Table of Contents

- [Introduction](#introduction)

- [What Does a Senior Manager at a Company Like Capital One Do?](#what-does-a-senior-manager-do)

- [Capital One Senior Manager Salary: A Deep Dive](#average-capital-one-senior-manager-salary-a-deep-dive)

- [Key Factors That Influence a Senior Manager's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Senior Managers](#job-outlook-and-career-growth)

- [How to Become a Senior Manager](#how-to-get-started-in-this-career)

- [Conclusion: Is a Senior Manager Career Path Right for You?](#conclusion)

---

Introduction

Imagine leading high-impact projects at the intersection of finance and technology, shaping the products and services used by millions of customers daily. Picture yourself at the helm of a talented team, driving strategic initiatives for a Fortune 100 company. This is the reality of a Senior Manager, a role that represents a significant milestone in a professional's career, combining leadership, strategy, and deep domain expertise. For many, landing a Senior Manager position at a forward-thinking institution like Capital One is a pinnacle of achievement, offering not only immense professional satisfaction but also a highly competitive compensation package.

The allure of this role is undeniable, with total compensation often soaring well into the six-figure range, frequently exceeding $200,000 to $275,000 or more when bonuses and stock options are factored in. But beyond the impressive numbers lies a complex and rewarding career path that demands a unique blend of skills, experience, and strategic vision.

I once mentored a brilliant analyst who was on the fast track to management. She was laser-focused on her base salary, but it wasn't until we mapped out the entire compensation structure—the performance bonus, the restricted stock units (RSUs), and the long-term incentives—that she truly grasped the wealth-building potential of a senior leadership role. This guide is designed to provide that same clarity for you, demystifying not just the Capital One Senior Manager salary, but the entire ecosystem surrounding this prestigious and demanding career.

This comprehensive article serves as your ultimate resource. We will dissect the salary components, explore the critical factors that dictate your earning potential, analyze the long-term job outlook, and provide a concrete, step-by-step roadmap to help you navigate your journey toward becoming a Senior Manager.

---

What Does a Senior Manager at a Company Like Capital One Do?

A Senior Manager is far more than just an experienced manager; they are a critical nexus between high-level strategy and on-the-ground execution. At a company like Capital One, which prides itself on being a technology company that specializes in finance, a Senior Manager is often described as a "player-coach" and a strategic owner. They are responsible for not just managing people, but for managing a significant business function, product, or program.

Their responsibilities are multifaceted and dynamic, but they generally revolve around three core pillars:

1. Strategic Planning and Ownership: Senior Managers don't just execute tasks; they help shape the "why" behind the work. They translate broad directives from Directors and Vice Presidents into actionable plans, defining project scope, setting key performance indicators (KPIs), and owning the outcomes. For example, a Senior Manager in Product might own the roadmap for a new feature in the Capital One mobile app, from initial concept to launch and post-launch analysis.

2. Team Leadership and Development: This role involves direct line management of a team of individual contributors (like analysts or specialists) and, in some cases, junior managers. A significant portion of their time is dedicated to coaching, mentoring, and developing their direct reports. They are responsible for performance management, career pathing, and fostering a collaborative and inclusive team culture that drives high performance.

3. Cross-Functional Collaboration and Influence: No Senior Manager operates in a silo. They are expert communicators and influencers who must work horizontally across the organization. A Senior Manager in Marketing, for instance, would collaborate daily with counterparts in Tech, Data Analytics, Legal, and Risk Management to ensure a campaign is effective, compliant, and technically feasible.

### A "Day in the Life" of a Senior Manager (Example: Digital Product)

To make this more tangible, let's walk through a hypothetical day for a Senior Product Manager at a large financial tech company.

- 8:30 AM - 9:00 AM: Review overnight performance dashboards for their product area. Check key metrics like user engagement, transaction volume, and app stability. Respond to a few urgent emails from the technology team regarding an upcoming software release.

- 9:00 AM - 9:30 AM: Lead the daily stand-up meeting with their team of product analysts, designers, and engineers. Discuss progress against sprint goals, identify blockers, and set priorities for the day.

- 10:00 AM - 11:00 AM: Meet with a Director-level stakeholder from the Card division to present a quarterly business review (QBR). They use data-driven insights to report on the product's performance and present the strategic plan for the next quarter.

- 11:00 AM - 12:00 PM: Conduct a one-on-one meeting with a direct report. This is a dedicated coaching session to discuss their career development, provide feedback on a recent project, and offer support for their current workload.

- 12:00 PM - 1:00 PM: Lunch, often used to catch up on industry news, read a competitor analysis report, or have an informal coffee chat with a peer in another department.

- 1:00 PM - 3:00 PM: "Deep work" block. This is protected time for focused strategic work, such as writing a detailed product requirements document (PRD) for a new initiative or building a financial model to forecast the business impact of a proposed feature change.

