---

Introduction

In the intricate machinery of any successful company, there exists a critical role that acts as both the blueprint and the fine-tuning mechanism: the Business Operations Analyst. If you're a strategic thinker, a data-driven problem-solver, and someone who gets a genuine thrill from making things work better, you might be looking at your ideal career. This role isn't just about spreadsheets and charts; it's about being the strategic linchpin that connects data to decisions, identifies hidden inefficiencies, and ultimately drives growth and profitability. The demand for these professionals is soaring, and with it, the potential for a highly rewarding and lucrative career.

The salary for a Business Operations Analyst is compelling, with a national average often cited between $75,000 and $95,000, and the potential for six-figure incomes as you gain experience and specialize. But that's just the surface-level view. Your actual earnings can be influenced by a complex interplay of your location, education, specific skills, and the industry you choose to enter.

I once worked with a mid-sized tech company that was bleeding money on its customer acquisition process. Everyone knew there was a problem, but it was a newly hired Business Operations Analyst who, after just three weeks of deep-dive analysis, pinpointed a single, overlooked bottleneck in the sales-to-onboarding pipeline. Her proposed process change not only saved the company over $250,000 in the first year but cemented her role as an indispensable strategic asset. This is the power of a great operations analyst—turning data into tangible, high-impact results.

This guide is designed to be your definitive resource for understanding every facet of a Business Operations Analyst's salary and career. We will dissect the numbers, explore the influencing factors, and lay out a clear roadmap for how you can enter and excel in this dynamic field.

### Table of Contents

- [What Does a Business Operations Analyst Do?](#what-does-a-business-operations-analyst-do)

- [Average Business Operations Analyst Salary: A Deep Dive](#average-business-operations-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Business Operations Analyst Do?

A Business Operations Analyst is a professional problem-solver who uses data analysis and process evaluation to improve a company's efficiency, productivity, and overall performance. They are internal consultants, working across various departments—from finance and marketing to supply chain and human resources—to understand current processes, identify weaknesses, and recommend data-backed solutions.

Think of them as the organization's efficiency experts. While a department head is focused on their team's specific goals (e.g., generating leads, shipping products), the operations analyst takes a bird's-eye view. They ask critical questions: Are we spending too much on this software? Is there a faster way to onboard new clients? Where are the communication breakdowns between the sales and service teams? Why is our inventory turnover rate declining?

Their work is a blend of quantitative analysis and qualitative investigation. They don't just look at numbers; they talk to people, map out workflows, and understand the real-world context behind the data.

Core Responsibilities and Daily Tasks:

A Business Operations Analyst's day is rarely the same, but their work typically revolves around these core functions:

- Data Collection and Analysis: Gathering data from multiple sources (CRM systems, financial reports, ERP software, employee surveys) and using tools like SQL, Excel, and Python to clean, analyze, and interpret it.

- Process Mapping and Improvement: Documenting existing business processes ("as-is" state) and designing more efficient future workflows ("to-be" state). This often involves methodologies like Six Sigma or Lean.

- Financial Analysis and Modeling: Creating budgets, forecasting revenue and expenses, analyzing pricing models, and assessing the financial impact of potential business decisions.

- Performance Reporting and Dashboard Creation: Building and maintaining dashboards in tools like Tableau or Power BI to track Key Performance Indicators (KPIs) and provide stakeholders with real-time insights into business health.

- Stakeholder Collaboration: Working closely with department managers, executives, and IT teams to understand their challenges, present findings, and champion proposed changes.

- Project Management: Often leading or participating in projects aimed at implementing new processes, software, or business strategies.

### A "Day in the Life" of a Business Operations Analyst

To make this more concrete, let's walk through a typical day for an analyst at a mid-sized e-commerce company.

- 9:00 AM - 10:00 AM: Morning Dashboard Review & KPI Check-In. The day begins by reviewing the company's core operational dashboards. The analyst checks daily sales figures, website traffic, conversion rates, and supply chain metrics (like order fulfillment times). They notice a 15% spike in "cart abandonment" over the past 48 hours and flag it for investigation.

