Introduction

Have you ever wondered what it takes to operate at the absolute pinnacle of the financial world? To be part of an elite team that moves markets, armed with bleeding-edge technology and unparalleled intellectual firepower? For many aspiring finance and technology professionals, the name "Citadel" represents this very apex. It's a symbol of immense challenge, groundbreaking work, and, of course, extraordinary financial reward. The pursuit of a career that could lead to a Citadel Investment Group salary is not just about a paycheck; it's about joining a league of the brightest minds dedicated to solving the most complex puzzles in global finance. The compensation is a direct reflection of the immense value, relentless dedication, and rare talent required to thrive in such an environment, with total compensation packages for experienced professionals often soaring deep into six and even seven figures.

When I was first starting my career analysis journey, I had the opportunity to interview a senior quantitative researcher from a firm of Citadel's caliber. I asked him what set their work apart. He didn't talk about the money first; he talked about the "intellectual purity" of the problems they solved daily and the adrenaline of seeing a complex mathematical model translate into a successful market strategy. The incredible compensation, he explained, was simply the byproduct of being the best at a very, very difficult game. This guide is built on that same principle: to understand the salary, you must first understand the role, the skills, and the relentless pursuit of excellence that defines this career path.

This article will serve as your definitive guide. We will deconstruct the roles, dive deep into the compensation structures, analyze the factors that drive salary figures sky-high, and provide a clear, actionable roadmap for anyone ambitious enough to pursue this path.

### Table of Contents

- [What Do Professionals at a Firm Like Citadel Do?](#what-do-they-do)

- [Average Citadel Investment Group Salary: A Deep Dive](#average-salary-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth in Elite Finance](#job-outlook)

- [How to Get Started on This Career Path](#how-to-get-started)

- [Conclusion: Is This High-Stakes Career Right for You?](#conclusion)

---

What Do Professionals at a Firm Like Citadel Do?

Before we can talk dollars and cents, it's crucial to understand what people at a multi-strategy hedge fund and market maker like Citadel and Citadel Securities actually *do*. These are not traditional "stockbroker" jobs. The work is intensely analytical, quantitative, and technology-driven. While the firm employs a wide range of professionals, the core value-generators typically fall into three interconnected categories: Investment & Research, Quantitative Analysis, and Technology.

1. Investment & Research Professionals: These are the experts who develop the core investment theses. Their work is a blend of deep fundamental analysis and sophisticated data interpretation. They might be specialists in a particular sector (like healthcare or energy), a specific asset class (like distressed debt or convertible bonds), or a macro strategy (analyzing global economic trends).

- Core Responsibilities:

- Conducting deep-dive research on companies, industries, and economies.

- Building complex financial models to forecast earnings, cash flow, and valuation.

- Meeting with company management, industry experts, and policymakers.

- Synthesizing vast amounts of information (from earnings calls to supply chain data) into a clear "buy," "sell," or "hold" recommendation.

- Presenting and defending investment ideas to Portfolio Managers.

2. Quantitative Analysts ("Quants"): Quants are the mathematicians, statisticians, and physicists of the financial world. They design and implement the complex mathematical models and algorithms that are the engine of modern trading. Their goal is to find statistical patterns and predictive signals in market data that are invisible to the human eye.

- Core Responsibilities:

- Researching and developing new trading models and strategies based on statistical arbitrage, machine learning, or other quantitative methods.

- Backtesting strategies against historical data to ensure their viability and robustness.

- Working with programmers to translate these models into production-level code.

- Constantly monitoring and refining existing models to adapt to changing market conditions.

3. Software & Trading Systems Engineers: The engineers at firms like Citadel are building some of the most sophisticated, high-performance computing systems on the planet. They create the infrastructure that allows for the execution of billions of dollars in trades in fractions of a second. This is not typical corporate IT; this is FinTech at its most extreme.

- Core Responsibilities:

- Designing and building ultra-low-latency trading systems where nanoseconds matter.

- Developing massive data pipelines to process and analyze petabytes of market data in real-time.

- Creating the software tools and platforms that Quants and Researchers use for their analysis.

- Ensuring the absolute reliability, security, and performance of the firm's entire technology stack.

