For individuals with a passion for finance and a talent for building strong client connections, a career as a Relationship Banker at a major institution like JPMorgan Chase can be both rewarding and financially lucrative. But what can you realistically expect to earn? This role serves as a critical gateway to the financial services industry, and understanding its compensation structure is the first step toward a successful career.

While salaries vary, a Chase Relationship Banker can typically expect a total compensation package ranging from $55,000 to over $85,000 annually, with top performers in high-demand markets earning even more. This article will break down the salary components, the key factors that influence your pay, and the promising future of this career path.

What Does a Chase Relationship Banker Do?

A Chase Relationship Banker is the primary point of contact for the bank's personal and small business clients. This is not a passive, transactional role; it's a proactive, advisory position focused on building long-term relationships. Their core mission is to understand a client's complete financial picture and help them achieve their goals.

Key responsibilities include:

- Building and Managing a Client Portfolio: Proactively engaging with new and existing customers to deepen relationships.

- Needs-Based Financial Guidance: Identifying client needs and recommending appropriate products and services, such as checking and savings accounts, credit cards, mortgages, auto loans, and investment referrals.

- Driving Growth: Meeting and exceeding individual and team sales goals for loans, deposits, and investments.

- Problem-Solving: Assisting clients with complex issues and navigating the bank's resources to find solutions.

- Ensuring Compliance: Adhering to all federal and state banking regulations and company policies.

Essentially, a Relationship Banker acts as a financial quarterback for their clients, connecting them to the full suite of services Chase has to offer.

Average Chase Relationship Banker Salary

Discussions about a Relationship Banker's salary must distinguish between *base salary* and *total compensation*. The latter is a more accurate measure of earning potential as this role is heavily performance-driven.

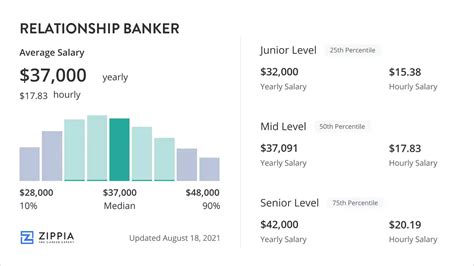

- Average Base Salary: According to data from salary aggregators like Glassdoor and Salary.com, the typical base salary for a Chase Relationship Banker in the United States falls between $48,000 and $62,000 per year.

- Average Total Compensation (Salary + Incentives): The true earning power comes from variable pay, which includes commissions and bonuses tied to performance goals. When these incentives are included, the average total compensation rises significantly. Data from Glassdoor suggests that total pay is often in the $65,000 to $85,000 range.

It's important to note that these figures are averages. Entry-level bankers will start at the lower end, while experienced, high-performing bankers in major metropolitan areas can surpass the higher end of this range.

*(Sources: Salary.com, Glassdoor, data reported in 2023 and 2024)*

Key Factors That Influence Salary

Your specific salary as a Chase Relationship Banker isn't set in stone. It’s influenced by a combination of your qualifications, performance, and market dynamics. Here are the most significant factors.

###

Level of Education

While a high school diploma is the minimum requirement, a bachelor's degree is strongly preferred by major banks like Chase and can directly impact your starting salary and career trajectory.

- Bachelor’s Degree: A degree in Finance, Business Administration, Economics, or a related field provides a strong foundation and is often a prerequisite for advancement. Candidates with a relevant degree may command a higher starting salary.

- Advanced Degrees & Certifications: While not necessary for the Relationship Banker role itself, an MBA or professional certifications like the Series 6 and Series 63 licenses (required for selling certain investment products) open the door to more specialized, higher-paying roles like a Financial Advisor or Private Client Banker.

###

Years of Experience

Experience is arguably the most critical factor in determining your earnings, especially the incentive-based portion of your pay.

- Entry-Level (0-2 Years): A new Relationship Banker will likely earn a base salary at the lower end of the spectrum ($48,000 - $55,000). The focus during this period is on learning the product suite, building a client book, and mastering the sales process.

- Mid-Career (3-5 Years): With a proven track record of meeting goals and a solid client portfolio, a mid-career banker can expect a higher base salary ($55,000 - $65,000) and, more importantly, a significant increase in bonus and commission earnings.

- Senior/Lead (5+ Years): Senior Relationship Bankers who consistently exceed their targets are the highest earners. They often handle more complex client needs and may take on mentorship responsibilities. Their success positions them for promotion to roles like Branch Manager or Private Client Banker, where total compensation can easily exceed $100,000.

###

Geographic Location

Where you work matters immensely. Compensation is adjusted based on the cost of living and the demand for financial professionals in a specific market. A Relationship Banker in New York City or San Francisco will have a significantly higher base salary and overall earnings potential compared to one in a small town in the Midwest, simply to account for the drastic difference in living expenses. Major financial hubs like Chicago, Los Angeles, and Boston also command higher-than-average salaries.

###

Company Type

While this article focuses on Chase, it's useful to understand its position in the market. As one of the largest "money-center" banks in the world, JPMorgan Chase generally offers highly competitive salaries, structured bonus programs, and comprehensive benefits packages to attract top talent. This may differ from smaller regional banks or credit unions, which might offer a different compensation structure, sometimes with a greater emphasis on work-life balance over maximum incentive pay.

###

Area of Specialization

Within Chase, there are opportunities to specialize, which can directly impact your earnings. A standard Relationship Banker focuses on general consumer needs. However, you can advance into more specialized and lucrative roles:

- Business Banker: Focusing exclusively on small to mid-sized business clients involves more complex products like commercial loans and merchant services, often leading to higher commission opportunities.

- Chase Private Client (CPC) Banker: This is a significant step up. CPC Bankers work with affluent and high-net-worth clients, managing larger asset portfolios and providing a more sophisticated level of wealth management advice. The compensation for these roles is substantially higher.

Job Outlook

The career outlook for banking professionals is bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Personal Financial Advisors—a field that Relationship Bankers often transition into—is expected to grow by 13% from 2022 to 2032, which is much faster than the average for all occupations.

The BLS attributes this growth to an aging population saving for retirement and a general increase in the need for financial planning services. The Relationship Banker role serves as a perfect training ground, providing the foundational skills in client management and financial products necessary to succeed in this growing industry.

*(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook)*

Conclusion

A career as a Chase Relationship Banker offers a dynamic and challenging environment with a clear path for financial and professional growth.

Here are the key takeaways:

- Solid Earning Potential: Expect a competitive base salary with a significant portion of your earnings coming from performance-based incentives, putting your total compensation well into the $65,000 - $85,000+ range.

- Performance is Key: Your ability to build relationships and meet sales goals is directly tied to your income.

- Growth is Multi-Faceted: Your salary will be influenced by your experience, location, and any specializations you pursue, such as business banking or wealth management.

- A Promising Future: The role is an excellent launchpad into the broader financial services industry, which is projected to see strong growth over the next decade.

If you are a driven individual who thrives on helping others achieve their financial goals, the role of a Relationship Banker at Chase is an outstanding career choice that rewards both your skills and your ambition.