- 10:00 AM - 12:00 PM: Deep-Dive Analysis & Stakeholder Meeting. The analyst pulls raw data from the company's analytics platform to investigate the cart abandonment issue. Using SQL, they query the database to see if the issue is tied to a specific product, browser, or geographic region. They then meet with the Head of Marketing and a developer from the IT team to discuss potential causes—a recent marketing campaign, a new website feature, or a technical bug.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 3:00 PM: Process Mapping for a New Project. The analyst shifts focus to a longer-term project: improving the product return process. They spend two hours interviewing customer service representatives to map out every single step of the current return workflow, from the initial customer email to the item being restocked in the warehouse.

- 3:00 PM - 4:30 PM: Reporting and Presentation Prep. The analyst compiles their findings from the morning's cart abandonment investigation into a concise report for senior management. They create a few key charts in Tableau to visually illustrate the problem and propose a clear action plan: A/B testing the checkout page to rule out a design flaw.

- 4:30 PM - 5:00 PM: Planning & Wrap-Up. The analyst updates their project management tool, outlines their priorities for the next day, and responds to any final emails before logging off.

This example highlights the dynamic nature of the role—a constant cycle of monitoring, investigating, collaborating, and recommending that directly impacts the company's bottom line.

Average Business Operations Analyst Salary: A Deep Dive

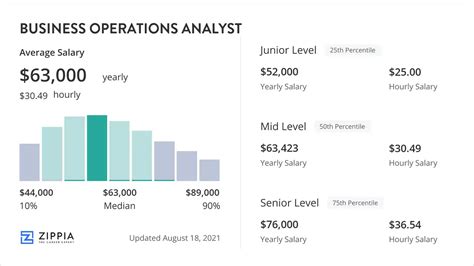

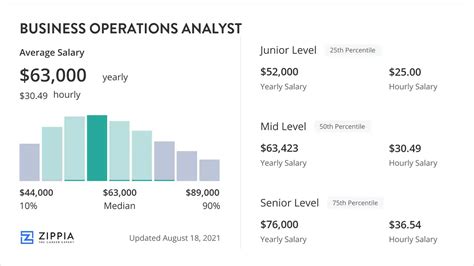

Understanding the earning potential is a crucial step in evaluating any career path. For Business Operations Analysts, the compensation is competitive and reflects the significant value they bring to an organization. While the numbers vary based on the factors we'll explore in the next section, we can establish a strong baseline using data from trusted industry sources.

According to Salary.com, as of late 2023, the median annual salary for a Business Operations Analyst in the United States is $80,590. However, the typical salary range falls between $72,190 and $89,890. This range represents the core bulk of professionals in the field, but it doesn't tell the whole story.

Let's break this down further by experience level, which is one of the most significant determinants of pay.

### Salary by Experience Level

Your salary will grow substantially as you move from an entry-level position, where you're primarily executing tasks under supervision, to a senior role, where you're leading strategic initiatives and mentoring others.

Here’s a look at the typical progression, with data aggregated from sources like Payscale, Glassdoor, and Salary.com:

| Experience Level | Common Titles | Typical Base Salary Range (USA) | Key Responsibilities & Expectations |

| ----------------------- | --------------------------------- | ------------------------------- | ------------------------------------------------------------------------------------------------------------------------------------ |

| Entry-Level (0-2 Years) | Junior Operations Analyst, Operations Analyst I | $60,000 - $78,000 | Gathers data, runs pre-defined reports, performs basic analysis, documents processes, supports senior analysts on larger projects. |

| Mid-Career (3-7 Years) | Operations Analyst, Senior Operations Analyst | $78,000 - $105,000 | Manages medium-sized projects independently, conducts complex analyses, develops dashboards, presents findings to managers. |

| Senior-Level (8+ Years) | Senior/Lead Analyst, Principal Analyst | $105,000 - $135,000+ | Leads large-scale strategic initiatives, mentors junior analysts, manages stakeholder relationships at the executive level. |

_Note: These figures are national averages and can be significantly higher in high-cost-of-living areas and certain high-paying industries like technology and finance._

For example, Glassdoor's data, which includes user-submitted salary information, shows a total pay estimate (including bonuses and other compensation) with an average of around $93,500 per year for a "Business Operations Analyst" in the US. This highlights the importance of looking beyond the base salary.