### A "Day in the Life" of a Quantitative Researcher

To make this tangible, let's imagine a day for "Anna," a Quantitative Researcher on a statistical arbitrage team:

- 6:30 AM: Anna is at her desk in Chicago, scanning overnight market news from Asia and Europe. She reviews the performance of her team's live trading algorithms, checking for any unexpected behavior or alerts triggered by the system.

- 7:00 AM: The team has a brief morning meeting to discuss the day's market outlook, potential volatility events (like an economic data release), and the performance of their models.

- 8:30 AM (Market Open): The pressure mounts. Anna closely monitors her strategies' real-time P&L (Profit and Loss) and risk exposures on a complex dashboard.

- 10:00 AM: With the initial market flurry over, she shifts her focus to research. Today, she's working on a new signal derived from natural language processing (NLP) of regulatory filings. She spends the next few hours coding in Python, running statistical tests, and analyzing the initial results of her backtest.

- 1:00 PM: She grabs a quick lunch from the firm's subsidized gourmet cafeteria with a Software Engineer to discuss the data infrastructure requirements for her new NLP model.

- 2:00 PM: Anna presents her preliminary research findings to her Portfolio Manager. The PM challenges her assumptions, asks probing questions about the model's robustness, and suggests new datasets to explore.

- 4:00 PM (Market Close): She runs an end-of-day reconciliation of the team's trading activity and begins preparing a summary report.

- 5:30 PM onwards: The "second part" of the day begins. This is often dedicated to deeper, uninterrupted research, reading academic papers, and refining her code. She might leave the office around 7:00 PM, but the complex problems she's solving will likely occupy her thoughts long after she's gone home.

This is a world of immense intellectual intensity, where performance is measured objectively and the standards are punishingly high. The compensation, as we'll see next, is designed to attract and retain the rare individuals who can thrive in this environment.

---

Average Citadel Investment Group Salary: A Deep Dive

Discussing salary at an elite hedge fund like Citadel is complex because "total compensation" is the only metric that matters. The base salary, while substantial, is often just a fraction of the overall earnings, especially for successful, experienced professionals. The real wealth generation comes from performance-based bonuses.

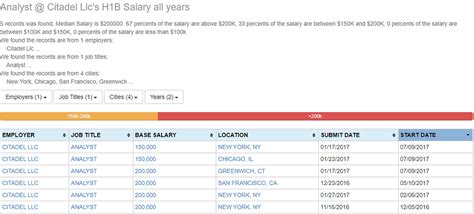

It's important to note that firms like Citadel do not publicly disclose their salary structures. The data presented here is aggregated from authoritative sources that collect self-reported data from current and former employees, as well as industry reports. We will rely on data from platforms like Glassdoor, Levels.fyi (which is particularly strong for quantitative and tech roles), and insights from financial industry publications like eFinancialCareers and Bloomberg.

Let's break down the compensation by role and experience level. Remember, these are estimates, and the actual bonus component can vary wildly based on individual, team, and firm-wide performance.

### Compensation Structure: Base + Bonus

- Base Salary: This is the fixed, guaranteed portion of your pay. It's competitive and designed to cover a high standard of living in expensive cities like New York, Chicago, or London.

- Performance Bonus: This is the variable, discretionary, and often enormous component. It's typically paid out annually (around January/February) and is tied to the P&L you generated or directly contributed to. For Quants and Investment Professionals, this can be a multiple of the base salary. For engineers, it's also highly performance-based but might be a smaller multiple than for direct P&L-generating roles.

- Sign-on Bonus / Relocation: Highly sought-after candidates, particularly those coming from competitor firms or top PhD programs, can command significant sign-on bonuses, often in the six-figure range, to compensate for forfeited bonuses at their previous employer.

- Other Benefits: These are top-tier and include comprehensive health, dental, and vision insurance (often with no or very low premiums), a generous 401(k) matching program, on-site chefs providing free meals, state-of-the-art fitness centers, wellness stipends, and more. While not direct cash, these perks significantly enhance the overall value proposition.

