Unlocking Your Earning Potential: A Deep Dive into the Commercial Loan Officer Salary

For professionals with a knack for finance, analysis, and building relationships, a career as a commercial loan officer offers a rewarding and dynamic path. But beyond job satisfaction, what is the earning potential? This role is well-known for its lucrative compensation structure, where top performers can earn well into the six figures. A typical total compensation package can range from $70,000 for an entry-level analyst to over $250,000 for a senior officer in a major market.

This guide breaks down the commercial loan officer salary, exploring the national averages and the key factors that can significantly influence your take-home pay.

What Does a Commercial Loan Officer Do?

Before diving into the numbers, it's important to understand the role. A commercial loan officer is a financial professional who acts as the crucial link between a business seeking capital and a financial institution (like a bank or credit union) that can provide it.

Their primary responsibilities include:

- Generating Leads: Proactively finding and developing relationships with businesses in need of financing for things like expansion, equipment purchases, or commercial real-estate.

- Analyzing Financials: Scrutinizing a company's financial health, including balance sheets, income statements, and cash flow projections to assess creditworthiness and risk.

- Structuring Deals: Designing loan packages that meet the client's needs while adhering to the bank's lending policies and risk tolerance.

- Negotiating Terms: Finalizing interest rates, repayment schedules, and loan covenants with the client.

- Managing a Portfolio: Overseeing a book of existing loans to ensure they are performing as expected and identifying new opportunities with current clients.

In essence, they are part business developer, part financial analyst, and part risk manager, playing a vital role in fueling economic growth.

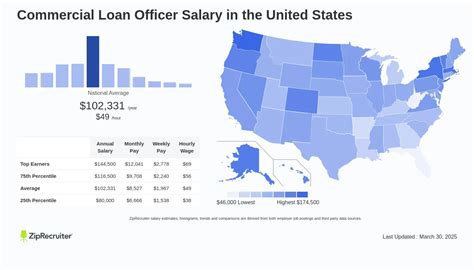

Average Commercial Loan Officer Salary

A commercial loan officer's salary is almost always a combination of two parts: a base salary and a variable commission or bonus. The base provides stability, while the commission—tied directly to the volume and profitability of the loans you close—is where the high earning potential lies. This structure rewards performance and is a key reason for the wide salary range.

Here's a look at what the data shows from leading sources:

- Total Compensation (Base + Bonus): According to Glassdoor, the estimated total pay for a Commercial Loan Officer in the United States is around $141,755 per year, with a likely range between $99,000 and $205,000.

- Median Base Salary: Salary.com reports a median base salary of $84,249, but emphasizes that total cash compensation, including bonuses, frequently pushes the median into the $120,000 to $150,000 range.

- General Loan Officer Data: The U.S. Bureau of Labor Statistics (BLS), which groups all loan officers (commercial, consumer, and mortgage), reported a median annual wage of $75,460 in May 2023. This figure is lower because it includes consumer and mortgage lending roles, which often have different and typically lower compensation structures than specialized commercial lending.

Key Takeaway: While the base salary is competitive, the true earning power in this career comes from performance-based incentives. An entry-level credit analyst or junior officer might start with a base of $60,000-$80,000 plus a small bonus, while a seasoned senior officer can easily double or triple that figure through commissions.

Key Factors That Influence Salary

Your specific salary will depend on several key variables. Understanding these factors is crucial for maximizing your earning potential throughout your career.

###

Level of Education

A bachelor's degree is the standard entry requirement for this field. Degrees in finance, accounting, economics, or business administration are highly preferred as they provide a strong foundation in financial analysis. While a bachelor's degree can secure you a great career, a Master of Business Administration (MBA), especially with a finance concentration, can be a significant accelerator. An MBA can open doors to positions at larger, more prestigious banks, lead to higher starting salaries, and fast-track your path to senior management roles.

