If you're exploring a career that offers a direct link between your effort and your income, where your success is measured by the relationships you build and the peace of mind you provide, then a role at Bankers Life might be on your radar. But the big question always looms: What does a Bankers life salary actually look like? Is it a stable paycheck, a high-risk/high-reward venture, or something in between?

The truth is, a career at Bankers Life is less about a traditional "salary" and more about building your own enterprise under the umbrella of an established industry leader. The income potential is substantial, with experienced professionals earning well into six figures, but it's a path that demands entrepreneurial spirit, resilience, and a genuine passion for helping people. Total compensation for a successful agent can range from a modest start of around $45,000 to over $150,000 annually as they build their book of business.

I once had a conversation with a family friend, a veteran insurance professional, who put it perfectly. He said, "My job isn't about selling a product; it's about sitting down with a family, understanding their fears about the future, and building a fortress of security around them. The income is a byproduct of how well I do that." This perspective is the very essence of a successful career in this field.

This comprehensive guide will demystify the Bankers Life compensation model. We will dissect the commission structure, explore the factors that dictate your earning potential, and provide a clear, step-by-step roadmap for anyone considering this challenging yet potentially lucrative career path.

### Table of Contents

- [What Does a Bankers Life Professional Do?](#what-does-a-bankers-life-professional-do)

- [Average Bankers Life Salary: A Deep Dive into Compensation](#average-bankers-life-salary-a-deep-dive-into-compensation)

- [Key Factors That Influence Your Earnings at Bankers Life](#key-factors-that-influence-your-earnings-at-bankers-life)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in a Career with Bankers Life](#how-to-get-started-in-a-career-with-bankers-life)

- [Conclusion: Is a Bankers Life Career Right for You?](#conclusion-is-a-bankers-life-career-right-for-you)

What Does a Bankers Life Professional Do?

Before we can understand the salary, we must first understand the role. A professional at Bankers Life, typically titled an Insurance Agent or Financial Representative, is at the forefront of helping clients prepare for retirement and navigate their healthcare needs. Bankers Life, a subsidiary of CNO Financial Group, has a long history, founded in 1879, and specializes in serving the retirement market. This focus sharply defines the daily activities and responsibilities of its agents.

The core of the job is a blend of sales, financial planning, and client relationship management. It is fundamentally an entrepreneurial role. You are responsible for building your own book of clients, and your success is directly tied to your ability to connect with people, understand their financial situations, and provide suitable solutions.

Core Responsibilities and Daily Tasks:

- Prospecting and Lead Generation: This is the lifeblood of the role. Agents spend a significant amount of time identifying potential clients. This can involve calling on company-provided leads, networking within the community, hosting educational seminars, asking for referrals, and building a professional presence online.

- Client Consultation and Needs Analysis: The role is highly consultative. An agent meets with potential clients (often in their homes or virtually) to conduct a thorough financial needs analysis. This involves discussing their retirement goals, current savings, health concerns, and long-term care plans. It requires active listening and empathy to uncover their true needs and anxieties.

- Presenting Solutions: Based on the needs analysis, the agent develops and presents a tailored plan. This involves explaining complex financial products in simple, understandable terms. The product suite at Bankers Life is focused on the senior market and includes:

- Life Insurance: Providing a death benefit to protect surviving family members.

- Annuities: Financial products that provide a guaranteed stream of income in retirement.

- Long-Term Care (LTC) Insurance: Covering the costs of care in a nursing home, assisted living facility, or at home.

- Medicare Supplement Insurance: Filling the gaps in coverage left by original Medicare.

- Closing Sales and Application Processing: Once a client agrees to a plan, the agent guides them through the application process, ensuring all paperwork is completed accurately and submitted in a timely manner.

- Client Servicing and Relationship Management: The job doesn't end after the sale. Great agents maintain long-term relationships with their clients, conducting periodic reviews, answering questions about their policies, and assisting with claims. This ongoing service builds trust and leads to valuable referrals.