### Beyond the Base Salary: Understanding Total Compensation

A Business Operations Analyst's paycheck is often more than just their base salary. Total compensation is a package that can significantly increase your overall earnings.

1. Bonuses:

- Performance Bonus: This is the most common type. It's an annual or quarterly bonus tied to your individual performance, your team's success, and the company's overall profitability. It can range from 5% to 20% or more of your base salary. A senior analyst who identifies millions in cost savings is in a strong position to receive a substantial performance bonus.

- Signing Bonus: A one-time payment offered by a company to a new employee as an incentive to join. These are more common for senior-level roles or in highly competitive job markets.

2. Profit Sharing:

Some companies, particularly private or partner-owned firms, distribute a portion of their annual profits among employees. This can be a significant addition to your income, directly tying your financial success to the company's performance.

3. Stock Options and Restricted Stock Units (RSUs):

Highly prevalent in the tech industry and publicly traded companies, equity is a powerful long-term wealth-building tool.

- Stock Options: Give you the right to buy company stock at a predetermined price in the future. If the stock price rises, you can profit from the difference.

- RSUs: A grant of company shares that vest over a period of time (typically 3-4 years). Once they vest, they are yours to keep or sell. For analysts at successful tech companies, vested RSUs can sometimes be worth more than their annual salary.

4. Retirement and Health Benefits:

While not direct cash, robust benefits packages are a critical part of compensation.

- 401(k) or 403(b) Matching: Many companies match a percentage of your contributions to your retirement account. This is essentially free money and a crucial part of long-term financial planning. A common match is 50% of the first 6% of your salary that you contribute.

- Health Insurance: Comprehensive health, dental, and vision insurance with low premiums and deductibles can save you thousands of dollars per year out-of-pocket, effectively increasing your disposable income.

5. Other Perks:

Other valuable perks can include tuition reimbursement for a master's degree or certifications, generous paid time off (PTO), a professional development stipend, wellness programs, and remote work flexibility (which can save significant commuting costs).

When evaluating a job offer, it's essential to look at the entire compensation package. A role with a slightly lower base salary but with a strong bonus structure, excellent 401(k) matching, and company-paid health insurance might be more lucrative in the long run than a role with a higher base salary and minimal benefits.

Key Factors That Influence Salary

The national average salary provides a useful benchmark, but your individual earning potential as a Business Operations Analyst is determined by a combination of personal and external factors. Mastering and strategically navigating these elements can add tens of thousands of dollars to your annual income. This section provides an in-depth analysis of the key drivers of salary in this profession.

---

### 1. Level of Education and Certifications

Your educational background is the foundation upon which your career is built. While a specific degree is not always required, employers look for a strong analytical and business-oriented foundation.

- Bachelor's Degree: This is the standard entry requirement. Degrees in Business Administration, Finance, Economics, Statistics, or Management Information Systems (MIS) are highly relevant. STEM degrees (e.g., Engineering, Computer Science) are also increasingly valued for their rigorous quantitative training. A candidate with a relevant bachelor's degree can expect to start in the entry-level salary range ($60k - $78k).

- Master's Degree: Pursuing an advanced degree can provide a significant salary bump and open doors to more senior and strategic roles.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier business school, is a powerful accelerator. It equips you with a holistic business perspective, advanced financial skills, and leadership training. Employers often view MBA graduates as future leaders, and the starting salary for an analyst role post-MBA can be 15-30% higher than for candidates with only a bachelor's degree.

- Master of Science in Business Analytics (MSBA) or Data Science: These specialized programs provide deep technical expertise in statistical modeling, machine learning, and data management. Graduates are equipped for more technical and quantitative operations roles and are highly sought after, often commanding a premium salary.

- Professional Certifications: Certifications validate your expertise in specific methodologies and tools. They demonstrate a commitment to your profession and can be a powerful negotiating tool.

- Six Sigma (Green Belt, Black Belt): This certification focuses on process improvement and waste reduction. A Six Sigma Black Belt is a mark of a highly skilled process expert and can lead to senior roles in operational excellence, often with salaries well over $115,000.

