Introduction

Have you ever looked at the towering skyscrapers of New York City or London's Canary Wharf and wondered about the brilliant minds inside, shaping the future of the global economy? For many ambitious graduates and young professionals, the pinnacle of that world is a firm like BlackRock, the world's largest asset manager. The title "Analyst at BlackRock" is synonymous with prestige, intellectual challenge, and, of course, significant financial reward. But what does that reward actually look like? What does it take to earn a BlackRock analyst salary, and what does that figure truly represent in the broader landscape of a career in finance?

This guide is designed to be your definitive resource, pulling back the curtain on not just the numbers, but the entire ecosystem of a financial analyst career, using BlackRock as our "gold standard" benchmark. We will dissect the compensation, explore the factors that can increase your earnings tenfold, and map out the precise steps you need to take to get there. The average total compensation for a first-year Analyst in a high-finance role can range from $150,000 to over $250,000 when including bonuses, a figure that grows substantially with experience.

In my years as a career analyst and mentor, I've seen firsthand the intense preparation that goes into landing these coveted roles. I once mentored a recent graduate who spent an entire summer deconstructing financial statements and building complex models, not for a class, but simply to be ready for the interview gauntlet. That level of dedication is what it takes, and this guide is built to honor that ambition by providing the clarity and direction you need to succeed.

Whether you're a student charting your future, a professional considering a pivot, or simply curious about the lucrative world of high finance, you've come to the right place. Let's begin.

### Table of Contents

- [What Does a Financial Analyst at a Firm Like BlackRock Do?](#what-does-a-blackrock-analyst-do)

- [Average BlackRock Analyst Salary: A Deep Dive](#average-blackrock-analyst-salary-a-deep-dive)

- [Key Factors That Influence Your Analyst Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Financial Analysts](#job-outlook-and-career-growth)

- [How to Become a Financial Analyst](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career as a Financial Analyst Right for You?](#conclusion)

What Does a Financial Analyst at a Firm Like BlackRock Do?

While the salary figures are eye-catching, it's crucial to first understand the demanding and intellectually rigorous work that commands such compensation. An "Analyst" at a firm like BlackRock isn't a single, monolithic role. It's a title given to entry-level professionals across various divisions, including asset management, risk analysis, investment banking (through their Financial Markets Advisory group), and quantitative analysis. However, the core function revolves around a central theme: using data to make informed financial decisions.

At its heart, the role is about bridging the gap between raw information and actionable investment strategy. Analysts are the bedrock of the financial world, performing the foundational research and analysis that portfolio managers, senior executives, and clients rely on. Their work is a blend of art and science—the science of quantitative analysis and the art of interpreting what the numbers mean for the future.

Core Responsibilities and Daily Tasks:

- Financial Modeling: This is the quintessential analyst task. It involves building complex spreadsheets (primarily in Excel) to forecast a company's future performance. Common models include the Discounted Cash Flow (DCF), Leveraged Buyout (LBO), and merger (M&A) models. These models are used to determine the valuation of a company or asset.

- Market and Industry Research: Analysts spend a significant amount of time reading—annual reports (10-Ks), quarterly reports (10-Qs), industry publications, economic news, and sell-side research from other banks. They must become experts in the specific sector they cover, be it technology, healthcare, energy, or consumer goods.

- Due Diligence: When considering an investment, analysts conduct deep-dive investigations into the target company. This involves scrutinizing financial statements, assessing management quality, understanding competitive landscapes, and identifying potential risks.

- Preparing Presentations and Reports: A huge part of the job is communicating findings effectively. Analysts create detailed presentations (known as "pitch decks") and internal memos that summarize their research and provide a clear "buy," "sell," or "hold" recommendation. This requires not just analytical skill but also excellent writing and data visualization abilities.

- Data Analysis: With the rise of big data, analysts are increasingly using tools like Python, SQL, and R to analyze vast datasets, identify trends, and back-test investment strategies.

### A "Day in the Life" of a First-Year Asset Management Analyst

To make this more concrete, let's walk through a typical (and very long) day for an analyst at a top-tier firm.

- 6:30 AM: Wake up. The first thing you do is check your phone for overnight market news from Asia and Europe. You quickly scan the Wall Street Journal, Financial Times, and Bloomberg.

