A career as a bank branch manager is a cornerstone of the financial services industry, blending leadership, financial acumen, and high-level customer service. For those with ambition and a knack for management, it's a highly rewarding path—both professionally and financially. But what can you realistically expect to earn? While the answer varies, a skilled bank branch manager can expect a competitive salary, with top earners in major markets pulling in well over six figures.

This guide will break down the typical salary for a bank branch manager in the United States, explore the key factors that drive compensation, and look at the future outlook for this vital profession.

What Does a Bank Branch Manager Do?

Before diving into the numbers, it's essential to understand the role. A bank branch manager is the leader of a local bank branch, acting as a mini-CEO for their location. Their responsibilities are diverse and demanding, requiring a unique mix of hard and soft skills.

Key responsibilities include:

- Team Leadership: Hiring, training, coaching, and managing a team of tellers, personal bankers, and loan officers.

- Operational Excellence: Ensuring the branch operates smoothly, efficiently, and in full compliance with banking regulations and security protocols.

- Sales and Growth: Driving branch performance by setting and achieving sales goals for loans, deposits, mortgages, and investment products.

- Customer Relationship Management: Serving as the face of the bank in the local community, resolving complex customer issues, and building lasting relationships with key clients.

- Financial Reporting: Analyzing branch performance data and reporting on profitability, sales metrics, and operational efficiency to regional management.

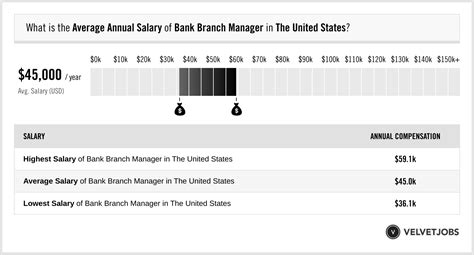

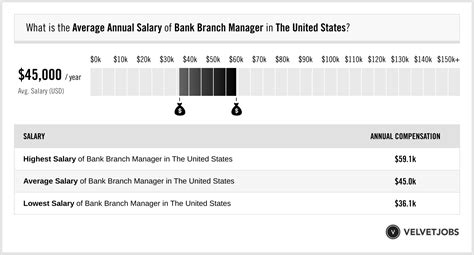

Average Bank Branch Manager Salary

So, what does this level of responsibility command in terms of salary? The compensation for a bank branch manager is composed of a base salary plus potential bonuses, commissions, and profit-sharing, which can significantly increase total earnings.

Based on the most current data from leading salary aggregators, here is a snapshot of typical earnings:

- Median Base Salary: Most sources place the median base salary for a bank branch manager in the United States between $78,000 and $92,000 per year.

- Typical Salary Range: According to Salary.com, the salary for a Bank Branch Manager typically falls between $82,311 and $112,656 as of early 2024.

- Total Compensation: It's crucial to consider total pay. Glassdoor reports an average total pay (including bonuses and additional compensation) of around $101,500 per year. The likely range for total pay spans from $74,000 on the low end to $144,000 on the high end for experienced professionals in top markets.

This range highlights that while there is a solid baseline, several key factors can dramatically influence your earning potential.

Key Factors That Influence Salary

Your final paycheck as a branch manager isn't determined by a single number. It's a dynamic figure influenced by your qualifications, location, and the specifics of your employer.

Level of Education

While extensive experience can sometimes substitute for formal education, a bachelor's degree is typically the minimum requirement for a branch manager role. A degree in Finance, Business Administration, Accounting, or Economics is highly preferred and can give you a competitive edge.

Professionals who pursue a Master of Business Administration (MBA), especially with a finance concentration, often command higher salaries and are fast-tracked into senior management or larger, more complex branches. Certifications like the Certified Financial Planner (CFP) can also boost earning potential, particularly in branches with a strong wealth management focus.

Years of Experience

Experience is arguably the most significant factor in determining salary. A manager's ability to navigate complex market conditions, lead diverse teams, and consistently hit growth targets is honed over time. Salary aggregator Payscale provides a helpful breakdown of how experience impacts earnings:

- Entry-Level (Less than 5 years of experience): A manager at this stage, who may be leading a smaller branch or stepping up from an assistant manager role, can expect a salary closer to the $65,000 - $75,000 range.

- Mid-Career (5-10 years of experience): With a proven track record, managers in this bracket see their earnings increase substantially, often falling within the $80,000 - $100,000 base salary range.

- Senior/Experienced (10+ years of experience): Senior managers overseeing large, high-volume, or strategically important branches can command base salaries well over $100,000, with total compensation packages often exceeding $120,000 - $140,000.

Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and the demand for financial talent in that market. A branch manager in a major metropolitan hub will earn significantly more than one in a rural area.

For example, branch managers in cities like New York, NY; San Francisco, CA; and Boston, MA will consistently see salaries at the top end of the national range. Conversely, salaries in smaller cities or states with a lower cost of living will trend closer to the lower end of the national average.

Company Type

The type of financial institution you work for plays a critical role in your compensation structure.

- Large National Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These institutions typically offer higher base salaries and have highly structured, performance-based bonus programs. The potential for large bonuses tied to branch profitability is significant, but the pressure to perform is also high.

- Community Banks and Credit Unions: These smaller institutions may offer slightly lower base salaries. However, they often compensate with a better work-life balance, strong community ties, and sometimes more generous benefits packages or profit-sharing plans. The bonus structure may be more modest but can be more directly tied to personal and branch-level success.

Area of Specialization

Not all branches are created equal. The focus of the branch you manage directly correlates with your earning potential due to the complexity and value of the client relationships.

- Retail Banking: A standard retail branch focuses on consumer accounts, personal loans, and mortgages. This is the most common type of branch management role.

- Commercial Banking: Managers of branches with a heavy focus on business clients—handling business loans, lines of credit, and treasury services—often earn more due to the complexity and larger dollar amounts involved.

- Private Banking/Wealth Management: Managing a branch in a high-net-worth area that focuses on private banking and investment services is typically the most lucrative. These roles require a sophisticated understanding of wealth management and carry the highest compensation potential.

Job Outlook

The career outlook for financial managers, the broader category under which bank branch managers fall, is very strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS attributes this robust growth to the increasing complexity of financial products and the need for skilled managers to oversee financial operations and ensure regulatory compliance. While technology and online banking are changing the landscape, the need for expert leadership and in-person relationship management at the branch level remains critical.

Conclusion

A career as a bank branch manager offers a clear and promising path for financial professionals who possess strong leadership and analytical skills. While the national median salary provides a solid benchmark, your ultimate earning potential is in your hands.

Key Takeaways:

- Aim High: A typical salary ranges from $75,000 to over $115,000, with total compensation packages for top performers reaching well beyond.

- Invest in Yourself: A relevant bachelor's degree is standard, but an MBA or industry certifications can unlock higher-tier roles and salaries.

- Build Your Experience: Your value—and your salary—will grow as you build a proven track record of leading teams and driving branch growth.

- Be Strategic: Your choice of location, company type, and branch specialization will significantly impact your long-term earnings.

For those aspiring to a leadership role in finance, becoming a bank branch manager is not just a job—it's a career with substantial room for growth, impact, and financial reward.