The role of a Chief Investment Officer (CIO) represents the pinnacle of a career in finance and investment management. It's a position of immense responsibility, strategic importance, and, consequently, significant financial reward. For ambitious finance professionals and students mapping out their future, the CIO path is one of the most lucrative available. But what does that earning potential actually look like?

This article provides a data-driven breakdown of a Chief Investment Officer's salary, the key factors that influence it, and the professional outlook for this elite role.

What Does a Chief Investment Officer Do?

A Chief Investment Officer is the senior executive responsible for managing and overseeing an organization's investment portfolio. Think of them as the strategic architect of a company's financial assets. Their primary goal is to grow the value of those assets while managing risk according to the organization's goals and policies.

Key responsibilities include:

- Developing Investment Strategy: Crafting and executing a long-term investment philosophy.

- Portfolio Management: Overseeing asset allocation, security selection, and the day-to-day management of investment portfolios.

- Risk Management: Identifying, analyzing, and mitigating financial risks across all investments.

- Leadership: Managing a team of portfolio managers, analysts, and traders.

- Stakeholder Communication: Reporting on investment performance and strategy to the board of directors, investment committees, or clients.

The role demands a rare blend of deep analytical prowess, market intuition, decisive leadership, and exceptional communication skills.

Average Chief Investment Officer Salary

The compensation for a Chief Investment Officer is substantial, reflecting the high stakes and specialized expertise required.

According to data from Salary.com, the median annual salary for a Chief Investment Officer in the United States is $307,468 as of early 2024. However, this figure is just the midpoint. The typical salary range is broad, generally falling between $224,961 (for the 10th percentile) and $452,785 (for the 90th percentile).

It is crucial to understand that base salary is only one part of the equation. Total compensation for a CIO is often significantly higher due to performance-based bonuses, profit-sharing, and equity incentives. Glassdoor reports an average total pay of $369,578 per year, with additional cash compensation (bonuses, etc.) averaging over $100,000. For CIOs at top-tier hedge funds or large asset management firms, total compensation can easily run into the seven figures.

Key Factors That Influence Salary

A CIO's salary isn't a single number; it's a dynamic figure influenced by a combination of personal qualifications and organizational context. Here are the most critical factors.

###

Level of Education

A strong educational foundation is non-negotiable for this role.

- Bachelor's Degree: A bachelor's in Finance, Economics, Accounting, or a related field is the minimum requirement.

- Master's Degree: An MBA with a specialization in finance is highly common and often expected by employers, as it equips candidates with both financial acumen and leadership skills.

- Professional Certifications: The Chartered Financial Analyst (CFA) designation is the gold standard in the investment management industry. Holding a CFA charter is a powerful signal of expertise and discipline, and it can significantly increase earning potential. Other relevant certifications include the Chartered Alternative Investment Analyst (CAIA).

###

Years of Experience

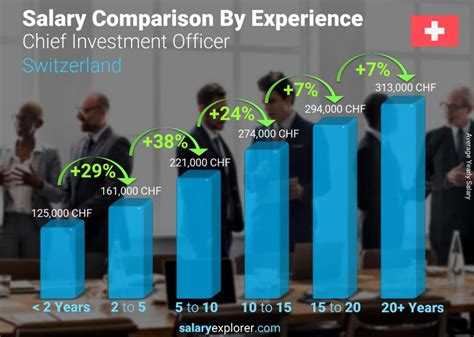

The Chief Investment Officer position is not an entry-level role. It is a senior executive position that requires a long and proven track record of success in progressively senior investment roles. Most CIOs have at least 15-20 years of experience, having worked their way up from roles like financial analyst, portfolio manager, and director of investments. Salary directly correlates with this experience, as a seasoned CIO with a history of delivering strong returns through various market cycles is an invaluable asset.

As noted by Payscale, compensation increases dramatically with experience, with "late-career" CIOs earning substantially more than those who are newer to the executive role.

###

Geographic Location

As with most high-finance roles, location plays a major part in compensation. CIOs working in major financial hubs command the highest salaries due to a high concentration of large firms and a more competitive talent market.

Key high-paying metropolitan areas include:

- New York, NY

- San Francisco, CA

- Boston, MA

- Chicago, IL

Salaries in these cities are often 15-30% higher than the national average to account for the increased cost of living and intense competition for top-tier talent.

###

Company Type

The type of organization a CIO works for is arguably the biggest determinant of their compensation structure and ceiling.

- Asset Management & Hedge Funds: These firms offer the highest earning potential. Compensation is often directly tied to the firm’s performance and the size of its Assets Under Management (AUM). A CIO managing a multi-billion-dollar fund will have a much higher earning potential than one managing a smaller portfolio.

- Corporate Sector: Large corporations employ CIOs to manage their pension funds, corporate treasury, and other investment assets. While compensation is excellent, it may be more structured and less variable than in a hedge fund.

- University Endowments and Foundations: These non-profit entities manage large investment portfolios to fund their operational goals. The roles are prestigious and well-compensated, though the absolute ceiling might be lower than at a top hedge fund.

- Family Offices: A CIO for a family office manages the wealth of a single ultra-high-net-worth family. Compensation can be extremely high and is often structured uniquely based on the family's goals and generosity.

###

Area of Specialization

Within investment management, expertise in certain asset classes can command a premium. CIOs with a deep, proven track record in high-growth or complex areas like private equity, venture capital, or alternative investments may earn more than those focused solely on traditional public equities or fixed income. This is because these specialized areas often require a unique skillset and have the potential for outsized returns.

Job Outlook

The future is bright for skilled financial leaders. While the U.S. Bureau of Labor Statistics (BLS) does not have a separate category for Chief Investment Officers, it provides data for the broader category of "Financial Managers," which serves as an excellent proxy.

According to the BLS Occupational Outlook Handbook, employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this robust growth to the increasing complexity of global financial markets and the growing need for expert financial management to ensure fiscal stability and growth for organizations. This strong demand will keep the competition for top-tier talent high, supporting continued growth in compensation for roles like the CIO.

Conclusion

Pursuing a career as a Chief Investment Officer is a marathon, not a sprint. It is a path defined by rigorous education, decades of hands-on experience, and an unwavering commitment to navigating the complexities of financial markets.

For those willing to undertake the journey, the rewards are exceptional. The role offers not only a highly lucrative salary and compensation package but also the profound satisfaction of steering an organization's financial destiny. By focusing on advanced education like an MBA or a CFA charter, gaining deep experience across different market cycles, and strategically targeting high-growth industries and locations, aspiring professionals can position themselves to one day reach this prestigious and rewarding executive role.