- 7:30 AM: Arrive at the office. You grab a quick coffee and start sifting through emails that came in from senior team members overnight. You update key data points in your financial models based on the morning's news.

- 8:30 AM: The morning meeting. The team gathers to discuss overnight market movements, news on companies in the portfolio, and the day's agenda. You might be asked to give a brief update on a company you're tracking.

- 9:30 AM - 1:00 PM: "Grind time." This is when you dive deep into your core task. Today, your Portfolio Manager wants to know if you should increase your position in a specific tech stock. You spend hours in Excel, updating your DCF model with new assumptions, stress-testing your valuation, and reading the latest research reports on the company and its competitors.

- 1:00 PM: Lunch at your desk. You eat while on a conference call for a company's quarterly earnings report, taking meticulous notes.

- 2:00 PM - 6:00 PM: Your focus shifts to communication. You start building a PowerPoint deck summarizing your findings on the tech stock. You create charts, write out your key arguments, and distill pages of research into a few clear, compelling slides.

- 6:00 PM - 8:00 PM: Your Vice President (VP) reviews your presentation draft. He gives you feedback (known as "turning comments"), pointing out a flaw in an assumption and asking for three new data slides. You get back to work, re-running numbers and adding the new analysis.

- 8:00 PM - 10:00 PM (or later): You finalize the presentation and send it to the team. You might start working on a secondary project or begin preliminary research for tomorrow's tasks. The day ends when the work is done, which is often late into the evening.

This demanding schedule is why the compensation is so high. It's a trade-off: a steep learning curve and long hours in exchange for unparalleled experience and significant financial reward.

Average BlackRock Analyst Salary: A Deep Dive

Now for the central question: what does an analyst at a top firm like BlackRock actually earn? It's essential to understand that compensation in high finance is not just a simple annual salary. It's a package, with the performance-based bonus often constituting a significant portion of the total take-home pay.

For the sake of this analysis, we will look at compensation for a first-year, entry-level Analyst role at BlackRock's New York City headquarters, which serves as a reliable industry benchmark. We will then broaden the scope to include general financial analyst salaries across different experience levels.

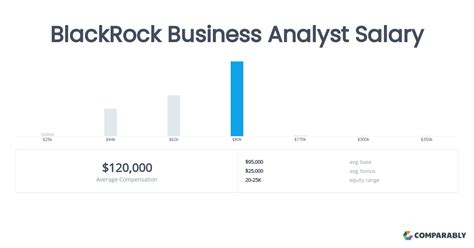

BlackRock Analyst Compensation (First Year)

Data from reputable sources like Glassdoor and Wall Street Oasis, which aggregate self-reported user data, provide a strong directional sense of compensation. As of late 2023 and early 2024, the structure for a first-year Analyst at BlackRock typically looks like this:

- Base Salary: The guaranteed portion of your pay. For a first-year Analyst, this is generally in the range of $100,000 to $120,000. BlackRock, along with other top financial firms, has been increasing base salaries in recent years to attract and retain top talent.

- Annual Bonus (Performance-Based): This is the variable component and is paid out at the end of the fiscal year. It depends on both your individual performance and the firm's overall success. For a first-year, the bonus can range from $50,000 to $100,000+. In a good year, it can be close to 100% of the base salary.

- Signing Bonus: Often offered to incoming analysts who have accepted their offer after a summer internship. This is a one-time payment and typically ranges from $10,000 to $20,000.

Total First-Year Compensation (All-In):

Adding these components together, a first-year Analyst at BlackRock can expect a total "all-in" compensation package in the range of $160,000 to $240,000, with variations depending on the division, location, and market conditions for that year.

*Source: Data compiled and synthesized from Glassdoor, Wall Street Oasis, and Levels.fyi reports for BlackRock Analyst roles in New York City, accessed in Q1 2024.*

### General Financial Analyst Salary by Experience Level

While BlackRock represents the top tier, it's useful to understand the salary landscape for financial analysts across the broader industry. The U.S. Bureau of Labor Statistics (BLS) provides a solid baseline.