- 3:00 PM - 4:00 PM: Participate in a cross-functional workshop with teams from Legal, Risk, and Brand to review the user experience and messaging for an upcoming product launch, ensuring it meets all compliance and brand guidelines.

- 4:00 PM - 5:00 PM: Review and approve budget requests, manage vendor relationships, and clear administrative hurdles for the team. End the day by preparing a brief agenda for the next day's key meetings.

This blend of strategic thinking, people management, and tactical execution makes the Senior Manager role both challenging and immensely rewarding.

---

Capital One Senior Manager Salary: A Deep Dive

Analyzing the salary for a Senior Manager at a top-tier company like Capital One requires looking beyond a single number. Compensation is a comprehensive package designed to attract and retain top talent in a highly competitive market. It typically consists of a strong base salary, performance-based bonuses, and long-term incentives like stock.

It's important to note that Capital One positions itself against both large financial institutions (like JPMorgan Chase, Bank of America) and major technology companies (like Amazon, Google), so its compensation structure is designed to be competitive with both sectors.

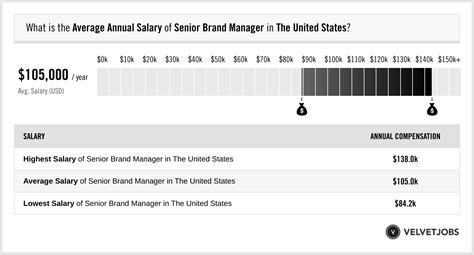

### National Average and Typical Salary Range

While salaries are highly dependent on the factors we'll discuss in the next section, we can establish a reliable baseline using data from reputable sources.

According to data aggregated from platforms like Glassdoor and Levels.fyi (a trusted source for tech and finance compensation), the typical salary for a Senior Manager at Capital One in the United States falls into the following ranges (as of late 2023/early 2024):

- Base Salary: $155,000 to $210,000 per year.

- Annual Performance Bonus: Typically ranges from 15% to 30% of the base salary, meaning an additional $23,000 to $63,000 or more, depending on individual and company performance.

- Long-Term Incentives (LTI) / Stock: Capital One often provides Restricted Stock Units (RSUs) that vest over a period of 3-4 years. The annual value of these grants can range from $15,000 to $50,000+.

- Total Compensation (Base + Bonus + Stock): This brings the typical annual total compensation for a Capital One Senior Manager into the $190,000 to $300,000+ range.

Source Citation: These figures are synthesized from user-reported data on Glassdoor (for "Senior Manager, Capital One"), Levels.fyi, and Payscale. It's crucial to recognize that these are aggregates and individual offers can vary significantly.

For broader context, Salary.com reports that the median base salary for a generic "Manager" position in the U.S. is around $120,000, while a "Senior Manager" median is closer to $150,000. This highlights the premium that a company like Capital One pays to secure top talent.

### Salary Brackets by Experience Level

Salary progression is directly tied to experience and impact. While "Senior Manager" is itself a senior role, there can be gradations within the title or clear expectations for salary growth as one's tenure and influence expand.

| Experience Level/Stage | Typical Base Salary Range | Typical Total Compensation Range | Notes |

| :--- | :--- | :--- | :--- |

| New Senior Manager (e.g., 5-8 years of experience) | $150,000 - $175,000 | $180,000 - $220,000 | Often a promotion from a Manager role or a new hire with solid, relevant experience. Focus is on mastering the role. |

| Mid-Career Senior Manager (e.g., 8-12 years of experience) | $170,000 - $195,000 | $210,000 - $270,000 | Demonstrates consistent high performance, leads more complex projects, and begins mentoring other managers. |

| Veteran Senior Manager (e.g., 12+ years of experience) | $190,000 - $210,000+ | $250,000 - $300,000+ | A top performer, often considered a subject matter expert and on the cusp of a Director-level promotion. May lead mission-critical initiatives. |

### Deconstructing the Full Compensation Package

To truly understand the value proposition, it's essential to break down each component of the compensation package.

1. Base Salary: This is the fixed, guaranteed portion of your annual pay. It's the most stable component and is determined by factors like job function, location, and experience level. It's the number used to calculate your bonus percentage.

2. Annual Bonus (Short-Term Incentive): This is a variable, at-risk component paid out once a year (usually in the first quarter). It's tied to both your individual performance (how well you met your goals) and the overall performance of the company. A strong performance year for both you and Capital One can result in a bonus at the higher end of the 15-30% range, or sometimes even more.

3. Long-Term Incentives (LTI) / Restricted Stock Units (RSUs): This is a powerful wealth-building tool designed to incentivize employees to think like owners and stay with the company.

