Unlocking Your Earning Potential: A Deep Dive into the Relationship Banker Salary

For those with a knack for numbers and a passion for people, a career as a relationship banker can be a rewarding entry point into the dynamic world of financial services. It’s a role that blends customer service, strategic sales, and financial guidance. But what does this rewarding career path mean for your wallet? In this article, we’ll break down the relationship banker salary, exploring the national averages and the key factors that can significantly increase your earning potential.

On average, a relationship banker in the United States can expect a total compensation package ranging from $45,000 to over $75,000 per year, with top performers in high-demand areas earning even more. Let's explore what shapes that number.

What Does a Relationship Banker Do?

Before diving into the salary specifics, it's crucial to understand the role. A relationship banker is far more than a traditional bank teller. They are the primary point of contact for bank clients, responsible for building and maintaining long-term customer relationships. Their daily responsibilities often include:

- Opening new checking, savings, and money market accounts.

- Proactively identifying client needs and recommending relevant financial products, such as credit cards, auto loans, mortgages, and personal loans.

- Assisting clients with complex service issues and problem-solving.

- Educating customers on digital banking tools and services.

- Meeting individual and branch sales goals by cross-selling and up-selling bank products.

In essence, they are the face of the bank, tasked with fostering loyalty and driving growth one client at a time.

Average Relationship Banker Salary

While salary can vary, we can establish a strong baseline by looking at data from leading compensation authorities.

Most relationship banker roles consist of two primary components: a base salary and variable pay (bonuses or commissions).

According to recent data from Salary.com, the median base salary for a mid-level Relationship Banker in the United States is approximately $51,500 per year, with a typical range falling between $45,300 and $58,000.

However, the base salary is only part of the story. The performance-based nature of the role means bonuses are a significant factor. Glassdoor reports a higher average for *total pay* (including bonuses and additional compensation) at around $61,000 per year. This highlights a critical point: your ability to meet sales goals directly impacts your overall earnings.

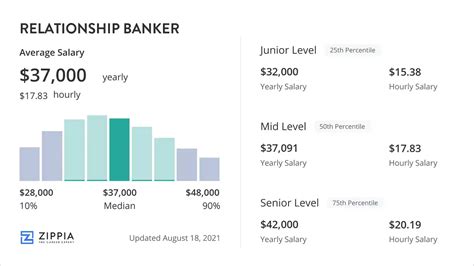

Here’s a general breakdown by experience level:

- Entry-Level Relationship Banker (0-2 years): Typically earns a base salary between $40,000 and $48,000, with modest initial bonus potential.

- Mid-Career Relationship Banker (2-5 years): With a proven track record, base salaries often range from $48,000 to $60,000, supplemented by more substantial performance bonuses.

- Senior Relationship Banker (5+ years): Highly experienced bankers who manage valuable client portfolios can command base salaries of $60,000 or more, with total compensation packages often exceeding $75,000-$80,000.

Key Factors That Influence Salary

Your specific salary is not set in stone. Several key factors can dramatically influence how much you earn. Understanding these variables can help you strategically navigate your career for maximum financial growth.

### Level of Education

While a high school diploma or equivalent is the minimum requirement for many entry-level positions, a college degree can give you a competitive edge. An Associate's or, more commonly, a Bachelor's degree in fields like Finance, Business Administration, or Economics is highly preferred by employers. A degree not only can lead to a higher starting salary but is often a prerequisite for advancement into roles like Branch Manager, Loan Officer, or Financial Advisor.

### Years of Experience

Experience is arguably the most significant driver of salary growth in this role. As you gain experience, you develop a deeper understanding of financial products, build a stronger client portfolio, and become more efficient at identifying and closing sales opportunities. Banks reward this proven expertise with higher base salaries and more lucrative bonus structures. A senior banker with a decade of experience and a loyal client base is far more valuable than a newcomer and is compensated accordingly.

### Geographic Location

Where you work matters. Salaries for relationship bankers are heavily influenced by the cost of living and the demand for financial professionals in a specific area. Major metropolitan hubs with a strong financial sector, such as New York City, San Francisco, Boston, and Chicago, will offer significantly higher salaries than rural areas or smaller cities. For example, a relationship banker in a high-cost-of-living city might earn 20-30% more than a counterpart in a lower-cost region to offset expenses.

### Company Type

The type of financial institution you work for also plays a major role in your compensation.

- Large National Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These institutions typically have highly structured salary bands and well-defined career progression paths. They often offer very competitive bonus structures and comprehensive benefits, leading to high total compensation potential.

- Regional Banks and Credit Unions: While their base salaries may sometimes be slightly lower than the national giants, they often compete with strong benefits packages, a focus on work-life balance, and a deep connection to the local community.

- Private Banks / Wealth Management Arms: Relationship bankers working in these elite divisions serve high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients. These roles are more complex, demand a higher level of sophistication, and come with substantially higher salaries and bonuses.

### Area of Specialization

As you advance, you can specialize, which is a powerful way to increase your earnings. A relationship banker who obtains financial licenses—such as the Series 6, Series 7, and Series 63, along with a Life & Health Insurance license—is qualified to sell investment products and annuities. Licensed bankers have a significantly higher earning potential, as they can tap into commission from more complex and profitable financial products, often transitioning into roles like Financial Advisor or Investment Consultant. Other specializations include focusing on small business banking or mortgage lending, both of which can lead to higher compensation.

Job Outlook

The banking industry is undergoing a digital transformation. While this has led to a decline in purely transactional roles, the outlook for relationship-focused professionals remains positive. The U.S. Bureau of Labor Statistics (BLS) projects a 12% decline for Bank Tellers from 2022 to 2032, as automation handles routine tasks.

However, this very trend increases the value of the Relationship Banker. As simple transactions move online, the in-person branch experience is becoming more centered on advice, problem-solving, and relationship-building—the exact skills of a great relationship banker. The career path often leads to more specialized roles with strong growth outlooks, such as Financial Services Sales Agents (projected 8% growth) or Personal Financial Advisors (projected 13% growth), which the BLS notes is much faster than the average for all occupations. This indicates that the skills learned as a relationship banker are a foundation for a secure and growing career in finance.

Conclusion

A career as a relationship banker offers a stable and promising entry into the financial services industry. While the national average salary provides a solid starting point, your ultimate earning potential is in your hands. By focusing on gaining experience, pursuing higher education or professional licenses, and strategically choosing your location and employer, you can build a lucrative and fulfilling career. For the ambitious and personable professional, the path of a relationship banker is not just a job, but a gateway to significant financial growth and opportunity.