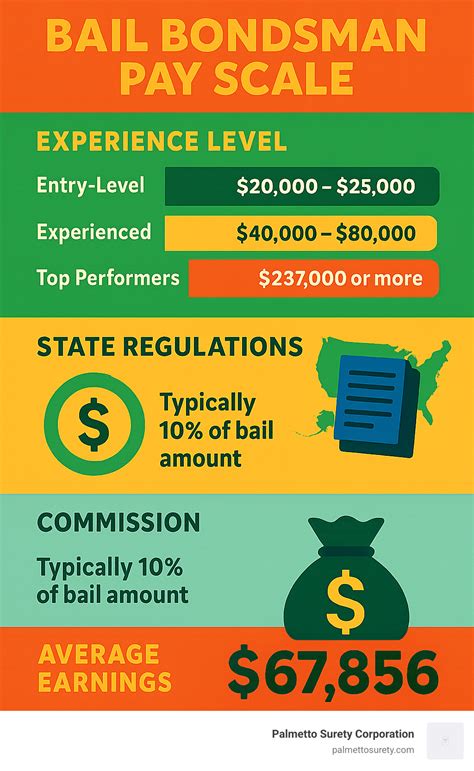

Based on an analysis of current data, the average bail bondsman salary in the United States typically falls between $55,000 and $65,000 per year.

Of course, an "average" only tells part of the story. The salary range is incredibly wide:

- Entry-Level Range: New bail bondsmen, often working for an established agency, can expect to earn between $30,000 and $45,000 annually as they build their client base and experience.

- Senior/Experienced Range: Highly experienced bondsmen, especially those who own their own agencies, can earn well over $100,000, with top performers in major markets exceeding $250,000 per year.

According to Salary.com, the median bail bondsman salary is $59,967, with the top 10% of earners reaching over $96,000. Similarly, Payscale.com reports an average of $56,330, highlighting the significant impact of commission and profit-sharing on total income.

Key Factors That Influence Salary

Your specific income as a bail bondsman is not set in stone. It is directly influenced by a combination of personal skills, business strategy, and market forces.

###

Level of Education

While a four-year college degree is not a strict requirement to become a bail bondsman, it can provide a significant advantage. The minimum educational requirement in most states is a high school diploma or GED. However, post-secondary education in fields like Criminal Justice, Finance, or Business Administration equips you with critical skills in risk management, accounting, and legal processes. This knowledge can lead to better decision-making and, consequently, higher profitability. More importantly, every state has specific pre-licensing courses and exams that are mandatory for legal operation.

###

Years of Experience

Experience is arguably the most critical factor in a bail bondsman's earning potential.

- New Agents: Initially, you may work for a larger agency, earning a smaller percentage of the commission in exchange for mentorship, a steady stream of clients, and coverage from the agency's surety company.

- Experienced Agents: With a few years of experience, you build a reputation with local attorneys and court staff, develop a sharper instinct for assessing risk, and learn the intricacies of fugitive recovery. This allows you to write more—and larger—bonds with confidence.

- Agency Owners: The highest earners are typically those who own their own bail bond agency. As an owner, you keep the entire 10-15% premium (after paying a small percentage to your surety insurer). While you also take on all the business overhead and risk, the potential for a high six-figure income is greatest at this level.

###

Geographic Location

Where you work matters immensely. Salary potential varies drastically by state and even by city, driven by:

- Population and Crime Rates: Larger metropolitan areas with higher population density naturally have a larger volume of arrests, creating more business opportunities.

- State Regulations: States like California, Texas, and Florida have robust and active bail bond industries, leading to higher earning potential. In contrast, states that have implemented bail reform, such as Illinois, New Jersey, and New York, have largely eliminated or reduced the need for cash bail, significantly shrinking the market for bondsmen.

- Cost of Living: Salaries are often higher in states with a higher cost of living to compensate.

###

Company Type

Your earnings structure is directly tied to your employment status.

- National Bail Agency: Working for a large, national company may offer more stability, benefits, and a base salary in addition to commission. However, your share of the commission will be smaller.

- Local Bail Agency: A smaller, local agency might offer a more generous commission split and more hands-on experience with the day-to-day operations of the business.

- Owner/Operator: As mentioned, owning your own agency offers the highest ceiling for earnings but also the most significant financial risk and responsibility.

###

Area of Specialization

Not all bonds are created equal. Specializing in certain types of bonds can greatly affect your income.

- High-Volume, Low-Risk: An agent might build a business model focused on writing a high number of bonds for minor misdemeanors. The individual premiums are small, but the risk is low and the work is consistent.

- High-Risk, High-Reward: Another agent might specialize in complex, high-value bonds for serious felonies (e.g., white-collar crime, major drug offenses). These bonds carry immense risk but offer massive premiums. A single 10% premium on a $1 million bond is $100,000. These agents are masters of risk assessment and often have deep financial reserves.

Job Outlook

The job outlook for bail bondsmen is complex and highly dependent on legislative trends. The industry faces significant challenges from the ongoing bail reform movement, which advocates for replacing the cash bail system with risk-assessment tools and non-monetary release conditions.

In states that have enacted comprehensive reforms, the demand for bail bondsmen has sharply declined. However, in the majority of states, the bail bond system remains an integral part of the pretrial process. In these regions, the profession is expected to remain stable. Prospective bondsmen must conduct thorough research into their specific state and local laws to understand the long-term viability of this career path.

Conclusion

A career as a bail bondsman offers a unique blend of financial services, investigation, and entrepreneurship. While the average salary provides a solid baseline, your ultimate earning potential is truly in your hands.

Key Takeaways:

- Salary is Performance-Based: Your income is primarily driven by commissions from the bonds you write.

- Experience Pays: Seasoned professionals, particularly agency owners, have the highest earning potential.

- Location is Everything: The health of the bail industry in your state is a critical factor for success.

- Risk Equals Reward: Your ability to accurately assess risk and manage your finances will directly determine your profitability.

For the right individual, being a bail bondsman is more than just a job—it's a business. By building a strong reputation, managing risk wisely, and understanding your market, you can unlock a highly rewarding and lucrative career.