- Project Management Professional (PMP): Since many operations initiatives are run as projects, a PMP certification is highly valuable. It proves your ability to manage scope, schedule, and budget effectively.

- Certified Business Analysis Professional (CBAP): Offered by the International Institute of Business Analysis (IIBA), the CBAP is a prestigious certification for senior analysts, recognizing extensive experience and expertise in identifying business needs and crafting solutions.

---

### 2. Years of Experience

As highlighted in the previous section, experience is perhaps the single most important factor in salary growth. Your career trajectory is a journey from execution to strategy.

- 0-2 Years (Entry-Level): You're learning the ropes. Your value is in your ability to learn quickly, execute tasks accurately (data pulls, report generation), and support the team. Salary growth is steady but modest as you prove your capabilities.

- 3-7 Years (Mid-Career): You've moved beyond basic execution. You can now manage your own projects, perform complex analyses with minimal supervision, and begin to interface directly with mid-level managers. This is where you see the most significant salary jumps as you demonstrate your ability to deliver independent value. Pay can increase by 40-60% from your starting salary during this period.

- 8+ Years (Senior/Lead): You are now a strategic partner to the business. You're not just analyzing problems; you're anticipating them. You lead complex, cross-functional initiatives, mentor junior team members, and present to C-suite executives. Your salary reflects this high level of responsibility and influence, often pushing deep into the six-figure range. Lead and Principal Analysts in high-paying sectors can earn $140,000 to $170,000 or more.

---

### 3. Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and the concentration of high-paying industries. A job in a major tech hub will pay significantly more than the same role in a smaller, more rural city.

High-Paying Metropolitan Areas:

These cities are typically major hubs for technology, finance, and large corporate headquarters.

| Metropolitan Area | Average Salary Premium vs. National Average | Sample Senior-Level Salary Range | Source Insight |

| ---------------------------- | ------------------------------------------- | -------------------------------- | ------------------------------------------------------------------------------------------------------------- |

| San Jose / San Francisco, CA | +25% to +40% | $140,000 - $180,000+ | Glassdoor/Payscale: Highest salaries in the nation, driven by the intense competition for talent in Silicon Valley. |

| New York City, NY | +20% to +35% | $130,000 - $170,000 | Salary.com: Financial services (FinTech, investment banking) drive up salaries for operations roles. |

| Seattle, WA | +15% to +30% | $125,000 - $160,000 | Driven by major tech employers like Amazon and Microsoft, creating a high-demand, high-salary environment. |

| Boston, MA | +10% to +25% | $120,000 - $155,000 | A strong hub for tech, biotech, and finance, all of which require sophisticated operations analysis. |

| Austin, TX | +5% to +15% | $110,000 - $145,000 | A rapidly growing tech scene ("Silicon Hills") has led to a sharp increase in demand and salaries. |

Average and Lower-Paying Regions:

Conversely, areas with a lower cost of living and fewer large corporate headquarters will typically offer salaries closer to or below the national average. This doesn't mean they are "bad" places to work; the take-home pay can feel similar or even greater once the cost of housing, transportation, and taxes is factored in.

The Rise of Remote Work: The COVID-19 pandemic accelerated the trend of remote work, which has complicated geographic pay scales. Some companies now offer location-agnostic salaries, while others use a tiered approach, adjusting pay based on the employee's location even for fully remote roles. This is a crucial point to clarify during the interview process.

---

### 4. Company Type, Size, and Industry

The context of your employer plays a massive role in your paycheck.

- Industry: The industry you work in is a primary driver.

- Top Tier (Highest Paying): Technology (SaaS, Hardware), Financial Services (Investment Banking, FinTech), and Management Consulting pay a significant premium for top analytical talent. Operations are core to their product and profitability.

- Mid Tier: Healthcare, E-commerce/Retail, and Manufacturing offer competitive salaries as operational efficiency is critical to managing complex supply chains, patient flows, or inventory.

- Lower Tier: Non-profit, Education, and Government sectors typically offer lower base salaries. However, they often compensate with excellent benefits, better work-life balance, and strong job security.