- How it works: You are granted a certain dollar value of company stock (e.g., $80,000). This grant "vests" over time, typically in installments. A common vesting schedule is 25% per year over four years. This means you would receive $20,000 worth of stock after your first year, another $20,000 after your second, and so on.

- The upside: If Capital One's stock price (ticker: COF) increases between the grant date and the vest date, your shares are worth more. This aligns your financial interests directly with the company's success.

4. Benefits and Perks: While not direct cash, these have significant financial value and are a key part of the total rewards. For a top-tier employer, these often include:

- 401(k) with Generous Match: Capital One is known for a strong 401(k) match, which is essentially free money for your retirement. For example, they might match 100% of your contributions up to a certain percentage of your salary (e.g., 6%).

- Comprehensive Health Insurance: Medical, dental, and vision insurance with low premiums and deductibles.

- Generous Paid Time Off (PTO): A substantial number of vacation days, holidays, and sick leave.

- Wellness Programs: Subsidies for gym memberships, mental health resources (like EAPs), and other wellness initiatives.

- Parental Leave: Competitive paid leave for new parents.

- Education and Tuition Assistance: Support for pursuing further education or relevant certifications.

When evaluating a job offer for a Senior Manager role, it is critical to assess this entire package, not just the base salary. The combination of bonus and LTI can add 30-50% or more to your base pay, dramatically increasing your overall annual earnings.

---

Key Factors That Influence a Senior Manager's Salary

The wide salary ranges discussed above exist because compensation is not one-size-fits-all. A multitude of factors interact to determine the final offer you receive and your earning potential over time. Understanding these levers is the key to maximizing your compensation throughout your career. This section provides an exhaustive breakdown of the most critical variables.

###

1. Area of Specialization or Business Line

This is arguably one of the most significant factors. "Senior Manager" is a title that exists across nearly every department, but the market value of these departments varies. At a tech-forward company like Capital One, functions closer to technology, data, and revenue generation typically command the highest salaries.

- Technology (Software Engineering, Cloud, Cybersecurity): Senior Technical Program Managers or Senior Managers in a software development vertical are at the top of the pay scale. Their expertise is in high demand and short supply. They can often be found at the upper end of the salary and total compensation bands ($200k+ base, $280k+ total comp).

- Data Science and Machine Learning: Senior Managers leading teams of data scientists who build predictive models for credit risk, fraud detection, or marketing personalization are extremely valuable. Their compensation is on par with, and sometimes exceeds, that of pure technology roles due to the specialized quantitative skills required.

- Product Management (Digital): As the "mini-CEOs" of a digital product, Senior Product Managers who can successfully blend user experience, technology, and business strategy are compensated handsomely. Their pay is highly competitive and sits just below the most technical roles.

- Finance, Strategy, and Corporate Development: Classic roles for those with MBA or top-tier consulting backgrounds. Senior Managers in these areas work on high-stakes projects like M&A, long-range financial planning, and competitive strategy. They are highly paid, reflecting the strategic importance of their work.

- Marketing (Analytics and Digital): A Senior Manager in Brand or traditional marketing may earn slightly less than one in Digital Marketing or Marketing Analytics. The closer your role is to measurable, data-driven customer acquisition and ROI, the higher your pay.

- Risk Management and Compliance: As a heavily regulated bank, these functions are mission-critical. While perhaps not as high as top tech roles, Senior Managers in areas like Credit Risk, Operational Risk, or AML (Anti-Money Laundering) are still very well-compensated due to the specialized knowledge required.

- Operations and Human Resources: While absolutely essential to the business, these roles sometimes fall on the lower end of the Senior Manager pay scale compared to technical or revenue-generating functions. However, at a company the size of Capital One, the salaries are still very competitive relative to the broader market.

###

2. Geographic Location

Where you live and work plays a massive role in your base salary. Companies adjust pay based on the local cost of labor and cost of living. Capital One has major hubs across the U.S., and compensation is tiered accordingly.

- Tier 1 (Highest Cost of Living): New York City, San Francisco Bay Area. Senior Managers in these locations will receive the highest base salaries to offset the exorbitant cost of housing and living. A base salary in NYC might be 15-25% higher than in a standard location.

- Tier 2 (Major Corporate Hubs): McLean, VA (Capital One HQ); Plano, TX; Chicago, IL; Richmond, VA. These locations have a high concentration of corporate talent and a significant cost of living, so salaries are very strong. McLean, as the headquarters, often sets a high benchmark.

- Tier 3 (Other & Remote Locations): For other office locations or fully remote positions (if available for the role), the salary may be benchmarked to a national average or a slightly lower tier. The rise of remote work has complicated geo-based pay, with some companies moving towards location-agnostic pay for certain roles, while others maintain strict geographic bands. It is crucial to clarify the company's policy during the interview process.

Example Salary Variation by Location (Illustrative):

- Senior Product Manager in NYC: Base Salary: $205,000

- Senior Product Manager in McLean, VA: Base Salary: $185,000

- Senior Product Manager in Richmond, VA: Base Salary: $170,000

###

3. Years and Quality of Experience

The salary trajectory for a manager is steep. Compensation grows not just with the number of years worked, but with the quality, relevance, and impact of that experience.

- Entry-Level Senior Manager (5-8 years): This professional has likely proven themselves as a high-performing Manager or has come from a similar role at another company. Their salary is at the lower end of the band as they acclimate to the increased scope and strategic responsibility.

- Experienced Senior Manager (8-12 years): At this stage, you have a track record of successfully delivering complex projects and leading teams effectively. You can point to specific business outcomes you've driven. This demonstrated impact allows you to command a salary in the middle to upper-middle part of the range.

- Domain Expert Senior Manager (12+ years): This individual is a recognized expert in their field. They may not be aiming for a Director role but prefer to be a deep individual contributor or senior-most manager. They are sought after for their knowledge and can command top-of-band salaries due to their immense value in a specific niche. Experience at a direct competitor or a highly respected tech firm (like Google, Amazon, Meta) also carries a significant premium.

###

4. Level of Education and Certifications

Your educational background provides the foundation for your career and can influence your starting salary and long-term trajectory.

- Bachelor's Degree: This is the standard requirement for almost any professional-track role at a company like Capital One. The field of study matters—degrees in Computer Science, Engineering, Finance, Economics, or Statistics are often valued more highly for quantitative and technical roles.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier (M7 or T15) program, is a powerful accelerator. It often allows candidates to enter directly into strategic roles (like Strategy or Product Management) at a Senior Manager level. An MBA from a top school can easily add a $20,000-$40,000+ premium to the starting salary compared to a candidate without one, and it opens up elite networking channels for future advancement.

- Other Advanced Degrees: A Master's or Ph.D. in a quantitative field like Statistics, Computer Science, or Economics is extremely valuable for leadership roles in Data Science and Analytics, commanding salaries at the absolute top of the scale.

- Professional Certifications: While not as impactful as a degree, relevant certifications demonstrate commitment and specialized knowledge. They can give you a competitive edge and a slight salary bump.

- Project Management Professional (PMP): Valuable for Program and Project Management roles.

- Agile/Scrum Master Certifications (CSM, SAFe): Essential for roles in tech and product development.

- Chartered Financial Analyst (CFA): A gold standard for finance and investment strategy roles.

- Cloud Certifications (AWS, Azure, GCP): Highly valuable for any technology leadership role.

###

5. In-Demand Skills

Beyond your formal title and experience, the specific skills you possess can directly impact your compensation. The more your skills align with the company's strategic priorities, the more you are worth.

- Technical Acumen: Even for non-technical roles, the ability to "speak the language" of technology is crucial at Capital One. Understanding concepts like APIs, cloud infrastructure (AWS is huge at Capital One), and data architecture is a major differentiator.

- Data Literacy and Analytics: The ability to not just read a dashboard but to interpret complex data, ask the right questions, and use data to build a compelling business case is a universal requirement for high-paying manager roles today. Proficiency in tools like SQL, Python/R (for analytics), and Tableau is a massive advantage.

- Leadership and People Development: Proven success in hiring, coaching, and retaining top talent is a non-negotiable skill that directly correlates with higher compensation.

- Stakeholder Management and Influence: The ability to build consensus, manage competing priorities, and influence senior leaders without direct authority is a hallmark of an effective Senior Manager and a skill that companies will pay a premium for.

- Financial Acumen: Understanding P&L statements, building business cases with clear ROI, and managing a budget are core skills that demonstrate business maturity and justify a higher salary.

By strategically developing your skills, experience, and education in these high-value areas, you can actively steer your career towards the higher end of the Senior Manager salary spectrum.

---

Job Outlook and Career Growth for Senior Managers

Choosing a career path isn't just about the salary today; it's about the opportunities and security of tomorrow. For Senior Managers, particularly within the dynamic financial technology sector, the outlook is robust, driven by persistent technological change, evolving customer expectations, and a continuous need for skilled leadership.

### Job Growth Projections

While the U.S. Bureau of Labor Statistics (BLS) does not track "Senior Manager" as a single occupation, we can analyze the outlook by looking at related, high-level management categories.

According to the BLS's 2023 Occupational Outlook Handbook, employment in "Top Executive" roles is projected to grow 3 percent from 2022 to 2032, which is about as fast as the average for all occupations. This will result in about 30,000 openings each year, on average, over the decade.

However, this broad category includes C-suite roles across all industries. A more relevant view comes from looking at the specific functions where Senior Managers are concentrated:

- Financial Managers: The BLS projects a 16 percent growth