Decoding Executive Pay: A Guide to Chief Financial Officer (CFO) Salaries

Are you searching for information on "cheifs salary cap" and trying to understand the earning potential of top-level executives? You've likely landed on one of the most critical and highly compensated roles in any organization: the Chief Financial Officer (CFO). A career as a CFO offers immense responsibility and a compensation package to match, with top earners commanding salaries well into the seven-figure range when including bonuses and equity.

This guide will break down what a CFO does, their average salary, the key factors that determine their pay, and the future outlook for this prestigious career.

What Does a Chief Financial Officer (CFO) Do?

A Chief Financial Officer is a C-suite executive who is the top financial leader in an organization. They are the chief architect and steward of the company's financial health and long-term strategy. While the CEO sets the overall vision, the CFO is responsible for ensuring the company has the financial resources and robust strategy to achieve it.

Key responsibilities include:

- Financial Planning and Analysis (FP&A): Creating budgets, forecasting future performance, and analyzing financial data to guide strategic decisions.

- Risk Management: Identifying and mitigating financial risks, from market volatility and credit risk to compliance and operational threats.

- Capital Structure Management: Deciding the best mix of debt, equity, and internal financing to fund the company's operations and growth.

- Investor Relations: Communicating the company's financial performance and strategy to shareholders, analysts, and the board of directors.

- Financial Reporting: Overseeing the accounting department to ensure accurate, timely, and compliant financial statements.

- Mergers and Acquisitions (M&A): Leading the financial due diligence and integration for potential company acquisitions or sales.

In essence, the CFO provides the financial foundation and strategic insight that allows a company to navigate challenges and seize opportunities.

Average Chief Financial Officer (CFO) Salary

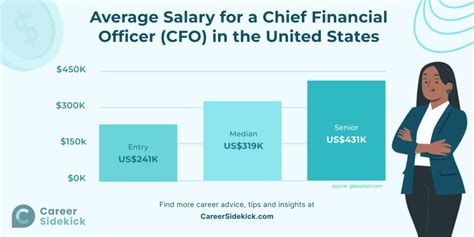

The compensation for a CFO is substantial, but it varies significantly based on factors we'll explore below. It's crucial to look beyond base salary to total compensation, which includes annual bonuses, stock options, and other long-term incentives.

- Median Salary: According to Salary.com, the median CFO salary in the United States as of late 2023 is $435,278. However, the typical range falls between $328,528 and $562,378.

- Total Compensation View: Glassdoor reports an average total pay of $283,501 per year, combining an average base salary of around $182,000 with significant additional pay (bonuses, stock, etc.) of over $101,000.

- Experience-Based Range: Payscale highlights the impact of experience, showing that while an early-career CFO might start around $100,000, an experienced CFO can earn a base salary well over $220,000, before bonuses that can exceed $50,000 annually.

The U.S. Bureau of Labor Statistics (BLS) groups CFOs under the "Top Executives" category, which had a median annual wage of $190,490 in May 2022. This lower figure includes executives from smaller organizations and non-profits, illustrating how company size dramatically impacts earnings.

Key Factors That Influence Salary

A CFO's salary isn't a single number; it's a complex equation. Here are the most significant variables that determine earning potential.

### Level of Education

Education is the bedrock of a CFO's career. While a bachelor's degree in finance, accounting, or economics is the minimum entry point, advanced credentials are a powerful driver of higher compensation.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier business school, is often a de facto requirement for CFO roles at large corporations. It signals advanced knowledge in strategy, leadership, and corporate finance, directly translating to higher salary offers.

- Certifications: The Certified Public Accountant (CPA) license is arguably the most valuable certification for a future CFO. It demonstrates mastery of accounting principles, financial reporting, and ethics. Other valuable certifications include the Chartered Financial Analyst (CFA) for investment expertise and the Certified Management Accountant (CMA).

### Years of Experience

There is no shortcut to the C-suite. A typical path to becoming a CFO involves 15+ years of progressive experience. This journey builds the technical skills and leadership acumen required for the role. A common career ladder looks like this:

1. Financial Analyst / Staff Accountant (Entry-Level)

2. Senior Financial Analyst / Senior Accountant (3-5 years)

3. Finance or Accounting Manager (5-10 years)

4. Controller or Director of FP&A (10-15 years)

5. Vice President (VP) of Finance (15+ years)

6. Chief Financial Officer

Each step up this ladder comes with a significant pay increase, with the jump to VP and then CFO representing the largest leaps in compensation.