- Company Size & Stage:

- Large Corporations (Fortune 500): These companies offer structured career paths, high base salaries, and strong benefits. Examples: Google, Microsoft, Johnson & Johnson, JPMorgan Chase.

- Startups (VC-Funded): Base salaries might be slightly lower than at large corporations, but the potential for high-growth is offset by significant equity (stock options). An early analyst at a startup that becomes a unicorn could see a life-changing financial outcome. The work is often more dynamic and less siloed.

- Small to Medium-Sized Businesses (SMBs): Salaries can vary widely. A successful, profitable SMB may pay very well, while others may be more constrained. These roles often offer broader responsibilities than at a large corporation.

---

### 5. Area of Specialization

"Business Operations Analyst" can be a generalist title, but specializing can make you a more valuable—and higher-paid—asset.

- Sales Operations (Sales Ops): Focuses on improving the efficiency and effectiveness of the sales team. This involves CRM management (e.g., Salesforce), sales funnel analysis, territory planning, and commission calculations. Because this role is so close to revenue generation, it's often one of the highest-paid specializations.

- Marketing Operations (Marketing Ops): The technical backbone of the marketing team. They manage the "marketing tech stack" (e.g., Marketo, HubSpot), analyze campaign performance, and optimize lead-to-customer conversion funnels.

- IT Operations: Works at the intersection of business and technology, analyzing IT infrastructure costs, software licensing, system performance, and IT service management (ITSM) processes.

- Supply Chain / Logistics Operations: Crucial in e-commerce, manufacturing, and retail. These analysts focus on inventory management, logistics network optimization, procurement cost analysis, and demand forecasting.

- Financial Operations (FinOps): Often overlaps with financial analyst roles, focusing on billing systems, payment processing, accounts receivable/payable efficiency, and financial reporting processes.

---

### 6. In-Demand Skills

Beyond your title, the specific skills you possess are what a company is truly paying for. Developing expertise in high-value areas is the most direct way to increase your salary.

- Technical Skills (The "What"):

- SQL (Advanced): This is non-negotiable. Moving beyond basic SELECT statements to complex joins, window functions, and subqueries is essential for independent analysis.

- BI & Data Visualization (Expert): Mastery of Tableau or Power BI is critical. You must be able to not only build dashboards but tell a compelling, intuitive story with data.

- Spreadsheet Software (Expert): Advanced Excel or Google Sheets skills (pivot tables, complex formulas, Power Query, VBA macros) are a baseline expectation.

- Programming (Growing Importance): Basic proficiency in Python or R is becoming a major differentiator. It allows you to automate data cleaning, perform sophisticated statistical analysis, and build predictive models, justifying a higher salary.

- ERP/CRM Systems: Experience with major platforms like Salesforce, SAP, or Oracle NetSuite is highly valuable, as this is where the core business data lives.

- Analytical & Soft Skills (The "How"):

- Financial Modeling: The ability to build models to forecast revenue, calculate ROI on a project, or analyze pricing strategies is a top-tier skill.

- Stakeholder Management: You must be able to communicate effectively with everyone from an entry-level IT technician to the CFO. This involves listening, building consensus, and translating complex data into understandable business implications.

- Strategic & Critical Thinking: The best analysts don't just report the numbers; they provide insight. They ask "why" and "so what," connecting their analysis to the company's strategic goals.

- Presentation & Storytelling: A brilliant analysis is useless if it can't be communicated effectively. The ability to present your findings in a clear, concise, and persuasive manner to an executive audience is a skill that commands a premium.

Job Outlook and Career Growth

Investing your time and resources into a career path requires a clear understanding of its long-term viability. For Business Operations Analysts, the future is exceptionally bright. The skills they possess are becoming more, not less, critical in an increasingly complex and data-saturated business world.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) provides authoritative data on career outlooks. While the BLS does not have a specific category for "Business Operations Analyst," the role aligns almost perfectly with that of a Management Analyst.

According to the latest BLS Occupational Outlook Handbook (updated September 2023), employment for Management Analysts is projected to grow 10 percent from 2022 to 2032. This growth rate is much faster than the average for all occupations, which is 3 percent.

- Projected New Jobs: The BLS projects about 103,500 openings for management analysts each year, on average, over the decade.