### A Day in the Life of a Bankers Life Agent

To make this more concrete, here's what a typical day might look like for a developing agent:

- Morning (8:30 AM - 12:00 PM): The Power Hours: The day starts with "prime time" prospecting. This means getting on the phone to follow up on leads and set appointments for the coming days. The focus is on filling the calendar, as appointments are the key performance indicator that leads to sales. This block of time is often protected and treated as the most important part of the day.

- Mid-Day (12:00 PM - 4:00 PM): Client-Facing Time: Afternoons are often reserved for client meetings. This could be a first appointment to conduct a needs analysis with a new prospect or a second meeting to present a proposed solution. These meetings can be in-person at a client's home or conducted over video conference. Between appointments, an agent might be preparing paperwork or doing research for the next meeting.

- Late Afternoon (4:00 PM - 5:30 PM): Administrative Wrap-Up: The end of the day is for administrative tasks: submitting applications, updating the client relationship management (CRM) system, responding to emails, and planning the next day's prospecting calls. It may also include team meetings or training sessions with a manager to review progress and discuss strategies.

This structure highlights that the role is one of immense autonomy but requires rigorous self-discipline. It's a far cry from a typical 9-to-5 desk job; it's a dynamic, people-centric, and sales-driven profession.

Average Bankers Life Salary: A Deep Dive into Compensation

This is the central question for many aspiring professionals, but the answer is complex. A career at Bankers Life is performance-based, meaning the term "salary" can be misleading. The vast majority of an agent's income is derived from commissions and bonuses, not a fixed annual wage. This model creates unlimited earning potential but also introduces income variability, especially in the early stages of a career.

It's crucial to think in terms of Total Compensation (Base + Commission + Bonuses) rather than a simple salary.

According to data aggregated from various professional sources:

- Payscale reports that the average total pay for an Insurance Agent at Bankers Life is approximately $60,000 per year. However, the range is vast, stretching from a low of $35,000 to a high of $133,000, which includes commissions, bonuses, and profit sharing.

- Glassdoor shows a similar structure, with a typical total pay for a Bankers Life "Benefits Advisor" estimated at around $76,711 per year, with a likely range between $57,000 and $103,000. It's important to note that these figures are based on user-submitted data and can vary.

- Salary.com provides data for the broader "Insurance Sales Agent" role. As of late 2023, the median salary in the U.S. is around $60,042, but the top 10% of earners can exceed $120,000. This aligns with the potential seen at companies like Bankers Life.

The key takeaway is that an average figure only tells part of the story. Income is not guaranteed; it is earned through performance.

### Compensation Structure by Experience Level

The income trajectory for a Bankers Life agent is not linear. It's a curve that typically starts slow and accelerates as an agent builds their skills, confidence, and client base.

| Career Stage | Years of Experience | Typical Annual Compensation Range | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level Agent | 0-2 Years | $35,000 - $60,000 | High effort, steep learning curve. Income is almost entirely from new sales (First-Year Commissions). Focus is on activity: calls, appointments, and learning the products. |

| Mid-Career Agent | 2-5 Years | $60,000 - $100,000+ | A "book of business" begins to form. Renewal commissions provide a more stable income base. The agent is more efficient, with a better closing ratio and a steady stream of referrals. |

| Senior/Veteran Agent| 5+ Years | $100,000 - $200,000+ | Significant income from renewals creates a strong financial foundation. The agent is a trusted expert, generating most new business from referrals and existing clients. May take on mentoring or leadership roles. |

| Sales Manager | 3-7+ Years | $80,000 - $180,000+ | Compensation includes a base salary, personal production commissions, and overrides (a percentage of the sales made by their team). |

*Source: Analysis based on data from Payscale, Glassdoor, and industry compensation models.*

### The Components of Compensation: Unpacking Your Paycheck

To truly understand your earning potential, you need to know how you get paid. A Bankers Life compensation plan is multi-faceted.

#### 1. Commissions

This is the largest and most important component of an agent's income.