### Geographic Location

Where a company is located plays a major role in salary due to differences in cost of living, talent demand, and the concentration of large corporations. Major financial and tech hubs offer the highest salaries.

According to data from Salary.com, a CFO in a high-cost-of-living city can earn significantly more than the national average. For example:

- San Francisco, CA: Approximately 25% above the national average.

- New York, NY: Approximately 20% above the national average.

- Boston, MA: Approximately 11% above the national average.

Conversely, CFOs in smaller metropolitan areas or regions with a lower cost of living may earn closer to or slightly below the national median.

### Company Type

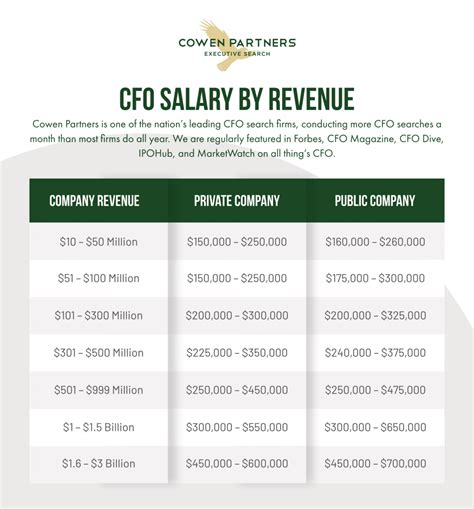

The size, stage, and structure of a company are perhaps the single biggest determinants of CFO compensation.

- Startups: A CFO at an early-stage startup may receive a lower base salary but will often be compensated with significant equity (stock options). If the company is successful, this equity can become far more valuable than a high salary.

- Small and Medium-Sized Businesses (SMBs): These roles offer competitive base salaries and bonuses, but total compensation is typically lower than at large public companies. The salary will often fall within the lower to middle end of the ranges cited earlier.

- Large Public Corporations (Fortune 500): This is where CFOs earn the highest compensation. Base salaries are substantial, but the majority of their pay comes from performance-based bonuses, stock awards, and long-term incentive plans. Total compensation can easily exceed $1 million annually and can reach tens of millions for the largest global companies.

- Non-Profit Organizations: CFOs in the non-profit sector are driven by mission as well as compensation. Their salaries are generally lower than their for-profit counterparts, reflecting the organization's revenue and operating budget.

### Area of Specialization

Within the field of finance, certain industries demand more complex financial leadership, leading to higher pay. A CFO's industry expertise is a valuable asset. For example, a CFO in:

- Financial Services or Private Equity: Requires deep knowledge of complex financial instruments, regulations, and deal structures.

- Technology or Biotechnology: Must be adept at managing finances for rapid growth, securing venture capital, and potentially leading an Initial Public Offering (IPO).

- Manufacturing: Requires expertise in supply chain finance, cost accounting, and operational efficiency.

CFOs with a proven track record in high-growth, high-complexity industries like tech and finance can command a premium salary.

Job Outlook

The career outlook for top executives, including CFOs, is stable and expected to grow in line with the broader economy. According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment for top executives is projected to grow 3 percent from 2022 to 2032.

While this growth is slower than the average for all occupations, the BLS projects about 217,800 openings for top executives each year, on average, over the decade. These openings are primarily expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. This indicates a consistent, albeit highly competitive, demand for experienced and capable financial leaders.

Conclusion

The path to becoming a Chief Financial Officer is a marathon, not a sprint. It demands a strong educational foundation, years of dedicated experience, and a commitment to continuous learning. For those who reach this pinnacle of corporate finance, the rewards are exceptional.

Here are the key takeaways:

- High Earning Potential: A CFO role offers a six-figure base salary with total compensation often reaching well beyond $400,000, especially at larger companies.

- Experience is Paramount: A minimum of 15 years of progressive experience is standard to acquire the necessary skills and leadership qualities.

- Education and Credentials Matter: An MBA and/or a CPA certification can significantly boost your earning potential and open doors to premier opportunities.

- Context is Key: Your salary will be heavily influenced by your location, the type and size of your company, and your industry specialization.

For aspiring financial professionals, the role of CFO represents a challenging and highly rewarding career goal. By strategically building your skills, gaining diverse experience, and understanding the factors that drive compensation, you can position yourself for a successful journey to the C-suite.