###

Years of Experience

Experience is arguably the single most important factor in determining a commercial loan officer's income. The career path typically follows a clear progression:

- Entry-Level (0-3 Years): Professionals often start as a Credit Analyst or Portfolio Manager. In this phase, the focus is on learning underwriting, financial modeling, and the bank's internal processes. Compensation is more heavily weighted toward base salary.

- Mid-Career (4-10 Years): As an established Loan Officer, you begin building your own client portfolio and originating new deals. Your network expands, and your ability to structure complex loans grows. Commission and bonuses become a much larger percentage of your total compensation.

- Senior-Level (10+ Years): Senior officers, often with titles like Vice President or Senior Vice President, manage the largest and most complex client relationships. They handle multi-million dollar deals and may lead a team of junior officers and analysts. At this level, total compensation can easily exceed $200,000 - $250,000, with top performers in major markets earning even more.

###

Geographic Location

Where you work matters. Salaries are higher in major metropolitan areas with a high concentration of large businesses and a higher cost of living. According to BLS and other salary data, financial hubs offer the most lucrative opportunities. Top-paying states and cities often include:

- New York, NY

- San Francisco, CA

- Chicago, IL

- Charlotte, NC

- Boston, MA

Working in a smaller, rural market will likely mean a lower salary, but this is often offset by a lower cost of living and a different work-life balance.

###

Company Type

The type of institution you work for directly impacts your compensation structure and potential earnings.

- Large National & Investment Banks (e.g., JPMorgan Chase, Bank of America): These institutions typically offer the highest earning potential due to the size and complexity of the deals. The environment is often high-pressure and highly competitive, but the rewards are significant.

- Regional Banks: These banks offer a strong balance of competitive compensation and a more localized focus. You'll build deep relationships within a specific geographic market.

- Community Banks & Credit Unions: While they may offer lower overall compensation packages, these institutions provide an excellent work-life balance and a strong connection to the local community. The focus is on serving small-to-medium-sized businesses.

###

Area of Specialization

Within commercial lending, specializing in a particular niche can further enhance your value and income. Common specializations include:

- Commercial Real Estate (CRE): A highly lucrative field focused on financing office buildings, retail centers, and industrial properties.

- Commercial & Industrial (C&I): Involves providing working capital, equipment financing, and lines of credit to operating businesses.

- SBA Lending: Specializing in loans backed by the Small Business Administration requires deep knowledge of government programs and can be a very profitable niche.

- Agricultural (Ag) Lending: A specialized field that serves the unique financing needs of farms and agribusinesses.

Job Outlook

The U.S. Bureau of Labor Statistics projects employment for loan officers to decline 2 percent from 2022 to 2032. However, it's critical to look beyond the headline number.

This slight decline is largely attributed to the automation of simpler lending processes, particularly in the consumer and mortgage sectors. The complex, relationship-driven nature of commercial lending is far less susceptible to automation. Businesses will always need expert guidance to navigate multi-million dollar financing deals. Therefore, while the overall number of loan officer jobs may shrink, the demand for highly skilled, analytical, and relationship-focused commercial loan officers is expected to remain strong and competitive.

Conclusion

A career as a commercial loan officer is an excellent choice for financially-minded individuals who thrive on analysis and personal interaction. While the role demands a unique blend of skills, the rewards are substantial.

Here are the key takeaways:

- High Earning Potential: Total compensation is strong, driven by performance-based commissions and bonuses that can far exceed the base salary.

- Experience is King: Your income will grow significantly as you move from an entry-level analyst to a senior, relationship-managing officer.

- Your Choices Matter: Factors like your location, the type of bank you work for, and any area of specialization you pursue will directly impact your salary.

- The Future is Skilled: Despite automation trends, the need for expert commercial lenders to handle complex, high-value deals remains robust.

For those willing to put in the work to build their skills and client portfolio, becoming a commercial loan officer is not just a job—it's a highly rewarding and lucrative long-term career.