### Estimated Total Compensation by Role and Experience Level

The following table provides estimated annual total compensation (Base + Bonus) for key roles at a firm of Citadel's caliber.

| Experience Level | Quantitative Analyst (Quant) | Investment/Research Analyst | Software Engineer (Trading Systems) |

| ----------------------- | ---------------------------- | --------------------------- | ----------------------------------- |

| Intern | $120/hr+ ($20k+/month)¹ | $100/hr+ ($17k+/month)¹ | $115/hr+ ($19k+/month)¹ |

| Entry-Level (New Grad) | $350,000 - $500,000+² | $250,000 - $400,000+³ | $300,000 - $450,000+² |

| Mid-Career (3-5 Years) | $500,000 - $900,000+ | $400,000 - $750,000+ | $450,000 - $700,000+ |

| Senior (5-10+ Years) | $800,000 - $2,000,000+ | $700,000 - $1,500,000+ | $600,000 - $1,000,000+ |

| Portfolio Manager / Director | $2,000,000 - $10,000,000+ | $1,500,000 - $8,000,000+ | N/A (Leads can earn $1M+) |

*Sources & Disclaimers:*

¹ *Internship data aggregated from reports on Levels.fyi and eFinancialCareers for 2023/2024 hiring seasons. The monthly figure is based on a 40-hour week, though interns often work longer hours.*

² *New Grad (Bachelor's, Master's, or PhD) data is heavily influenced by Levels.fyi and represents a typical range including a substantial sign-on bonus.*

³ *Investment Analyst roles may start slightly lower on the base salary but have a very high bonus ceiling based on performance.*

*All figures for experienced hires are broad estimates. The upper end of these ranges is highly dependent on the individual's track record and the firm's annual performance. For top-performing Portfolio Managers, compensation can easily exceed $10 million in a good year.*

As you can see, the compensation trajectory is incredibly steep. A top-performing Quant or Engineer can realistically expect to be earning over half a million dollars within just a few years of graduating. For those who progress to senior, P&L-responsible roles like Portfolio Manager, the compensation becomes astronomical, as they are directly rewarded with a share of the profits their strategies generate. This "eat what you kill" mentality is a core tenet of hedge fund compensation and the primary driver of these remarkable figures.

---

Key Factors That Influence Your Salary

The vast salary ranges presented above are not arbitrary. They are influenced by a confluence of factors that firms like Citadel weigh heavily when crafting a compensation package. Understanding these levers is critical for anyone aiming for the top tier of earnings. This is the most important section for maximizing your potential income in this field.

###

1. Level and Prestige of Education

In the world of elite finance, your educational background is more than a line on a resume; it's a powerful signaling mechanism of your intellectual horsepower and trainability.

- Undergraduate Degree & University: A bachelor's degree is the absolute minimum. However, the source of that degree matters immensely. Firms like Citadel heavily recruit from a small pool of "target" schools known for their rigorous programs in STEM, economics, and finance. These include MIT, Stanford, Carnegie Mellon, Caltech, the Ivy League (Harvard, Princeton, Yale, etc.), University of Chicago, and top international universities like Oxford, Cambridge, and Waterloo. A high GPA (typically 3.8+) from one of these institutions is often a prerequisite to even get an interview.

- Advanced Degrees (Master's & PhD): For Quantitative Analyst roles, an advanced degree is often the standard.

- PhD: A PhD in a highly quantitative field like Physics, Mathematics, Statistics, Computer Science, or Electrical Engineering is the gold standard for Quant Researchers. These programs train individuals in the rigorous research, problem-solving, and modeling skills that are directly applicable to financial markets. A PhD from a top university can command the highest starting salaries, often placing candidates directly into roles with significant research autonomy.

- Master's Degree: A Master's in Financial Engineering (MFE), Quantitative Finance, or Computer Science can also be a powerful entry point, bridging the gap between an undergraduate degree and the deep specialization of a PhD.

- For Investment Analysts: While STEM PhDs are less common, a Master's in Business Administration (MBA) from a top-tier business school (Harvard Business School, Stanford GSB, Wharton) can be a valuable asset, particularly for those transitioning from other industries. The Chartered Financial Analyst (CFA) designation is also highly respected and demonstrates a deep commitment to and knowledge of investment management principles.

Impact on Salary: A PhD in a relevant field can add $100,000 or more to an entry-level total compensation package compared to a bachelor's degree holder. It signals a capacity for independent research that firms are willing to pay a premium for.

###

2. Years and Quality of Experience

Experience is the most significant driver of salary growth in this industry. However, it's not just about the number of years; it's about the quality and relevance of that experience.