- First-Year Commission (FYC): This is the commission earned on the first year's premium of a new policy sold. It is the highest percentage and the primary source of income for new agents. For example, if you sell an annuity with a $100,000 premium and the commission rate is 5%, your FYC would be $5,000. Different products (Life, LTC, Annuities) have different commission rates.

- Renewal Commissions: For many types of policies, agents earn a smaller commission on the premiums paid by clients in subsequent years (years 2 and beyond). This is the key to long-term financial stability. While a single renewal commission is small, a large book of hundreds of clients paying renewals creates a significant and predictable passive income stream. This is what veteran agents live on, freeing them up to focus on larger new business opportunities.

#### 2. Base Salary / Training Stipend

Many Bankers Life offices offer a modest base salary or training stipend for new agents during their initial months. This is designed to provide some financial cushion while they are learning the business and building their initial pipeline of clients. According to Glassdoor data, this base can be around $40,000-$50,000, but it is often structured as a "draw against commission." This means the base pay is an advance on future earned commissions. Once you start earning commissions, you "pay back" the draw. If you don't earn enough in commission to cover the draw, you may owe the company money upon departure. It is critical to understand the specific terms of any base pay offered.

#### 3. Bonuses

Bankers Life, like many sales organizations, uses bonuses to incentivize specific behaviors and reward top performance. These can include:

- Production Bonuses: Awarded for reaching certain sales targets within a week, month, or quarter.

- New Agent Bonuses: Special incentives designed to help new agents get off to a fast start.

- Annual Convention Trips: Top-producing agents are often rewarded with all-expenses-paid trips to exotic locations for the company's annual convention. While not cash, this is a significant and highly valued part of the compensation package.

#### 4. Benefits

Beyond direct compensation, Bankers Life offers a standard benefits package to eligible agents and managers, which contributes to the overall value proposition. This typically includes:

- Health, Dental, and Vision Insurance

- 401(k) Retirement Savings Plan with a company match

- Life and Disability Insurance

Understanding this complete picture—the high-risk/high-reward commission structure, the long-term power of renewals, and the various incentives—is the first step to accurately assessing the "Bankers Life salary" potential.

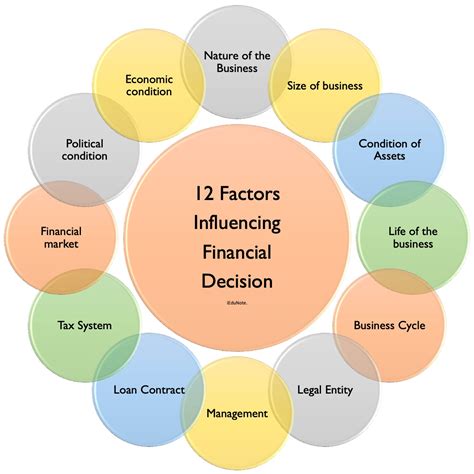

Key Factors That Influence Your Earnings at Bankers Life

Two agents can start at Bankers Life on the same day, receive the same training, and have access to the same resources, yet one year later, one might be struggling while the other is thriving. Why? Because income in this career is not standardized; it is highly dependent on a specific set of factors, skills, and circumstances. This section dives deep into the variables that will determine your financial trajectory.

###

Level of Education and Professional Certifications

While a four-year college degree is not always a strict requirement to become a Bankers Life agent, it is often preferred and can provide a significant advantage.

- Relevant Degrees: A Bachelor's degree in Finance, Business Administration, Economics, or Marketing provides a strong foundation. It equips you with financial literacy, communication skills, and a professional mindset that can accelerate your learning curve and build credibility with clients.

- The Real Education: Licensing and Certifications: In this field, professional designations are more impactful on earnings than the diploma on your wall.

- State Insurance License: This is non-negotiable. To sell insurance products, you must pass your state's licensing exam for Life and Health insurance. This is the barrier to entry.

- Securities Licenses (Series 6, 7, 63, 65, 66): While Bankers Life's core products are insurance-based, agents who wish to offer a broader range of investment products (like mutual funds or variable annuities) must obtain securities licenses. Holding these licenses can significantly expand your product offerings and, therefore, your income potential, allowing you to provide more holistic financial planning.