According to the BLS Occupational Outlook Handbook, the median annual wage for financial analysts was $96,220 in May 2022. However, this figure includes analysts in a wide range of industries, including corporate finance and government, which typically pay less than Wall Street. A more granular breakdown by experience level provides a clearer picture:

| Experience Level | Typical Role Title | Typical Base Salary Range | Typical All-In Compensation Range (with Bonus) |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Analyst | $85,000 - $120,000 | $120,000 - $250,000 |

| Mid-Career (3-5 Years) | Associate / Senior Analyst | $150,000 - $200,000 | $250,000 - $450,000 |

| Senior-Level (5-10 Years) | Vice President (VP) | $200,000 - $275,000 | $400,000 - $800,000+ |

| Executive-Level (10+ Years) | Director / Managing Director | $300,000+ | $800,000 - $2,000,000+ |

*Source: Data ranges are synthesized from industry reports by Johnson Associates, Heidrick & Struggles, and self-reported data on platforms like Glassdoor and Salary.com for financial services roles in major financial hubs.*

### Deconstructing the Compensation Package

Understanding the components is as important as the final number.

1. Base Salary: This is your predictable, bi-weekly or monthly income. While it's the focus of many salary discussions, in high finance, it's often less than half of the total compensation for experienced professionals. It's meant to cover your living expenses.

2. Performance Bonus: This is where top performers are rewarded. It's a highly variable cash payment calculated at the end of the year. Factors influencing your bonus include:

- Your Individual Performance: Were your analyses accurate? Did your investment recommendations perform well? Did you work effectively with your team?

- Your Group's Performance: How did your specific desk or team (e.g., US Equities, Global Fixed Income) perform relative to its goals?

- The Firm's Performance: How profitable was the firm as a whole? In a bull market with high profits, the bonus pool is much larger.

3. Stock-Based Compensation (RSUs/Stock Options): As you become more senior (typically post-Analyst years), a portion of your bonus will be paid in Restricted Stock Units (RSUs) or stock options. This aligns your incentives with the long-term health of the firm, as the value of your compensation is tied to the company's stock price.

4. Benefits and Perks: While not direct cash, these have significant value. Top firms offer exceptional benefits packages, including:

- 401(k) with Generous Matching: Firms often match employee contributions up to a certain percentage, which is essentially free money for retirement.

- Premium Health Insurance: Comprehensive medical, dental, and vision plans with low premiums and deductibles.

- Other Perks: These can include wellness stipends, subsidized gym memberships, generous parental leave, and tuition reimbursement for further education.

The takeaway is that a "BlackRock analyst salary" is a complex package heavily weighted toward performance. The base salary provides a high degree of financial security, while the bonus offers immense upside potential for those who excel.

Key Factors That Influence Your Analyst Salary

A starting salary of $175,000 is fantastic, but it's just the beginning. The trajectory of a financial analyst's earnings is one of the steepest in any profession. However, that growth isn't automatic. It's influenced by a confluence of factors, each of which can add or subtract tens or even hundreds of thousands of dollars from your annual compensation. Understanding these levers is the key to maximizing your earning potential over the course of your career.

###

Level of Education and Certifications

Your educational background is your entry ticket. While a bachelor's degree is the minimum requirement, the quality of your institution, your major, and any advanced credentials you hold play a significant role.

- Undergraduate Degree: A bachelor's degree in Finance, Economics, Accounting, or a STEM field (like Math, Engineering, or Computer Science) from a "target" or "semi-target" university is the standard path. These schools (e.g., Ivy League universities, MIT, Stanford, NYU, UChicago) have deep recruiting relationships with firms like BlackRock, giving their students a distinct advantage. While it's possible to break in from other schools, it requires significantly more networking and effort.

- Master's Degrees (MBA, Master's in Finance): An MBA from a top-tier business school (e.g., Harvard, Stanford, Wharton, Booth, Columbia) is the primary vehicle for career acceleration or switching into high finance. Graduates of these programs typically re-enter the industry at the "Associate" level, skipping the Analyst years. An Associate's starting all-in compensation is substantially higher, often in the $300,000 - $400,000 range. A Master's in Finance (MFin) can also provide a boost, particularly for those from non-traditional undergraduate backgrounds.