- Entry-Level (0-2 years): This stage is about learning and proving yourself. Compensation is high but heavily weighted towards base salary and a standardized bonus structure. The focus is on absorbing the culture, learning the firm's systems, and contributing as a junior member of a team.

- Mid-Career (3-5 years): By this point, you are expected to be a significant contributor. You have a track record of performance. Your bonus becomes a much larger and more variable part of your compensation, directly tied to your team's success and your individual contribution. A Quant at this level might be responsible for maintaining and improving a suite of models, while an Investment Analyst may have primary coverage of several stocks.

- *Salary Growth:* It's common to see total compensation double or even triple from the entry-level point during this phase for high performers.

- Senior/VP (5-10+ years): Senior professionals are leaders. They may manage small teams, take on significant risk, and be responsible for a meaningful slice of the team's P&L. Their "book" or track record is their primary asset. Compensation is heavily skewed towards the performance bonus, which can be many multiples of their base salary. A Quant might be leading a new research initiative, while an Investment Analyst could be a senior voice in portfolio construction.

- Portfolio Manager/Director Level: This is the top of the pyramid. PMs have direct responsibility for a portfolio of capital. Their compensation is almost entirely performance-based, typically a percentage of the profits they generate for the firm. This is where seven- and eight-figure annual incomes become possible.

###

3. Geographic Location

Elite finance is concentrated in a few global hubs, and compensation is adjusted to reflect the high cost of living and intense competition for talent in these cities.

- Top Tier (Highest Pay):

- New York City, NY: The undisputed capital of the US financial world. NYC commands the highest salaries due to the sheer concentration of hedge funds, investment banks, and talent. According to Salary.com, financial analyst salaries in NYC are approximately 20% higher than the national average.

- Chicago, IL: A major hub for proprietary trading and derivatives, home to both Citadel and Citadel Securities headquarters. While the cost of living is lower than in NYC, compensation remains extremely competitive to attract top-tier talent.

- London, UK: The primary financial center of Europe. Compensation is on par with NYC, though currency fluctuations and different tax structures can affect take-home pay.

- Other Major Hubs:

- Hong Kong & Singapore: The key gateways to Asian markets. These locations offer highly competitive, often low-tax, compensation packages to attract expatriate and local talent.

- San Francisco Bay Area, CA: While more known for Big Tech, the Bay Area has a strong and growing presence of quantitative funds and FinTech companies competing for the same pool of engineering and data science talent, driving up salaries.

- Emerging Hubs (e.g., Miami, FL): In recent years, firms like Citadel have expanded significantly in locations like Miami, drawn by favorable tax laws and lifestyle. While salaries are still robust, they may trail the established hubs slightly, though the lower tax burden can lead to higher net pay.

###

4. Company Type & Size

"Finance" is not a monolith. The type of firm you work for is arguably the most critical determinant of your earning potential.

- Elite Multi-Strategy Hedge Funds / Proprietary Trading Firms (e.g., Citadel, Two Sigma, Renaissance Technologies, Jane Street): These firms sit at the absolute top of the pay scale. They have the highest performance potential and, therefore, the highest bonus potential. Their business model is to use their own (and investors') capital to generate outsized returns, and they pay their talent accordingly.

- Large Investment Banks (e.g., Goldman Sachs, Morgan Stanley): These firms have prestigious quantitative and trading divisions. While compensation is excellent, it can be more bureaucratic and may have a lower ceiling than top hedge funds due to a different business model (more client-facing services) and tighter regulation post-2008. According to data on Wall Street Oasis, hedge fund compensation for similar roles typically outpaces investment banking compensation after the first few years.

- Traditional Asset Managers (e.g., BlackRock, Fidelity): These firms manage vast sums of money, often in mutual funds and ETFs. While they employ highly skilled analysts and portfolio managers, the compensation structure is generally less aggressive than at hedge funds. Bonuses are a smaller percentage of base pay, reflecting a focus on long-term, stable growth rather than high-octane absolute returns.

- FinTech Startups: A venture-backed startup building trading technology might offer a lower base salary and bonus but compensate with potentially lucrative equity options. This is a higher-risk, potentially higher-reward path that depends on the company's ultimate success.

###

5. Area of Specialization

Within the core roles, what you specialize in can create further salary differentiation.