- Advanced Designations: Pursuing advanced certifications demonstrates a commitment to professionalism and expertise, which translates to higher client trust and the ability to handle more complex financial situations. These are major differentiators:

- Certified Financial Planner (CFP®): The gold standard in financial planning. Earning a CFP® requires extensive coursework, a comprehensive exam, relevant experience, and adherence to a strict code of ethics. CFPs often earn substantially more than their non-certified peers.

- Chartered Financial Consultant (ChFC®): Similar to the CFP®, this designation focuses on comprehensive financial planning and has a deep curriculum.

- Chartered Life Underwriter (CLU®): This designation signals expert-level knowledge in life insurance and estate planning.

Impact on Salary: An agent with a CLU® or CFP® designation can more confidently work with high-net-worth clients and on complex cases, which naturally involve larger premiums and higher commissions.

###

Years of Experience: The Power of Compounding

Experience is arguably the single most important factor in determining an agent's income. The career is a marathon, not a sprint, and income growth is powered by the compounding effect of knowledge, relationships, and renewals.

- Years 0-2 (The Foundation): As detailed in the compensation table, these years are about survival and skill-building. Income is volatile and directly tied to your weekly prospecting activity. Many agents quit during this phase because the effort-to-reward ratio feels unbalanced. The median pay for entry-level insurance agents, according to the U.S. Bureau of Labor Statistics (BLS), was $31,690 in May 2022, reflecting this difficult start.

- Years 2-5 (The Growth Phase): This is where the magic begins. Your prospecting skills are sharp, you have a solid base of clients, and referrals start to become a primary source of new business. Most importantly, renewal commissions from the policies you sold in years 1, 2, and 3 start to create a predictable income floor. This reduces the pressure of constant prospecting and allows you to be more selective and strategic.

- Years 5+ (The Mastery Phase): Veteran agents operate with a different model. Their renewal income can often cover their entire lifestyle, making any new commission a bonus. They are established experts in their community. According to BLS data, the top 10% of insurance sales agents earn more than $131,910 annually, and this is the category where 5+ year veterans at a company like Bankers Life fall. Their income is a combination of large new cases, a strong renewal base, and potentially leadership overrides.

###

Geographic Location: Market Matters

Where you work has a direct impact on your earning potential. This is not about a cost-of-living adjustment in a salary; it's about the characteristics of the client market.

- High-Potential Markets: Agents in areas with a high concentration of retirees or pre-retirees (the target market for Bankers Life) have a distinct advantage. Think of states like Florida, Arizona, and California. Metropolitan areas with affluent suburbs also offer greater opportunities. A larger, more condensed population simply means more potential clients to contact.

- BLS Geographic Data: The U.S. Bureau of Labor Statistics provides a breakdown of Insurance Sales Agent wages by state. As of May 2022, the states with the highest annual mean wage for this profession were:

1. Massachusetts: $102,640

2. New York: $93,490

3. California: $90,110

4. New Hampshire: $87,480

5. Colorado: $86,750

While Bankers Life has a specific target market, this data shows that affluent, densely populated states generally provide a more fertile ground for higher earnings in the insurance sales industry. An agent in rural Wyoming will face a different set of challenges and opportunities than an agent in Palm Beach, Florida.

###

Company Type & Size: Captive vs. Independent Model

This article focuses on Bankers Life, which operates on a captive agent model. This is a critical distinction that affects your job and income.

- Captive Agent (The Bankers Life Model): As a captive agent, you primarily represent and sell the products of one company (Bankers Life and its affiliates).

- Pros: Strong brand recognition, company-provided leads (a major benefit), structured training, and a clear career path into management. The support system is robust.

- Cons: Limited product shelf. If a client needs a specific solution that Bankers Life doesn't offer, you cannot sell it to them. Commission rates are fixed by the company.

