A career as an industrial accountant offers a direct path to influencing a company's financial strategy from the inside, moving beyond traditional tax and audit to drive business decisions. But what is the real earning potential of this dynamic career? For qualified professionals, the financial rewards are significant, with salaries often ranging from $70,000 to well over $150,000 depending on a variety of key factors.

While "Certified Industrial Accountant" isn't a formal designation in itself, it perfectly describes a crucial and sought-after role: a certified accounting professional working within the private industry. The premier credential for this path is the Certified Management Accountant (CMA) certification.

This guide breaks down the salary you can expect as an industrial or management accountant and explores the critical factors that will maximize your earning potential.

What Does an Industrial or Management Accountant Do?

Unlike public accountants who serve multiple clients, an industrial or management accountant works for a single company in the private sector (e.g., a manufacturing firm, a tech company, or a retail corporation). They are the financial backbone of the organization, providing data-driven insights to support internal decision-making.

Key responsibilities include:

- Cost Accounting: Analyzing the costs of production, labor, and overhead to improve efficiency and profitability.

- Budgeting and Forecasting: Creating financial plans and predicting future performance to guide company strategy.

- Performance Analysis: Measuring the financial health of different departments or product lines against established goals.

- Financial Planning and Analysis (FP&A): Providing senior leadership with the strategic insights needed to make informed decisions about pricing, investments, and growth.

- Internal Controls and Reporting: Ensuring financial data is accurate and compliant with regulations.

Average Industrial & Management Accountant Salary

Salary data shows a strong and stable earning potential for accountants in industry, with a significant premium for those holding a professional certification.

According to Salary.com, the median salary for a Management Accountant in the United States is approximately $107,200 as of early 2024. Most professionals can expect to earn within a range of $96,600 to $118,500.

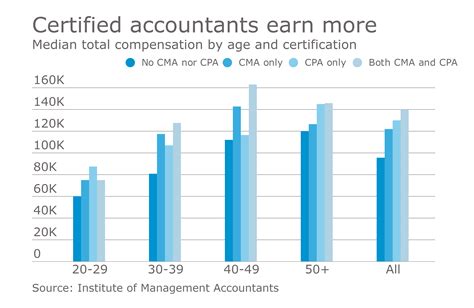

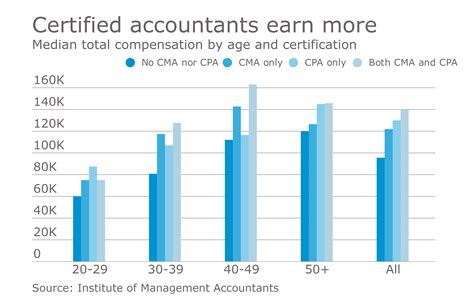

However, the most critical data point comes from the IMA (Institute of Management Accountants), the body that grants the CMA certification. Their latest Global Salary Survey reveals a powerful truth: certification pays. The survey consistently finds that CMAs earn significantly more in median total compensation than their non-certified peers. This premium underscores the value that employers place on the advanced skills in financial planning, analysis, control, and decision support that the CMA designation represents.

Key Factors That Influence Salary

Your salary isn't just one number; it's a dynamic figure influenced by your unique background, skills, and choices. Here are the primary factors that will determine your compensation.

### Level of Education & Certification

Your educational foundation is the launching point for your salary. A bachelor's degree in accounting, finance, or a related field is the standard requirement. However, to truly maximize your earnings, professional certification is paramount.

- Bachelor's Degree: The essential entry ticket to the profession.

- Master's Degree (MAcc, MBA): A master's degree can provide a salary bump and open doors to leadership positions faster.

- Certified Management Accountant (CMA): This is the gold standard for industrial accountants. As cited by the IMA, holding the CMA certification provides a substantial and quantifiable salary advantage over non-certified accountants. It signals a mastery of the complex financial and strategic skills that companies desperately need.

### Years of Experience

Experience is a powerful driver of salary growth. As you gain more experience, you take on more complex responsibilities, leading to higher compensation.

- Entry-Level (0-3 years): Professionals starting their careers can expect salaries in the $65,000 to $85,000 range, often in roles like Staff Accountant or Junior Cost Accountant.

- Mid-Career (4-9 years): With solid experience, accountants can move into Senior Accountant or Financial Analyst roles, with salaries typically ranging from $85,000 to $120,000, according to data from Payscale and Glassdoor.

- Senior/Experienced (10+ years): Professionals with a decade or more of experience are prime candidates for leadership roles like Controller, Finance Manager, or Director of FP&A, where salaries can easily exceed $130,000 and push upwards of $200,000 or more.

### Geographic Location

Where you work matters. Salaries for accountants vary significantly across the country to reflect local demand and cost of living. Major metropolitan areas with large corporate headquarters tend to offer the highest salaries.

According to data from the U.S. Bureau of Labor Statistics (BLS) and other aggregators, top-paying metropolitan areas for accountants include:

- San Jose-Sunnyvale-Santa Clara, CA

- New York-Newark-Jersey City, NY-NJ-PA

- San Francisco-Oakland-Hayward, CA

- Washington-Arlington-Alexandria, DC-VA-MD-WV

- Boston-Cambridge-Nashua, MA-NH

Working in these high-cost-of-living areas can significantly increase your base salary compared to working in a smaller city or rural area.

### Company Type and Industry

The size of your company and its industry have a direct impact on your paycheck.

- Company Size: Large, publicly traded multinational corporations generally have larger budgets and more complex financial operations, leading to higher salaries than small or mid-sized businesses.

- Industry: Industries with high margins and complex financial needs, such as technology, pharmaceuticals, manufacturing, and financial services, often pay their accountants more than other sectors.

### Area of Specialization

Within industrial accounting, certain career paths offer greater earning potential. As you specialize and move up the corporate ladder, your salary will grow accordingly.

- Cost Accountant: A foundational role focused on production costs.

- Financial Analyst: A more strategic role focused on forecasting and analysis.

- Financial Controller: A high-level management role responsible for overseeing all accounting operations. According to Salary.com, the median salary for a Controller in the U.S. is over $160,000.

- Chief Financial Officer (CFO): The top financial position in a company. This executive role commands the highest salaries, often supplemented with significant bonuses and equity.

Job Outlook

The future for skilled accountants is bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for accountants and auditors will grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady demand is driven by the constant need for financial accountability, globalization, increasingly complex regulations, and, most importantly, the growing reliance on data-driven decision-making. Accountants who can interpret data and provide strategic guidance are no longer just "number crunchers"—they are essential business partners.

Conclusion

A career as an industrial or management accountant offers a stable, rewarding, and financially lucrative path. While a baseline salary is strong, your ultimate earning potential is in your hands. To build a top-tier career in this field, focus on these key takeaways:

1. Get Certified: The single most impactful step you can take to increase your salary and career opportunities is earning the CMA certification.

2. Gain Diverse Experience: Don't be afraid to take on challenging roles in cost accounting, FP&A, and financial analysis to build a versatile skill set.

3. Be Strategic About Location & Industry: Target high-growth industries in major metropolitan areas to maximize your earning power.

4. Never Stop Learning: The most valuable accountants are those who evolve with the business and embrace their role as strategic partners.

By focusing on these areas, you can move beyond a standard salary and build a highly compensated and impactful career as a leader in corporate finance.