- For Quantitative Analysts:

- High-Frequency Trading (HFT): Specialists in this area, who work on strategies that operate on microsecond or nanosecond timescales, are highly prized for their expertise in low-latency programming and market microstructure. This is one of the highest-paying sub-fields.

- Machine Learning / AI: As AI becomes more central to trading, quants with deep expertise in areas like deep learning, reinforcement learning, and NLP are in extremely high demand and can command a premium.

- For Investment Analysts:

- Distressed Debt / Special Situations: This complex area involves analyzing companies in or near bankruptcy. It requires a unique blend of legal and financial expertise and can be highly lucrative.

- Complex Derivatives: Analysts who can model and trade exotic options and other complex derivatives are rare and highly compensated for their specialized knowledge.

- For Software Engineers:

- Low-Latency C++ Development: Engineers who can write highly optimized, "close-to-the-metal" C++ code for trading execution systems are among the best-paid programmers in any industry.

- Big Data & Distributed Systems: Building the platforms that can ingest and process petabytes of market data for backtesting and research is a critical function, and experts in technologies like Spark, Kafka, and distributed databases are highly valued.

###

6. In-Demand Skills

Beyond your degree and experience, a specific portfolio of high-value skills will directly impact your compensation and career trajectory.

- Programming Languages: Proficiency is non-negotiable.

- Python: The lingua franca for quantitative research, data analysis, and machine learning. Expertise in libraries like Pandas, NumPy, Scikit-learn, and TensorFlow/PyTorch is essential.

- C++: The king of high-performance, low-latency execution systems. Deep knowledge of modern C++ (C++17/20) is critical for trading systems roles.

- R: Still widely used in statistical analysis and econometrics.

- Kdb+/q: A specialized database and language optimized for time-series data, widely used in finance.

- Quantitative & Mathematical Skills:

- Advanced Statistics & Econometrics: Deep understanding of time-series analysis, regression, and probability theory.

- Stochastic Calculus: Essential for modeling derivatives and random processes in markets.

- Machine Learning: Expertise in both classic models and modern deep learning architectures.

- Soft Skills: These are often the tie-breakers.

- Resilience & Pressure Handling: The ability to remain calm, logical, and focused while managing millions of dollars in a volatile market is paramount.

- Communication: You must be able to clearly and concisely explain highly complex technical or financial concepts to team members and portfolio managers.

- Intellectual Curiosity & Drive: A relentless desire to learn, solve puzzles, and improve is the defining characteristic of successful individuals in this field.

---

Job Outlook and Career Growth

The career path leading to a firm like Citadel is not a typical 9-to-5 job, and its outlook isn't captured by a single government statistic. However, by analyzing trends in related fields and the financial industry at large, we can paint a clear picture of the future.

### Analyzing the Job Market

The U.S. Bureau of Labor Statistics (BLS) provides projections for related, broader professions. While these don't specifically target elite hedge funds, they indicate the underlying health of the analytical and financial sectors.

- Financial and Investment Analysts: The BLS projects employment for this group to grow by 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this growth to the increasing complexity of financial products and the need for in-depth analysis. This underlying demand for analytical talent directly feeds the recruitment pipeline for hedge funds.

- Financial Quantitative Analysts: This is a more specific and relevant category. The BLS projects a 19 percent growth rate for "Financial and Investment Analysts, Mathematical Finance," a subset of the former group, over the same period. This explosive growth highlights the "quantification" of finance, where data science and mathematical modeling are becoming central to investment decisions. The BLS explicitly states, "The use of trading algorithms and advanced data analysis will continue to grow, creating demand for these workers."

- Software Developers: With a projected growth rate of 25 percent through 2032, the demand for top-tier software developers is immense across all industries. Elite financial firms are in a direct "talent war" with Big Tech companies (like Google, Meta, and Amazon) for the best engineers. This intense competition is a primary driver of the massive compensation packages for software engineers in finance.

The takeaway is clear: the foundational skills required for a career at a place like Citadel—quantitative analysis, financial acumen, and high-performance engineering—are in extremely high and growing demand across the economy.

### Emerging Trends and Future Challenges

The world of quantitative finance is anything but static. Staying ahead of these trends is critical for long-term career success.

- The AI and Machine Learning Arms Race: The biggest trend is the deepening integration of AI. Firms are moving beyond traditional statistical models to sophisticated deep