- Independent Agent/Broker: An independent agent is not tied to any single carrier. They can source policies from dozens of different insurance companies.

- Pros: Can offer clients the "best" solution from the entire market, potentially leading to better client outcomes and higher closing rates. They may also be able to find higher commission products.

- Cons: They are true entrepreneurs. There are no company leads, no training stipends, and no structured support system. They are responsible for all their own marketing, technology, and overhead.

Impact on Salary: In the beginning, the captive model at Bankers Life can lead to a faster start due to the lead support and training. Long-term, high-producing independent agents may have a higher ceiling on their income, but they also have higher risk and business expenses.

###

Area of Specialization

Within the Bankers Life ecosystem, agents can dramatically increase their income by becoming a go-to expert in a specific niche. Generalists can do well, but specialists often excel.

- Product Specialist: Some agents become masters of a particular product. For example, an agent who deeply understands the nuances of Long-Term Care (LTC) insurance—a complex but critically important product for seniors—can become the trusted advisor for this need in their community. The same applies to becoming an annuity expert who understands how to structure income streams for retirees.

- Market Specialist: Other agents specialize in a target market. An agent might focus exclusively on helping small business owners with succession planning and retirement. Another might become an expert in the pre-retiree market (ages 55-65), guiding them through the transition from work to retirement, including navigating Medicare choices. This focused expertise builds a powerful reputation and referral engine.

###

In-Demand Skills: The Intangibles That Drive Income

Beyond product knowledge, a specific set of soft skills separates the top 10% of earners from the rest. These skills directly translate into more appointments, higher closing ratios, and larger cases.

- Resilience and Grit: This is the #1 skill. You will face rejection daily. The ability to hear "no" 10 times and make the 11th call with the same enthusiasm is what defines success.

- Consultative Selling: Top earners don't "sell"; they "advise." They ask insightful questions, listen more than they talk, and position themselves as problem-solvers. This builds trust and makes the commission a natural outcome of providing value.

- Exceptional Networking Ability: Building a professional network with CPAs, estate planning attorneys, and other professionals can create a powerful referral pipeline.

- Disciplined Time Management: As an autonomous agent, you are your own boss. The ability to structure your day, prioritize income-producing activities (like prospecting), and avoid distractions is paramount.

- Financial Acumen: You must be able to understand and clearly explain financial concepts. Clients are trusting you with their life savings; confidence in your financial knowledge is essential.

- Client Relationship Management: The ability to build genuine, long-term rapport is what creates a sustainable business built on renewals and referrals, rather than a constant, exhausting chase for the next new sale.

Job Outlook and Career Growth

When considering a long-term career, understanding the future prospects of the profession is just as important as the immediate salary potential. For those looking at a career with Bankers Life, the outlook is shaped by powerful demographic trends and the evolving nature of the financial services industry.

### Job Outlook for Insurance Sales Agents

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative data on career projections. According to the BLS's Occupational Outlook Handbook:

- Projected Growth: Employment of insurance sales agents is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

- Number of Jobs: The BLS anticipates about 45,300 openings for insurance sales agents each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

What is driving this growth?

The primary driver, especially for a company like Bankers Life, is demographics. The aging of the Baby Boomer generation is one of the most significant economic and social shifts of our time.

- The "Silver Tsunami": Millions of people are entering retirement or are already in it. This massive population group needs expert guidance on how to turn their accumulated savings into a sustainable retirement income, how to manage healthcare costs via Medicare and supplemental insurance, and how to plan for potential long-term care needs.

- Increased Need for Financial Advice: As pensions have become rare, the responsibility for funding retirement has shifted almost entirely to the individual. This creates a huge demand for the products and services Bankers Life specializes in: annuities for income, life insurance for legacy planning, and LTC insurance for asset protection.

This demographic tailwind provides a strong, sustainable market for Bankers Life agents for decades to come.

### Emerging Trends and Future Challenges

While the demographic outlook is strong, the profession is not static. Successful agents must adapt to emerging trends and navigate potential challenges.

Key Trends: