Considering a career that merges financial expertise with the fast-paced world of automotive sales? The role of a Car Dealership Finance Manager, often called an F&I (Finance & Insurance) Manager, is one of the most critical and potentially lucrative positions within any dealership. But what does that potential actually look like in terms of salary?

This guide breaks down the earning potential of an F&I manager, exploring the average compensation, key factors that can increase your pay, and the long-term outlook for this dynamic career. For those with a talent for numbers, negotiation, and customer service, the road ahead can be exceptionally rewarding, with top-tier professionals earning well into the six-figure range.

What Does a Car Dealership Finance Manager Do?

Before diving into the numbers, it's essential to understand the role. A Car Dealership Finance Manager is much more than a number-cruncher; they are a vital hub of profitability for the dealership. They step in after a customer has agreed to purchase a vehicle, guiding them through the final, crucial stages of the transaction.

Key responsibilities include:

- Securing Financing: Working with a network of banks and lenders to find competitive auto loan options for customers.

- Selling Add-on Products: Presenting and selling valuable aftermarket products, such as extended warranties, GAP (Guaranteed Asset Protection) insurance, tire and wheel protection, and vehicle maintenance plans. This is a primary source of commission.

- Ensuring Compliance: Meticulously handling all legal paperwork, ensuring that every contract adheres to federal, state, and local regulations.

- Managing Customer Relationships: Building trust and clearly explaining complex financial terms to customers, ensuring they feel confident and secure in their purchase.

It's a high-pressure, performance-driven role that requires a unique blend of financial acumen, sales skills, and regulatory knowledge.

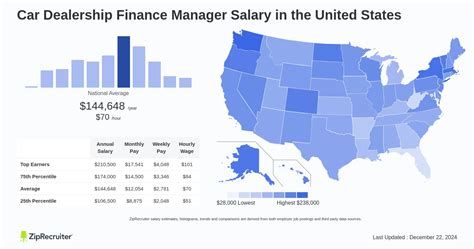

Average Car Dealership Finance Manager Salary

The compensation for a Car Dealership Finance Manager is heavily tied to performance, making a simple "average salary" slightly misleading. The structure is typically a combination of a modest base salary plus significant commissions and bonuses.

According to data from leading salary aggregators, the average total compensation for a Car Dealership Finance Manager in the United States typically falls between $120,000 and $150,000 per year.

Let's break that down:

- Typical Range: Salary.com reports that the salary range for an Automotive Finance and Insurance Manager generally falls between $91,241 and $164,187, with the median around $124,535 (as of late 2023).

- Base vs. Commission: Glassdoor data highlights the compensation structure, showing an average base pay of around $65,000, with an additional average cash compensation (commission, bonuses) of approximately $78,000.

- Top Earners: It's not uncommon for highly experienced and successful F&I managers at large, high-volume dealerships to surpass $200,000 or even $250,000 in annual earnings.

*(Sources: Salary.com, Glassdoor, 2023 data)*

Key Factors That Influence Salary

Your individual earnings as an F&I manager will depend on several critical factors. Understanding these can help you strategize your career path for maximum income potential.

### Level of Education

While a bachelor's degree is not always a strict requirement, it is highly advantageous. Dealerships increasingly prefer candidates with a degree in finance, business administration, or a related field. A formal education provides a strong foundation in financial principles, business ethics, and management, which can lead to higher starting offers and a faster track to senior roles like Finance Director. Furthermore, industry-specific certifications, such as those from the Association of Finance & Insurance Professionals (AFIP), can significantly boost your credibility and earning power by demonstrating a commitment to compliance and ethical practices.

### Years of Experience

Experience is arguably the most significant factor in determining an F&I manager's salary. The learning curve is steep, and seasoned professionals who have built strong relationships with lenders and mastered the art of selling aftermarket products are invaluable.

- Entry-Level (0-3 Years): Professionals often start as sales consultants or junior finance managers. In this phase, total compensation might range from $70,000 to $95,000 as they learn the processes and build a performance record.

- Mid-Career (4-9 Years): With a proven track record, an F&I manager can command the average industry salary of $120,000 to $160,000. They are efficient, knowledgeable, and a consistent source of profit for the dealership.

- Senior/Experienced (10+ Years): Top-tier F&I managers with a decade or more of experience are masters of their craft. They work at high-volume or luxury dealerships and can earn $175,000+, with the top 10% pushing well beyond the $200,000 mark.

*(Source: Analysis based on data from Payscale and industry reports)*

### Geographic Location

Where you work matters. Salaries are often adjusted to reflect the local cost of living and market demand. F&I managers in major metropolitan areas with high vehicle sales volume, such as Los Angeles, Miami, Dallas, or the New York City metro area, can expect to earn significantly more than their counterparts in smaller, rural towns. The higher volume of sales and higher vehicle prices in these urban centers create more opportunities for commission.

### Company Type

The type and size of the dealership play a huge role in your income.

- High-Volume Brands: Dealerships for brands like Toyota, Honda, and Ford sell a large number of vehicles, providing more opportunities to write contracts and earn commissions.

- Luxury Brands: Working for brands like Mercedes-Benz, BMW, Lexus, or Porsche means handling higher-value transactions. This can lead to larger loan amounts and higher-priced F&I products, boosting commission on a per-deal basis.

- Dealership Groups vs. Single Stores: Large, publicly-owned dealership groups may offer more structured compensation plans and better benefits, while a successful, privately-owned single store might offer a higher commission percentage to a star performer.

### Area of Specialization

Developing expertise in a specific niche can make you a more valuable asset. An F&I manager skilled in subprime financing—securing loans for customers with challenging credit histories—can be a huge profit driver for a dealership and command a premium salary. Similarly, those with experience in commercial or fleet vehicle financing or niche markets like RV and marine sales possess specialized knowledge that is highly sought after.

Job Outlook

The future for skilled financial professionals is bright. While the U.S. Bureau of Labor Statistics (BLS) does not have a separate category for F&I managers, it groups them under the broader category of "Financial Managers."

For this group, the BLS projects an employment growth of 17% from 2022 to 2032, a rate described as "much faster than the average for all occupations." This robust growth is driven by the ongoing need for professionals who can manage financial transactions, ensure regulatory compliance, and drive profitability. As long as vehicles are being sold, there will be a strong demand for skilled F&I managers to finalize the deals.

*(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Managers)*

Conclusion

A career as a car dealership finance manager is not for the faint of heart. It demands resilience, sharp sales skills, and an unwavering attention to detail. However, for those who thrive in a performance-based environment, the rewards are substantial.

Key Takeaways:

- High Earning Potential: Total compensation frequently exceeds six figures, driven by a strong commission structure.

- Performance is Paramount: Your income is directly tied to your ability to secure financing and sell F&I products.

- Experience Pays: Seasoned professionals with a strong track record and lender relationships earn the highest salaries.

- Strategic Choices Matter: Your choice of dealership (luxury vs. volume) and location (urban vs. rural) will significantly impact your earnings.

- Strong Job Outlook: The demand for skilled financial managers remains high, promising long-term career stability and growth.

For driven individuals looking for a challenging career with a direct link between effort and reward, becoming a Car Dealership Finance Manager is an excellent and highly lucrative path to consider.