- The CFA® Charter: The Chartered Financial Analyst (CFA) designation is arguably the most respected and rigorous credential in the investment management industry. Earning the charter requires passing three challenging six-hour exams and accumulating relevant work experience. While it doesn't guarantee a higher salary, it signals a deep commitment and mastery of portfolio management and investment analysis. According to a 2019 report from the CFA Institute, charterholders reported median total compensation that was 54% higher than that of their colleagues without the charter. It is a powerful tool for long-term career advancement and salary growth, especially in asset management.

###

Years of Experience: The Career Ladder

Experience is the single most powerful driver of salary growth in finance. The industry follows a relatively rigid, hierarchical promotion track, with significant pay bumps at each level.

- Analyst (Years 0-3): This is the entry-level role described earlier. The focus is on learning the technical skills, working long hours, and proving your worth.

- *Year 1 Total Comp:* ~$160k - $240k

- *Year 2 Total Comp:* ~$180k - $280k

- *Year 3 Total Comp:* ~$200k - $350k (Top performers may receive a promotion to Associate early or a "stub" Associate bonus).

- Associate (Years 3-6): Associates have more responsibility. They manage analysts, take the lead on modeling and deal execution, and begin to have more client or portfolio manager interaction. This is the post-MBA entry point.

- *Associate Total Comp:* ~$275k - $500k, with compensation becoming more variable.

- Vice President (VP) (Years 6-10): VPs are mid-level managers. They are responsible for leading deal teams, managing key client relationships, and developing investment theses. The role becomes more about project management and less about hands-on Excel modeling.

- *VP Total Comp:* ~$450k - $800k+. A significant portion of this is now deferred compensation (stock).

- Director / Principal (Years 10-15): These senior professionals are focused on generating business and leading large, complex transactions or investment strategies.

- *Director Total Comp:* ~$700k - $1.5M+

- Managing Director (MD) / Partner (Years 15+): This is the top of the pyramid. MDs are senior leaders responsible for the profitability of their entire division. Their compensation is almost entirely performance-based and can easily reach multiple millions of dollars in a good year.

###

Geographic Location

Where you work matters immensely. Financial analyst salaries are not uniform across the country; they are heavily adjusted for the cost of living and the concentration of financial activity in a given city.

- Tier 1: Major Global Hubs (New York City, San Francisco): These cities offer the highest absolute salaries to compensate for their extremely high cost of living and the intense competition. NYC is the undisputed king of finance, while San Francisco/Silicon Valley leads for tech-focused finance and venture capital. A salary in NYC might be 15-25% higher than in other major cities.

- Tier 2: Major Financial Centers (Chicago, Boston, Los Angeles, Houston): These cities have robust financial industries and offer high salaries, though slightly below NYC levels. The cost of living is generally lower, meaning your take-home pay can go further. Houston is a major hub for energy-focused finance.

- Tier 3: Growing Regional Hubs (Charlotte, Dallas, Atlanta, Salt Lake City): These cities are seeing a boom in financial services jobs as firms open "nearshore" offices to reduce costs. While base salaries and bonuses are lower than in Tier 1 or 2 cities, the significantly lower cost of living can result in a higher quality of life for many. A base salary in Charlotte might be $85,000 for a role that pays $110,000 in New York.

Salary Comparison by City (Entry-Level Financial Analyst Base Salary Estimates):

| City | Estimated Base Salary | Cost of Living Index (vs. US Avg of 100) |

| :--- | :--- | :--- |

| New York, NY | $115,000 | 187.2 |

| San Francisco, CA | $120,000 | 179.1 |

| Boston, MA | $105,000 | 148.4 |

| Chicago, IL | $100,000 | 105.2 |

| Charlotte, NC | $90,000 | 98.7 |

*Source: Salary data synthesized from Glassdoor and Salary.com for 2024. Cost of living data from Payscale.*

###

Company Type & Size

The type of firm you work for is a massive determinant of your compensation structure and culture.

- Bulge Bracket Investment Banks (e.g., Goldman Sachs, J.P. Morgan): These large, global firms offer highly structured training programs and pay at the top of the market. The work is high-pressure and focuses heavily on M&A advisory and capital raising.

- Elite Boutique Banks (e.g., Evercore, Centerview Partners): These smaller, specialized firms often pay *even more* than bulge brackets, especially at senior levels. They offer leaner deal teams and greater early exposure to complex transactions.

- Asset Management Firms (e.g., BlackRock, Fidelity, Vanguard): These firms are on the "buy-side," meaning they manage investments. The culture is often perceived as having a better work-life balance than investment banking. Compensation is still exceptional but may have a slightly lower ceiling than top-tier banking or private equity.

- Private Equity (PE) & Hedge Funds (e.g., Blackstone, KKR, Bridgewater Associates): This is the "promised land" for many analysts. These firms are notoriously difficult to break into, typically hiring analysts after 2-3 years in investment banking. The compensation is the highest in the industry, with a significant component tied to the performance of the fund's investments (known as "carried interest" in PE), which can lead to life-changing wealth.

- Corporate Finance (e.g., at Apple, Ford, Procter & Gamble): Working as a financial analyst within a non-financial corporation (often called FP&A - Financial Planning & Analysis). The work-life balance is significantly better, but the compensation is much lower. A starting analyst might earn $75,000 - $95,000 with a smaller bonus.

###

Area of Specialization

Within a firm, what you specialize in can impact your pay and exit opportunities.

- Mergers & Acquisitions (M&A): Traditionally one of the most prestigious and demanding groups, with strong compensation and excellent exit opportunities into private equity.

- Equity Research: Analysts who cover stocks and make buy/sell recommendations. Requires deep industry expertise and strong writing skills.

- Fixed Income, Currencies, and Commodities (FICC): Involves trading and analyzing bonds, currencies, and raw materials. Can be highly lucrative, especially for traders.

- Quantitative Analysis ("Quants"): These analysts have deep backgrounds in math, physics, and computer science. They build complex algorithms for trading and risk management. Due to their rare skill set, top quants are among the highest-paid professionals in finance.

###

In-Demand Skills

Finally, your specific skill set can give you a competitive edge and command a salary premium.

- Hard Skills:

- Advanced Financial Modeling: Mastery of DCF, LBO, and M&A models is non-negotiable.

- Excel & VBA: You need to be an Excel wizard. Knowing Visual Basic for Applications (VBA) to automate tasks is a plus.

- Python/SQL/R: Programming skills are increasingly important for data analysis, back-testing, and automating research. Analysts who can code are highly valuable.

- Data Visualization Tools (Tableau, Power BI): The ability to present data in a clear, compelling visual format is a critical communication skill.

- Soft Skills:

- Communication & Presentation Skills: You can have the best analysis in the world, but if you can't communicate it clearly, it's worthless.

- Attention to Detail: A single misplaced decimal can invalidate an entire model. Accuracy is paramount.

- Resilience and Work Ethic: The ability to handle immense pressure, long hours, and critical feedback without burning out is perhaps the most important "soft skill" of all.

By strategically developing these skills, targeting high-paying locations and firm types, and pursuing advanced credentials, you can actively steer your career towards the highest echelons of financial compensation.

Job Outlook and Career Growth for Financial Analysts

A high starting salary is attractive, but long-term career stability and growth potential are what make a profession truly viable. For financial analysts, the future looks bright, albeit one that is constantly evolving with technology and market trends.

Official Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) is the most authoritative source for job outlook data. In their latest Occupational Outlook Handbook, the projections for financial analysts are strong:

- Projected Growth (2022-2032): The BLS projects employment of financial analysts to grow by 8 percent from 2022 to 2032. This is much faster than the average for all occupations, which is 3 percent.

- New Jobs: This growth is expected to result in about 29,600 new job openings for financial analysts each year, on average, over the decade. These openings will arise from both new job creation and the need to replace workers who transfer to different occupations or exit the labor force.

*Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Analysts (last modified September 6, 2023).*

The BLS attributes this robust growth to several factors. A growing range of financial products and the need for in-depth knowledge of geographic regions will continue to drive demand. Furthermore, the increasing importance of data analysis in making informed business decisions means that the core skills of a financial analyst are more valuable than ever across various industries.

### Emerging Trends and Future Challenges

While the overall